TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

META Profit – 35% In 22 Minutes

By Using A Weekly

Options Trade!

Meta Platforms (NASDAQ: META), the Facebook parent, delivered a smashing fourth-quarter earnings report on Thursday, announcing a massive share buyback, and declaring a dividend for the first time, as well as focusing on cutting back costs and shoring up billions in profits.

The stock rose 20% Friday to close at an all-time high of $474.99 per share. The gain added $197 billion to its market capitalization, the biggest single-session market value addition.

Meta has some clear advantages in its AI efforts. The social media giant's business model has always involved gathering and monetizing huge amounts of data.

This set the scene for Weekly Options USA Members to profit by 35%, in 22 minutes, using a META Options trade!

Join Us And Get The Trades – become a member today!

Monday, February 12, 2024

by Ian Harvey

Meta Platforms (NASDAQ: META), the Facebook parent, provided members of “Weekly Options USA" a potential return of 1,300% profit on Friday, February 02, 2024.

Even after rallying another 30% year to date and achieving new all-time highs, Meta may still have more fuel left in the tank. This gave us cause to execute another trade on Meta.

Wall Street analysts expect earnings per share and free cash flow to rise another 15% and 18%, respectively, in 2024 -- and to continue at a similar rate of increase for the next couple of years afterward.

META is benefiting from steady user growth across all regions, particularly Asia Pacific. Increased engagement for its offerings like Instagram, WhatsApp, Messenger and Facebook has been a major growth driver. META is leveraging AI to recommend Reels content, which is driving traffic on Instagram and Facebook.

META’s innovative portfolio, which includes Threads, Reels, Llama 2, Ray-Ban Meta smart glass, and mixed reality device Quest 3, is likely to drive growth. Reels continued to impress across both Instagram and Facebook backed by growing adoption. People reshared Reels 3.5 billion times every day during the fourth-quarter.

Why the META Weekly Options Trade was Originally Executed!

Meta Platforms Inc (NASDAQ: META) is the parent behind the world's top social media assets. Collectively, Facebook, WhatsApp, Instagram, and Facebook Messenger are four of the most downloaded apps globally and were responsible for luring nearly 4 billion monthly active users during the December-ended quarter.

Even after rallying another 30% year to date and achieving new all-time highs, Meta may still have more fuel left in the tank. Wall Street analysts expect earnings per share and free cash flow to rise another 15% and 18%, respectively, in 2024 -- and to continue at a similar rate of increase for the next couple of years afterward.

Shares of Meta Platforms have crushed the broader market handsomely in the past year with impressive gains of 154%, driven by robust growth in its top and bottom lines. It looks like its eye-popping rally is here to stay following its latest earnings report.

Meta Platforms released its fourth-quarter and full-year 2023 results on Feb. 1. Shares of the company jumped 20% the following day thanks to its better-than-expected numbers and guidance. The good part is that Meta stock remains affordable, and investors who haven't bought this tech giant yet should consider buying it hand over fist right now.

Members of Weekly Options USA were in a position to gain a potential profit of 1,300% at this time.

The META Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy META MAR 08 2024 500.000 CALLS - price at last close was $4.10 - adjust accordingly.

NOTE: It is not necessary for the stock price to hit $500 – we are after the profit generated as it makes its way there.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the META Weekly Options (CALL) Trade on Monday, February 12, 2024, at 9:39, for $4.80.

Different Profit Scenarios – depends on the individual members risk strategy......

1. Sold half the META weekly options contracts on Monday, February 12, 2024, at 10:01 (22minutes) for $6.46; a potential profit of 35%.

2. Sold half the META weekly options contracts on Monday, February 12, 2024, at 11:34 for $6.83; a potential profit of 42%.

3. Retained all Meta contracts for further profit.

4. Or/and adding more options by buying the dip at 2:05 for $3.80.

Don’t miss out on further trades – become a member today!

About Meta Platforms.....

Meta Platforms, Inc. is a US-based multinational technology company and 1 of the Big 5 US tech companies. It is a member of the FAANG group holding the first position with its original name, Facebook.

