TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Microsoft

Corporation Shares Getting

A Tailwind From AI!

And Members Are Up 140% Potential Profit

Using A Weekly Call Option!

Members of “Weekly Options USA,” Using A Weekly Call Option,

Make Potential Profit Of 140%,

After Microsoft Takes The Lead In AI'S RISE Through

Its Azure Cloud Computing Services.

Where To Now?

AI is providing a massive tailwind for Microsoft Corporation (NASDAQ:MSFT) as it stands to especially benefit because it is a major cloud services provider.

This set the scene for Weekly Options USA Members to profit by 140%, using a MSFT Weekly Options trade!

Join Us And Get The Trades – become a member today!

Sunday, June 04, 2023

by Ian Harvey

Prelude…..

Microsoft Corporation (NASDAQ:MSFT) is a shareholder of ChatGPT creator OpenAI, and the two companies have already completed a long list of integrations with the former's various product offerings. On Microsoft's recent earnings call, management said that 2,500 business customers had already signed up to use OpenAI on its Azure cloud platform -- a whopping 1,000% increase in just three months.

While no AI winner can be declared just yet, Microsoft looks to be taking a clear lead now. In addition to going all-in on ChatGPT, Microsoft could further benefit from AI's rise through its Azure cloud computing services. AI processing needs massive cloud computing power, and Azure is already the No. 2 cloud computing service behind Amazon.

It is forecast that AI software will become a $14 trillion market by 2030, and Microsoft could be a fantastic way to tap into this market, especially when you consider that the company is already implementing ChatGPT into its services and has a huge opportunity to grow Azure through expanding AI cloud demand.

Why the MSFT Weekly Options Trade was Executed?

AI should provide a massive tailwind for Microsoft Corporation (NASDAQ:MSFT) as it stands to especially benefit because it is a major cloud services provider.

Microsoft is a shareholder of ChatGPT creator OpenAI, and the two companies have already completed a long list of integrations with the former's various product offerings. On Microsoft's recent earnings call, management said that 2,500 business customers had already signed up to use OpenAI on its Azure cloud platform -- a whopping 1,000% increase in just three months.

AI-exposed stocks have rallied in recent days after Nvidia ’s consensus-smashing outlook on surging demand for its AI chips. The chip maker’s forecast is good for Microsoft.

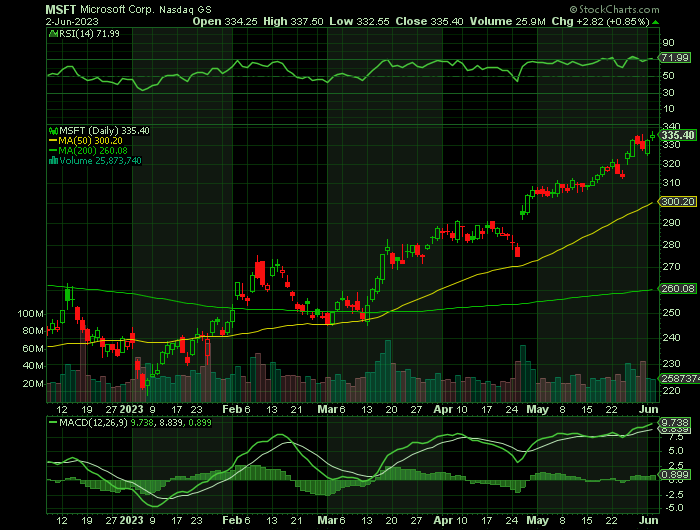

Microsoft shares' 2023 rally will continue thanks to the Redmond-based tech giant's efforts to integrate ChatGPT and artificial intelligence into its business model.

"ChatGPT will be the next leg of the growth stool for Microsoft," Wedbush analyst Dan Ives said Monday in a research note.

"Redmond is just starting to hit its next gear of growth with ChatGPT and AI also adding a new layer of growth to the Microsoft story over the coming years," he added.

Ives upped his price target for the tech stock from $340 to $375 a share – up 13% from its current $333 level, equivalent to adding $300 billion worth of market capitalization.

Microsoft shares are already up 39% in 2023, benefiting from both the ChatGPT craze and traders' expectation that the Federal Reserve will soon pause its interest-rate hiking campaign.

The MSFT Weekly Options Trade Explained.....

