TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Microsoft Weekly Options Calls Provide Profit In A

Down Day!

Weekly Options Members

Are Up 82% Potential Profit

Using A Weekly CALL Option!

Microsoft Corporation (NASDAQ:MSFT) stock rose Tuesday on news related to its artificial intelligence initiatives.

Microsoft is steadily integrating AI into its massive consumer and enterprise tech portfolio. Last week, the company announced it would add an AI key to its Windows PC keyboard. The button will launch Microsoft's AI assistant feature, called Copilot. It is the first significant change to the keyboard in three decades, as described by the company.

Microsoft's AI push has fueled bullish views for the stock among Wall Street analysts.

This set the scene for Weekly Options USA Members to profit by 82% using a MSFT Options trade!

Join Us And Get The Trades – become a member today!

Wednesday, January 17, 2024

by Ian Harvey

Microsoft Corporation (NASDAQ:MSFT) stock rose Tuesday on news related to its artificial intelligence initiatives.

Microsoft stock got a lift from news of a strategic partnership and expansion of its Copilot offerings.

On Tuesday, Microsoft and U.K.-based Vodafone (VOD) announced a 10-year strategic partnership to bring generative AI and cloud services to more than 300 million businesses, public sector organizations and consumers across Europe and Africa.

Vodafone will invest $1.5 billion over the next 10 years in cloud and customer-focused AI services developed with Microsoft. Those services include Microsoft's Azure OpenAI and Copilot offerings.

Meanwhile, Microsoft plans to invest in Vodafone's managed Internet-of-Things connectivity platform, which will become a separate, stand-alone business by April 2024.

Why the Microsoft Weekly Options Trade was Originally Executed!

Tech stalwart Microsoft Corporation (NASDAQ:MSFT)is riding a rocket ship of rising revenue thanks not to its ubiquitous Windows and Office products but rather to cloud computing and AI.

Microsoft is steadily integrating AI into its massive consumer and enterprise tech portfolio. Last week, the company announced it would add an AI key to its Windows PC keyboard. The button will launch Microsoft's AI assistant feature, called Copilot. It is the first significant change to the keyboard in three decades, as described by the company.

Microsoft's AI push has fueled bullish views for the stock among Wall Street analysts.

Jefferies analyst Brent Thill recently named Microsoft a top pick for 2024. In a client note, Thill said gen AI applications will help reaccelerate growth for Azure, while the introduction of AI PCs could help drive a refresh cycle for personal computers.

Meanwhile, in a December note, Wedbush analyst Daniel Ives described the Copilot feature as a "game changer."

Further, Ives said the price of the stock is "yet to price in what we view as the next wave of cloud and AI growth coming" to Microsoft. He added that he sees Microsoft's "FY24 with a strong competitive cloud edge vs. Amazon and Google."

The Microsoft Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy MSFT FEB 02 2024 400.000 CALLS - price at last close was $4.65 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the MSFT Weekly Options (CALL) Trade on Thursday, January 11, 2024 for $4.70.

Sold half the MSFT weekly options contracts on Tuesday, January 16, 2024 for $8.55; a potential profit of82%.

Holding the remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About Microsoft.....

Microsoft Corporation was founded in 1975 in Albuquerque, New Mexico by Bill Gates and Paul Allen. The two quit their respective Harvard schooling and programming jobs to start a software company focused on the then-popular Altair 8800. Originally named Micro-Soft, Microsoft is a portmanteau of the words microprocessor and software. The company quickly took off and was relocated to Washington State where it is headquartered today.

Microsoft launched a game called Flight Simulator in 1982 that has since become the longest-running video game franchise. The company’s first major breakthrough came in the early 80s when it licensed MS-DOS to IBM for their personal computer and then another came in 1985 the company altered the way computers were used when it launched Windows. Windows used a graphical interface to display information that included drop-down menus, scroll bars, and other features commonly found in operating systems today.

