TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

LYFT Provides 128% Potential Profit Using A Weekly Option!

Members of “Weekly Options USA,” Using A Weekly CALL Option,

Make Potential Profit Of 128%,

After The

Ride-Sharing Operator Announced A Change In Management.

where to now?

Join

Us and GET FUTURE TRADEs!

Shares of LYFT Inc (NASDAQ:LYFT) have moved higher after the ride-sharing operator announced a change in management.

This set the scene for Weekly Options USA Members to profit by 86%, using a LYFT Weekly Options trade!

Join Us And Get The Trades – become a member today!

Monday, April 02, 2023

by Ian Harvey

Why the LYFT Weekly Options Trade was Executed?

Shares of LYFT Inc (NASDAQ:LYFT) are on the move after the ride-sharing operator announced a change in management. It said that the two co-founders would relinquish their roles in day-to-day operations and David Risher, a former Amazon and Microsoft executive, would become the next CEO.

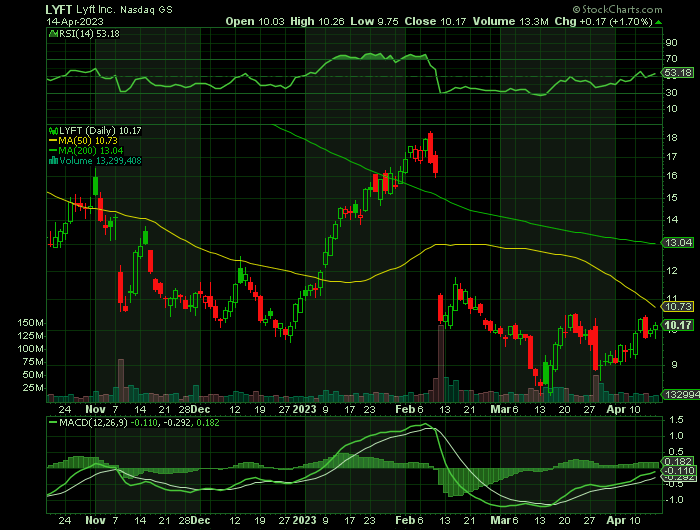

Lyft has struggled since its 2019 initial public offering (IPO), and the stock is down more than 80% since then. Profits failed to materialize, the pandemic dealt a significant setback to the company, and it lost market share to rival Uber more recently.

Now, co-founders Logan Green (CEO) and John Zimmer (President) will move on to board positions as non-executive chair and vice chair, respectively, putting David Risher in the hot seat, effective April 17. Risher was Amazon's first head of product and ran its U.S. retail division, and has been on Lyft's board since 2021.

Lyft's (LYFT) incoming CEO, David Risher, says he is up to the task of driving a better Lyft business, and it starts with taking the fight back to larger rival Uber (UBER).

"Our top priority is getting a great experience to our customers. To a certain extent, a focus on the basics — we pick you up on time, we are priced in line with the other guys and get you where you want to go," Risher said.

The LYFT Weekly Options Trade Explained.....

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

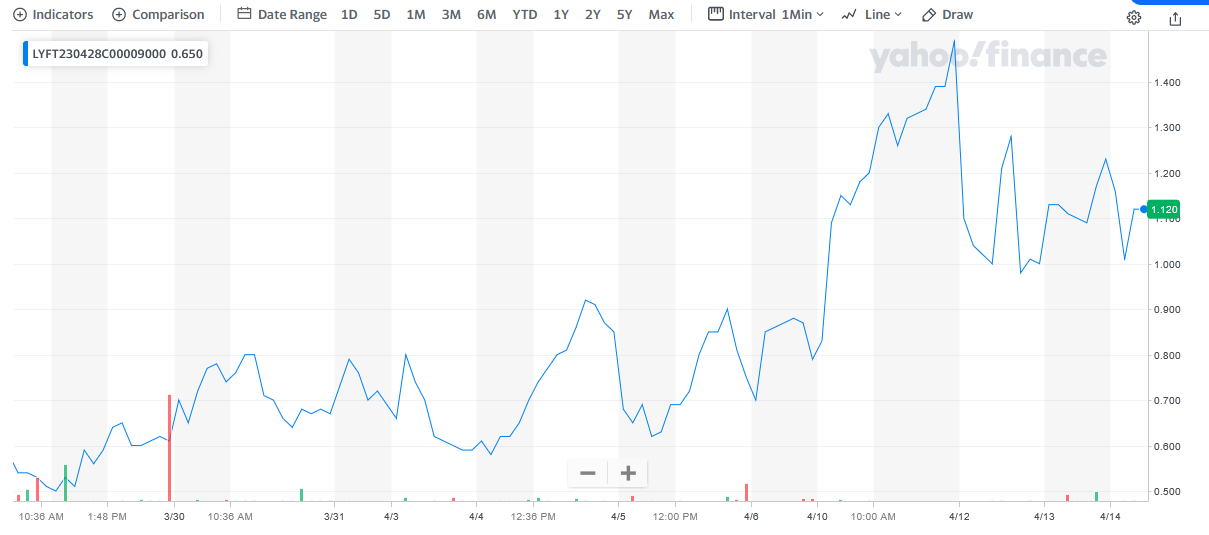

The Option Trade: Buy LYFT APR 28 2023 9.000 CALLS - price at last close was $0.65 - adjust accordingly.

