TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Netflix (NFLX)

Shares Continue To Climb!

And Members Are Up 91%

Potential Profit, In 1 Day,

Using A Weekly Call Option!

Members of “Weekly Options USA,” Using A Weekly Call Option,

Make Potential Profit Of 91%,

After JPMorgan And Wells Fargo Analysts Both

Raised Their Price Targets For Netflix,

Citing The Streaming Platform's New

Ad-Tier Performance.

JPMorgan analyst Doug Anmuth reiterated his bullish view on the streaming giant Netflix Inc (NASDAQ: NFLX) and raised his price objective to $470 that suggests an 18% upside on its previous close.

This set the scene for Weekly Options USA Members to profit by 91%, in 1 day, using a NFLX Weekly Options trade!

Join Us And Get The Trades – become a member today!

Thursday, June 08, 2023

by Ian Harvey

Below is the RECOMMENDATION sent to Weekly Options USA Members Today Explaining…..

Why the NFLX Weekly Options Trade was Executed!

Prelude.....

On Wednesday, JPMorgan analyst Doug Anmuth reiterated his bullish view on the streaming giant Netflix Inc (NASDAQ: NFLX) and raised his price objective to $470 that suggests an 18% upside on its previous close.

He remains constructive on the Netflix stock since the company last month confirmed that its password-sharing crackdown and ad-supported tier were gaining traction.

“We’re updating our NFLX model to capture the broader Paid Sharing opportunity following the rollout in late May to 100+ markets. We believe there’s further upside as estimates move higher.”

In April, Netflix said it added a less-than-expected 1.75 million net new subscribers in its fiscal Q1.

The Netflix Weekly Options Trade Explained.....

** OPTION TRADE: Buy NFLX JUN 23 2023 420.000 CALLS - price at last close was $5.57 - adjust accordingly

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the NFLX Weekly Options (CALL) Trade on Thursday, June 08, 2023, at 9:36, for $4.90.

Sold half the NFLX weekly options contracts on Thursday, June 08, 2023, at 3:59, for $7.90; a potential profit of 91%.

Total Dollar Profit is $790 - $4.90 (cost of contract) = $300

Holding the remaining NFLX weekly options contracts for further profit before expiry.

Don’t miss out on further trades – become a member today!

About Netflix.....

Netflix is a digital technology and media company and company that put streaming on the map. Begun as an easy way to get DVDs through the mail, Netflix ended the era begun by Blockbuster and ushered in a new age with the advent of streaming media. Today, the company provides a complete range of digitized media content and its services are available through most types of media devices. Netflix, Inc. is headquartered in Los Gatos, California, and went public in 2002.

Netflix was founded on August 29, 1997, by partners Reed Hastings and Marc Randolph. The two met after their previous projects merged together and came up with the idea while carpooling to work. The idea was to find a category of goods akin to Amazon’s dominance with books and make them available over the Internet in a similar fashion.

The pair had already discounted the idea of renting VHS tapes over the mail when they heard about DVDs which first became available in 1997. After a test run to be sure a DVD could be mailed and delivered intact, the pair jumped into the multi-billion dollar movie rental business head first. Along the way, the company will make many innovations including a tool that makes personalized movie suggestions for each member. In 2006 membership will top 5 million then later, in 2007, the company will enter the streaming market where it will quickly dominate too.

Netflix entered the original content market in 2012 with the release of Hemlock Grove. Hemlock Grove is a supernatural drama that was followed up by Orange Is The New Black. Orange Is The New Black was a groundbreaking series for viewers and led to a series of other successes including Stranger Things. In March 2021 Netflix Studios was the most nominated at the Academy Awards.

Today the company has approximately 222 million paid members in 190 countries and offers services in more than 62 languages. Subscribers can choose from a variety of plans but all include unlimited access to all the content on the site. The difference in plans is in how many screens or devices can be used at a single time which allows subscription-sharing among family and friends.

The company has also moved on from a pure-play on rentals to making its own content and has a growing portfolio of brands to its credit. At one point in the company’s evolution, Jeff Bezos offered to acquire the company for Amazon for about $15 million but Hastings turned him down. The company was valued at a market cap of $99.42 BILLION in late 2022.

Further Catalysts for the NFLX Weekly Options Trade…..

With paid sharing, Anmuth expects Netflix Inc to monetise up to 14 million borrowers this year and another 12 million in 2024.

The JPMorgan analyst sees paid sharing revenue to hit $2.4 billion in total next year and climb further to $3.5 billion in 2025. His research note reads:

With some Paid Sharing benefits already built into our model, our revenue increases 4.0% in 2024 while operating income increases 6.0%. We now model free cash flow of $6.0 billion in 2024.