Microsoft went public in 1986 making founder Bill Gates the world’s youngest billionaire. Other innovations that helped make the company’s name include Windows 95 which included many upgrades to the original and, when the Internet took off, Internet Explorer. Bill Gates gave up his role as CEO in 2000 and the company is now run by Satya Nadella. Mr. Nadella took over the role of CEO in 2014 and then the role of chairman in 2021.

Today the company develops, licenses, and supports software, services, devices, and solutions worldwide. The company operates in three segments that include Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. As of 2022, Microsoft’s Azure powered more than 20% of the Cloud putting it in second place globally.

The Productivity and Business Processes segment offers several software solutions including Office, Exchange, SharePoint, Microsoft Teams, Office 365 Security and Compliance, Microsoft Viva, and Skype for Business. Microsoft also operates Skype, Outlook.com, OneDrive, and LinkedIn for business professionals as well as Dynamics 365. Dynamics 365 is a set of cloud-based and on-premises business solutions for organizations and enterprises of all sizes.

Further Catalysts for the MSFT Weekly Options Trade…..

Microsoft is the world's second-most-valuable company (after Apple), with a market cap of $2.7 trillion. The company is home to some of the most widely recognized names in tech: Windows, Office, Xbox, LinkedIn, and Azure, which attract billions of users.

The growth of these offerings sent Microsoft's stock soaring 260% over the last five years, with annual revenue up 68%. The company posted over $63 billion in free cash flow in 2023, giving it the funds to invest heavily in high-growth markets and overcome possible headwinds.

That has allowed it to invest billions of dollars in AI. It partnered with OpenAI in 2019, initially putting $1 billion into the start-up, and has since achieved a 49% stake in OpenAI, granting it exclusive access to some of the industry's most advanced AI models.

Microsoft has so far used the partnership to introduce AI across its product lineup, including improvements to its search engine Bing, new tools on its cloud service Azure, and an AI assistant added to its various Office productivity services through Microsoft 365. The assistant, called Copilot, was launched as a $30 add-on to a 365 subscription, the company's first steps to monetize its AI offerings.

Other Catalysts.....

In its fiscal first quarter, which ended Sept. 30, the company saw revenue jump 13% year over year to $56.5 billion while net income soared 27% to $22.3 billion.

Its Azure and other cloud computing products experienced 29% year-over-year growth. These products generated $22.3 billion, nearly half of Microsoft's fiscal Q1 revenue.

The company expects its sales success to continue, forecasting double-digit second-quarter revenue growth across many of its products, including Azure. In the words of Microsoft CFO Amy Hood, "With our strong start to FY24, I am confident that as a team, we will continue to deliver healthy growth in the year ahead driven by our leadership in commercial cloud and our commitment to lead the AI platform wave."

Microsoft is infusing AI across many of its products. Currently, over 18,000 organizations use Microsoft's artificial intelligence technology. And with its acquisition of Activision Blizzard in late 2023, Microsoft's gaming division is positioned to grow revenue in 2024 and beyond.

Storage.....

Microsoft said on Thursday its European Union cloud customers would be able to process and store all personal data in the region as part of a phased roll-out plan.

Microsoft had earlier allowed processing of some data in the region. With the current move, it would now also include data found in system-generated logs, produced automatically while using its services.

For big companies, data storage has become so large and distributed across so many countries that it becomes difficult for them to understand where their data resides and if it complies with privacy rules.

Later this year, Microsoft will launch a next phase that will deal with storing temporary data transfers required for technical support interactions, Chief Privacy Officer Julie Brill said in a blog post.

The company is also planning to offer a paid support option which will provide initial technical response from within the EU, Brill said.

