TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Intel Corporation Shares Fall Due To New Guidance!

Weekly Options Members

Are Up 70% Potential Profit

Using A Weekly PUT Option!

It appears that the pendulum has turned for Intel Corporation (NASDAQ:INTC) after providing us with solid profits of 271% earlier this month using an options call.

The CFO also shed light on the declining revenue from Intel's data center unit, its second-largest business as per S&P Global Market Intelligence data. Despite expectations of recovery, this unit has been underperforming for the past two years.

It would seem that this downward spiral will continue.

This set the scene for Weekly Options USA Members to Make Potential Profit Of 70%, using an INTC Weekly Options trade!

Join Us And Get The Trades – become a member today!

Tuesday, September 26, 2023

by Ian Harvey

Intel's core CPU processor business for laptops and traditional data center servers is in a downturn. That's made things especially difficult for Intel, as the company also needs to invest in its ambitious turnaround and transformation outlined by CEO Pat Gelsinger, who took over in 2021.

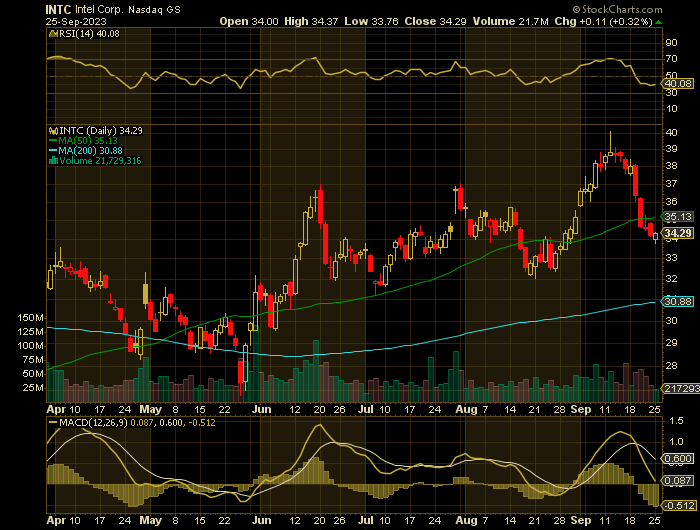

Intel's earnings are still depressed and its free cash flow is negative, the stock currently trades at just around 7.4 times its peak earnings from 2019, and at just 1.4 times book value.

Already years into an expected turnaround in its chip business, CFO David Zinser disappointed investors when he warned that Intel is still more than a year away from even breaking even on operating cash flow. He also admitted that rather than rebounding, revenue from the company's data center unit (Intel's second-biggest business, according to data from S&P Global Market Intelligence, but stuck in a decline for the past two years) is still declining.

Citigroup analyst Christopher Danely pointed out that Intel's new guidance is below the consensus of what Wall Street analysts had forecast for the company -- suggesting it may be heading for an earnings miss.

Danely highlighted that Zinser had said that any profit margin improvements that Intel accomplishes this quarter will be "modest." And Intel's efforts to build a chip foundry business (i.e., manufacturing computer chips designed by other companies, for those companies) seem pointless to the analyst, who predicts that profits from such a business will not be "material" for Intel.

Neither Morgan Stanley not Citi has a buy rating on Intel stock, by the way. (Both rate it neutral.) And for good measure, Citi's Danely is recommending that Intel abandon the foundry effort.

As well, Intel was fined 376 million euros ($400 million) on Friday in an EU antitrust case stemming from the U.S. chipmaker's anti-competitive practice nearly two decades ago to block rivals.

Another problem for Intel is RISC-V, which is a reduced instruction set, with the V (a Roman numeral) signifying the fifth-generation of RISC architecture.

A big draw of RISC-V is its open architecture. Fast progress is being made to expand the ecosystem, which helps with uptake as more software is written on the instruction set.

This could be a risk to a company like Intel, which is still at this point highly reliant on x86-based chips.

It's important to bear in mind that computing tech is always in flux. RISC-V could pose serious challenges for leaders like Intel if rival chip design firms continue to funnel lots of money into RISC-V hardware and software development.

