TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Microsoft Corporation Stock Price Jumps!

Then Pullbacks To Provide Another Trade!

“Weekly Options” Members

Profit Up 255%

In 2 Separate TRADES!

More Growth Expected?!

Wednesday, November 24, 2021

by Ian HarveyMicrosoft Corporation has gone straight up since the start of October, adding nearly 25% into Monday’s mid-session peak.

However, Monday afternoon trading saw the stock price pull-back, and continued to drop further on Tuesday, but now provides traders a great opportunity to again capture some more gains as Microsoft Corporation picks up steam again.

And Weekly Options Members executed 2 separate trades to gain a potential profit of 255%.

Expect Another Trade Today!

Microsoft Corporation (NASDAQ:MSFT)

On Friday, November 19, 2021, a Microsoft Corporation Weekly Options trade was recommended to our members based on several catalysts.

READ Details of the Original Microsoft Corporation Weekly Options Recommendation Further Below.....

Dow component Microsoft Corporation has outperformed its mega-cap rivals so far in 2021, posting a phenomenal 53% return. It hasn’t touched the 200-day moving average in 20 months or carved a single 20% pullback since March 2020. In addition, the stock has gone straight up since the start of October, adding nearly 25% into Monday’s mid-session peak.

However, Monday afternoon trading saw the stock price pull-back, and continued to drop further on Tuesday, but now provides traders a great opportunity to again capture some more gains as Microsoft Corporation picks up steam again.

Despite the torrid advance, Wells Fargo analyst Michael Turrin just reaffirmed his belief that Microsoft shares will continue to rise, noting “we acknowledge shares are trading at historical highs, but think this is justified given.....

- the market positioning is the best it’s ever been,

- core businesses have evolved favorably over the past decade, including numerous strategic additions (i.e. LinkedIn, GitHub, etc.), and

- strong incumbent position in a tight market, which we view as especially favorable in the current environment”.

The Actual Recommended Microsoft Corporation Weekly Options Trade.....

** OPTION TRADE: Buy MSFT NOV 26 2021 345.000 CALLS at approximately $2.00.

(Actually bought for $2.19)

Microsoft Corporation Weekly Options Trade Call Success Explained.....

This trade could have been played out in two (2) separate parts…..

Trade 1: Friday, November 19, 2021

- Bought at 9:32 for $2.19

- Sold at 10:04 for $3.36

- Profit is 53%

Trade 2: Friday, November 18, 2021

- Re-bought at 2:50 for $1.90

- Sold Monday, November 22 at 10:28 for $5.75

- Profit is 202%

Total Potential Profit is 255%

It is very likely that a new Microsoft Corporation Weekly Options trade, if recommended, will be also successful.

Join us and see what we are proposing!

The Original Major Catalysts for the Microsoft Corporation Weekly Options Trade…..

Prelude.....

Another quarter and another stellar earnings report from the world’s largest software company Microsoft Corporation (NASDAQ:MSFT). The company continues to see impressive growth in its Microsoft Cloud business, which generated $20.7 billion in revenue for Q1, up 36% year-over-year. Investors should be confident that trends like the digital transformation of enterprises will continue benefitting this area of the company over the long term, as we are likely only in the early innings of the widespread adoption of hybrid cloud services. Other compelling areas of Microsoft's business include successful productivity and business process software like Microsoft Office, the latest Xbox Series X video game system, and digital advertising services.

Microsoft has been one of the best performing mega-cap technology stocks this year, yet the rally might have more gas left in the tank after the company's flawless Q1.

Microsoft is currently the largest public company in the world, slightly edging out its longtime rival in the consumer products space, Apple. It's also one of the most recognizable brands in the world, with its Windows 10 operating system active on over 1.3 billion devices, and its Office 365 document suite a staple among households and businesses alike.

Its roaring success in software hasn't stopped it from innovating in other areas. Microsoft owns the Xbox gaming platform, and the much newer Surface line of notebooks and tablets, both of which are billion-dollar consumer hardware brands in their own right. It also owns LinkedIn, the professional network that delivered 42% revenue growth in the fiscal first quarter, with record user engagement.

Also, a further boost to Microsoft Corporation is that it is one of the two beneficiaries of a Pentagon cloud computing contract to modernize IT systems. The government agency is soliciting bids for its Joint Warfighting Cloud Capability (JWCC) program, a replacement to the $10 billion Joint Enterprise Defense Infrastructure (JEDI) initiative from 2019.

Spending on cloud computing by federal agencies has surged in the past

couple of years. They spent $6.6 billion on cloud computing in fiscal 2020, a

marginal increase from the $6.1 billion in 2019. The pace is expected to pick

up in the coming years. The Department of Defense (DoD) itself has committed to

spending a total of $798 million on cloud capabilities in 2022, with a majority

of that budget earmarked for commercial cloud versus developing in-house

capabilities.

The Major Catalysts for the Microsoft Corporation Weekly Options Trade…..

1. Cloud Computing.....

Cloud computing is where the company is really shining. Microsoft Azure is a cloud services platform that caters to businesses, and it's the second largest in the industry behind Amazon Web Services. It hosts over 40 different solutions, including an innovative artificial intelligence product that can be used for speech and image recognition.

Azure revenue has consistently outperformed Microsoft's total revenue, and in the first quarter delivered 48% growth year over year.

Spending on cloud computing globally is expected to grow at an annual rate of 18% through 2026, so Azure's outsize performance hints at a future with increased market share for Microsoft, which should translate to a buoyant share price.

From a risk perspective, investors are buying a highly profitable business with a suite of brands that are very difficult for new competitors to disrupt. Microsoft's dominant market position, while also playing a leading role in innovation, makes it a bankable stock to beat the market next year. Its price has soared 465% over the last five years compared to the S&P 500's 114% gain.

