TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Microsoft Weekly Call Option Provides 127% Potential

Profit!

Members of “Weekly Options USA,” Using A Weekly CALL Option,

Make Potential Profit Of 127%,

Due To Claims That The Newest Model Of

Chatgpt, An AI Algorithm Backed By The PC Pioneer, Was Showing “Sparks” Of

Intelligence That Were “Strikingly Close To Human-Level Performance;” And Microsoft

May Have Gotten There First.

where to now?

Join

Us and GET FUTURE TRADEs!

Microsoft weekly call option call up 127% as it is found that ChatGPT has already integrated into its search engine, Bing, sparking fears that the new AI-powered search tool could upend the traditional power balance that has seen Google dominate for decades.

Join Us And Get The Trades – become a member today!

Tuesday, April 04, 2023

by Ian Harvey

Why the Profit on Microsoft Weekly Call Option Trade?

Microsoft Corporation (NASDAQ:MSFT) is one of the leading cloud computing companies in the world and the second-largest U.S. company overall.

Microsoft has had a terrific year so far in 2023, riding the tailwinds of a broader rally in technology stocks. Shares of the tech titan are up 15% so far this year, more than triple the gains of the S&P 500. This is in stark contrast to its performance in 2022

The Microsoft Weekly Call Option Trade Explained.....

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

The Trade: Buy MSFT APR 14 2023 285.000 CALLS - price at last close was $5.74 - adjust accordingly.

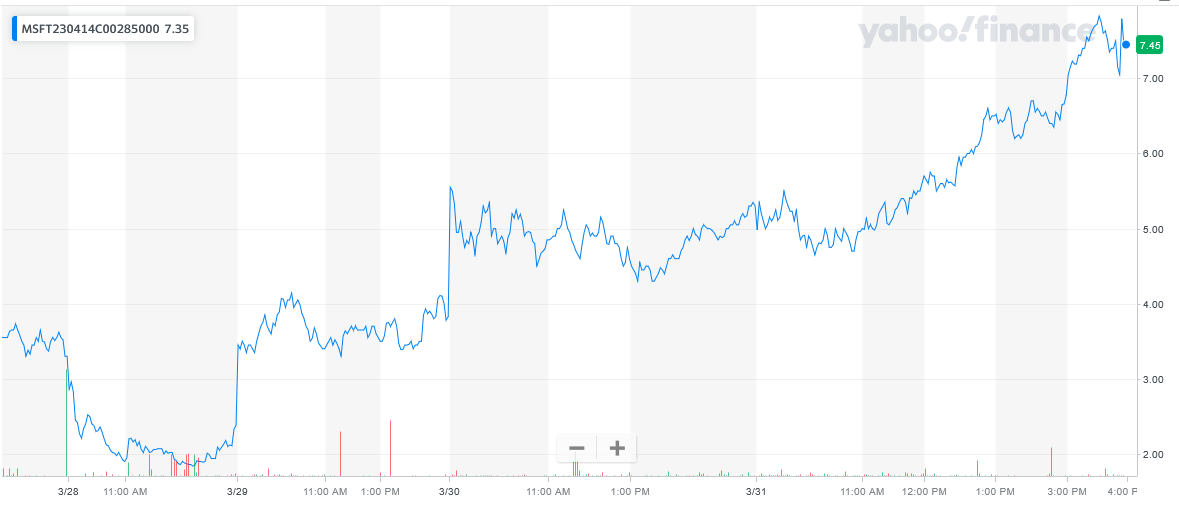

Entered the Microsoft Weekly Call Option Trade on Monday, March 27, 2023 at $3.45.

Sold the Microsoft weekly options contracts on Friday, March 31, 2023 for $7.83; a potential profit of 127%.

Don’t miss out on further trades – become a member today!

The Actual Recommended

Trade for Microsoft.....

(READ HERE)

Prelude.....

Last Friday Microsoft Corporation (NASDAQ:MSFT) claimed that the newest model of ChatGPT, an AI algorithm backed by the PC pioneer, was showing “sparks” of intelligence that were “strikingly close to human-level performance”.

Artificial general intelligence, as it is known, has been the holy grail of researchers for decades. The prospect that Microsoft may have gotten there first is yet another body blow for Google.

“Search is as good as how you use it,” says Sachin Dev Duggal, founder of UK start-up Builder.AI. “Most people just type in a bunch of words."

