TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Netflix

Stock Climbs After Ackman’s Hedge Fund Buys In!

And, “Weekly Options” Members are Up 48% or 95%

Using A Weekly call Option!

Can More Profit Be Expected?

Don’t

Miss Out On Further Profit!

Friday, January 28, 2022

by Ian HarveyNetflix stock jumped after Ackman of Pershing Square Capital Management, built a new stake in streaming service worth more than $1 billion.

And, “Weekly Options USA” Members, Are Up 48% or 95%, depending on the strike price used, after executing a Weekly Call Option!

Netflix Inc (NASDAQ: NFLX)

On January 20, Netflix Inc (NASDAQ: NFLX) stock tumbled more than 20% after the company released its fourth-quarter earnings report. Although NFLX reported better-than-expected profit and revenue that was in line with Wall Street's expectations, the company's outlook for subscriber growth was disappointing.

NFLX is a reminder of just how quickly the market can move these days, as the stock has fallen a remarkable 40% from its 52-week highs from back in November.

However, it appears that there is a consensus that a bottom may have been reached!

Billionaire investor William Ackman, of Pershing Square Capital Management, has built a new stake in streaming service Netflix Inc worth more than $1 billion since its stock price tumbled starting last Thursday.

Bear markets feel very unnerving to live through, but fortunately, the bear doesn't stick around long. Stocks crash and then rebound, and those rebounds happen as suddenly as when the market falls. Netflix could be a good example of this scenario!

The Trades Explained.....

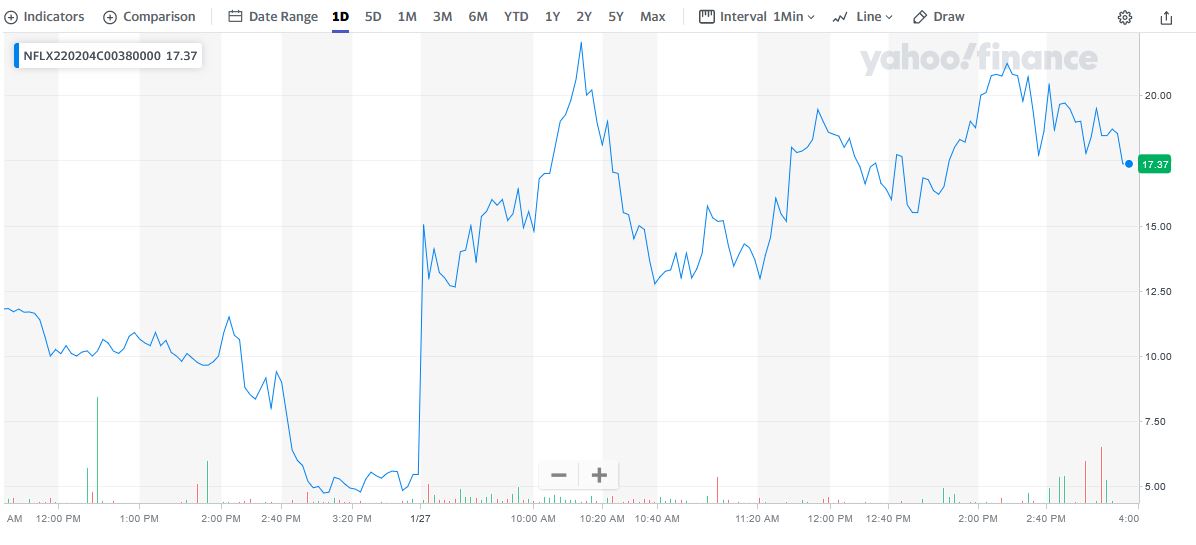

Weekly Options USA Members entered this trade on Thursday, January 27, 2022 – with a choice of two strike prices.

Trade 1. Expiry of 380.

Bought at $14.85 and reached $22.00 on the day – providing 48% potential profit.

Trade 2. Expiry of 400.

Bought at $5.80 and reached $11.30 on the day – providing 95% potential profit.

About Netflix.....

Netflix,

Inc. operates as a streaming entertainment service company. The firm provides

subscription service streaming movies and television episodes over the Internet

and sending DVDs by mail.

It operates

through the following segments: Domestic Streaming, International Streaming and

Domestic DVD. The Domestic Streaming segment derives revenues from monthly

membership fees for services consisting of streaming content to its members in

the United States. The International Streaming segment includes fees from

members outside the United States. The Domestic DVD segment covers revenues

from services consisting of DVD-by-mail.

The company was founded by Marc Randolph and Wilmot Reed Hastings Jr. on August 29, 1997 and is headquartered in Los Gatos, CA.

The Major Catalysts for the NETFLIX Weekly Options Trade….

The Earnings Report.....

