TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Kohl’s Wokeness Causes

Shares To Drop!

Weekly Options USA

Members Make 42% Potential Profit

In Less Than 1 Hour!

Members of “Weekly Options USA,” Using A Weekly Put

Option, Make Potential Profit Of 42%,

In

Less Than 1 Hour,

After Shoppers criticized Kohl's department store for selling

LGBTQ clothing

for infants and young kids!

Where To Now?

The culture war continues to incite anti-LGBTQ+ mobs to attack major brands and retailers -- and its latest victim is Kohl’s Corporation (NYSE: KSS).

Shoppers are criticizing Kohl's after the department store became the latest major retailer to sell LGBTQ clothing for infants and young kids.

This set the scene for Weekly Options USA Members to profit by 42% using a KSS Weekly Options trade!

Join Us And Get The Trades – become a member today!

Wednesday, May 31, 2023

by Ian Harvey

Why the Original Kohl’s Weekly Options Trade was Executed?

The culture war continues to incite anti-LGBTQ+ mobs to attack major brands and retailers -- and its latest victim is Kohl’s Corporation (NYSE: KSS).

Shoppers are criticizing Kohl's after the department store became the latest major retailer to sell LGBTQ clothing for infants and young kids.

Various social media accounts posted a plethora of Pride Month merchandise, including a "Baby Sonoma Community Pride Bodysuit set" designed for 3-month, 6-month and 9-month-old kids. The outfit depicts what appears to be a lesbian couple with a dog and three children, including a young boy in a wheelchair. One of the adults in the drawing carries a progressive pride flag.

Other merchandise includes a "Love Is Love" banner, towels, bibs, candles, shorts, and pillows.

The Kohl's website displays various clothing items for newborns and infants.

Several other clothing items can also be found, including shirts that say, "Be Proud" and "Ask Me My Pronouns."

The Pride display and associated products were initially highlighted by the Twitter account "End Wokeness," which posted pictures of several items alongside the caption, "Looks like Kohl's didn't learn a thing from Bud Lite and Target."

Kohl's Corporation has seen its stock plummet over the last year, sinking by over 50% due to various worrying signs. In July 2022, the stock dropped almost 21% after the retailer revealed it had ended a potential deal to be acquired by Franchise Group and warned of a decline in sales exacerbated by a drop in consumer spending.

The KSS Weekly Options Trade Explained.....

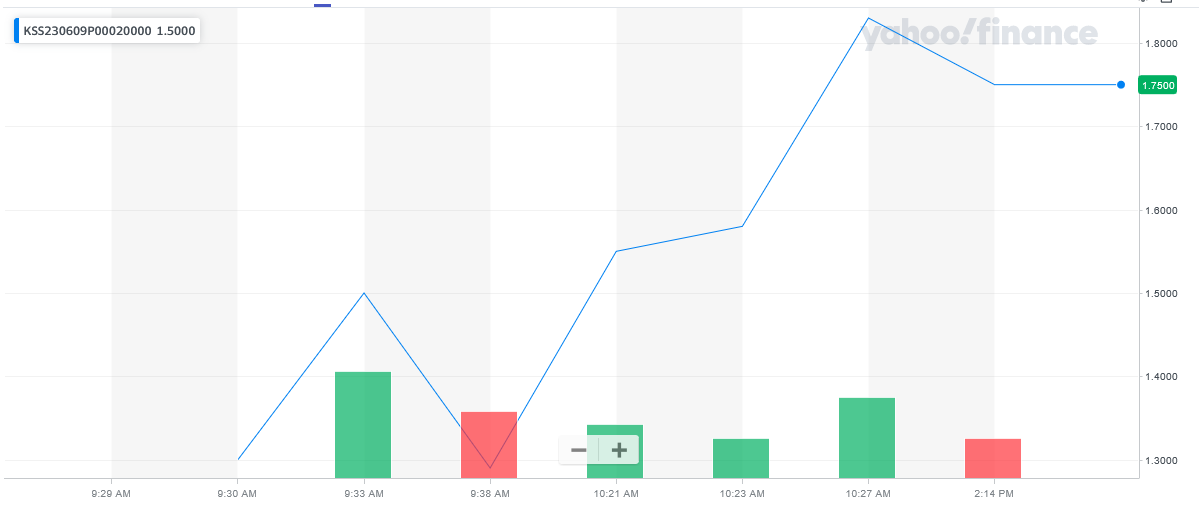

** OPTION TRADE: Buy KSS JUN 09 2023 20.000 PUTS - price at last close was $1.09 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the KSS Weekly Options (PUT) Trade on Tuesday, May 30, 2023, at 9:38, for $1.29.

Sold half the KSS weekly options contracts on Tuesday, May 30, 2023, at 10:27, for $1.83; a potential profit of 42%.