The Nasdaq-listed firm added 64 new movies and 14 new TV series to its streaming platform last week. For the year, Netflix stock is up roughly 35% at writing.

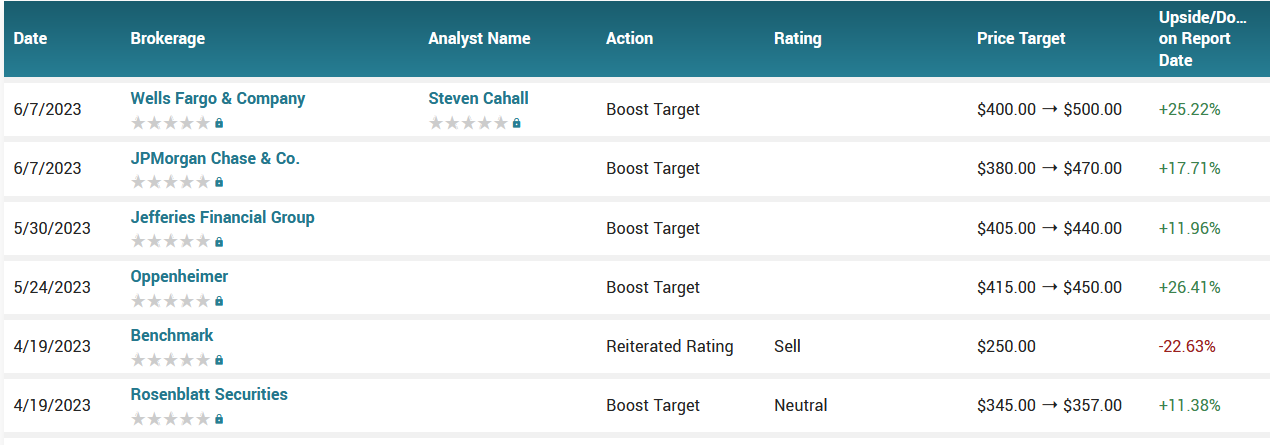

Analysts.....

According to the issued ratings of 37 analysts in the last year, the consensus rating for Netflix stock is Moderate Buy based on the current 3 sell ratings, 10 hold ratings and 24 buy ratings for NFLX. The average twelve-month price prediction for Netflix is $355.00 with a high price target of $500.00 and a low price target of $215.00. for Salesforce is $220.97 with a high price target of $275.00 and a low price target of $150.00.

Summary.....

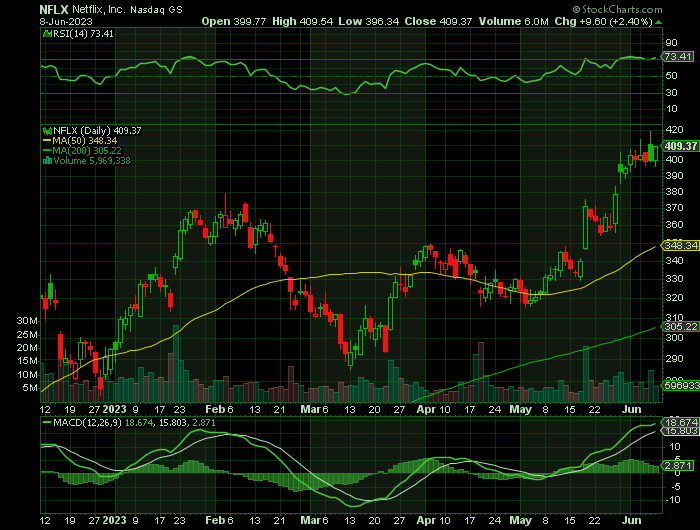

Shares of Netflix Inc. inched 0.12% higher to $399.77 Wednesday, on what proved to be an all-around mixed trading session for the stock market, with the Dow Jones Industrial Average rising 0.27% to 33,665.02 and the S&P 500 Index falling 0.38% to 4,267.52.

Netflix Inc. closed $14.09 short of its 52-week high ($413.86), which the company achieved on June 5th. Netflix stock traded up $5.16 during midday trading on Wednesday, hitting $404.45. 6,832,802 shares of the company were exchanged, compared to its average volume of 7,341,491. The firm has a market capitalization of $179.79 billion, a PE ratio of 42.93, a price-to-earnings-growth ratio of 1.61 and a beta of 1.26. Netflix, Inc. has a fifty-two week low of $164.28 and a fifty-two week high of $418.95. The business has a fifty day simple moving average of $346.52 and a two-hundred day simple moving average of $329.22. The company has a debt-to-equity ratio of 0.64, a quick ratio of 1.26 and a current ratio of 1.26.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from NETFLIX

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!