TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Netflix Inc Stock

Does It Again and

Continues To Scream Higher!

And, “Weekly Options” Members are Up 420% or 902%,

Depending On The Strike Price,Using A Weekly call Option!

Can More Profit Be Expected?

Don’t

Miss Out On Further Profit!

Wednesday, February 02, 2022

by Ian Harvey

Netflix Inc continued to move upwards again on Tuesday, after analysts upgraded the stock on Monday; and $20 million purchase of Netflix stock by Netflix CEO Reed Hastings – and the stock is still on a positive move this morning!

And, “Weekly Options USA” Members, Are Up 420% or 902%, Depending On The Strike Price, Using A Weekly Call Option!

Can

More Profit Be Expected?

Don’t Miss Out On Further Profit!

Netflix Inc (NASDAQ: NFLX)

Netflix Inc continued to move upwards again on Tuesday, after analysts upgraded the stock; and $20 million purchase of Netflix stock by Netflix CEO Reed Hastings – and the stock is still on a positive move this morning!

It may be that Netflix’s pricing power might be superior to other streaming services' pricing power. The recent weakness may merely be temporary, based on a short-term subscriber headwind. The stock's bullishness could be the beginning of a prolonged recovery move.

These rises are on top of the rise last Thursday after Billionaire investor William Ackman, of Pershing Square Capital Management, had built a new stake in streaming service Netflix Inc worth more than $1 billion.

For past insight read these two articles.....

“Netflix Stock Climbs After Ackman’s Hedge Fund Buys In!”

“Netflix NFLX Stock Continues To Rocket Higher!”

Netflix Inc soared on Tuesday to close at $457.13, adding $29.99 (7.02%) by the close of the market.

The Trades Explained.....

Weekly Options USA Members entered this trade on Thursday, January 27, 2022 – with a choice of two strike prices.

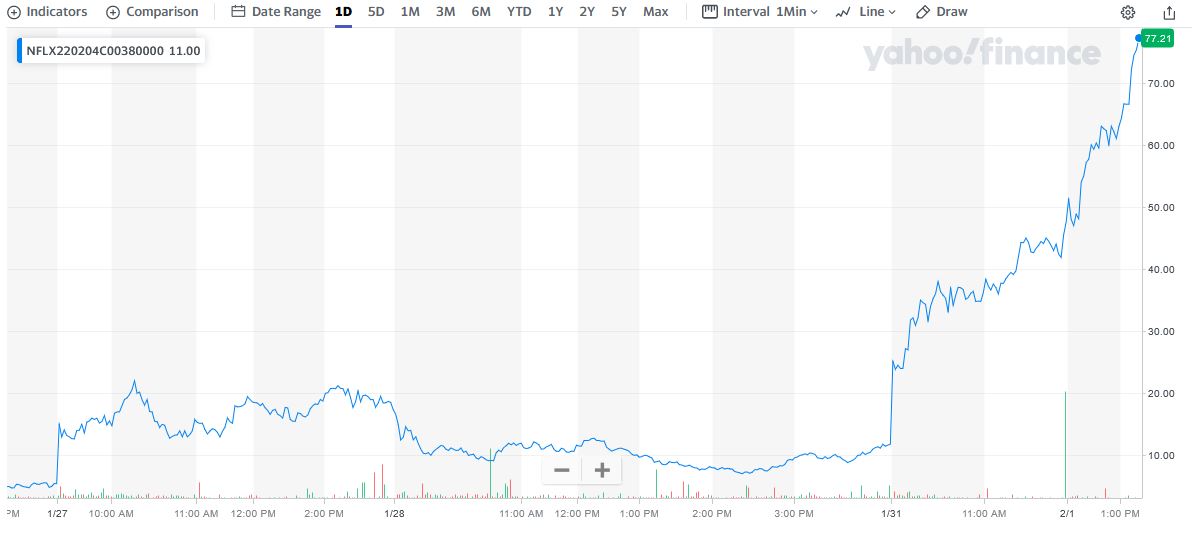

Trade 1. Expiry of 380.

Bought at $14.85 and reached $77.21 on Tuesday – providing 420% potential profit.

This is a profit of $6,236 on 1 contract!

