TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Micron

Technology Earnings

Sunday, December 19, 2021

by Ian HarveyMicron Technology earnings are set for approximately 4:00 PM ET on Monday, December 20, 2021.

expectations for Micron Technology Earnings

Micron Technology, Inc. (NASDAQ: MU) will report first-quarter fiscal 2022 results on Monday, December 20, after the market closes.

Micron's

fiscal 2022 first-quarter guidance shows that it won't be running out of steam.

The company anticipates $2.10 per share in adjusted earnings on revenue of

$7.65 billion this quarter, while the non-GAAP gross margin is expected to land

at 47%. These numbers point toward a huge improvement over the prior-year

period.

Micron had

earned $0.78 per share in the first quarter of fiscal 2021, indicating that its

earnings could increase 169% year over year at the midpoint of the guidance

range. Additionally, the company's revenue is on track to jump 32% year over

year from $5.77 billion in the year-ago quarter.

It is worth

noting that Micron Technology earnings for fiscal first quarter covers the three-month period

from September to November, so any weakness in DRAM prices would be reflected

in the company's results. However, the guidance suggests that the prices will

continue to remain strong, and recent Wall Street chatter indicates that the

demand from the PC, server, and smartphone markets will remain robust next

year.

Analysts estimate that Micron Technology earnings for revenue could increase 15% in fiscal 2022, followed by a 16% jump in fiscal 2023. What's more, the company's earnings are expected to jump 45% this fiscal year and 24% in the next one. Micron's five-year annual earnings growth forecast of 22% is also healthy, which isn't surprising given the booming memory demand anticipated in the coming years.

For the last reported quarter, it was expected that Micron Technology earnings would post earnings of $2.33 per share when it actually produced earnings of $2.42, delivering a surprise of +3.86%.

Over the last four quarters, Micron Technology earnings has beaten consensus EPS estimates four times.

About Micron Technology, Inc. (NASDAQ: MU)

Micron

Technology, Inc. engages in the provision of innovative memory and storage

solutions.

It operates

through the following segments: Compute & Networking Business Unit (CNBU),

Mobile Business Unit (MBU), Storage Business Unit (SBU), and Embedded Business

Unit (EBU). The CNBU segment includes memory products sold into cloud server,

enterprise, client, graphics, and networking markets. The MBU segment offers

memory products sold into smartphone and other mobile-device markets. The SBU

segment comprises of SSDs and component-level solutions sold into enterprise

and cloud, client, and consumer storage markets, and other discrete storage

products sold in component and wafer forms. The EBU segment consists of memory

and storage products sold into automotive, industrial, and consumer markets.

The company was founded by Ward D. Parkinson, Joseph Leon Parkinson, Dennis Wilson, and Doug Pitman on October 5, 1978 and is headquartered in Boise, ID.

Influencing Factors for Micron Technology Earnings

United Microelectronics Corporation Relationship.....

On Nov. 25, Micron and the Taiwanese semiconductor foundry United Microelectronics (NYSE:UMC) reached a settlement in a long-standing intellectual property dispute. To settle the claim by Micron that UMC stole secrets and leaked them to a Chinese customer, UMC agreed to make an undisclosed one-time payment to Micron.

Then on Wednesday, December 01, Micron and UMC announced an enhanced strategic partnership. According to the press release, Micron will expand its business relationship with UMC, especially for customers in the automotive and mobile markets.

Micron's head of global operations, Manish Bhatia, said: "Expanding our relationship with UMC helps us strengthen our customers' supply chains and is a great opportunity to increase collaboration across the semiconductor industry. ... This expanded relationship provides Micron continuing access to products that are critical to our automotive and mobile customers, and we look forward to working with UMC in the coming years to deliver our industry-leading memory and storage solutions to our customers globally."

Metaverse.....

Whether the metaverse works out or not, one solid bet is the continued buildout of data centers, communications equipment, and consumer devices that will need more and more computing power. Enter Micron Technology, one of only three producers of DRAM memory and one of only six major producers of NAND flash storage.

Think of DRAM and NAND as the "oil" that drives the "horsepower" of computing. The more computing power you need, the more bits of DRAM. The more data that needs to be stored, whether in devices or the cloud, the more NAND flash you need.

Due to commodity-like properties of DRAM and NAND flash, prices per bit can fluctuate. That volatility and cyclicality has caused Micron Technology to trade at a huge discount to the rest of the tech industry: Currently, just 9 times next year's earnings estimates.

However, if you think about not just metaverse investments, but also 5G phones, artificial intelligence and machine learning, cloud computing, and autonomous vehicles, demand for memory is only increasing and broadening across a range of industries.

Micron's management believes we're entering a new era in which chip and memory demand becomes steadier; to highlight this prediction, management recently instituted a dividend this past summer. The new dividend, more share repurchases, and hopefully more consistency could spell a valuation rerating higher for Micron in the "metaverse era."

Other Factors Effecting Micron Technology Earnings.....

Micron has solid memory chip demand across all its end-markets. The pandemic-led work-and-learn from home trend has fueled significant demand for personal computers (PCs) and notebooks.

The remote-working and online-learning trend amid the COVID-19 crisis has also stoked demand for cloud storage.

As well, lockdowns and social distancing measures have fueled the usage of online and e-commerce services globally, compelling data-center operators to enhance their capacities in order to accommodate the demand spike for cloud services.

There has been a solid uptick in the dynamic random access memory (DRAM) bit shipments for the cloud, graphics, PC and notebook, 5G and automotive markets.

Micron should also be getting even more cash in the door this quarter in particular selling its plant in Lehi, Utah, to Texas Instruments for $900 million.