2. Digital Tools for Agriculture…..

Bayer AG and Microsoft Corp. are collaborating on new internet-based products aimed at helping farmers and industries tied to agriculture become more efficient and sustainable.

Bayer is partnering with the U.S. software giant to develop digital tools and data science capabilities for agricultural businesses and associated industries, the German company said in a Wednesday statement. The effort is designed to help startups to global businesses in areas including farming operations, sustainable sourcing, manufacturing and supply-chain improvement as well as measuring environmental, social and governance efforts.

“This is a chance to accelerate some really important work in the industry, and we think that this is what’s needed given the societal demands that are increasing to make our business more sustainable,” said Jeremy Williams, head of climate corporation and digital farming for Bayer’s crop science division.

3. Videogames…..

The craze for videogames is far from over and gamers have been aggressively spending on content, hardware and software. Many had predicted that the gaming market would slow down once outdoor entertainment and recreation joints open, but that hasn’t been the case.

Spending on videogames has been on the rise, with October turning out to be a great month yet again in terms of sales.

Microsoft Corporation is one of the leading videogame makers and manufacturers of hardware and accessories. MSFT has been expanding its footprint in the industry and recently announced that it will be acquiring videogame maker ZeniMax Media.

Microsoft is a pioneer in consoles andon Nov 15, its flagship Xbox turned 20 years. The other MSFT launches include Xbox 360 (2005), Xbox One (2013) and the latest Xbox Series consoles (2020).

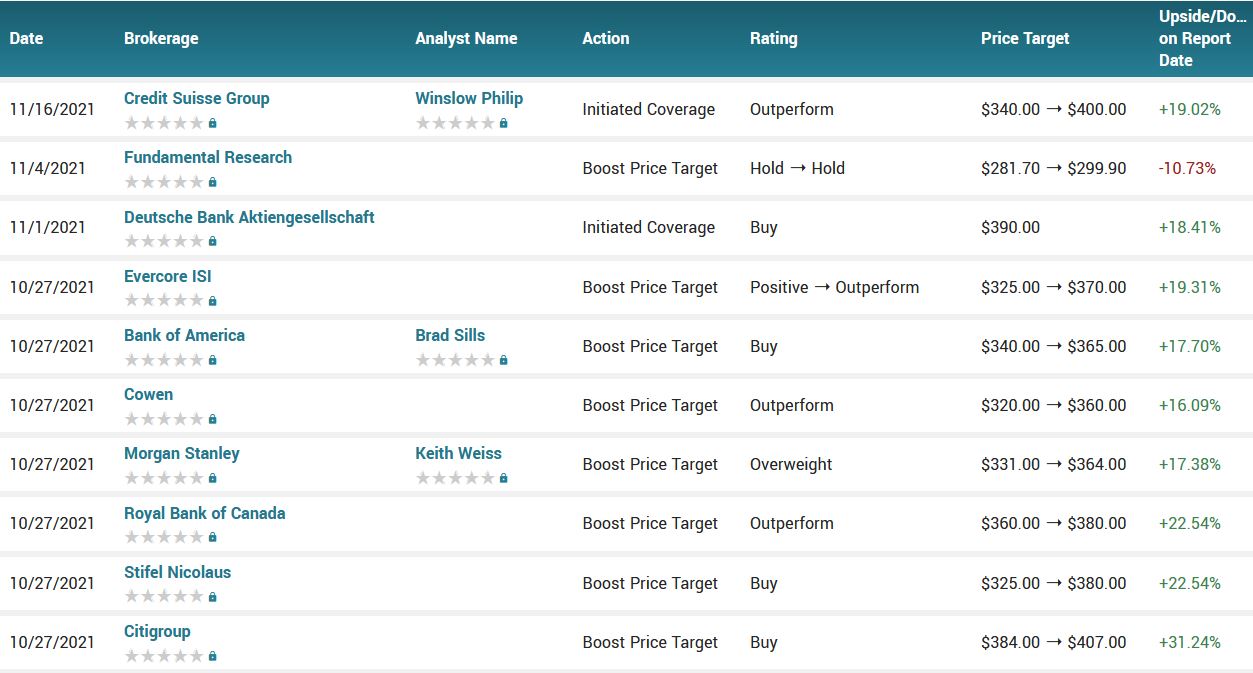

7. Analysts Thoughts.....

According to the issued ratings of 32 analysts in the last year, the consensus rating for Microsoft stock is Buy based on the current 1 hold rating, 30 buy ratings and 1 strong buy rating for MSFT. The average twelve-month price target for Microsoft is $348.25 with a high price target of $407.00 and a low price target of $275.00.Summary.....

Microsoft’s 50-day moving average is $309.22 and its two-hundred day moving average is $285.50. The company has a market capitalization of $2.55 trillion, a P/E ratio of 37.93, a P/E/G ratio of 3.08 and a beta of 0.86. The company has a debt-to-equity ratio of 0.33, a quick ratio of 2.12 and a current ratio of 2.16. Microsoft Co. has a fifty-two week low of $208.16 and a fifty-two week high of $342.19.

Conclusion.....

Microsoft Corporation will likely continue to fire on all cylinders to attract new investors but has the tools in place to outperform the competition well into 2022. Internet-as-a-Service (IaaS), cybersecurity, and productivity segments continue to post excellent year-over-year growth, relieving pressure from an operating system that’s grown resistant to profitable upgrades. And let’s not forget margins, which have expanded from 30% to 42% in just five years.

Therefore…..

The Microsoft Corporation Weekly Options Trade Has Been A Big Winner!

What Further Microsoft Corporation Weekly Trades Will We Recommend?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!

Back to Weekly Options USA Home Page from Microsoft Corporation