TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Netflix NFLX Stock Takes A Dive

Members of “Weekly

Options USA,” Using A Weekly Put Option,

Make 76%

Potential Profit On The Day!

More to come?

Join

Us and GET THE TRADEs!

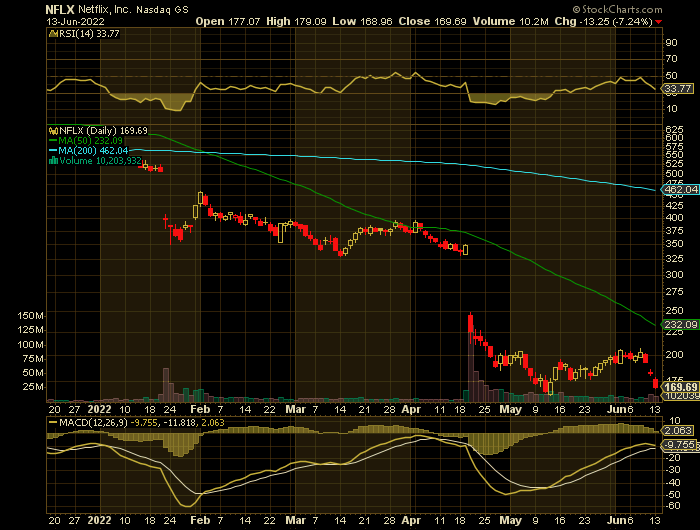

Netflix NFLX shares fell 5% on Friday, and a further 7% today, after Goldman Sachs analyst Eric Sheridan downgraded the streaming pioneer over risks of slower consumer spending and tough competition from Amazon and Walt Disney Co.

Where is it headed now?

Join Us And Get The Trades – become a member today!

Monday, June 13, 2022

Prelude.....

Netflix NFLX Inc (NASDAQ: NFLX) shares fell 5% on Friday after Goldman Sachs analyst Eric Sheridan downgraded the streaming pioneer over risks of slower consumer spending and tough competition from Amazon and Walt Disney Co.

However, last week's selloff paled in comparison to the bloodbath on Wall Street today. All three major indexes logged their fourth-straight loss, with the Dow in particular shedding 876 points to close at its lowest level since February 2021. The S&P 500 closed in bear market territory and at its lowest level since March 2021, while the Nasdaq fell to levels not seen since November 2020.

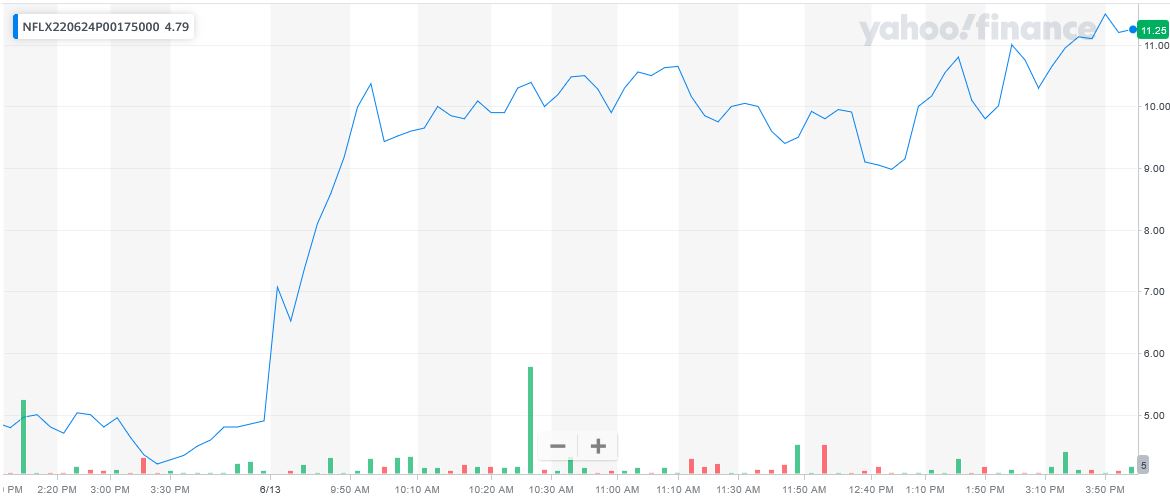

And,

Netflix NFLX fell another 7.24% today. This gave Weekly Options USA members the

chance to make 76% potential profit using a PUT OPTION. (see chart below).