“With a language model [the technology underpinning ChatGPT], you can get a more refined search result. It can infer what those words mean in a wider context.”

Microsoft has already integrated ChatGPT into its search engine, Bing, sparking fears that the new AI-powered search tool could upend the traditional power balance that has seen Google dominate for decades.

“[Microsoft chief executive Satya] Nadella and OpenAI [ChatGPT’s developer] are right now miles ahead of Google and its Bard endeavour for AI,” says Dan Ives, an analyst at Wedbush Securities.

After ChatGPT’s viral success, Microsoft invested billions in OpenAI. Companies including Stripe, Morgan Stanley and Klarna have all announced deals with the start-up.

About Microsoft.....

Microsoft Corporation was founded in 1975 in Albuquerque, New Mexico by Bill Gates and Paul Allen. The two quit their respective Harvard schooling and programming jobs to start a software company focused on the then-popular Altair 8800. Originally named Micro-Soft, Microsoft is a portmanteau of the words microprocessor and software. The company quickly took off and was relocated to Washington State where it is headquartered today.

Microsoft launched a game called Flight Simulator in 1982 that has since become the longest-running video game franchise. The company’s first major breakthrough came in the early 80s when it licensed MS-DOS to IBM for their personal computer and then another came in 1985 the company altered the way computers were used when it launched Windows. Windows used a graphical interface to display information that included drop-down menus, scroll bars, and other features commonly found in operating systems today.

Microsoft went public in 1986 making founder Bill Gates the world’s youngest billionaire. Other innovations that helped make the company’s name include Windows 95 which included many upgrades to the original and, when the Internet took off, Internet Explorer. Bill Gates gave up his role as CEO in 2000 and the company is now run by Satya Nadella. Mr. Nadella took over the role of CEO in 2014 and then the role of chairman in 2021.

Today the company develops, licenses, and supports software, services, devices, and solutions worldwide. The company operates in three segments that include Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. As of 2022, Microsoft’s Azure powered more than 20% of the Cloud putting it in second place globally.

The Productivity and Business Processes segment offers several software solutions including Office, Exchange, SharePoint, Microsoft Teams, Office 365 Security and Compliance, Microsoft Viva, and Skype for Business. Microsoft also operates Skype, Outlook.com, OneDrive, and LinkedIn for business professionals as well as Dynamics 365. Dynamics 365 is a set of cloud-based and on-premises business solutions for organizations and enterprises of all sizes.

Further Catalysts for the MSFT Weekly Options Trade…..

In 2022, the Nasdaq Composite plunged 33%, bringing down the stocks of some of the world's most valuable companies. For instance, despite having the second-largest market cap in the world at $2 trillion, Microsoft fell 29% throughout last year. Like many in the tech world, the company was hit by steep declines in the PC market brought on by reduced consumer spending.

However, Microsoft's history of stellar growth suggests recent headwinds were only temporary, and its developing venture in artificial intelligence (AI) is a strong argument for long-term success. The stock has begun trending up since the start of 2023 but remains down 10% year over year.

OpenAI's ChatGPT.....

The launch of OpenAI's ChatGPT in November 2022 kicked off an AI race that has seen many companies venture into the burgeoning market. So far, Microsoft has had the advantage in the race, investing $1 billion in OpenAI in 2019. ChatGPT's success prompted the company to invest another $10 billion in OpenAI in January.

According to Grand View Research, the AI market was valued at $137 billion in 2022 and is projected to expand at a compound annual rate of 37.3% through 2030. And Microsoft's investment in OpenAI has allowed it to use its technologies in several programs. For example, ChatGPT has been integrated into Microsoft's search engine Bing and is available on its cloud platform Azure.

Each of these products would benefit by incorporating ChatGPT into its customer interface -- as it's clear the chatbot is already a smash hit with the public.

However, the Bing search tool might be the product with the most to gain. Suppose the company can capitalize on ChatGPT's integration with Bing. In that case, Microsoft may finally threaten Alphabet's stranglehold on the online search market.

The stock surged 5% from March 15 to 17 after an announcement that the company would enhance its Office productivity software (like Word and Excel) with OpenAI technology. Microsoft says the AI features, dubbed Copilot, will provide a "first draft to edit and iterate on -- saving hours in writing, sourcing, and editing time."

Azure.....