Entered the LYFT Weekly Options (CALL) Trade on Thursday, March 30, 2023 for $0.65.

Sold the LYFT weekly options contracts on Friday, April 13, 2023 for $1.49; a potential profit of 129%.

About Lyft.....

Lyft Inc. is a ridesharing company that provides transportation services to consumers through its mobile app. The company was founded in 2012 by Logan Green and John Zimmer and is headquartered in San Francisco, California. Lyft is a peer-to-peer transportation platform that connects drivers with passengers who need a ride. The company operates in over 600 cities across the United States and Canada and has facilitated over 1 billion rides since its inception. Lyft's mission is to improve people's lives through the world's best transportation.

Lyft's management team is led by co-founders Logan Green and John Zimmer. Green serves as the CEO, while Zimmer is the President. Other key management team members include Elaine Paul, the Chief Financial Officer and Ashwin Raj, the Head of Ride Share.

Lyft's financial performance has been impacted by the COVID-19 pandemic, with revenue declining significantly in 2020. In 2019, the company reported revenue of $3.6 billion, an increase of 68% from the previous year. However, in 2020, revenue declined to $2.4 billion, a decrease of 34%. Despite the challenging year, Lyft has a strong balance sheet, with cash and marketable securities available to help carry it through the rebound from COVID-19.

Lyft's valuation metrics have been impacted by the pandemic and the company's financial performance. However, Lyft's price-to-earnings ratio has maintained the pace or slightly exceeded the industry averages. Lyft's stock price has been volatile recently, with significant fluctuations based on investor sentiment and news events.

Further Catalysts for the LYFT Weekly Options Trade…..

(READ HERE)

Lyft has been scrapping with Uber for years for a bigger sliver of the car-share market, but its new CEO thinks that the challenges to the company go beyond just its longtime competitor.

The company’s founders have just stepped back from their executive roles, and David Risher, who was previously a senior vice president at Amazon and a general manager at Microsoft, has been given the top spot and the task to navigate the company through a period of economic uncertainty and immense competition.

“At some point, I don’t think of this as just an Uber battle,” Risher told MarketWatch on Monday. “It’s a battle against staying at home. How do we get people out? How do we get them playing and working together?”

COVID-19-linked restrictions and cautious behavior severely dented the ride-share business as more people were confined to their houses. Lyft reportedly lost 75% of its ridership in the 12 months between April 2019 and 2020, and Uber said its ride booking dropped by 75% between April and June 2020.

While Risher didn’t reveal his grand plan for prying people out of their homes, he did say that unlike Uber, Lyft would not enter the food delivery space. Uber launched its food delivery arm, UberEats, in 2014 and by March 2023 it had become the second largest meal delivery service in the U.S., according to Bloomberg Second Measure, a data analytics company.

“Our primary vehicle (ha!) will be rideshare. And we’re going to focus on making sure our riders and drivers have an incredible experience every time they interact with us, so they use us again and again to get out into the world,” Richer said in a statement Monday.

Analysts.....

Deutsche Bank had put out a note saying that the move could lead to a buyout. Wedbush said it was more positive on the stock following the CEO change.

According to the issued ratings of 35 analysts in the last year, the consensus rating for Lyft stock is Hold based on the current 1 sell rating, 28 hold ratings and 6 buy ratings for LYFT. The average twelve-month price prediction for Lyft is $17.57 with a high price target of $60.00 and a low price target of $10.00.

Summary.....

In early February, Lyft reported generating $1.18 billion in fourth-quarter revenue, coming in 21% higher year over year. Its net loss for the quarter was $588 million, marking a nearly 108% widening from the $283 million in the same period in the prior year.

"In the end, I think right now our job … is to remind customers why we're a great alternative to the 800-pound gorilla in the room where we're focused on them, not just on packages and pizza and other things, and how we're going to, you know, really work pretty hard, I think, to earn their ridership back, because I think we've fallen a little off to the side," Risher said. "I think it's time to really come back and really, you know, really make a big statement."

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from LYFT

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!