TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Netflix Inc (NFLX)

Shares Get Another Analyst Boost!

And Members Are Up 110%

Potential Profit

Using A Weekly Call Option!

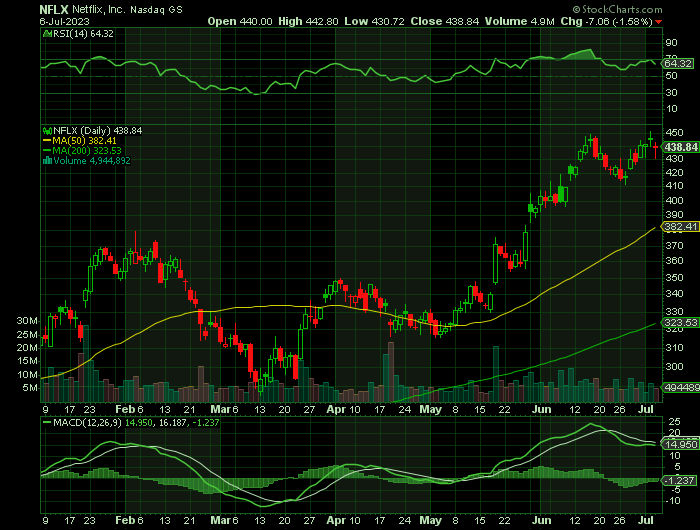

Shares of Netflix Inc (NASDAQ: NFLX) have skyrocketed this year. The streaming TV and movie service company's shares have gained 47% year to date.

Wednesday, last week, Netflix pulled in new gains with a terrific report from Jason Helfstein, an analyst from Oppenheimer. On Thursday, it grabbed new attention at Citi as it started a 30-Day Catalyst Watch. This initially gave it a boost.

And now, Netflix shares edged higher Wednesday, this week, after Goldman Sachs analysts boosted their rating and price target on the streaming service heading into its second-quarter earnings report later this month.

This set the scene for Weekly Options USA Members to profit by 110%, using a NFLX Weekly Options trade!

Join Us And Get The Trades – become a member today!

Friday, July 07, 2023

by Ian Harvey

Netflix Inc (NASDAQ: NFLX) shares edged higher Wednesday after Goldman Sachs analysts boosted their rating and price target on the streaming service heading into its second-quarter earnings report later this month.

And, Wednesday, last week, saw Netflix pull in new gains with a terrific report from Jason Helfstein, an analyst from Oppenheimer. On Thursday, it grabbed new attention at Citi as it started a 30-Day Catalyst Watch. This initially gave it a boost.

Goldman analyst Eric Sheridan lifted his rating on Netflix to neutral from sell, while upgrading a dated price target by $170 to $400 a share. The analyst cited "the overall positive current operating performance" and "continued forward positive operating momentum" heading into the second half of the year.

"Netflix management has executed its password sharing initiative in excess of our prior assumptions ... and overall industry competition has become more muted," Sheridan wrote. He noted that Netflix shares have more than doubled (up 135%), compared with a 12.5% gain for the S&P 500, since the stock was added to Goldman's sell list in June of last year.

"Our neutral rating reflects our continued low visibility into the pathway to that upside node, but we do acknowledge that a probability weighted outcome toward such a result makes it unlikely the shares would underperform for any extended period in the coming quarters," he added.

The company had begun notifying users in the U.S. that it would limit their ability to share passwords, and force those living outside the homes of the account holders to purchase their own subscriptions.

Netflix rolled out the first phase of its "paid sharing" effort earlier this spring in Canada, New Zealand, Spain and Portugal, and launched its main U.S. focus on May 23.

The Netflix Weekly Options Trade Explained.....