In April, Netflix NFLX lost subscribers for the first time in more than a decade, signaling trouble ahead for the industry as rising prices of food and gas left people with little to spend on entertainment.

Suspending its services in Russia after the Ukraine invasion also took a toll on Netflix.

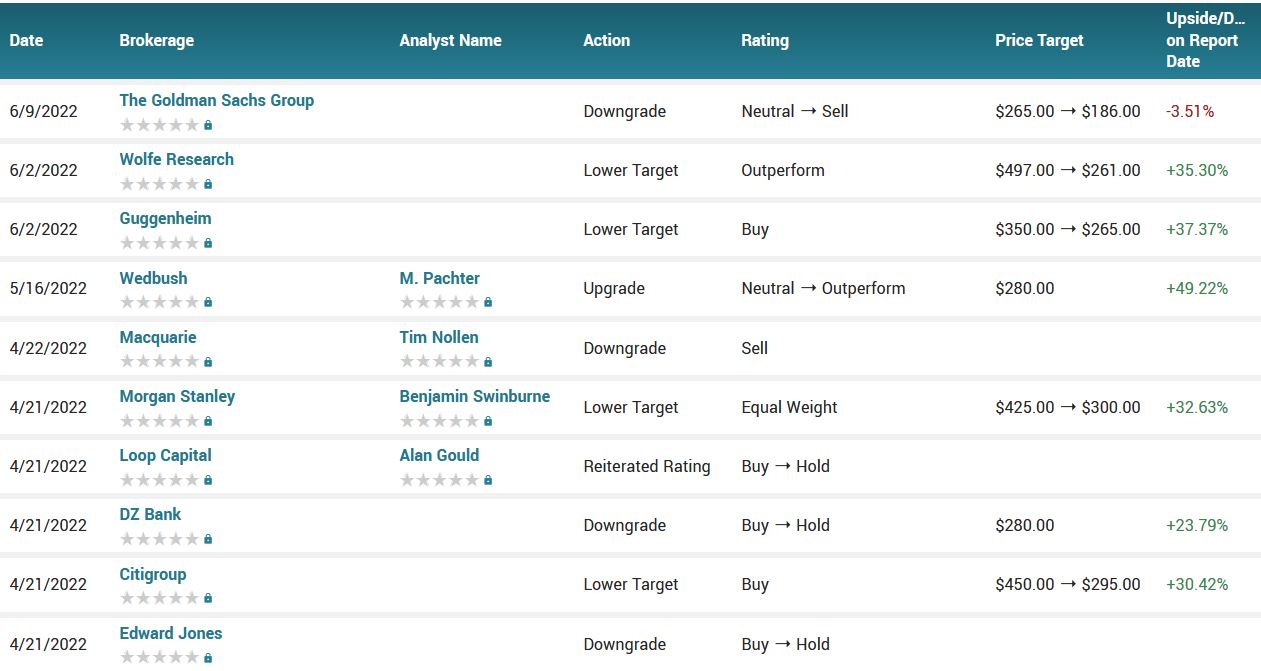

Goldman downgraded the stock to "sell" from "neutral" and slashed its price target to $186 from $265, the lowest PT among analysts covering the stock, according to data from Refinitiv.

"We have concerns around the impact of a consumer recession as well as heightened levels of competition on demand trends (both in the form of gross adds and churn), margin expansion, and levels of content spend and view Netflix as a show-me story with a light catalyst path in the next 6-12 months," Sheridan warned in the new note to clients.

