TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Palantir Future

Looks Promising!

Weekly

Options Members Profit Up 102%!

As of 2024, Palantir has seen a significant uptick in its stock performance, with a remarkable 114% increase year-to-date.

The company's recent contracts, including a substantial five-year agreement with the U.S. Army and a multi-million dollar deal with Nebraska Medicine, highlight its expanding influence in both the government and commercial sectors.

Palantir's ongoing innovation and expansion into new markets, coupled with its strategic partnerships, are poised to sustain its growth momentum.

This set the scene for Weekly Options USA Members to profit by 102% using a PLTR Weekly Options trade!

Join Us And Get The Trades – become a member today!

Saturday, November 02, 2024

by Ian Harvey

UPDATE

Palantir Technologies: A Leader in Real-World AI Solutions

Palantir Technologies Inc. (NYSE: PLTR) has risen to prominence by delivering impactful AI-driven solutions to both government and commercial sectors. Founded in 2003, Palantir initially gained traction with U.S. government agencies like the FBI and NSA. Today, it has expanded globally, working with governments in the U.K., Ukraine, and beyond. This government foundation provides stable revenue and a competitive edge.

Palantir’s commercial sector is rapidly growing, now representing nearly half of its income. Through its Foundry platform, it serves industries like healthcare and finance by integrating data for strategic insights. Its platforms—Gotham for government, Foundry for commercial, Apollo for seamless updates, and AIP for advanced AI—deliver practical, deployable solutions in real time.

Financially, Palantir is thriving, with a 27% year-over-year revenue increase last quarter and strong profit growth. However, its high valuation, with a price-to-earnings ratio above 240, reflects elevated investor expectations, which some view as a risk.

Palantir’s reinvestment strategy has fueled innovation, positioning it as a unique AI provider focused on real-world applications. As it prepares for its November 4 earnings report, investors are eager to see if it can sustain its growth in both government and commercial arenas. Palantir’s future looks promising, with strong market demand and high growth potential, though caution is advised due to its premium valuation. For those willing to embrace the risks, Palantir remains a compelling investment in the AI sector.

READ THE FULL ARTICLE “Palantir Technologies: Harnessing AI for Real-World Impact and Investor Interest!"

The PLTR Weekly Options Potential Profit Explained.....

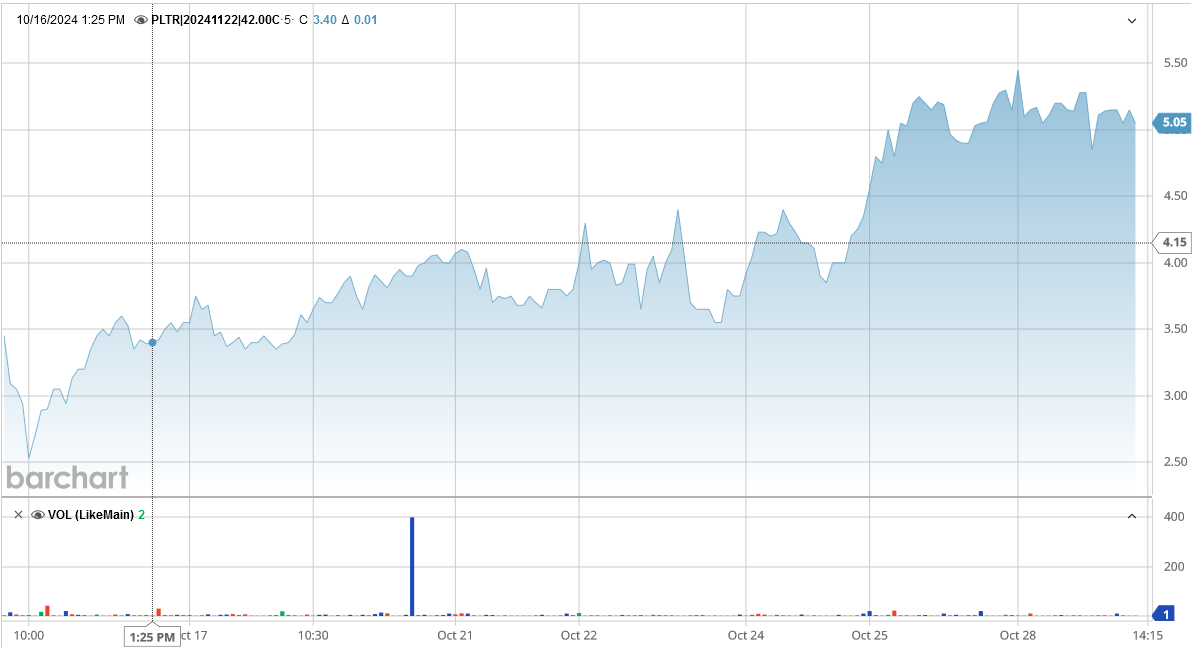

** PROPOSED OPTION TRADE: Buy PLTR NOV 22 2024 42.000 CALLS - price at last close was $3.65 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the PLTR Weekly Options (CALL) Trade on Wednesday, October 16, 2024 for $2.70.

Sold half the PLTR Weekly Options contracts on Monday, October 28, 2024, for $5.45; a potential profit of102%.

