TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

JD.Com Continues To Fall On Downgrades!

Weekly Options Members

Are Up 210% Potential Profit Using A Weekly PUT Option!

JD.com’s share price has halved since the start of the year, reflecting concerns about China’s sluggish consumption as the authorities struggle to revive spending and growth.

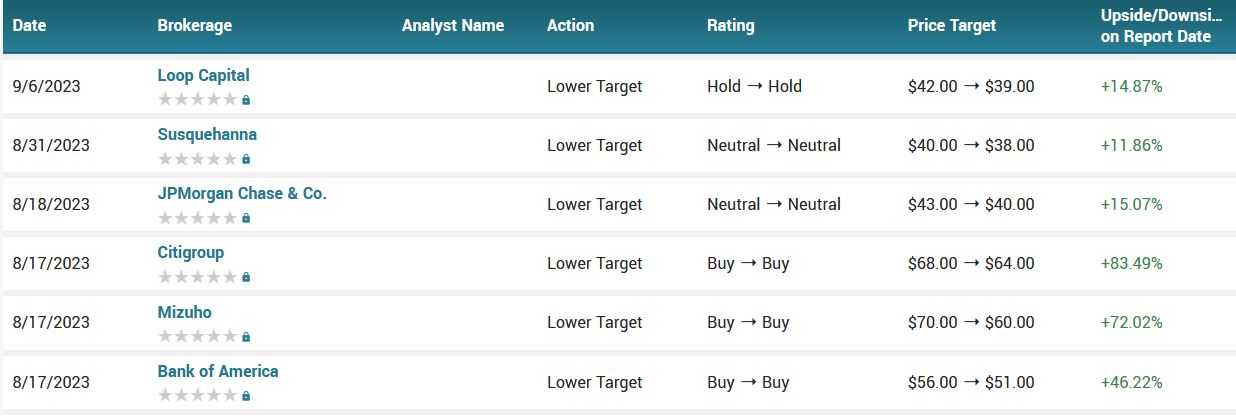

At least seven brokerage firms including Morgan Stanley and Citigroup Inc. have either downgraded the stock or lowered price targets.

This set the scene for Weekly Options USA Members to profit by 210%, using a JD Options trade!

Join Us And Get The Trades – become a member today!

Sunday, October 22, 2023

by Ian Harvey

Why the JD Weekly Options Trade was Originally Executed!

JD.Com Inc (NASDAQ: JD) slumped to a record low in Hong Kong as Wall Street brokerages turned bearish on the stock and rumors swirled that a businessman with the same surname as the company’s chairman had been arrested.

At least seven brokerage firms including Morgan Stanley and Citigroup Inc. have either downgraded the stock or lowered price targets in the past two days. The stock extended its drop after JD.com said on its Weibo account it had lodged a police report over a rumor that a businessman surnamed Liu had been arrested on suspicion of violation of laws. The firm’s chairman is Richard Liu.

The NVDA Weekly Options Trade Explained.....

