TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

NIO Stock In A Fast Uptrend!

“State-of-the-Art” Members

Profit Up 37% In 1 Day!

Much

More Profit On Its Way!

Thursday, July 01, 2021

by Ian Harvey

NIO stock moved higher yesterday after a Wall Street analyst raised his bank's price target for the shares in a bullish note. Citibank analyst Jeff Chung raised the bank's price target on NIO to $72, from $58.30.

“State-of-the-Art Members,” using an options call trade, made potential profits of 37% in 1 day!

More is expected when the market opens.

Nio Inc – ADR (NYSE: NIO)

Prelude…..

NIO stock is experiencing further movement upwards after an analyst got more bullish. Tuesday, Citigroup‘s Jeff Chung increased his price target for stock in the Chinese electric vehicle maker, believing things are looking up for the third quarter and the second half of 2021.

Chung’s price target for Nio Inc – ADR (NYSE: NIO) stock goes to $72 from $58.30 a share. It’s the second target price hike for the analyst this month, although the first one was small. He took his NIO stock price target to $58.30 from $57.60 on June 1.

On Monday, NIO stock price moved

higher after the

company said it will hold a "NIO Power Day" event next month.

"NIO Power" is the company's name for its suite of vehicle-recharging

products and services. READ Details Below.....

The Recommended NIO Stock Options Trade.....

** OPTION TRADE: Buy NIO SEP

17 2021 55.000 CALLS at approximately $4.40. (Actually bought for $4.65)

NIO Stock Options Trade Call Success Explained.....

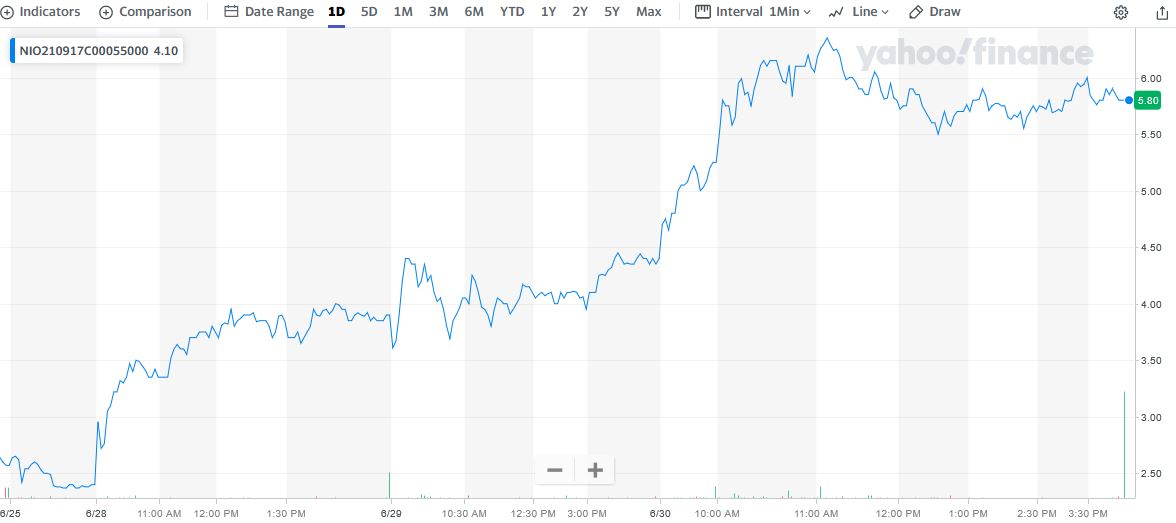

On Wednesday, June 30, 2021, “State-of-the-Art Members,” entered the trade mentioned above for $4.65.

By close of the stock market normal session, NIO stock price had reached a high of $53.84 – up 6.9%.

The option trade hit $6.35 during the trading day – up $1.70 or 37%.

More profit is expected today as the pre-market NIO stock price is already up $1.06 - close to 2.0%.

Why the Recommendation and the Reasoning behind

the Options Trade on NIO Stock

Typically, it's smaller companies that generate some of the fastest sales growth, while large-cap stocks (those with market caps of at least $10 billion) grow at a more tempered pace. Larger companies are more likely to have time-tested or mature operating models, making it less common that they generate eye-popping revenue growth.

However, Nio Inc – ADR (NYSE: NIO), often referred to as "the Tesla of China," and is showing great promise in following in the footsteps of the EV pioneer, is bucking the trend in this situation.

Nio is on track to, at minimum, quintuple its sales over a four-year period, according to Wall Street's consensus revenue estimate for 2024 (or fiscal 2025). You could rightly say that this is one of the fastest-growing large-cap stocks on the planet.

If all goes well, full-year sales can catapult from about $2.5 billion in 2020 to $16.8 billion in 2024. That's a sales increase of approximately 561%.

Despite a global chip shortage, NIO has shown Wall Street that it can effectively scale its production. After delivering 20,060 vehicles in the first quarter, the company is on pace to deliver between 21,000 and 22,000 EVs in the second quarter. Once global chip supply issues are resolved, NIO will look to boost its annual delivery capacity to around 150,000 EVs.

For NIO, innovation is extremely important. It's been introducing one new vehicle each year, with the sportier EC6 crossover SUV hitting showrooms last summer. It's quickly become a hit with EV buyers.

