TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Meta Fine Provides 63% Potential

Profit For Members!

Members of “Weekly Options USA,” Using A Weekly PUT Option,

Make Potential

Profit Of 63%,

After Facebook Owner Meta Platforms Was

Hit

By A Record €1.2 Billion ($1.3 Billion) European Union Privacy Fine.

Where To Now?

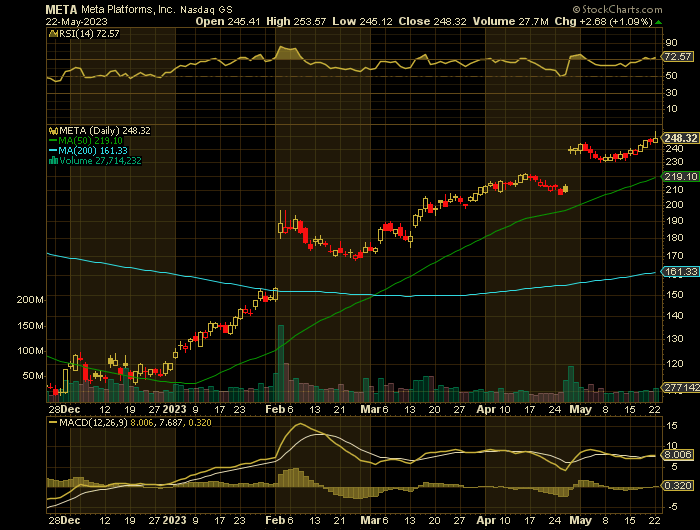

Meta shares are falling after European regulators hit Facebook's parent company, Meta, with a $1.3 billion fine on Monday, finding that the company had misused Europeans' data.

This set the scene for Weekly Options USA Members to profit by 63%, using a META Weekly Options trade!

Join Us And Get The Trades – become a member today!

Monday, May 22, 2023

by Ian Harvey

Why the Original Meta Platforms Weekly Options Trade was Executed?

Facebook owner Meta Platforms Inc (NASDAQ: META) was hit by a record €1.2 billion ($1.3 billion) European Union privacy fine and given a deadline to stop shipping users’ data to the US after regulators said it failed to protect personal information from the American security services.

The social network giant’s continued data transfers to the US didn’t address “the risks to the fundamental rights and freedoms” of people whose data was being transfered across the Atlantic, the Irish Data Protection Commission said on Monday.

On top of the fine, which eclipses a €746 million EU privacy penalty previously doled out to Amazon.com Inc., Meta was given five months to “suspend any future transfer of personal data to the US” and six months to stop “the unlawful processing, including storage, in the US” of transferred personal EU data.

As well, Meta shares traded lower Friday after it showcased its AI chips and supercomputer.

About Meta Platforms.....

Meta Platforms, Inc. is a US-based multinational technology company and 1 of the Big 5 US tech companies. It is a member of the FAANG group holding the first position with its original name, Facebook.

Meta Platforms, Inc life began in 2004 as a digital “face book” for Harvard students. The company was founded by Mark Zuckerburg and a group of friends but now only Zuckerburg remains. The company quickly grew and expanded into other universities and then opened itself to the public in 2006. As of 2006, anyone over the age of 13 can be a Facebook user which is the company’s primary source of income. As of 2022, the company claimed more than 2.9 billion monthly active Facebook users.

Facebook, Inc filed for its IPO on January 1st 2012. The prospectus stated the company was seeking to raise $5 billion but it got so much more. The day before the IPO execs announced it would sell 25% more stock than it had previously stated because of the high demand. The company wound up raising more than $16 billion making it the 3rd largest IPO in history at the time.

The massive IPO valuation earned Facebook a spot in the S&P 500 in the first year of its public life. Although its valuation has deteriorated in the wake of scandal and consumer trends within social media, early investors were treated to gains in excess of 1000% at the peak of the stock run. Mark Zuckerburg retained 22% ownership in the company following the IPO, and 57% of the voting rights. As of 2022, those holdings were down to about 14% of the company and 54% of the voting rights.

Over the years, Facebook acquired a large number of apps and other businesses that include but are not limited to Instagram and WhatsApp. The company changed its name to Meta Platforms DBA Meta in 2021 to reflect its business and mission better. The new name describes the metaverse and refers to the seamless social interaction provided by Meta’s social media application universe.