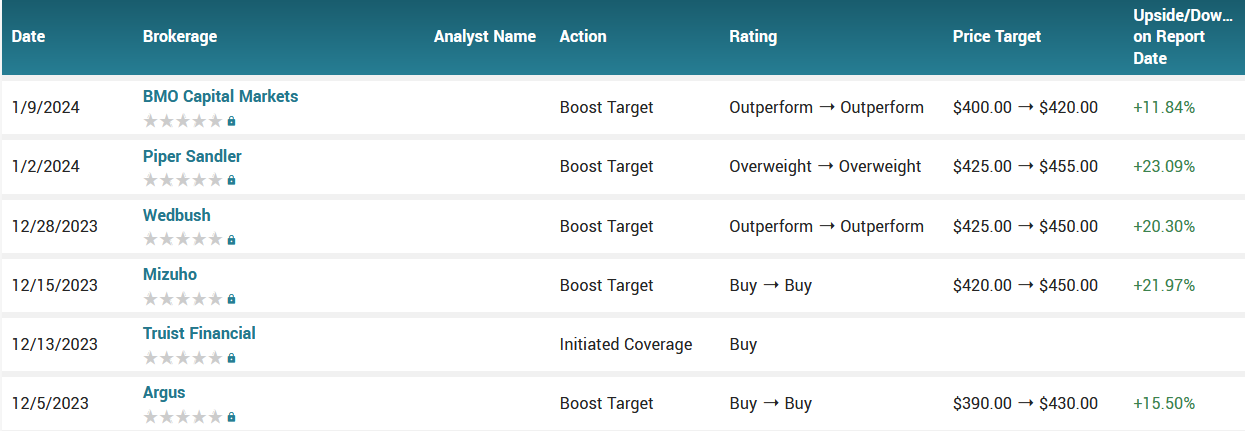

Analysts.....

Microsoft had its target price raised by BMO Capital Markets from $400.00 to $420.00 in a report issued on Tuesday morning. The brokerage currently has an outperform rating on the software giant’s stock.

According to the issued ratings of 40 analysts in the last year, the consensus rating for Microsoft stock is Moderate Buy based on the current 4 hold ratings and 36 buy ratings for MSFT. The average twelve-month price prediction for Microsoft is $395.62 with a high price target of $475.00 and a low price target of $232.00.

Summary.....

Microsoft was the recipient of unusually large options trading on Wednesday. Traders purchased 508,723 call options on the stock. This represents an increase of approximately 34% compared to the typical daily volume of 381,004 call options.

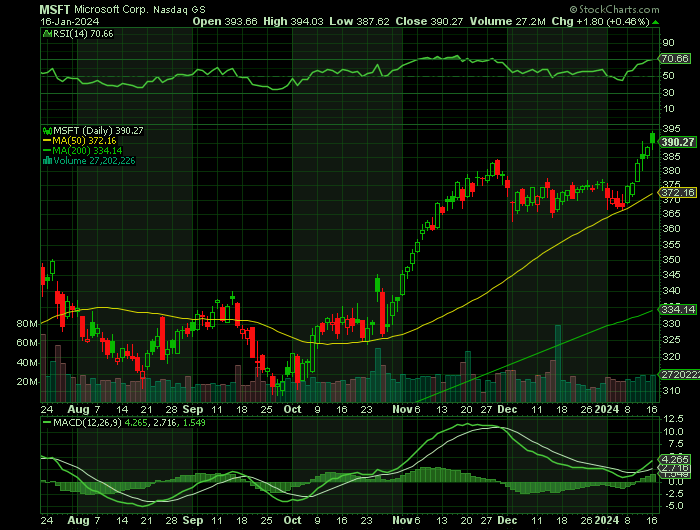

Microsoft has a fifty-two week low of $230.68 and a fifty-two week high of $384.30. The company has a market capitalization of $2.84 trillion, a P/E ratio of 36.91, and a P/E/G ratio of 2.18 and a beta of 0.88. The company has a debt-to-equity ratio of 0.19, a current ratio of 1.66 and a quick ratio of 1.64. The business’s fifty day simple moving average is $370.86 and its 200-day simple moving average is $344.64.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Microsoft

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!