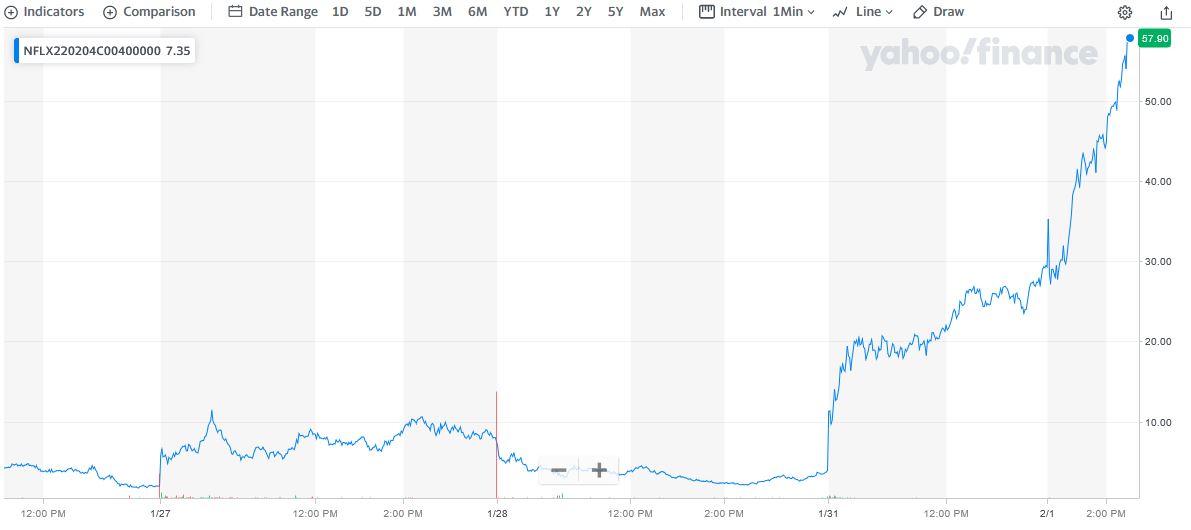

Trade 2. Expiry of 400.

Bought at $5.80 and reached $58.14 on Tuesday – providing 902% potential profit.

This is a profit of $5,234 on 1 contract!

Influencing Factors for Netflix Inc Gains

There was no new news on the day that provided the impetus for the Netflix Inc. It appears that investors continued to trade on the previous news of the Monday upgrades and the fact that the CEO, Reed Hastings of Netflix Inc, bought $20 million worth of the shares, disclosed after the market closed last Friday.

This rise is on top of the rise last Thursday after Billionaire investor William Ackman, of Pershing Square Capital Management, had built a new stake in streaming service Netflix Inc worth more than $1 billion.

While Netflix Inc has no doubt experienced slower growth than investors are used to, and particularly after the pandemic surge in 2020, proponents of the stock still see a major opportunity for the company to dominate the world of video entertainment.

However, there is still some untapped potential domestically. And when it comes to price increases, Netflix's management has historically done a fantastic job of executing. In fact, CFO Spence Neumann highlighted on the Q4 earnings call that the leadership team continues to see improved member churn and engagement.

Focusing on and continuing to develop competence in creating insanely successful international hits produced in local languages, like Squid Game and Money Heist, give Netflix Inc a major advantage.

Netflix is keeping its core customer base happy and reducing the amount of subscribers who quit (or “churn”) after they’ve watched the series they want to watch, but with a total base of around 222 million people, executives feel they’re not growing as fast as they would like, and they see investment in video games as a way to remedy that.

Netflix has reached an agreement with the Montreal-based RocketRide Games, a self-described “boutique consulting agency for the video game industry,” to bring more games to the streaming service’s mobile platform.

In November,

Netflix launched its mobile games initiative, adding five different titles from

three different developers: “Stranger Things: 1984” and “Stranger Things 3: The

Game” from (BonusXP), “Shooting Hoops” and “Teeter Up” from (Frosty Pop), and

Card Blast from Amuzo & Rogue Games.

Summary.....

Netflix Inc shares were down nearly 40% over the past three months before the start of the week – so there is plenty of room for further positive stock movement.

Therefore…..

We Have Had A Successful Netflix Inc Trade!

Will We Hold For Further Profit?

What Further Netflix Inc Weekly Trades Will We Recommend?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!

Back to Weekly Options USA Home Page from Netflix Inc