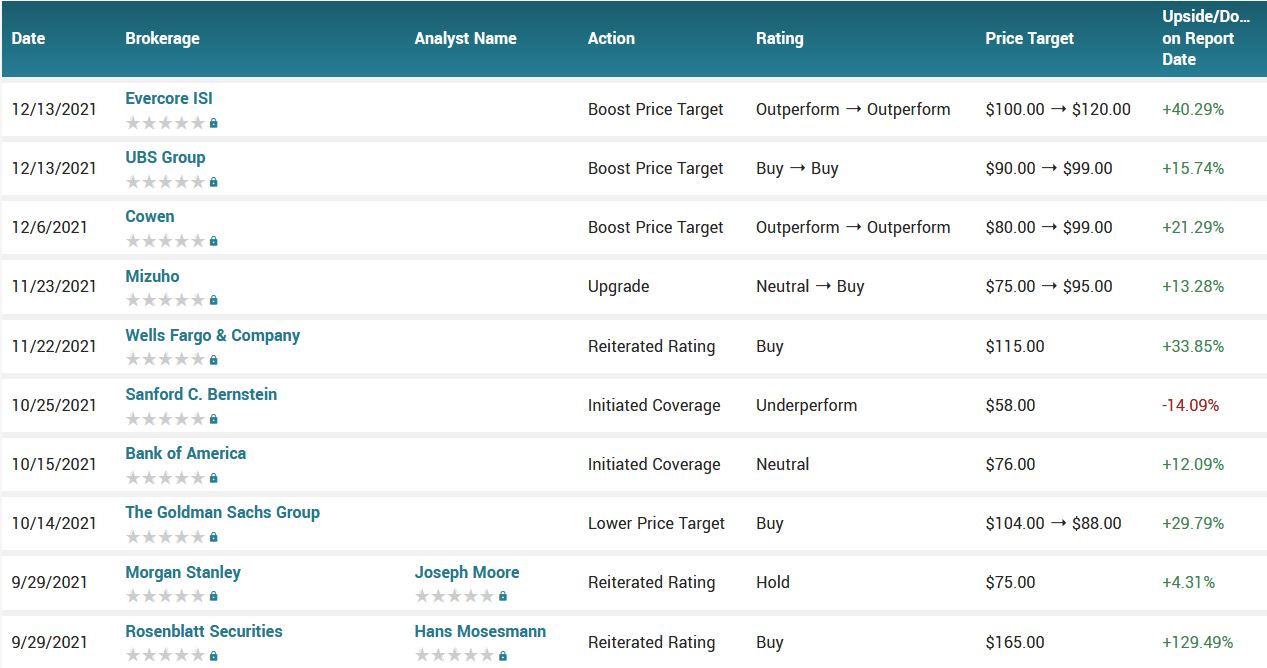

Analyst

Thoughts on Micron Technology Earnings.....

Micron was named one of Citigroup's "top picks" in the semiconductor space for 2022. Micron had sold off over the summer, as investors grew wary of potential softening of PC memory demand amid shortages of other chips. In addition, some had feared companies had double-ordered and built inventory in the strong first half.

However, Citigroup's Christopher Danely said inventories may stay high, as semiconductor companies have moved toward long-term agreements, and most are solidly booked through 2022. Micron had also said on its September conference call that its customers may choose to hold higher levels of inventory than they did before the pandemic, as the costs of higher inventory are less than those of lost sales experienced amid shortages this year.

Additionally, DRAM demand in particular, which is where Micron gets most of its revenue, was just revised upward by research firm Trendforce, as notebook demand has come in better than feared. Micron is perhaps the most sensitive to booms and busts, so continued strength in demand next year would make it one of the bigger winners in the space.

According to the issued ratings of 31 analysts in the last year, the consensus rating for Micron Technology stock is Buy based on the current 1 sell rating, 7 hold ratings, 22 buy ratings and 1 strong buy rating for MU. The average twelve-month price target for Micron Technology is $104.34 with a high price target of $165.00 and a low price target of $58.00.

Summary for Micron Technology Earnings.....

Semiconductors are a highly attractive sector, since they are levered to big technology trends, but generally trade at much better valuations than their high-multiple software peers.

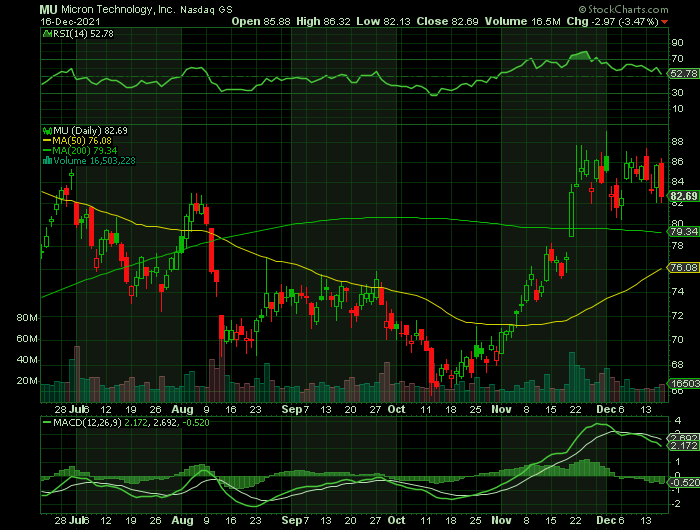

Micron's stock has rebounded a strong 22% over the past month alone. The settlement and enhanced strategic partnership with UMC should only help with sentiment through the rest of the year.

So if pandemic-fueled technology growth continues and economic growth remains resilient to omicron, semi stocks like Micron looks attractive heading into year-end.

FINALLY.....

To see what we have proposed for

Micron Technology Earnings CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!