Netflix reported Q4 revenue of $7.71 billion, up 16% year-over-year, and added 8.28 million global paid net subscribers during the quarter, both exceeding the consensus estimates. Netflix also stated that it will be free cash flow positive in 2022, which is another positive that might be getting overlooked.

Forecasted Guidance.....

The stock is getting hammered following the report because of its forecasted guidance for subscriber growth in Q1 2022, which could be hinting at the fact that streaming video competitors are eating into the company’s market share.

With that said, Netflix recently increased its prices, has an internal recommendation software that will be tough for competitors to replicate, and has great opportunities in international markets to gain more users going forward.

Bill Ackman.....

Ackman told investors that his hedge fund, Pershing Square Capital Management, started buying on Friday and now owns more than 3.1 million shares in Netflix, making Pershing Square a top 20 shareholder.

In a letter to his clients, Ackman praised the company's "best-in-class management team" and on Twitter the manager said he has long admired Netflix CEO Reed Hastings and the "remarkable company he and his team have built."

Netflix shares climbed as much as 5% in after-hours trading. They had tumbled more than 30% in the last five days, a much steeper swoom than the broader market. After the market closed last Thursday, Netflix forecast weak subscriber growth.

Ackman, whose firm invests $22.5 billion, wrote that he had been analyzing Netflix at the same time he was investing in Universal Music Group and was ready to buy when Netflix' "stock price declined sharply last Friday."

"Now with both UMG and Netflix, we are all-in on streaming as we love the business models, the industry contexts, and the management teams leading these remarkable organizations."

Ackman said Netflix benefits from highly recurring revenues, adding the company has pricing power and delivers industry-leading content.

Goldman Sachs.....

After a brutal two weeks for the market this month, Goldman Sachs is saying it's about time for investors to dip their toes in the volatile waters.

Not whole-hog on adding risk assets to the portfolio, but a nibble.

"To the extent that zero interest rate policies, negative real interest rates and quantitative easing have been supportive for risk assets, it is understandable that a perceived move away from these supports should cause a correction, particularly given high valuations. But this adjustment has now been reflected in the markets and the downside risks from here are much lower so long as economies can grow. Our Risk Appetite Indicator (GSRAII) has fallen back, suggesting we are getting closer to levels that have typically been a good entry point for longer-term investors," said Goldman Sachs strategist Peter Oppenheimer on Wednesday.

Growth Potential.....

According to Wall Street analysts, the company's revenues could hit $38 billion by 2023, an increase of nearly 400% from 2016.

However, the pandemic didn't necessarily create new demand. Rather, it accelerated trends that were already in progress in the global streaming market. This doesn't just apply to subscriber growth. Companies like Disney (NYSE:DIS) accelerated their streaming rollout plans as well, making more content available for subscribers. Money is also flooding into production. It seems as if every single content producer now has a unique offering that consumers need to pay a monthly subscription for.

The company generated positive cash flow in 2021 and expects to remain cash generative for the foreseeable future. As such, for the first time in its history, it is no longer reliant on investor financing to keep the lights on and fund content development and licensing spending.

This is a huge step forward for the business.

Business Model.....

Its subscription service has become a non-negotiable spend for some consumers, which gives the enterprise an air of defensiveness. Its cash flows are relatively stable and predictable, and it can increase its subscription prices. Consumers are unlikely to notice a 5% per annum increase in prices. Even if they do, it's such a small expense that they are unlikely to cancel the subscription, especially when one considers the amount of entertainment value a Netflix account provides.

The sticky nature of the client base is the primary reason the stock now offers an interesting opportunity. Based on Wall Street growth projections for 2023, the stock is trading at a forward price-earnings ratio of just 25. This seems incredibly cheap for a business with a sticky customer base and the potential for substantial revenue and profit growth in the years ahead.

Indeed, even if the company's subscriber growth falls to zero, it still has the potential to grow earnings through price increases.

Customer Focus.....

With the monster success of shows like Squid Game and Money Heist, as well as recent movies like Red Notice and Don't Look Up, it appears as though the business still excels at entertaining viewers. And in 2021, Netflix had the most Emmy and Oscar nominations and wins of any studio out there.

As a result, it would be the last streaming subscription consumers would cancel if they had to. In fact, according to Nielsen data, Netflix has a 7% share of total TV viewing time in the U.S., the most of any streaming service.

From the customer's perspective, Netflix is still the top dog, with an exceptional value proposition that is increasing with the introduction of mobile games. And management just raised prices in the U.S. and Canada.

Analysts.....

