TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

HP Inc Earnings Disappoints!

But Members Make 63% Potential Profit,

On The Day, Using A

Weekly Put Option!

Members of “Weekly Options USA,” Using A Weekly Put

Option, Make Potential Profit Of 63%,

In A Day,

As HP Inc. Reported Sales That Fell Further Than Analysts’ Estimated,

A

Sign The Company Continues To Be Hamstrung

By The Ongoing Slump In Demand For

Personal Computers.

Where To Now?

Yesterday, HP Inc (NYSE: HPQ) reported earnings that disappointed. Unfortunately, the company reported downbeat earnings and guidance Tuesday night, taking the steam out of some of the recent AI-related enthusiasm for chip stocks.

This set the scene for Weekly Options USA Members to profit by 63%, within the day, using a HPQ Weekly Options trade!

Join Us And Get The Trades – become a member today!

Wednesday, May 31, 2023

by Ian Harvey

Prelude…..

Yesterday, both HP Inc (NYSE: HPQ) and Hewlett Packard Enterprise (HPE) reported earnings that disappointed. Both companies were each part of the old HP, which split into two companies back in 2015. Today, HP Inc. holds the printer and PC businesses, while Hewlett Packard Enterprise holds the enterprise server and services businesses.

Unfortunately, both companies reported downbeat earnings and guidance last night, taking the steam out of some of the recent AI-related enthusiasm for chip stocks.

HP Inc. reported a rather sizable 21.7% decline in revenue last quarter on the back of a brutal 29% decline in PC sales, as the historic post-pandemic PC slump continues. Revenue missed expectations, while earnings managed to beat expectations on the back of management's cost-cutting efforts. Meanwhile, HP Enterprise also surprised to the downside, with a 3.9% increase in revenue missing expectations. Its full-year outlook was also underwhelming, with revenue projected between $6.7 billion to $7.2 billion, much lower than consensus estimates of $7.24 billion.

Why the HPQ Weekly Options Trade was Executed?

U.S. stock futures were in the red early Wednesday ahead of a key vote on the U.S. debt ceiling in the House of Representatives. HP Inc (NYSE: HPQ) stock was 5% lower after the PC maker posted its lowest quarterly revenue since the start of the Covid-19 pandemic.

HP Inc. reported sales that fell further than analysts’ estimated, a sign the company continues to be hamstrung by the ongoing slump in demand for personal computers.

Revenue declined 22% to $12.9 billion on a worse-than-expected drop in consumer PC sales, the company said Tuesday in a statement. HP’s Personal Systems segment fell 29% to $8.2 billion, compared with analysts’ average estimate of $8.4 billion.

“The macro situation is obviously impacting demand across industries,” Chief Executive Officer Enrique Lores said in an interview.

The shares declined about 1% in extended trading, after closing at $30.93 in New York. The stock has gained 15% this year.

The HPQ Weekly Options Trade Explained.....

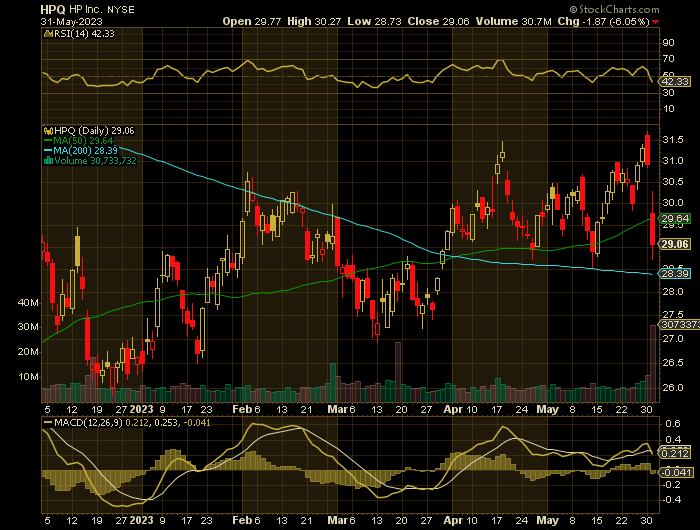

OPTION TRADE: Buy HPQ JUN 09 2023 30.000 PUTS - price at last close was $0.61 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the HPQ Weekly Options (PUT) Trade on Wednesday, May 31, 2023, at 10:20, for $0.62.

Sold half the HPQ weekly options contracts on Wednesday, May 31, 2023, at 3:54, for $1.01; a potential profit of 63%.

Holding the remaining HPQ weekly options contracts for further profit as the week progresses.

Total Dollar Profit is $101 - $62 (cost of contract) = $39

Don’t miss out on further trades – become a member today!

About HP.....

HP Inc. provides products, technologies, software, solutions, and services to individual consumers, small- and medium-sized businesses, and large enterprises, including customers in the government, health, and education sectors worldwide.