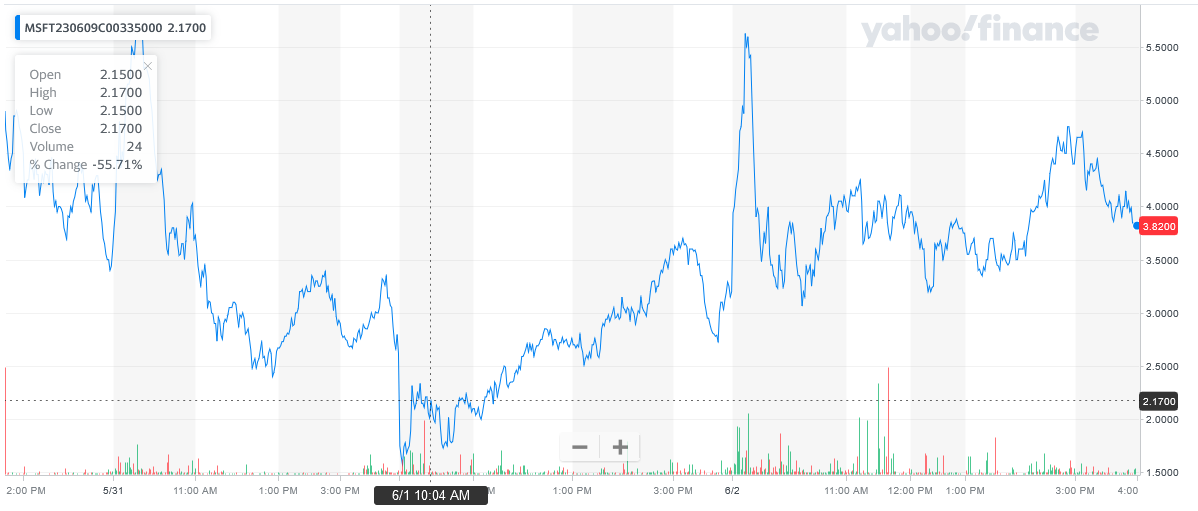

** OPTION TRADE: Buy MSFT JUN 09 2023 335.000 CALLS - price at last close was $3.30 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the MSFT Weekly Options (CALL) Trade on Wednesday, May 31, 2023, for $2.40.

Sold half the MSFT weekly options contracts on Friday, June 02, 2023, for $5.75; a potential profit of 140%.

Total Dollar Profit is $575 - $240 (cost of contract) = $335

Holding the remaining TSLA weekly options contracts for further profit next week.

Don’t miss out on further trades – become a member today!

About Microsoft.....

Microsoft Corporation was founded in 1975 in Albuquerque, New Mexico by Bill Gates and Paul Allen. The two quit their respective Harvard schooling and programming jobs to start a software company focused on the then-popular Altair 8800. Originally named Micro-Soft, Microsoft is a portmanteau of the words microprocessor and software. The company quickly took off and was relocated to Washington State where it is headquartered today.

Microsoft launched a game called Flight Simulator in 1982 that has since become the longest-running video game franchise. The company’s first major breakthrough came in the early 80s when it licensed MS-DOS to IBM for their personal computer and then another came in 1985 the company altered the way computers were used when it launched Windows. Windows used a graphical interface to display information that included drop-down menus, scroll bars, and other features commonly found in operating systems today.

Microsoft went public in 1986 making founder Bill Gates the world’s youngest billionaire. Other innovations that helped make the company’s name include Windows 95 which included many upgrades to the original and, when the Internet took off, Internet Explorer. Bill Gates gave up his role as CEO in 2000 and the company is now run by Satya Nadella. Mr. Nadella took over the role of CEO in 2014 and then the role of chairman in 2021.

Today the company develops, licenses, and supports software, services, devices, and solutions worldwide. The company operates in three segments that include Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. As of 2022, Microsoft’s Azure powered more than 20% of the Cloud putting it in second place globally.

The Productivity and Business Processes segment offers several software solutions including Office, Exchange, SharePoint, Microsoft Teams, Office 365 Security and Compliance, Microsoft Viva, and Skype for Business. Microsoft also operates Skype, Outlook.com, OneDrive, and LinkedIn for business professionals as well as Dynamics 365. Dynamics 365 is a set of cloud-based and on-premises business solutions for organizations and enterprises of all sizes.

Further Catalysts for the MSFT Weekly Options Trade…..

Microsoft is positioned exceptionally well for a major splash in artificial intelligence that could lift the company’s market value another $300 billion this year.

The tech giant is “in the driver's seat” during a pivotal moment for the tech industry, due to Microsoft’s partnership with OpenAI creator ChatGPT, which Microsoft is using to power its cloud apps and services, and upcoming releases of A.I.-powered products.

In midday trading on Tuesday, the company’s shares were at $331, translating into a market value of around $2.5 trillion.

ChatGPT will be the next leg of the growth stool for Microsoft, as the company is just starting to hit its next gear of growth, with ChatGPT and other A.I. technology. Microsoft’s stock has already gained nearly 40% this year after a $10 billion investment in OpenAI in January.

The “jaw-dropping guidance” recently announced by chip manufacturer Nvidia is one of the reasons for optimism about tech companies and A.I. Nvidia became the fifth company—after Apple, Microsoft, Alphabet, and Amazon—to reach $1 trillion in market cap on Tuesday. The company’s stock has soared since a first-quarter earnings report last week that showed higher-than-expected revenues.

Microsoft is well-positioned in respect to using ChatGPT in more of its new cloud services. While the company’s A.I.-powered Bing search engine has provided information that is riddled with mistakes since its release earlier this year, the bigger source of Microsoft’s revenue growth will be the successful integration of A.I. with its cloud offerings, operated under its cloud computing platform, Azure.