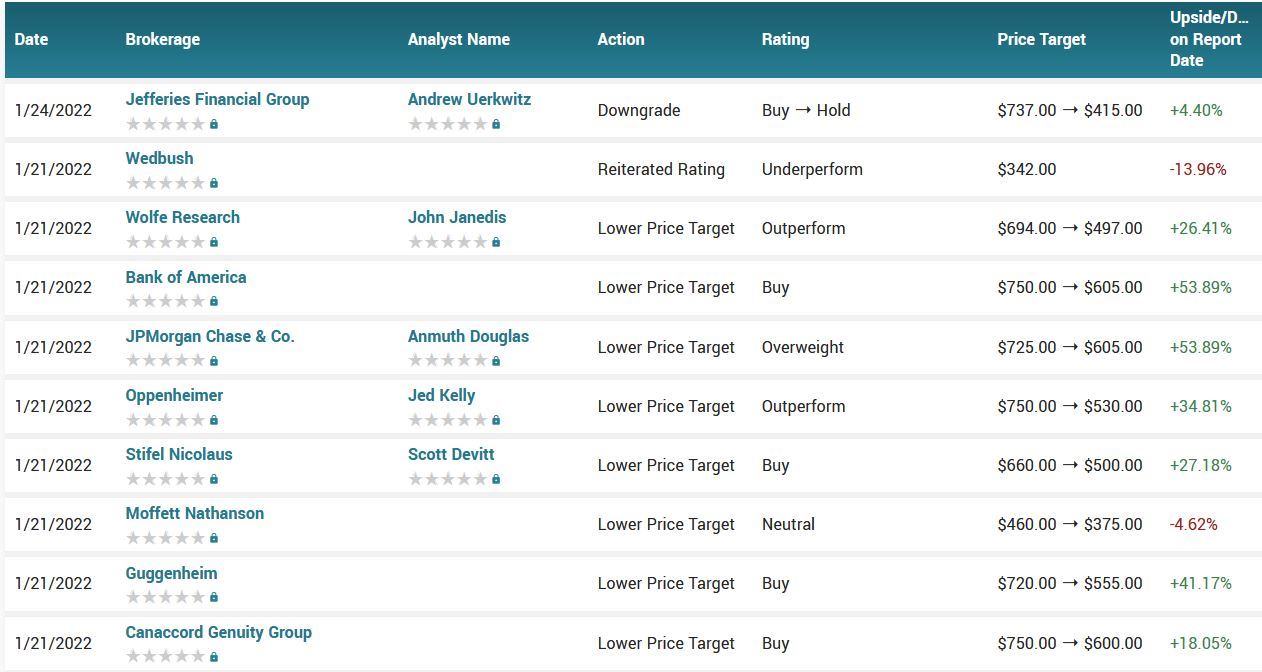

The weak outlook for the first quarter seems to have taken Wall Street by surprise. However, despite several analysts cutting their NFLX price targets and downgrading the stock, the general consensus remains bullish. The median price target is $521, indicating more than 30% growth potential in 2022.

Despite lowering his NFLX price target from $700 to $650, BMO Capital analyst Daniel Salmon remains bullish, predicting an upside of nearly 70%. The analyst believes Netflix management will engage in a buyback later this quarter. He also notes that Netflix has little regulatory risk, compared to other FAANG stocks.

Another bull is Cowen analyst John Blackledge, who lowered his firm's price target on Netflix from $750 to $600. But he maintained his Outperform rating on NFLX, implying an upside of more than 50%. The analyst reported that foreign exchange headwinds had compressed margin expectations in Netflix's guidance.

Still on the bull side, UBS analyst John Hodulik lowered his firm's price target on Netflix from $690 to $575. But that's still nearly a 50% upside. He also reiterated his "buy" recommendation on NFLX shares. The analyst acknowledges the soft first-quarter subscriber outlook and attributes it to macro pressure in Latin America. Hodulik remains bullish on the company's operating leverage due to Netflix management holding its outlook at 300bps of average annual margin expansion.

According to the issued ratings of 39 analysts in the last year, the consensus rating for Netflix stock is Hold based on the current 3 sell ratings, 17 hold ratings and 19 buy ratings for NFLX. The average twelve-month price target for Netflix is $547.85 with a high price target of $800.00 and a low price target of $342.00.

Summary.....

Shares of Netflix plummeted after its recent earnings report. Net subscriber additions were just shy of management's forecast, but Netflix has been here before. Netflix is an almost indispensable form of entertainment that continues to look well-positioned for long-term growth.

Netflix's something-for-everyone content strategy has gained 221 million subscribers globally, but there still in the early innings of where streaming media is headed over the next 30 years. With the massive lead it has in viewers and content investment, it's difficult to imagine a world without Netflix.

Subscriptions might slow when the economy is weak, but Netflix's

recurring revenue stream would help me sleep well no matter how the stock

market is performing. Plus, with the company's free cash flow improving,

Netflix will have more cash to grow its content budget and maintain its lead in

streaming.

Therefore…..

We Have Had A Successful Netflix Trade!

Will We Hold For Further Profit?

What Further Netflix Weekly Trades Will We Recommend?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Join us today and find out!

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!

Back to Weekly Options USA Home Page from Netflix