Why the INTC Weekly Options Trade was Originally Executed!

It appears that the pendulum has turned for Intel Corporation (NASDAQ:INTC) after providing us with solid profits earlier this month using an options call.

Shares of semiconductor giant fell by 4.5% yesterday, following disquieting remarks made by the company's CFO, David Zinser, at the Innovation Conference held on Tuesday. Zinser indicated that Intel is more than a year away from reaching a break-even point in operating cash flow, a statement that came as a surprise given the company's ongoing efforts to revitalize its chip business.

The CFO also shed light on the declining revenue from Intel's data center unit, its second-largest business as per S&P Global Market Intelligence data. Despite expectations of recovery, this unit has been underperforming for the past two years.

It would seem that this downward spiral will continue.

The INTC Weekly Options Trade Explained.....

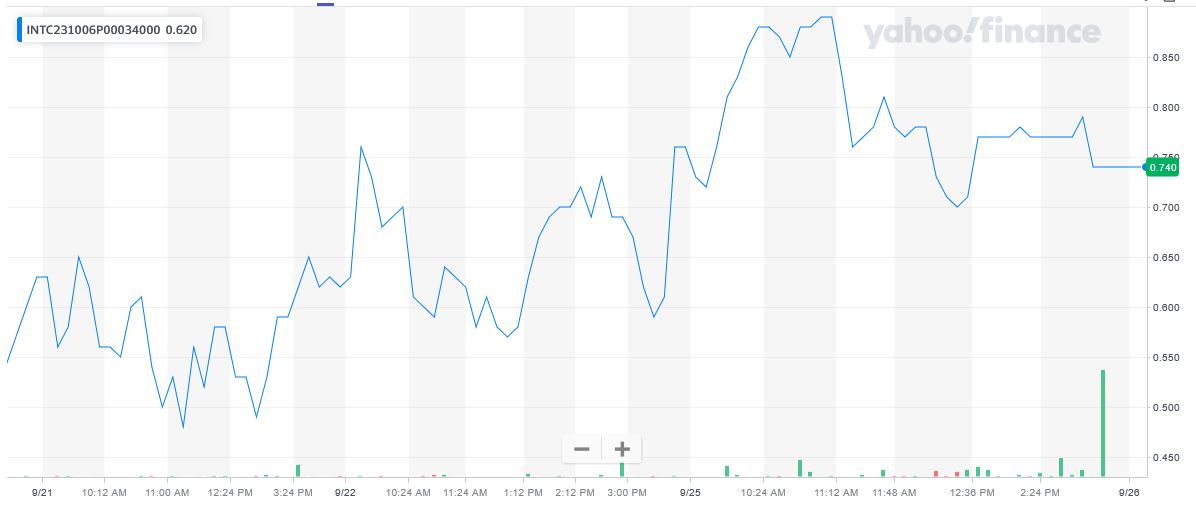

** OPTION TRADE: Buy INTC OCT 06 2023 34.000 PUTS - price at last close was $0.63 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the INTC Weekly Options (PUT) Trade on Friday, September 21, 2023, for $0.54.

Sold the INTC weekly options contracts on Monday, September 25, 2023 for $0.92; a potential profit of 70%.

Don’t miss out on further trades – become a member today!

Further Catalysts for the INTC Weekly Options Trade…..

In response to these disclosures, Investment bank Morgan Stanley stated on Wednesday morning that they were not entirely unexpected. However, Citigroup (NYSE:C) analyst Christopher Danely expressed concern in a report released early Wednesday. According to Danely, Intel's new guidance falls short of Wall Street analysts' consensus forecast, hinting at a possible earnings shortfall for the company.

Danely drew attention to Zinser's mention of only "modest" improvements in profit margins for Intel this quarter. The analyst voiced doubts about Intel's attempts to establish a chip foundry business - manufacturing computer chips designed by other firms - and predicted such an endeavor would not generate significant profits for Intel.

Currently, neither Morgan Stanley nor Citigroup recommends buying Intel stock; both rate it as neutral. Furthermore, Danely from Citigroup advises Intel to abandon its chip foundry venture.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from INTEL

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!