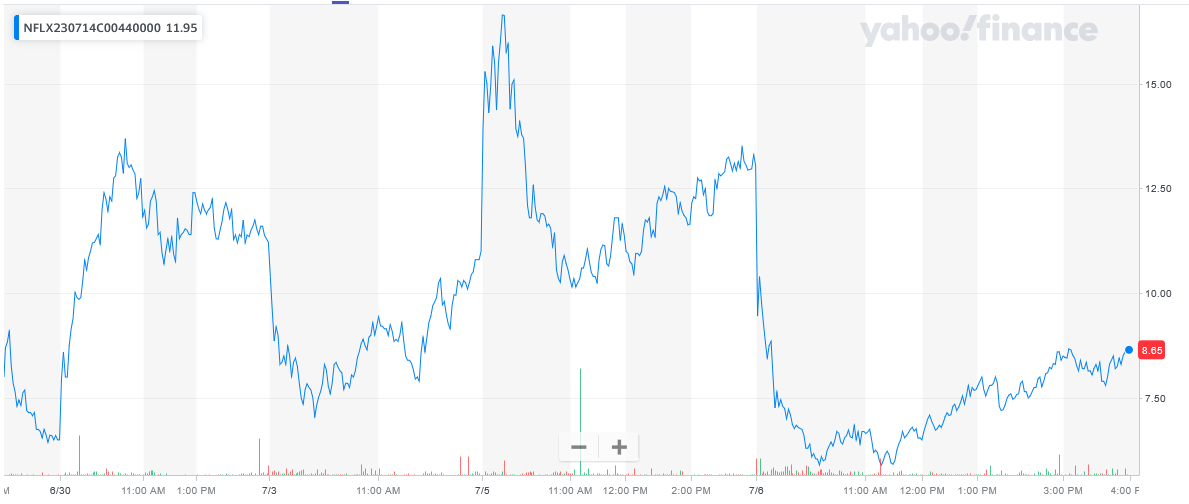

** OPTION TRADE: Buy NFLX JUL 14 2023 440.000 CALLS - price at last close was $6.50 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the NFLX Weekly Options (CALL) Trade on Friday, June 30, 2023, for $8.00.

Sold half the NFLX weekly options contracts on Thursday, July 06, 2023, for $16.79; a potential profit of 110%.

Holding the remaining NFLX weekly options contracts for further profit before expiry.

Don’t miss out on further trades – become a member today!

Why the NFLX Weekly Options Trade was Executed?

Prelude.....

Shares of Netflix Inc (NASDAQ: NFLX) have skyrocketed this year. The streaming TV and movie service company's shares have gained 47% year to date.

Wednesday, Netflix pulled in new gains with a terrific report from Jason Helfstein, an analyst from Oppenheimer. On Thursday, it grabbed new attention at Citi as it started a 30-Day Catalyst Watch. This initially gave it a boost.

Citi—via analyst Jason Bazinet—noted that the ad tier on Netflix will have officially launched six months ago when Netflix releases its second-quarter earnings next month. That should bring along with it some meaningful news about just how many users were turning to that tier, particularly in light of the modifications to the Basic tier and the password crackdown. The combination of those two factors should drive more users to the ad-supported tier than other premium-priced tiers.

Further Catalysts for the NFLX Weekly Options Trade…..

Netflix shares rose nearly 1.5% in pre-market trading on Thursday as investment firm Citi opened a 30-day catalyst watch on the streaming giant, citing potential positives about its advertising tier.

Analyst Jason Bazinet, who has a buy rating on Netflix and boosted his per-share price target to $500 from $400, noted that it will be two full quarters since the launch of its ad tier when it reports second-quarter results next month, with expectations that some meaningful updates will be shared.

Bazinet also said the quarterly results should be aided by the password sharing crackdown in the U.S., which is more likely to drive ad-tier subscribers than higher-tier subscribers.

"We would expect shares to respond positively to any incremental positive commentary on the firm’s ad-tier roll-out, which we believe will give investors incremental confidence in the progress of this initiative," Bazinet wrote in an investor note.

Other Positive Catalysts.....

Netflix, Inc. Common Stock is expected to report earnings on July 19, 2023 after the market closes. The report will be for the fiscal Quarter ending Jun 2023. Based on 11 analysts' forecasts, the consensus EPS forecast for the quarter is $2.81. The reported EPS for the same quarter last year was $3.2.

There are actually some good reasons to believe Netflix stock remains attractive at current levels. Chief among those reasons are some clear catalysts for earnings growth in the coming years. Those catalysts include:

- layoffs in 2022 that led to a leaner business

- growth in the company's new higher-margin advertising business

- efforts from management to reduce account sharing

- further international growth

- improving economies of scale

The last reason to expect strong earnings growth from Netflix in the coming years -- improving economies of scale -- is worth expanding on. Unlike in the previous decade, Netflix's annual content-spend growth has slowed in recent years. Indeed, the company has maintained an annual budget of around $17 billion for content in 2022 and 2023 -- and management expects this to remain the company's approximate budget in 2024. This is enabling Netflix to spread its content investments across a growing base of subscribers.

Paid subscribers have been growing at a rate of around 4% to 5% year over year recently, and this growth rate could accelerate in the second half of the year as the company's recent efforts to reaccelerate growth start paying off. Netflix's improving economies of scale mean each new subscriber may lead to more profits than new subscribers did in previous years.

To this end, analysts expect Netflix's adjusted earnings per share to compound at an average annualized rate of about 21% over the next five years -- a growth rate that would likely justify the stock's current valuation.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from NETFLIX

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!