Meta Platforms, Inc life began in 2004 as a digital “face book” for Harvard students. The company was founded by Mark Zuckerburg and a group of friends but now only Zuckerburg remains. The company quickly grew and expanded into other universities and then opened itself to the public in 2006. As of 2006, anyone over the age of 13 can be a Facebook user which is the company’s primary source of income. As of 2022, the company claimed more than 2.9 billion monthly active Facebook users.

Facebook, Inc filed for its IPO on January 1st 2012. The prospectus stated the company was seeking to raise $5 billion but it got so much more. The day before the IPO execs announced it would sell 25% more stock than it had previously stated because of the high demand. The company wound up raising more than $16 billion making it the 3rd largest IPO in history at the time.

The massive IPO valuation earned Facebook a spot in the S&P 500 in the first year of its public life. Although its valuation has deteriorated in the wake of scandal and consumer trends within social media, early investors were treated to gains in excess of 1000% at the peak of the stock run. Mark Zuckerburg retained 22% ownership in the company following the IPO, and 57% of the voting rights. As of 2022, those holdings were down to about 14% of the company and 54% of the voting rights.

Over the years, Facebook acquired a large number of apps and other businesses that include but are not limited to Instagram and WhatsApp. The company changed its name to Meta Platforms DBA Meta in 2021 to reflect its business and mission better. The new name describes the metaverse and refers to the seamless social interaction provided by Meta’s social media application universe.

Today, Meta develops digital applications that allow people to connect with family, friends, businesses, and merchants through Internet connections. Applications are available for mobile, PC, VR, and smart homes.

The company’s primary operating segment is the Family of Apps. The family of Apps includes Facebook and all the other digital applications. This segment produces virtually all of the revenue which is in turn 97% advertising oriented. The other operating segment is Reality Labs. Reality Labs develops and markets a line of virtual and augmented-reality products.

Further Catalysts for the META Weekly Options Trade…..

Meta Platforms reported Q4 revenue of $40.1 billion, an increase of 25% over the year-ago period. Additionally, the company reduced its costs and expenses by 8% during the quarter, which allowed it to triple its adjusted earnings on a year-over-year basis to $5.33 per share. The numbers were better than consensus expectations of $4.96 per share in earnings on revenue of $39.2 billion.

It is worth noting that Meta's Q4 revenue grew at the fastest pace since the middle of 2021 and outpaced the company's full-year revenue increase of 16%. The tech giant's full-year earnings were up 73% to $14.87 per share on account of its focus on controlling costs and improving the efficiency of its business operations in 2023.

Other Catalysts.....

Meta benefited from an improvement in digital ad spending last year. According to eMarketer, digital ad spending increased 10.7% in 2023 to $627 billion. So, Meta grew at a faster pace than the market in which it operates. Moreover, its 2023 revenue indicates that it controlled 21.5% of the digital ad space last year. That's an improvement over the 20.5% share in 2022.

Even better, Meta's revenue forecast for the first quarter of 2024 indicates that it could continue to corner a bigger share of the digital ad market. The company is anticipating almost $36 billion in revenue in the current quarter at the midpoint of its guidance range. That would be a 25% increase over the prior-year period's figure of $28.6 billion. Meanwhile, overall digital ad spending is estimated to jump 13.2% in 2024.

Artificial intelligence (AI) could be a key reason why Meta is gaining ground in the digital ad space. The company pointed out on its latest conference call with analysts that it continues to "leverage AI across our ads systems and product suite" in a bid to improve monetization efficiency. Meta's offerings such as Advantage+, which allows advertisers to create automated ad campaigns with the help of AI and optimize those campaigns to drive greater returns on ad dollars spent, are gaining solid traction among its customers.

AI Adoption.....

The company also released new generative AI features in the previous quarter for advertisers, with which they can generate multiple background images that complement product images and create alternative versions of advertising text so that they can choose the one that will help them improve reach. Meta management says that the "initial adoption of these features has been strong and tests are showing promising early performance gains."