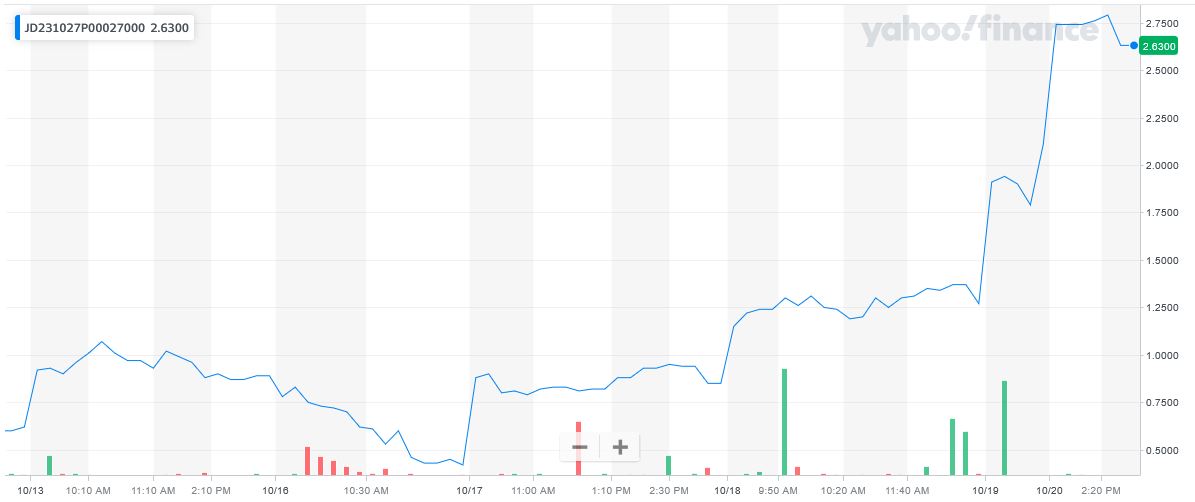

** OPTION TRADE: Buy JD OCT 27 2023 27.000 PUTS - price at last close was $0.62 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the JD Weekly Options (PUT) Trade on Friday, October 13, 2023, for $0.90.

Sold the JD weekly options contracts on Friday, October 20, 2023 for $2.79; a potential profit of210%.

Don’t miss out on further trades – become a member today!

About JD.....

JD.com, Inc., also known as Jingdong and Joybuy, is a Chinese e-commerce company headquartered in Beijing. Founded on June 18, 1998, by Qiangdong Liu, JD.com started as an online magneto-optical store but quickly diversified its product offerings to include electronics, mobile phones, computers, and other consumer goods. Over the years, the company has become one of China's largest B2C online retailers by transaction volume and revenue. JD.com operates through various business segments, including JD Retail, JD Logistics, JD Technology, JD Health, and JD Digits. The company's core business, JD Retail, offers an extensive range of products through its online retail platform, known for its authentic low prices, quality assurance, and customer-centric approach.

With a mission to provide customers with a convenient and reliable shopping experience, JD.com has built a robust logistics network to facilitate fast and efficient deliveries. The company has also heavily invested in advanced technologies like AI, big data, and cloud computing to enhance its operations and provide innovative solutions to its customers.

JD.com's target market primarily includes consumers worldwide who prefer online shopping for a wide range of products, from electronics to fashion, groceries, and healthcare items. The company aims to cater to the diverse needs of its customers by offering a vast selection of products from local and international brands.

JD.com's leadership team is led by its Founder and Chairman, Mr. Qiangdong Liu. Under his guidance, the company has experienced tremendous growth and has become a prominent player in the e-commerce industry. The Chief Executive Officer and Executive Director, Ms. Ran Xu, brings experience driving operational excellence and customer-centric strategies. The management team comprises professionals with diverse backgrounds and expertise in technology, logistics, finance, and marketing. Their collective efforts have contributed to the company's success and its ability to stay ahead in the competitive market.

In 2022, JD.com reported a remarkable year-over-year increase in revenue, reaching over one trillion CNY (around USD 140 billion), showcasing its strong market presence and continuous growth. The company's net income also surged significantly, highlighting its profitability and efficient cost management strategies. Moreover, JD.com's net profit margin substantially improved, reflecting better operational efficiency and profitability. The company's robust EBITDA growth indicates its ability to generate significant earnings before accounting for interest, taxes, depreciation, and amortization. However, it is important to interpret these financial metrics in conjunction with the stock's performance and other market dynamics to understand JD.com's overall health and attractiveness of JD.com as an investment.

Multiple factors, including financial performance, market sentiment, and overall economic conditions, have influenced JD.com's recent stock performance. Positive earnings reports and strategic announcements have typically led to stock price appreciation, whereas unexpected challenges or external factors may result in short-term fluctuations. It's essential to consider the stock's performance in the context of the broader market and the e-commerce industry to make well-informed investment decisions.

JD.com operates in the highly competitive e-commerce industry, which has experienced rapid growth in recent years. The company's key advantage lies in its expansive product range, efficient logistics infrastructure, and commitment to customer satisfaction. JD.com's strong logistics network provides a competitive edge compared to its peers, enabling faster and more reliable deliveries. Its strategic partnerships with leading companies have also expanded its market positioning.

