TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

HP Inc Share

Price Expected To Pick Up!

Weekly Options Members

Are Using A Weekly Call Option

To Profit From This news!

HP Inc share price expected to rise with anticipation that personal computer demand will pick up after a two-year slump, with projected profit for the fiscal year beginning in November in line with analysts’ estimates.

This set the scene for Weekly Options USA Members to Buy a HPQ Options Call trade!

Join Us And Get The Trades – become a member today!

Monday, October 16, 2023

by Ian Harvey

HP Inc (NYSE: HPQ), anticipating that personal computer demand will pick up after a two-year slump, with projected profit for the fiscal year beginning in November in line with analysts’ estimates.

Earnings, excluding some items, will be $3.25 a share to $3.65 a share for the 2024 fiscal year, the company said Tuesday in a statement. Analysts, on average, estimated $3.47 a share. Free cash flow in the fiscal year will be $3.1 billion to $3.6 billion, compared with an average projection of $3.17 billion.

The slowdown may be coming to an end. Gartner Inc. analysts said Monday that PC shipments “bottomed out” in the period ending in September and they anticipate a rebound beginning in current quarter.

“HP is very well positioned to deliver long-term sustainable growth,” Chief Executive Officer Enrique Lores said in the statement. “We are innovating to meet the changing needs of our customers and we see attractive opportunities to drive profitable growth across our business.”

About HP.....

HP Inc. provides products, technologies, software, solutions, and services to individual consumers, small- and medium-sized businesses, and large enterprises, including customers in the government, health, and education sectors worldwide.

It operates through Personal Systems and Printing segments. The Personal Systems segment offers commercial personal computers (PCs), consumer PCs, workstations, thin clients, commercial tablets and mobility devices, retail point-of-sale systems, displays and other related accessories, software, support, and services for the commercial and consumer markets. The Printing segment provides consumer and commercial printer hardware, supplies, media, solutions, and services, as well as scanning devices; and laserJet and enterprise, inkjet and printing, graphics, and 3D printing solutions.

The company was formerly known as Hewlett-Packard Company and changed its name to HP Inc. in October 2015. HP Inc. was founded in 1939 and is headquartered in Palo Alto, California.

Further Catalysts for the HPQ Weekly Options Trade…..

Companies such as HP, Lenovo and Dell Technologies have seen demand ease from peaks hit during the pandemic, when work-from-home trends drove up sales of laptops and other electronic devices.

Shares of Palo Alto, California-based HP were up more than 2% in trading after the bell yesterday. They have fallen roughly 2% so far this year.

"Our Future Ready plan is strengthening our core business, accelerating our expansion in services, building new operational capabilities, and improving our structural costs," said HP CEO Enrique Lores.

The board has approved an increase to the planned dividend amount to $1.10 per share, reflecting a 5% increase from the prior dividend, the company said.

Analysts.....

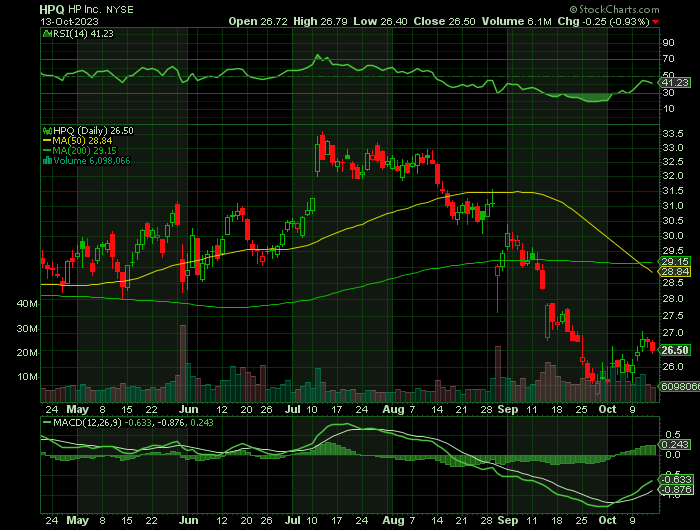

According to the issued ratings of 8 analysts in the last year, the consensus rating for HP stock is Hold based on the current 1 sell rating, 5 hold ratings and 2 buy ratings for HPQ. The average twelve-month price prediction for HP is $30.45 with a high price target of $39.00 and a low price target of $23.00.

Summary.....

HP has a 1-year low of $24.08 and a 1-year high of $33.90. The business’s fifty day moving average price is $29.56 and its two-hundred day moving average price is $30.10. The company has a market capitalization of $25.60 billion, a P/E ratio of 11.16, and a PEG ratio of 2.24 and a beta of 1.04.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from HPQ

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!