The adoption of AI in the digital marketing space is forecast to increase at an annual rate of almost 27% through 2030. AI in digital marketing is expected to generate annual revenue of $79 billion in 2030 compared to just $1.8 billion in 2022. So, Meta is pulling the right strings to ensure that it can keep winning a bigger share of the digital ad market by giving advertisers more AI-focused tools.

WhatsApp…..

The company has been doubling down its efforts to monetize WhatsApp through business messaging, among other initiatives. And while they still account for a tiny percentage of its total revenue, this could be a massive opportunity given Meta Platforms' large ecosystem. And it is just one of the company's growth initiatives.

Year of Efficiency.....

The macroeconomic landscape aside, one of the biggest contributors to Meta's improving outlook was the efforts it took last year to rein in spending, which CEO Mark Zuckerberg dubbed the company's "year of efficiency." Initially, management expected full-year 2023 expenses in a range of $94 billion to $100 billion. However, several revised estimates and much belt-tightening later, Meta's expenses for the year clocked in at just $88 billion -- which in turn helped boost the company's bottom line.

That, combined with the recovering digital advertising market, had a dramatic effect on Meta's recent financial results.

Management is so confident in the company's prospects that Meta declared its first-ever quarterly dividend of $0.50 per share, a yield of about 0.44%. Based on its 2023 results, that works out to a payout ratio of about 13%, which leaves plenty of opportunity for increases.

Hedge Fund Adoption.....

Meta Platforms ranks as the top holding in Tepper's Appaloosa hedge fund. As of Sept. 30, 2023, it owned 1.95 million shares -- more than 11.5% of the overall portfolio at the time.

Until recently, Meta wouldn't have made a list featuring Tepper's dividend stocks. However, the social media leader announced on Feb. 1, 2024 that it's initiating a quarterly dividend of $0.50 per share. This translates to a dividend yield of around 0.44%. It's not great, but it's a start.

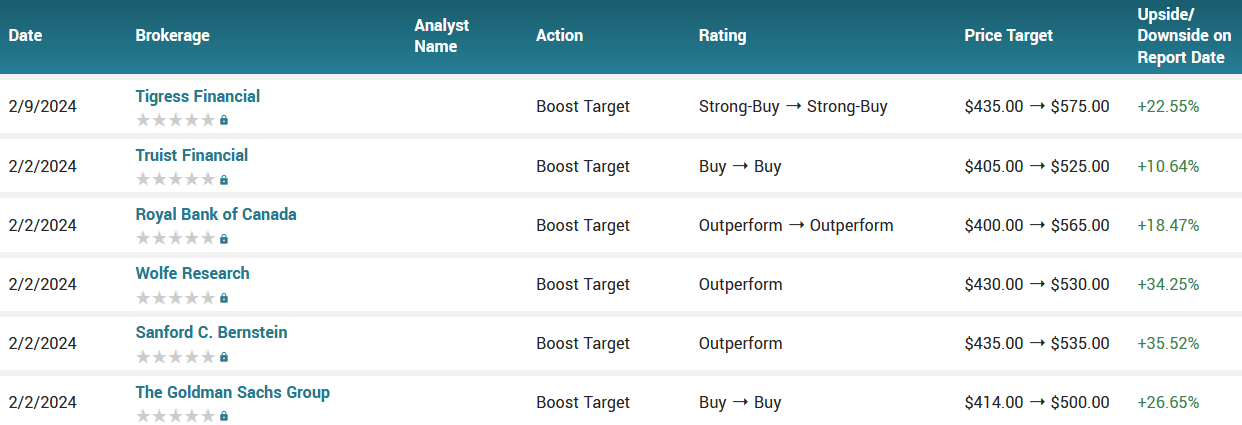

Analysts.....

It is not surprising to see analysts expecting Meta's growth to remain solid.

Tigress Financial analyst Ivan Feinseth has reiterated their bullish stance on META stock, giving a Buy rating on February 5.