New Microsoft A.I. products that substantially lift revenue will “not be built overnight” as the company tests new features in the coming months. Still, Microsoft may be ahead of its major competitors in cloud computing, such as Amazon’s Web Services branch. A.I. is the “catalyst” in competition between Azure and AWS over the next 12 to 18 months, and Microsoft is currently in “an enviable position” to gain market share in its enterprise business against AWS.

Other Positive Catalysts.....

• BHP Group Limited (NYSE: BHP) tapped the software firm to leverage its artificial intelligence and machine learning to improve copper mining to meet the demand for decarbonization technologies.

• Microsoft's developer conference last week made exciting revelations. Microsoft Azure OpenAI customers climbed by 80% month-on-month to 4500, up 80% from April 25. Also, Bing became the default search engine on ChatGPT for Plus users, with a free tier coming up shortly.

• Microsoft declared 50 new products, highly AI-focused on leveraging the Microsoft and OpenAI partnership.

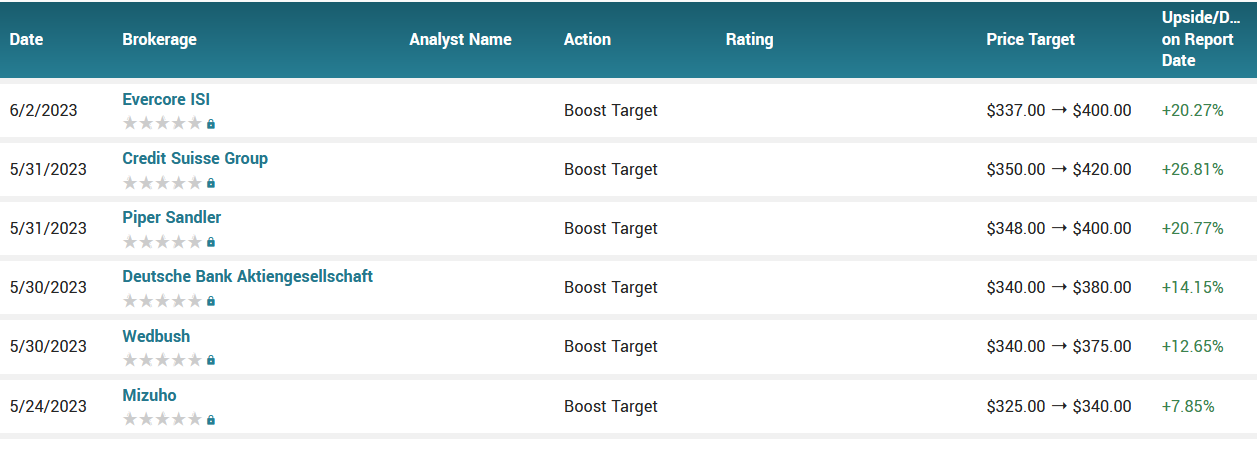

• At least two wall street broker boosted their price targets on the stock Tuesday. Wedbush analyst Daniel Ives maintains Microsoft with an Outperform and raises the price target from $340 to $375.

• Deutsche Bank analyst Brad Zelnick maintains Microsoft with a Buy and raises the price target from $340 to $380.

Analysts.....

The battle for AI market share resembles the TV show Game of Thrones, Wedbush analysts said as they put forward the case for Microsoft as one of the sector’s big winners.

The analysts, led by Dan Ives, raised their price target on the stock to $375 from $340 and reiterated an Outperform rating Monday. “Resilient cloud deal flow and the AI monetization opportunity makes us more bullish on the name,” they said in a note, adding that the stock remains firmly on its best ideas list.

“We believe Nvidia’s ‘jaw-dropping’ guidance heard around the world is a direct barometer for [Microsoft] as our recent checks further confirm the monetization opportunity for Microsoft is happening much sooner than the Street has anticipated,” he said.

Microsoft (MSFT) isn’t the only beneficiary in what Wedbush calls the “Game of Thrones Battle” for AI market share, with an estimated $800 billion market opportunity over the next decade.

But Microsoft is leading the AI arms race, Ives said, with monetization the next step for the company.

“We strongly believe the first step for MSFT was Azure/Office 365 with the next step ChatGPT/AI monetization on both the consumer and enterprise fronts combined adding $40 to $50 per share to MSFT’s sum-of-the parts valuation,” Wedbush analysts added.

According to the issued ratings of 36 analysts in the last year, the consensus rating for Microsoft stock is Moderate Buy based on the current 1 sell rating, 4 hold ratings and 31 buy ratings for MSFT. The average twelve-month price prediction for Microsoft is $325.72 with a high price target of $380.00 and a low price target of $232.00.

Summary.....

Microsoft has a 12 month low of $213.43 and a 12 month high of $319.04. The stock has a 50 day moving average of $289.47 and a 200 day moving average of $260.55. The company has a market capitalization of $2.36 trillion, a PE ratio of 34.34, and a price-to-earnings-growth ratio of 2.79 and a beta of 0.93. The company has a debt-to-equity ratio of 0.22, a current ratio of 1.91 and a quick ratio of 1.88.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from MICROSOFT

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!