TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

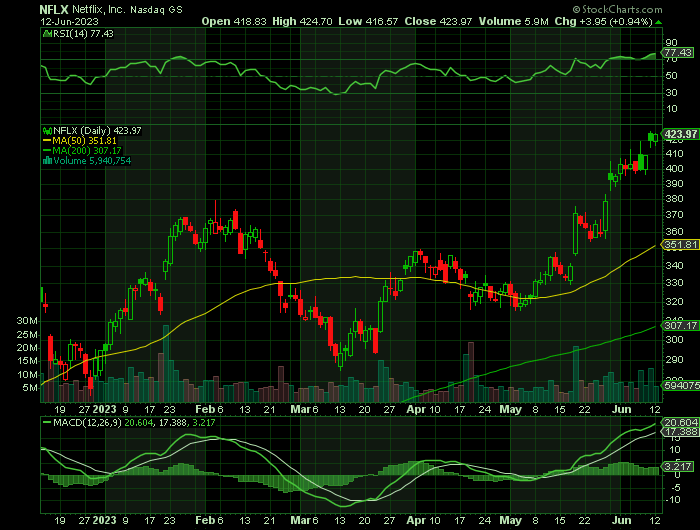

Netflix Inc (NFLX)

Shares Are A Force To Reckon With!

And Members Are Up 227%

Potential Profit

Using A Weekly Call Option!

Members of “Weekly Options USA,” Using A Weekly Call Option,

Make Potential Profit Of 227%,

As Netflix Inc NFLX Shares Jump Higher Due To

Password Sharing Rules And New Advertising Tier.

Netflix Inc NFLX Shares are moving higher as strong content portfolio, the positive impact of password sharing and the debuting of the advertising tier has had a positive impact.

This set the scene for Weekly Options USA Members to profit by 227%, using a NFLX Weekly Options trade!

Join Us And Get The Trades – become a member today!

Monday, June 12, 2023

by Ian Harvey

Prelude.....

Streaming entertainment is one such space that continues to receive a lot of attention. The internet completely revolutionized how people watch video entertainment, and there are numerous companies all vying for a piece of the action.

Streaming is not a new phenomenon, though, and there are already some winners. With over 232 million paid memberships as of March 31, Netflix Inc (NASDAQ: NFLX) deserves credit for pioneering streaming. Co-founder and former CEO Reed Hastings correctly predicted that video entertainment would become extremely popular because it was much more convenient and affordable for consumers.

He was right, and he positioned his business to capture this opportunity before others caught on. Netflix's first-mover advantage resulted in it finally producing positive free cash flow, with $1.6 billion in 2022 and a projected $3.5 billion this year.

Like many technology stocks, Netflix has suffered over the past year or so. After hitting its peak in late 2021, the stock plunged more than 75% as fears grew that Netflix was past its prime. However, over the past year, Netflix stock has risen to being a great stock again, gaining 150% since it bottomed last June.

Netflix’s shares have surged 42.5% year to date.

The Netflix Weekly Options Trade Explained.....

** OPTION TRADE: Buy NFLX JUN 23 2023 420.000 CALLS - price at last close was $5.57 - adjust accordingly

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the NFLX Weekly Options (CALL) Trade on Thursday, June 08, 2023, at 9:36, for $4.90.

Sold half the NFLX weekly options contracts on Thursday, June 08, 2023, at 3:59, for $7.90; a potential profit of 91%.

Total Dollar Profit is $790 - $4.90 (cost of contract) = $300

Sold the remaining NFLX weekly options contracts on Friday, June 09, 2023 for $16.00; a potential profit of 227%.

Total Dollar Profit on Friday is $1,600 - $490 (cost of contract) = $1,110

Thursday + Friday Profits = $1,410

For any members that missed selling their weekly options contracts there is still time as Netflix stock is still performing well.

Don’t miss out on further trades – become a member today!

Why the NFLX Weekly Options Trade Keeps Getting Better…..

There are two major catalysts at the moment helping push Netflix’s share price higher…..

1. Password Sharing - Netflix announced its paid password-sharing model in the United States on May 23, notifying members that their accounts cannot be shared for free to users outside their households.

Netflix experienced an increase in subscribers during the four days

following the announcement. The paid sharing model is an integral step to

tackle widespread account sharing, which erodes the company’s ability to invest

and improve content for paying members.

Netflix gained around 100K daily sign-ups on May 26 and May 27, higher than any

other four-day period in the United States since 2019. Its average daily

sign-ups reached 73K during that period, up 102% increase from the prior 60-day

average.

Netflix already launched paid sharing model in Canada, New Zealand, Spain and

Portugal in first-quarter 2023. Moreover, NFLX has plans to launch the paid

sharing model in major markets like Brazil, Britain, France and Mexico.

2. Advertising Tier - Late last year, Netflix debuted its Standard with Ads tier at $6.99 per month. Now, the lower-priced plan appears to have hit its stride. Early last month, the company informed advertisers that the plan had attracted nearly 5 million monthly active users across the globe. Perhaps as importantly, the engagement of subscribers on the Standard with Ads tier is on par with comparable plans without advertising.

Netflix will generate roughly $620 million in digital ad revenue in 2023. Add to that the roughly $419 million earned in estimated subscribers' fees from the lower-cost plan, and revenue from the Standard with Ads tier is starting to add up.

Conclusion…..

Netflix’s strong content portfolio and the positive impact of password sharing are expected to help it win subscribers in the near term. It expects second-quarter 2023 revenues to increase 3.4% year over year to around $8.242 billion.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from NETFLIX

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!