TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

How To Play

Microsoft Weekly Options And Profit!

Gains of 50%,

36% and ????

Microsoft Corporation (NASDAQ:MSFT) is at the forefront of AI technology, having invested heavily in OpenAI's ChatGPT.

Microsoft's stock price traded up 0.73% on Tuesday. The stock traded as high as $451.42 and last traded at $450.95. Microsoft shares are up about 30% over the past one year.

Many Wall Street analysts are bullish on Microsoft. New Street Research recently started covering the stock with a Buy rating, saying Microsoft is well positioned to grow earnings in the low teens for “years to come” even if the AI story fails to pan out.

This set the scene for Weekly Options USA Members to profit by 50%, 36% and holding further contracts, using several Microsoft Options trade!

Join Us And Get The Trades – become a member today!

Tuesday, June 25, 2024

by Ian Harvey

UPDATE

The Dow Jones Industrial Average closed lower Tuesday even as blue-chip Microsoft Corporation (NASDAQ:MSFT) shook off overseas antitrust charges.

Microsoft's stock price traded up 0.73% on Tuesday. The stock traded as high as $451.42 and last traded at $450.95. 3,045,564 shares changed hands during trading. The stock had previously closed at $447.67.

Barclays Venu Krishna recently pointed out in a research report that mutual funds are piling into big tech stocks like Microsoft. Microsoft shares are up about 30% over the past one year.

Many other Wall Street analysts are also bullish on Microsoft. New Street Research recently started covering the stock with a Buy rating, saying Microsoft is well positioned to grow earnings in the low teens for “years to come” even if the AI story fails to pan out. The firm set a $570 price target on Microsoft.

Analysts believe Microsoft’s AI ecosystem around its products would strengthen its Cloud division thanks to Microsoft’s integration of AI into its Cloud products. Microsoft’s Intelligent Cloud segment’s profit in the latest quarter totaled $12.51 billion, a 32% growth on a YoY basis.

Microsoft’s huge investments to revive its Search business are also working. Bing’s market share has jumped to 3.64% as of April 2024, a 0.88 points gain on a YoY basis.

The MSFT Weekly Options Potential Profits Explained.....

** OPTION TRADE: Buy MSFT JUL 12 2024 455.000 CALLS - price at last close was $5.70 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the MSFT Weekly Options (CALL) Trade on Monday, June 24, 2024, at 9:40am for $4.20.

Sold the MSFT Weekly options contracts on Monday, June 24, 2024, at 10:05am for $6.30; a potential profit of 50%.

Re-bought the MSFT Weekly Options (CALL) Trade on Tuesday, June 25, 2024, at 10:00am for $3.80.

Sold half the MSFT Weekly options contracts on Tuesday, June 25, 2024, at 3:45pm for $5.15; a potential profit of 36%.

(This will vary for members depending on their entry and exit strategies).

Holding the remaining MSFT Weekly options contracts for further profit!

Don’t miss out on further trades – become a member today!

Why the MICROSOFT Weekly Options Trade was Originally Executed!

Weekly Options Trade - Microsoft Corporation (NASDAQ:MSFT) CALLS

Monday, June 24, 2024

Trade Details

OPTION TRADE: Purchase MSFT JUL 12 2024 455.000 CALLS - last closing price was $5.70 - adjust as necessary.

- Expiration Date: July 12, 2024.

- Strike Price: $455.00.

- Last Closing Price: $5.70.

Risk Management:

- Set a sell target at approximately 50% above purchase price (modify based on your strategy).

- Implement a protective stop loss at -60% of entry price.

- Note: Given the current market volatility, I personally opt for a flexible sell target rather than a fixed stop loss. Adapt this to your own risk tolerance.

Trade Analysis

Microsoft Corporation (NASDAQ:MSFT) is at the forefront of AI technology, having invested heavily in OpenAI's ChatGPT. This strategic move has allowed Microsoft to integrate advanced AI capabilities across its product range, significantly enhancing its software offerings such as Windows, Office, and Azure.

Current Situation

Microsoft is leveraging its AI advancements to transform consumer and business applications. The integration of AI into products like the Office suite with Copilot and Bing search engine has bolstered its market position as a leader in productivity software.

Key Insights from Earnings Call

The recent earnings report for Q3 2024 showed a 17% increase in revenue year-over-year, with significant contributions from AI-enhanced cloud and business process solutions. This growth is a testament to Microsoft's successful integration of AI technologies, which are becoming a core component of its offerings.

Catalysts for the Trade

Microsoft's ongoing development in AI and cloud computing is expected to continue driving its financial performance. The upcoming quarters may see further growth in AI services, which could positively impact stock prices.

Further Catalysts for the Trade

Strategic AI Investments

Microsoft's early investment in AI through partnerships like that with OpenAI has positioned it well against competitors. This foresight is likely to pay off as AI becomes more integrated into business and consumer applications.

Market Position and Future Outlook

As AI continues to be a critical driver of innovation, Microsoft's strong market position and robust financial health suggest it is well-equipped to capitalize on these advancements, potentially leading to increased market share and stock valuation.

Analyst Reactions

Analysts have responded positively to Microsoft's strategic direction, with upgrades in stock price targets reflecting confidence in its growth trajectory. Notable mentions include Citigroup's increase from $495.00 to $520.00.

Company Overview

Founded in 1975, Microsoft has evolved from a software provider to a global leader in technology solutions, including AI and cloud computing. Its strategic investments and continuous innovation have solidified its position as a dominant force in the tech industry.

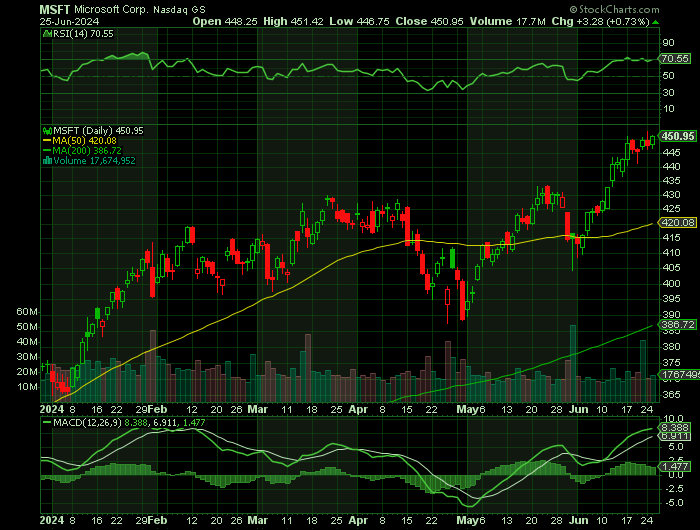

Technical Analysis

- Market capitalization: $3.34 trillion.

- PE ratio: 38.94.

- Beta: 0.89.

- 52-week low: $309.45.

- 52-week high: $450.94.

- Fifty-day moving average: $419.96.

- Two-hundred-day moving average: $407.17.

Capitalizing on Microsoft's AI Growth

This trade aims to leverage Microsoft's ongoing growth in AI technology and its strong market position. The company's strategic investments and robust financial performance provide a solid basis for this options trade.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from MICROSOFT

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!