TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Marathon

Digital Reacting Positively To Crypto Movement!

Weekly Options Members

Are Up 43% Potential Profit, in 1.5 hours,

Using A Weekly CALL Option!

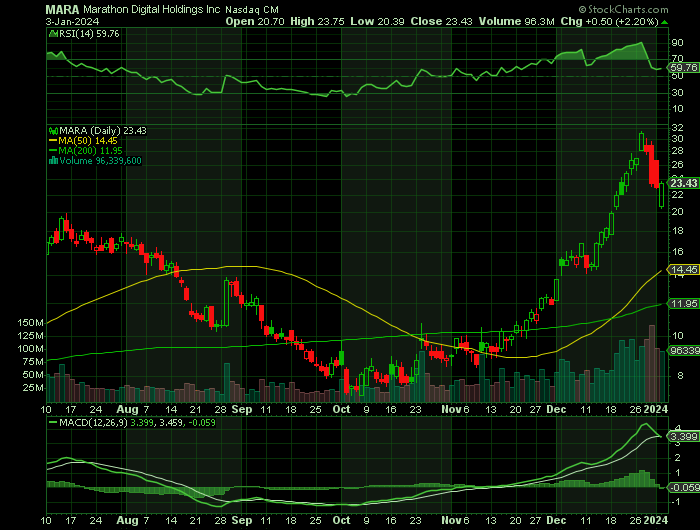

MARA stock has had a wild run recently, jumping from $9 to a high of $29.67 in just two months. From open to close in 2023, MARA stock rose 452.71%.

After jumping to $26.69 to kick off 2024, the shares of Marathon Digital sported a 2.9% lead to trade at $24.16 on Monday. Dropped back Tuesday, but climbed more than 2.5% today.

While the company has already had an incredible run, the stock market projects even more volatility for 2024, as seen by the 128.6% implied volatility through the Jan. 17, 2025, options cycle.

This set the scene for Weekly Options USA Members to profit by 43%, in 1.5 hours, using a MARA Options trade!

Join Us And Get The Trades – become a member today!

Wednesday, January

03, 2024

by Ian Harvey

Why the Marathon Digital Holdings Weekly Options Trade was Originally Executed!

The new surge in the world’s largest cryptocurrency — which began on Monday night — is due largely to excitement about a series of spot bitcoin exchange-traded funds that could receive approvals this month.

After jumping to $26.69 to kick off 2024, the shares of Marathon Digital Holdings Inc (NASDAQ:MARA) sported a 2.9% lead to trade at $24.16 on Monday. This positive price action follows Bitcoin's (BTC) first move above the $45,000 level since April 2022, which is boosting the cryptocurrency sector. However, this dropped again slightly yesterday, but pre-market is trading back up.

Marathon Digital stock has been a massive sector outperformer over the last year, boasting a 613.5% gain compared to a 113.1% 12-month lead for the ProShares Bitcoin Strategy ETF (BITO). MARA scored a Dec. 27, 52-week high of $31.30, locking in 2023 as its second-best yearly performance, lagging only behind a 1,084.5% gain in 2020.

Despite this outperformance, analysts remain hesitant. In fact, seven of the nine in coverage rate Marathon Digital stock a "hold" or worse, leaving room for an unwinding of pessimism. Further, while short interest is unraveling -- down 16.7% over the last month -- the 44.99 million shares sold short still represent 20.8% of MARA's total available float.

The Marathon Digital Holdings Weekly Options Potential Profit Explained.....