Holding remaining contracts until the earnings report!

Don't miss out on further trades – become a member today!

Why the PLTR Weekly Options Trade was Originally Executed!

Trade Analysis

Current Situation

Palantir Technologies (NYSE: PLTR) is a prominent SaaS company renowned for its advanced AI and big data analytics capabilities. Founded in 2003, Palantir has expanded its offerings to include Palantir Gotham, Palantir Apollo, Palantir Foundry, and Palantir Metropolis, each designed to enhance human intelligence with robust data-gathering and analytic tools.

As of 2024, Palantir has seen a significant uptick in its stock performance, with a remarkable 114% increase year-to-date. This surge is attributed to its inclusion in the S&P 500 index, a milestone that underscores the company's growth and appeal to retail investors.

The company's recent contracts, including a substantial five-year agreement with the U.S. Army and a multi-million dollar deal with Nebraska Medicine, highlight its expanding influence in both the government and commercial sectors.

Key Insights from Earnings Call

During the recent earnings call, Palantir's leadership emphasized the accelerated deployment of its AI-driven platforms, which are gaining traction across diverse industries. The company's strategic focus on enhancing operational efficiencies through AI integration has been well-received, reflecting in its robust financial performance and forward-looking statements.

Catalysts for the Trade

- Institutional Investment: Following its inclusion in the S&P 500, institutional investors are increasingly compelled to acquire PLTR stock, potentially stabilizing and driving its price upward.

- Technological Superiority: Palantir's advanced AI and analytics platforms continue to set industry standards, attracting significant commercial interest and investment.

- Strategic Contracts: Recent high-value contracts are expected to significantly bolster Palantir's revenue streams and market positioning.

Further Catalysts

Palantir's ongoing innovation and expansion into new markets, coupled with its strategic partnerships, are poised to sustain its growth momentum. The upcoming earnings report on November 7, 2024, is particularly anticipated to shed light on its trajectory and potential market adjustments.

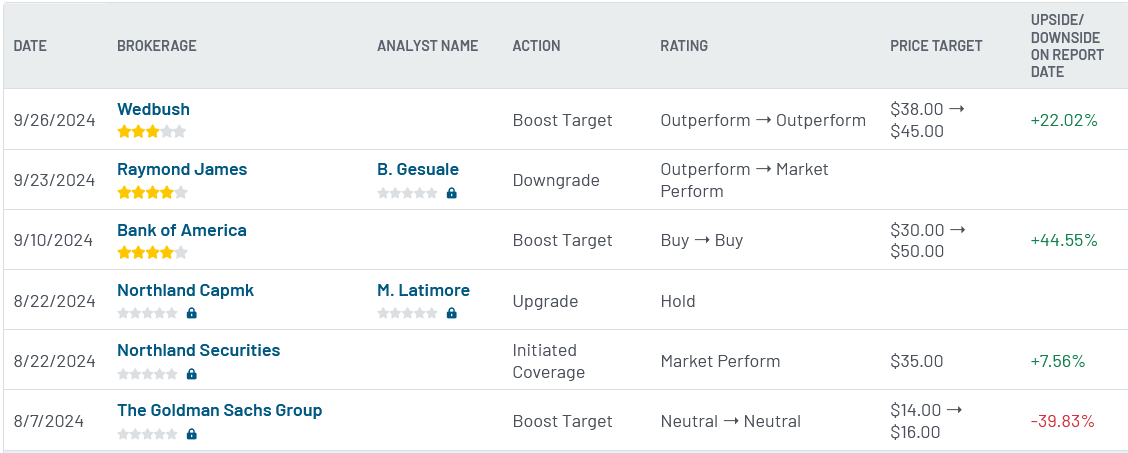

Analyst Reactions

Recent analyses by market experts have shown a positive outlook on PLTR stock, with projections of substantial price appreciation. Notably, analysts from Bank of America and Wedbush have highlighted Palantir's robust market strategy and innovative technology stack, enhancing its investment appeal.

Company Overview

Palantir Technologies, headquartered in Denver, Colorado, continues to lead in the AI and big data analytics sector, providing cutting-edge solutions that empower government and commercial entities worldwide. The company's commitment to innovation and its strategic market positioning underscore its potential for sustained growth and market leadership.

Technical Analysis

- Market Capitalization: $96.69 billion

- PE Ratio: 249.66 (reflecting its growth potential despite high valuation)

- Beta: 2.72 (indicating higher volatility compared to the market)

- 52-Week Low: $14.48

- 52-Week High: $44.39

- Fifty-Day SMA: $34.46

- Two-Hundred-Day SMA: $27.59

Summary

Palantir Technologies presents a compelling investment opportunity, particularly in light of its recent S&P 500 inclusion and the institutional buying it has spurred. The company's innovative solutions and strategic market maneuvers position it well for potential stock appreciation. Investors are advised to consider their risk tolerance and market dynamics before executing trades.

Trade Execution

Consider placing a buy order for PLTR NOV 22 2024 42.000 CALLS, with a premium of $3.65. Adjust your sell point and stop loss according to your risk tolerance.

Disclaimer

This trade suggestion is based on current market analysis and is not a guaranteed success. Always consider your risk tolerance and consult with a financial advisor if necessary.