JD.com has several growth opportunities to leverage in the dynamic e-commerce landscape. The continued growth of online shopping in China and globally presents a vast market for JD.com to capture. Expanding its product categories and reaching untapped customer segments are potential avenues for growth. JD.com's investment in advanced technologies, including AI and big data, also opens doors for further innovation in customer experience and supply chain management.

Despite its success, JD.com faces various risks and challenges that investors should consider. Intense competition from other e-commerce giants, regulatory changes, and economic uncertainties could impact the company's performance. Supply chain disruptions, cybersecurity threats, and changing consumer preferences pose potential risks. JD.com must manage these risks effectively through proactive strategies and adaptability to market dynamics.

Further Catalysts for the JD Weekly Options Trade…..

JD.com’s share price has halved since the start of the year, reflecting concerns about China’s sluggish consumption as the authorities struggle to revive spending and growth. A subdued domestic inflation print released Friday and lackluster spending data from the Golden Week Holiday suggest that the retailer may face an uphill battle in trying to reverse the negative sentiment.

“We expect a long-term trend of consumption downgrade in China, and if JD is not able to successfully implement its low price strategy that caters to the trend, we think it could be in a structurally less favorable position in China’s e-commerce market,” Morgan Stanley analysts including Eddy Wang wrote in a note.

JD.com’s shares dropped as much as 13% to an all-time low of HK$102.50 since its listing in 2020 in Hong Kong. Its US-listed shares fell as much as 4.4% in premarket trading on Friday. The move came after a slew of brokerages cut their outlook on the stock, citing worries about how the firm will grow its revenue amid the weaker macro environment in China.

The outlook has been challenging as consumer demand for big-ticket items — a segment that the company used to thrive on in the past — has been particularly weak in China, To make matters worse, its massive discount campaign hasn’t helped in fending off the challenge from PDD Holdings Inc., which is grabbing market share by using a low price strategy.

“Heading into 4Q23, despite seasonally strong 11.11 promotion, we believe cautious consumption sentiment and competitive pricing discount are likely to weigh on any meaningful rebound of growth for JD,” Citigroup analysts including Alicia Yap wrote in a note.

Other Catalysts.....

Shares in JD.com, which is also China's largest home appliance retailer, closed at their lowest level since their June 2020 debut.

A debt crisis in the key property sector has contributed to slowing China's economic growth after the pandemic, while many Chinese have cut back on spending due to concerns over the economy and job security, hurting the retail sector.

In March, JD.com warned it would take time to rebuild consumer confidence post-pandemic as it missed fourth-quarter revenue forecasts.

Citi Research lowered its revenue assumption for JD.com by 3.4% and 4.3% for the third and fourth quarter, saying that it now estimates 0.8% and 1.3% growth respectively.

The bank's analysts cited a "relatively muted consumption trend, high base, intense competition, and on-going impact from restructuring adjustment" for the change in estimates.

Nomura said JD.com had yet to see any meaningful improvement in retail since the third quarter, adding that the company had also missed on any positives from the stimulus policies China has rolled out since September to rescue the property market.

Analysts.....

Several banks and brokers cut price targets and revenue growth forecasts for the firm, citing a weaker-than-expected recovery in consumer spending.

The brokerages and banks including Citi, Daiwa and Jefferies, which issued notes to clients on Thursday and Friday with the revised estimates.

According to the issued ratings of 11 analysts in the last year, the consensus rating for JD.com stock is Moderate Buy based on the current 5 hold ratings and 6 buy ratings for JD. The average twelve-month price prediction for JD.com is $53.64 with a high price target of $73.00 and a low price target of $38.00.

Summary.....

JD.com stock has a fifty day simple moving average of $32.74 and a 200 day simple moving average of $35.51. The firm has a market capitalization of $39.44 billion, a P/E ratio of 14.79, and a PEG ratio of 0.27 and a beta of 0.57. The company has a quick ratio of 1.10, a current ratio of 1.34 and a debt-to-equity ratio of 0.11.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from NVIDIA

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!