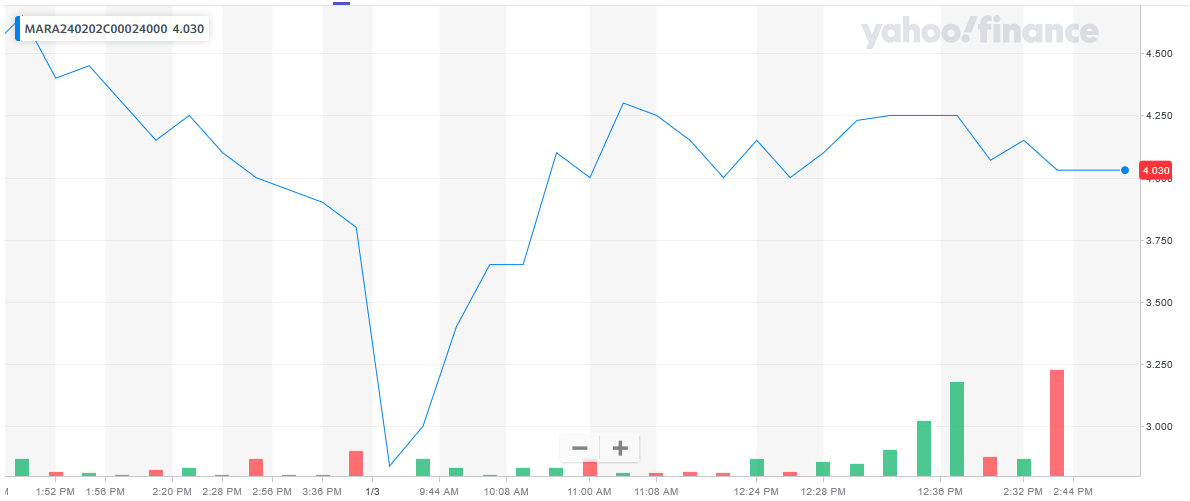

** OPTION TRADE: Buy MARA FEB02 2024 24.000 CALLS - price at last close was $3.80 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the MARA Weekly Options (CALL) Trade on Wednesday, January 03, 2024, at 9:31am, for $3.00.

Sold half the MARA weekly options contracts on Wednesday, January 03, 2024, at 11:03am for $4.30; a potential profit of 43%.

Holding the remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About Marathon Digital.....

Marathon

Digital Holdings Inc, also known as Marathon Patent Group, is a digital asset

technology company based in Las Vegas, Nevada. The blockchain technology-based

mining company specializes in producing digital assets like Bitcoin.

The company was formerly known as Marathon Patent Group and was a

patent-holding company that held patents but did not produce products, instead

operating as a patent trolling company that purchases patents and then takes

legal action against patent infringers. In 2020 Marathon Patent Group changed its

name to Marathon Digital Holdings Inc.

It partnered with the Hardin Generating Station Montana coal plant to power the

adjacently constructed Marathon bitcoin mining center.

The

company's leadership team comprises experienced professionals with finance, law

and technology backgrounds. The chief executive officer is Fred Thiel, who

replaced Merrick Okamoto as the CEO and Chairman of the Board. Fred Thiel

previously worked as Marathon's Lead Independent Director.

Other notable executive management team members include Hugh Gallagher, the

Chief Financial Officer with over thirty years of experience in capital

markets, investment analysis and treasury management.

Also notable is Ashu Swami, the Chief Technology Officer, an experienced chip

designer, crypto and DeFi expert. Ashu Swami brings Marathon deep technical,

regulatory and market expertise. Ashu Swami joins Marathon Digital Holdings

from his previous employer Core Scientific, where he served as the chief

product officer, leading the company's foray into DeFi and heading mining

hardware and software optimization.

Marathon

Digital Holdings has experienced growth issues since its inception, with the

stock price dropping from its IPO price of $100 to around $8. The company's

gross profit margins have improved over time, but the company's blended profit

margin since the IPO is about -180%.

The company has debt levels that have remained at approximately 50% of its

asset value. In December 2020, Marathon Digital Holdings completed a public

offering of common stock, raising $250 million in net proceeds.

Marathon Digital Holdings trades at a price-to-earnings ratio higher than the

industry average, and the company's price-to-book ratio is more than twice the

industry average. These metrics suggest that Marathon Digital Holdings is

valued at a premium over its industry peers.

The company's stock price has experienced significant volatility in recent

years, especially after the bitcoin crash of 2021. Trading volume has been

higher than industry peers averaging around 31 million daily shares.