Holding the remaining KSS weekly options contracts for further profit as the week progresses.

Total Dollar Profit is $183 - $129 (cost of contract) = $54

Don’t miss out on further trades – become a member today!

About Kohl's.....

Kohl's Corp. engages in the operation of family-oriented department stores. Its business line includes apparel, footwear, and accessories for women, men, and children, home products, beauty products, and accessories. The stores generally carry a consistent merchandise assortment with some differences attributable to regional preferences. The company was founded in 1962 and is headquartered in Menomonee Falls, WI.

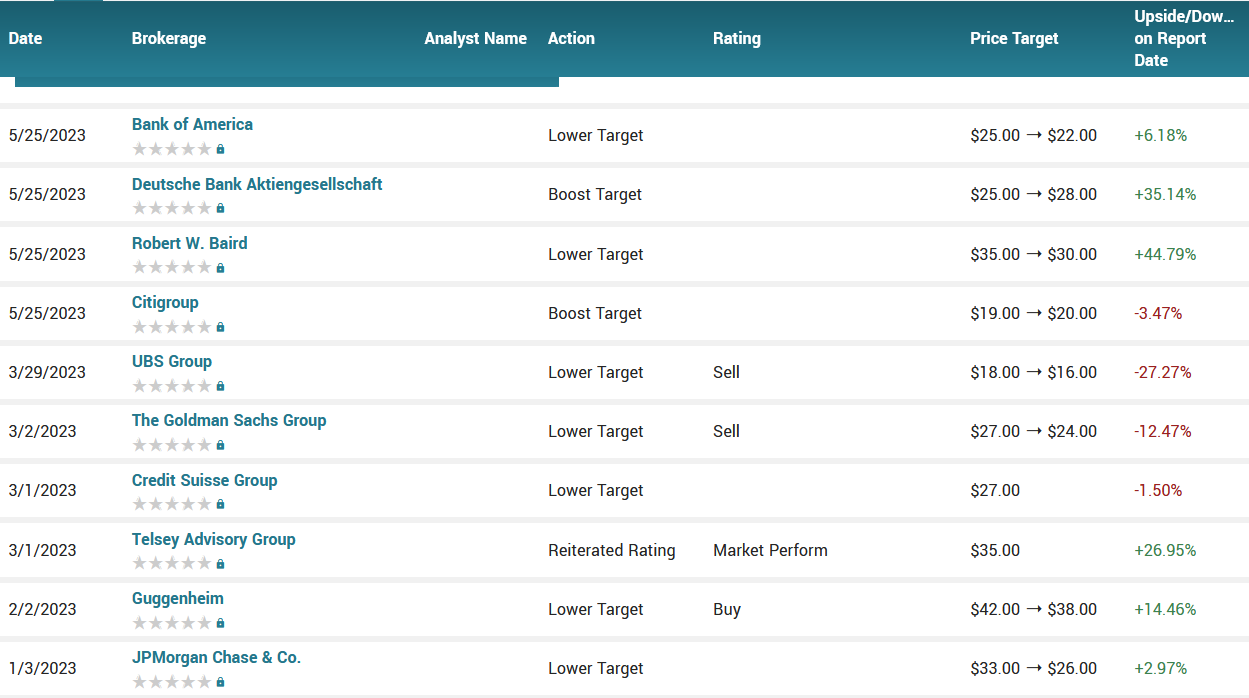

Analysts.....

According to the issued ratings of 13 analysts in the last year, the consensus rating for Kohl's stock is Hold based on the current 4 sell ratings, 6 hold ratings and 3 buy ratings for KSS. The average twelve-month price prediction for Kohl's is $27.88 with a high price target of $38.00 and a low price target of $16.00.

Summary.....

Given the backlash that started in April when Bud Light hired trans spokesperson Dylan Mulvaney, right-wing and anti-gay mobs have been empowered to attack all major brands promoting similar ideology.

Some other brands that have been targeted in recent weeks include: Miller Lite, which was attacked after a pro-women ad was revived earlier in the month; The Los Angeles Dodgers, who were accused by a Florida senator of being “anti-Catholic” after inviting a human rights group to its Pride month celebration; and Target, the most similar to Kohl’s after being attacked for selling Pride-positive clothing.

Kohl’s has a 1 year low of $18.61 and a 1 year high of $47.63. The stock has a 50-day moving average price of $21.71 and a 200-day moving average price of $26.45. The firm has a market cap of $2.22 billion, a PE ratio of -46.58, and a P/E/G ratio of 1.05 and a beta of 1.66. The company has a debt-to-equity ratio of 1.17, a current ratio of 1.17 and a quick ratio of 0.18.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from KOHL'S

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!