Microsoft experienced strong market-share gains in the worldwide cloud infrastructure market in 2022, reaching 23%, up from 21% in the preceding four quarters, according to data compiled by Synergy Research Group. In fact, over the past five years, Microsoft has notched the largest share gains in the industry, growing by nearly 11 percentage points since 2017. Given the consistency of the company's market-share increases in recent years, there's every reason to believe that trend will continue.

Analysts.....

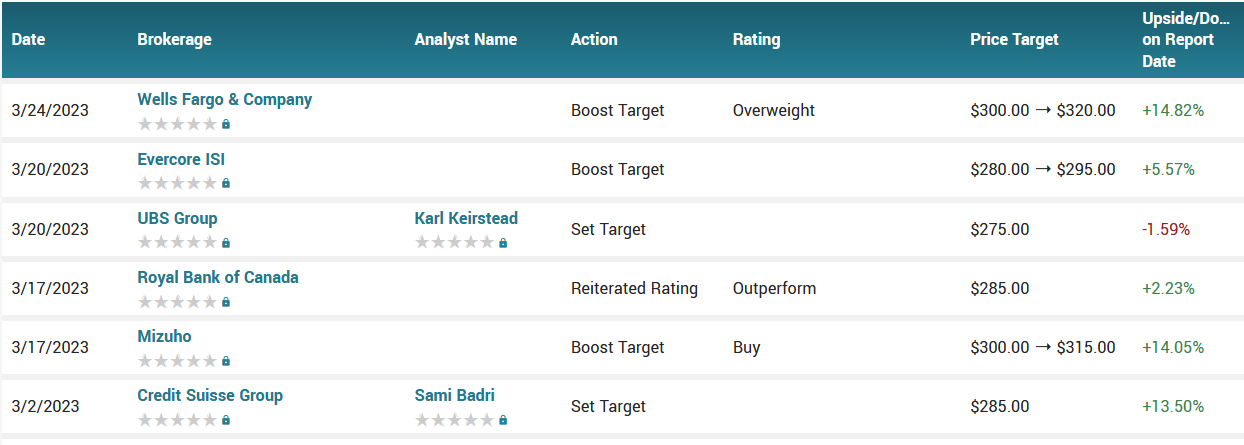

According to the issued ratings of 32 analysts in the last year, the consensus rating for Microsoft stock is Moderate Buy based on the current 1 sell rating, 4 hold ratings and 27 buy ratings for MSFT. The average twelve-month price prediction for Microsoft is $287.92 with a high price target of $370.00 and a low price target of $212.00.

Summary.....

Today, Microsoft is one of the leading cloud computing companies in the world and the second-largest U.S. company overall.

Microsoft has had a terrific year so far in 2023, riding the tailwinds of a broader rally in technology stocks. Shares of the tech titan are up 15% so far this year, more than triple the gains of the S&P 500. This is in stark contrast to its performance in 2022

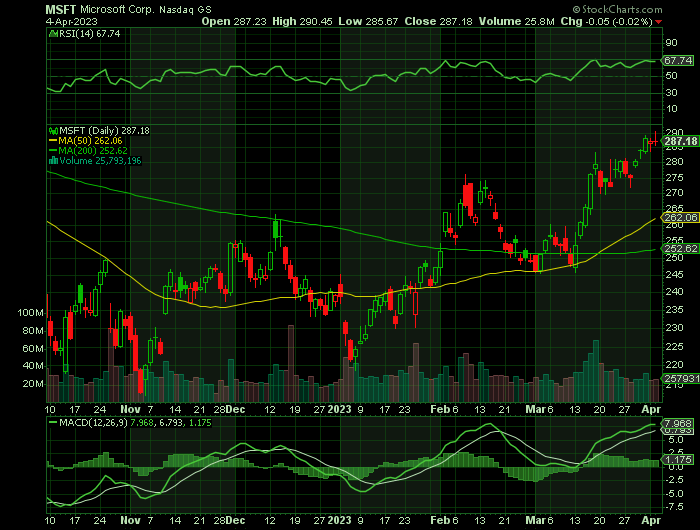

The company has a debt-to-equity ratio of 0.24, a quick ratio of 1.89 and a current ratio of 1.93. Microsoft Co. has a one year low of $213.43 and a one year high of $315.95. The company’s fifty day simple moving average is $254.84 and its 200 day simple moving average is $245.71. The stock has a market capitalization of $2.08 trillion, a price-to-earnings ratio of 30.25, and a P/E/G ratio of 2.50 and a beta of 0.92.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Microsoft Weekly Call Option

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!