Marathon Digital Holdings operates in the rapidly growing blockchain technology industry, which has been gaining mainstream attention in recent years. The industry is characterized by high competition, with a few dominant players and many smaller firms. The industry is also subject to regulatory and political risks, with many governments worldwide taking different approaches to regulating cryptocurrencies and blockchain technology.

Marathon Digital Holdings has several potential growth opportunities, including expanding its mining operations, launching new digital asset products and exploring partnerships with other blockchain technology companies. The company has recently invested in new mining equipment, which is expected to increase its mining capacity significantly. The company is also exploring new products, such as the potential launch of a Bitcoin exchange-traded fund.

Marathon Digital Holdings is subject to significant price fluctuations, impacting the company's revenue and profitability. The regulatory environment surrounding blockchain technology is still determined, and regulation changes could affect the company's operations. The industry is subject to intense competition, and Marathon Digital Holdings must continue to innovate and stay ahead of its competitors.

Another challenge for Marathon Digital Holdings is the reliance on the Bitcoin mining industry. If the Bitcoin network experiences significant disruptions or a decline in popularity, it could negatively impact the company's revenue and profitability.

The company is also subject to operational risks, such as cybersecurity threats, equipment failure and electricity and internet connectivity availability.

Further Catalysts for the MARA Weekly Options Trade…..

The Securities and Exchange Commission is expected to rule by Jan. 10 on applications from 12 money managers that hope to launch the ETFs, which would allow everyday people to get exposure to bitcoin without having to own it.

The applicants include some of the biggest names on Wall Street, from BlackRock (BLK) to Franklin Templeton (BEN). The SEC has in the past denied such applications, arguing the products were vulnerable to market manipulation.

Those in the industry say there are signs that regulators won’t stand in the way this time around and will instead give the green light to all applicants at once.

Other Catalysts.....

Marathon was once a tiny patent holding company. But in 2020, it ordered tens of thousands of top-tier ASIC miners and rebranded itself as a pure-play Bitcoin miner.

Many investors were initially skeptical of that plan, which sounded like a questionable way to profit from the market's soaring interest in Bitcoin. Nevertheless, Marathon consistently expanded over the following three years and became the world's largest Bitcoin mining company, with a fleet of about 184,400 active miners as of Dec. 1. Its closest competitor, Riot Platforms, operated a fleet of 112,944 active miners at the end of November.

Marathon produced an average of 38.4 BTC daily in November, which represented a 144% increase from a year earlier. Riot only produced 18.4 BTC daily, which represented a mere 6% increase from the previous year.

Marathon is scaling up its business at a much faster rate than Riot. Over the past year, it opened two new plants, launched a new joint venture in Abu Dhabi, and agreed to buy multiple BTC mining sites for $179 million in mid-December. Those bold moves will likely consolidate a large portion of the market and widen its lead against Riot.

Revenue.....

Marathon generates most of its revenue from BTC mining. It also periodically sells the BTC it mines to boost its cash holdings. At the end of the third quarter of 2023, it held $101 million in cash and $287 million in BTC on its balance sheet. That marked the first time its total cash and BTC holdings exceeded its total debt.

Marathon's revenue soared from $4 million in 2020 to $150 million in 2021 as it deployed its first miners. But in 2022, its revenue declined to $118 million as BTC's price tumbled amid rising interest rates and other macro headwinds.

Looking Ahead.....

Analysts expect Marathon's revenue to more than triple to $359 million this year as BTC's price recovers and it significantly expands its mining operations. They also expect its revenue to rise another 47% in 2024 and 42% in 2025 -- but we should take those estimates with a grain of salt, because they're tightly tethered to BTC's volatile price.

Analysts.....

BTIG analyst Gregory Lewis maintained a Hold rating on Marathon Digital Holdings yesterday. The company’s shares closed last Tuesday at $25.87.

According to the issued ratings of 9 analysts in the last year, the consensus rating for Marathon Digital stock is Hold based on the current 1 sell rating, 5 hold ratings and 3 buy ratings for MARA. The average twelve-month price prediction for Marathon Digital is $12.41 with a high price target of $24.00 and a low price target of $4.00.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Marathon Digital

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!