Ivan Feinseth has given his Buy rating due to a combination of factors that highlight Meta Platforms’ strong performance and promising future prospects. The analyst emphasizes Meta’s continued success in the digital advertising realm, bolstered by their innovative use of AI, which is expected to drive further ad revenue growth. Additionally, the company’s introduction of new products and features is anticipated to increase user engagement, a key metric for social media platforms.

Furthermore, Feinseth recognizes Meta’s strategic financial management, including disciplined cost measures that are forecasted to accelerate business performance and enhance shareholder value. The report also notes Meta’s robust balance sheet and cash flow, which support the company’s ability to invest in growth initiatives and make strategic acquisitions. These financial strengths, combined with the commencement of share repurchases and the initiation of a dividend, present a strong case for Meta’s potential to reward investors, thus warranting the Buy rating.

In another report released on February 5, DZ BANK AG also maintained a Buy rating on the stock with a $550.00 price target.

Also, Raymond James managing director Josh Beck calls Meta "a little bit of [an] unsung hero" of AI. He specifically cites the "incremental monetization opportunities in advertising," which is right in Meta's ballpark. As a result, he believes Meta can grow at twice the rate of the overall ad industry in 2024.

Wall Street seems to agree, as analysts' consensus estimates call for revenue of nearly $157 billion in 2024, a 16% increase -- which is about twice the 8% growth rate the ad industry is expected to achieve this year. It's worth pointing out that Meta has made a habit of exceeding expectations, so these estimates could end up being conservative.

According to the issued ratings of 46 analysts in the last year, the consensus rating for Meta Platforms stock is Moderate Buy based on the current 2 sell ratings, 2 hold ratings, 40 buy ratings and 2 strong buy ratings for META. The average twelve-month price prediction for Meta Platforms is $494.53 with a high price target of $575.00 and a low price target of $280.00.

Summary.....

There is still plenty of fuel left in Meta's growth engine. The company ended 2023 with 3.98 billion monthly active users, an increase of 6% year over year. That's more than half the world's population.

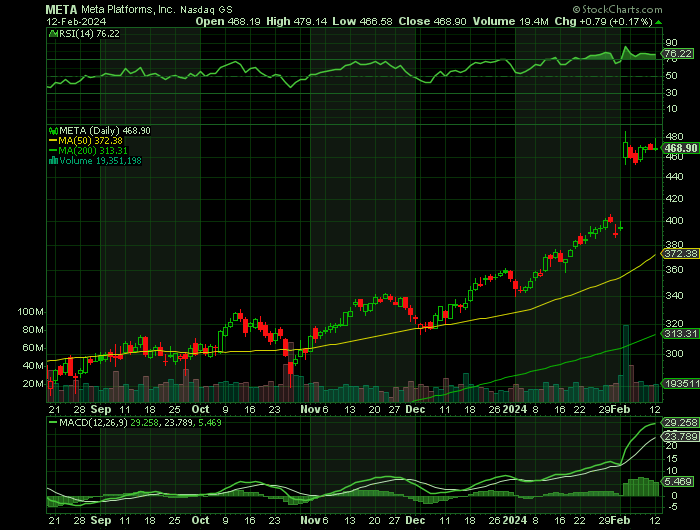

Meta Platforms stock traded down $1.89 during trading hours on Friday, reaching $468.11. The stock had a trading volume of 18,413,137 shares, compared to its average volume of 21,937,472. The company has a market cap of $1.20 trillion, a price-to-earnings ratio of 31.42, and a PEG ratio of 1.22 and a beta of 1.15. The company has a debt-to-equity ratio of 0.12, a current ratio of 2.67 and a quick ratio of 2.57. The business's 50 day moving average price is $371.59 and its 200-day moving average price is $331.84. Meta Platforms, Inc. has a 52 week low of $167.66 and a 52 week high of $485.96.

Finally, after it tripled last year, you might expect Meta's valuation to be stretched, but that's not the case. The stock is selling for 30 times earnings and 9 times sales, a slight premium to the overall market.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from META

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!