The brokerage also lowered its ratings on e-commerce platform eBay Inc and online gaming firm Roblox Corp to "sell" from "neutral". Roblox and eBay shares fell nearly 4% in afternoon trading.

Netflix NFLX is now a "show-me story", Goldman said, as it cut revenue estimates for 2022-2023.

That sent Netflix shares down 4.6% at $184.06 in midday trading on Friday, adding on to this year's 68% slump.

further Reasoning Behind The netflix nflx Recommendation....

NFLX

Previous Trade…..

On Tuesday, May 10, 2022, we executed a Weekly Put Option on Netflix NFLX providing members with a potential return of 227%.

Many of the catalysts mentioned at that time are still applicable today.

To view that recommendation CLICK HERE.

Earnings.....

Netflix was on the outs long before April rolled in. The stock took a massive haircut in January after its subscriber growth guidance for the first quarter came in below Wall Street's expectations.

The first-quarter report hit the news wires on April 19, and it wasn't pretty. The soft prediction for subscriber additions turned into a negative number for the first time since the Qwikster era in 2011. Even worse, management sees the negative trends continuing in the second quarter, so the next quarter's subscriber drop looks even larger.

It didn't matter that Netflix also reported revenue right in line with analyst projections while crushing analysts' bottom-line targets. Earnings of $3.53 per share left the Street consensus far behind at $2.90 per share.

The company is raising subscription prices and tweaking its business operations to cut costs and boost profits. But investors are ignoring all of that to focus on those all-important subscriber figures. Netfix shares fell more than 37% the next day alone.

Inflation Effect.....

Shares

of Netflix gained downside momentum together with other tech stocks after the

U.S. reported that Inflation Rate increased by 8.6% year-over-year in May.

Analysts expected that Inflation Rate would grow by 8.3%.

The

high Inflation Rate is a bearish catalyst for Netflix stock for several

reasons. First, the Fed will be forced to raise the rate aggressively in order

to curb inflation. This is bearish for tech stocks in general.

Second,

Netflix may face additional problems as consumers analyze their budgets amid

high inflation and cut “unnecessary” subscriptions.

Moving Ahead.....

Analyst estimates for Netflix NFLX have been moving lower after the release of a disappointing quarterly report in April. Currently, the company is expected to report earnings of $10.91 per share in 2022 and $11.97 per share in 2023, so the stock is trading at 15 forward P/E.

While such valuation levels may look cheap for Netflix, traders should keep in mind that the company’s growth is slowing down. In addition, the situation in the economy is worse than previously expected, which could hurt Netflix’ financial performance.

Analysts…..

"The cost of living crisis will have a major impact on all streaming services. Let's not forget the market is now awash with too many streaming media services chasing too few services," said Paolo Pescatore, an analyst at PP Foresight.

"Expect some to pivot more towards a yearly discounted bundle to entice users and increase loyalty."

Netflix is already considering a cheaper subscription that includes advertising, following the success of similar offerings from rivals HBO Max and Disney+.

According to the issued ratings of 38 analysts in the last year, the consensus rating for Netflix stock is Hold based on the current 4 sell ratings, 24 hold ratings and 10 buy ratings for NFLX. The average twelve-month price prediction for Netflix is $365.24 with a high price target of $730.00 and a low price target of $186.00.

Summary.....

Netflix has a quick ratio of 1.05, a current ratio of 1.05 and a debt-to-equity ratio of 0.83. The firm has a market cap of $81.27 billion, a P/E ratio of 16.60, a PEG ratio of 1.00 and a beta of 1.28. Netflix has a 52 week low of $162.71 and a 52 week high of $700.99. The business’s fifty day simple moving average is $231.96 and its 200 day simple moving average is $389.59.

Therefore…..

For answers, join us here at Stock options Made Easy, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Netflix NFLX

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!