Today, Meta develops digital applications that allow people to connect with family, friends, businesses, and merchants through Internet connections. Applications are available for mobile, PC, VR, and smart homes.

The company’s primary operating segment is the Family of Apps. The family of Apps includes Facebook and all the other digital applications. This segment produces virtually all of the revenue which is in turn 97% advertising oriented. The other operating segment is Reality Labs. Reality Labs develops and markets a line of virtual and augmented-reality products.

The META Weekly Options Trade Explained.....

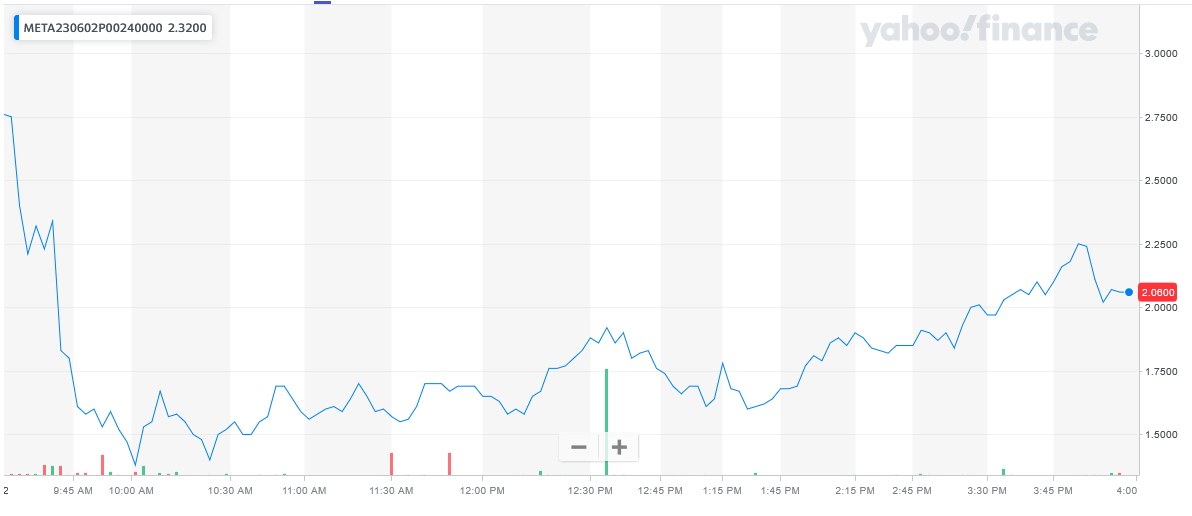

** OPTION TRADE : Buy META JUN 02 2023 240.000 PUTS - price at last close was $3.15 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the META Weekly Options (PUT) Trade on Monday, May 22, 2023, at 10:00, for $1.38.

Sold half the META weekly options contracts on Monday, May 22, 2023, at 3:51, for $2.25, a potential profit of 63%.

Holding the remaining META weekly options contracts for further profit as the week progresses.

Don’t miss out on further trades – become a member today!

Why Meta Platforms Shares Are Falling…..

The ban on data transfers was widely expected and once prompted the US firm to threaten a total withdrawal from the EU. Still, the likely impact has now been muted by the transition phase and the prospect of a new EU-US data flows agreement that could already be operational by the middle of this year.

Monday’s decision is the latest round in a long—running saga that eventually saw Facebook and thousands of other companies plunged into a legal vacuum. In 2020, the EU’s top court annulled an EU-US pact regulating transatlantic data flows over fears citizens’ data wasn’t safe once it arrived on US servers.

While judges didn’t strike down an alternative tool based on contractual clauses, their doubts about American data protection quickly led to a preliminary order from the Irish authority telling Facebook it could no longer move data to the US via this other method either.

The data-transfer curbs risk carving up the internet “into national and regional silos, restricting the global economy and leaving citizens in different countries unable to access many of the shared services we have come to rely on,” Nick Clegg, Meta’s president of global affairs, and Jennifer Newstead, chief legal officer, said in a blog post.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from META PLATFORMS

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!