Additionally, NIO introduced a battery-as-a-service program. For a monthly fee, this subscription service allows buyers to replace or upgrade their vehicle's batteries. It also reduces the initial purchase price of the vehicle. Though NIO is giving up near-term margin by reducing the purchase price of its EVs, it's keeping buyers loyal and generating very high margin residual service revenue.

Influencing Factors…..

NIO has also done an excellent job of ramping up production over the past year. Even though output is currently constrained by a global chip shortage, it's on track to deliver between 21,000 and 22,000 EVs in the second quarter. For some context, it delivered only 20,565 vehicles in the entirety of 2019.

It wasn’t so long ago that analysts and investors alike were ready to write off their losses and give up on electric vehicle manufacturer Nio. But China’s answer to Tesla’s dominance powered on, eclipsed estimates, and most importantly, kept its balance sheet in line. And it’s paid off, in a big way. Nio Tesla’s largest competitor in China, has also started to offer a batteries-as-a-service concept, in which car buyers can ‘lease’ the battery of their vehicle and save as much as $10,000 on the price of a new vehicle, while also offering buyers the option to swap batteries after a few years of use.

This could be huge for Nio, which is already making major moves. In fact, just last fall, Nio revealed a pair of sedans that even the biggest Tesla die-hard would struggle to pass up. The vehicles, meant to compete with Tesla’s Model 3, could be just what the company needs to pull back control of its local market from Elon Musk’s electric vehicle giant.

Nio broke above its downtrend with nearly a 10% gain. Over the weekend, analysts reported 5 more battery swap stations in China from the company and also noted they have a Power Day coming up July 9.

"NIO Power Day"

Nio said it will hold a "NIO Power Day" event next month. "NIO Power" is the company's name for its suite of vehicle-recharging products and services.

Chinese electric-vehicle news outlet CnEVPost reported that NIO has begun inviting China-based journalists to NIO Power Day on July 9. The NIO Power "service," as the company calls it, includes NIO's charging network, its fast-growing network of battery-swap stations, and related services including home chargers and "mobile charging cars" that can assist stranded NIO owners.

The event will commemorate the third anniversary of NIO Power's launch, the company said.

Electric-vehicle investors have become accustomed to companies using big-day events to unveil new products and services but the excitement is warranted in this case. NIO has said that it is accelerating the rollout of its new-and-improved battery-swap stations, and we might see updates on that front; but I'm not (yet) expecting big news from the July 9 event.

Benefits of Electric.....

The future is electric …And it could be much more than that.

It’s about on-demand cars, virtual showrooms, and an end to insurance, maintenance and commitment.

This is where we get super clean and wildly convenient.

EV sales broke just about every previous EV record in 2020, even in the middle of a pandemic.

EV sales soared by over 40%, while overall car sales dropped by 14%.

And we’re just getting started and now there’s another potential huge disruptor. This one won’t hinder the mainstreaming of EVs, but it could help rock the auto industry to its core.

According to one analyst, the car subscription market is set to top $12 billion by 2027.

Analysts Thoughts.....

The first supercharged growth stock Wall Street sees driving away from its competition is electric-vehicle manufacturer NIO. Even though NIO is getting near the mean consensus price target, the high-water mark among analysts calls for the company to hit $92 a share. That implies a more than doubling in NIO's shares, based on where it closed this past weekend.

The bullishness surrounding NIO likely has to do with the company's location and its ability to scale production. Concerning the former, China is the largest auto market in the world. By 2035, the projection is that half of all vehicles sold will be powered by some form of alternative energy, 95% of which are EVs. Since the EV market is still nascent in China, the door is wide open for NIO to become a major player.

A number of brokerages have recently issued reports on NIO.....

- Citigroup raised NIO from a “neutral” rating to a “buy” rating in a research note on Tuesday, June 1st.

- Deutsche Bank Aktiengesellschaft reaffirmed a “buy” rating and set a $60.00 price objective on shares of NIO in a research note on Tuesday, April 27th.

- BOCOM International initiated coverage on NIO in a research note on Tuesday, June 8th. They issued a “buy” rating and a $57.00 target price on the stock.

- CLSA initiated coverage on NIO in a research note on Friday, April 23rd. They issued a “buy” rating and a $50.00 target price on the stock.

- Finally, HSBC raised their target price on NIO from $44.70 to $54.00 and gave the stock a “hold” rating in a research note on Friday, February 26th.

Six analysts have rated the stock with a hold rating and fourteen have assigned a buy rating to the company. The company has an average rating of “Buy” and an average price target of $49.86.

Summary…..

With NIO sitting on a mammoth cash pile and introducing a high-margin battery subscription service last year, this options trade seem achievable.

China-based electric vehicle manufacturer Nio is one of the best performing stocks on the New York Stock Exchange today. At last check, the security is up 8.7% at $49.01, eyeing its highest close since March 1. NIO boasts a 26.9% lead over the last month and a 609.7% year-to-date gain. Options traders have been taking notice of the Tesla (TSLA) competitor as a result.

Therefore…..

The Options Trade On NIO Stock Should Continue To Provide Profit!

Will We Hold Or Take The Existing Profit On NIO Stock After Today!

Will We Recommend Further Trades On NIO Stock In The Future?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem – What’s Next? -

Tariffs and the Stock Market: Positive and Negative Impacts in 2025

Tariffs and the Stock Market: Positive and Negative Impacts in 2025. This article explores both the positive and negative effects of tariffs on the stock market based on recent data, forecasts, and ma… -

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs

Back to Weekly Options USA Home Page from NIO Stock