It operates through Personal Systems and Printing segments. The Personal Systems segment offers commercial personal computers (PCs), consumer PCs, workstations, thin clients, commercial tablets and mobility devices, retail point-of-sale systems, displays and other related accessories, software, support, and services for the commercial and consumer markets. The Printing segment provides consumer and commercial printer hardware, supplies, media, solutions, and services, as well as scanning devices; and laserJet and enterprise, inkjet and printing, graphics, and 3D printing solutions.

The company was formerly known as Hewlett-Packard Company and changed its name to HP Inc. in October 2015. HP Inc. was founded in 1939 and is headquartered in Palo Alto, California.

Further Catalysts for the HPQ Weekly Options Trade…..

Free cash flow in the fiscal year ending in October will be about $3.25 billion. The guidance is the same as that issued in February and assumes improving demand for personal computers in the coming quarters. HP also narrowed its forecast for fiscal-year adjusted profit to $3.30 to $3.50 a share, topping analysts’ average estimate, according to data compiled by Bloomberg.

The PC market showed “weak demand, excess inventory, and a worsening macroeconomic climate,” from January-March, industry analyst IDC reported last month.

Printing revenue slipped 5% to $4.7 billion in the period ended April 30. Analysts, on average, projected $4.6 billion. The print business should perform similarly in the second half of the year, Lores said.

HP reported profit, excluding some items, of 80 cents a share in the quarter, topping the average estimate of 76 cents. Adjusted earnings per share will be 81 cents to 91 cents in the current period ending in July, the Palo Alto, California-based company said.

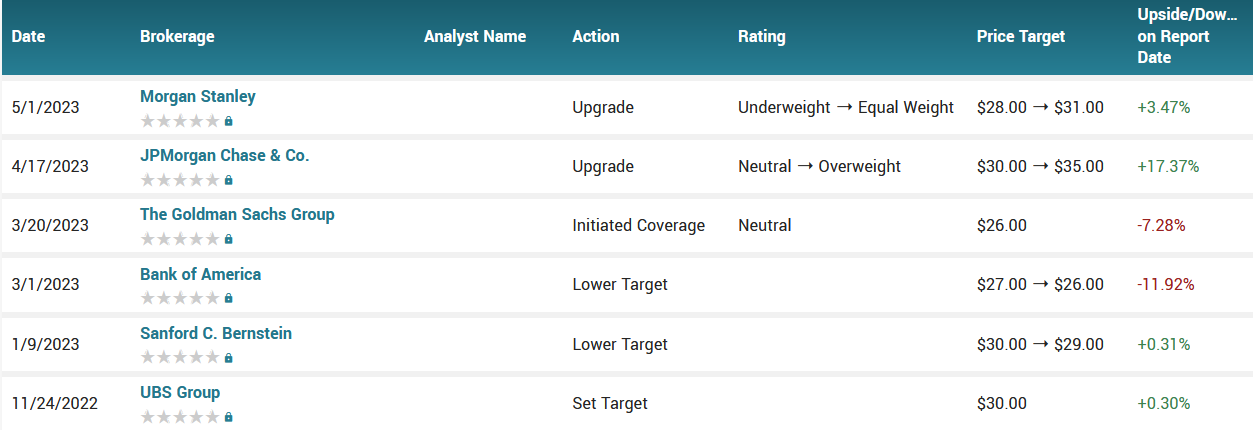

Analysts.....

New data showing stability in hybrid work has some benefits for HP, Meta Marshall, an analyst at Morgan Stanley, wrote in advance of the results. Printing, however, remains a category where spending continues to falter, she added.

In a report released yesterday, Mike Ng from Goldman Sachs reiterated a Hold rating on HP. The company’s shares closed yesterday at $30.93.

Evercore ISI (In-line rating; $33 price target):

"Net/net: we think HP is doing an impressive job in executing well on the EPS/FCF [free cash flow] front despite a challenged macro environment. Their second half guidance is implying step-up in EBIT margins that we think may make investors more cautious till we see a clear sign of demand improvement. Positively, we think buybacks could resume in second half and provide an upside lever to estimates."

According to the issued ratings of 13 analysts in the last year, the consensus rating for HP stock is Hold based on the current 3 sell ratings, 9 hold ratings and 1 buy rating for HPQ. The average twelve-month price prediction for HP is $29.81 with a high price target of $35.00 and a low price target of $24.00.

Summary.....

HP has a 50 day moving average of $29.59 and a two-hundred day moving average of $28.99. HP Inc. has a fifty-two week low of $24.08 and a fifty-two week high of $40.79. The stock has a market cap of $30.83 billion, a P/E ratio of 12.47, and a P/E/G ratio of 3.46 and a beta of 1.00.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from HPQ

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!