TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Nvidia Weekly Call Options Jump Again!

Weekly Options Members

Are Up 250% Potential Profit Using A Weekly Call Option!

NVIDIA Corporation (NASDAQ:NVDA) is riding high as the king of the artificial intelligence (AI) mountain, posting hypergrowth top and bottom-line forecasts.

It can largely be credited for lifting the technology sector higher and legitimizing the AI boom since its unexpected blowout in fiscal Q1 2024 earnings.

This set the scene for Weekly Options USA Members to profit by 250%, using a NVDA Options trade!

Join Us And Get The Trades – become a member today!

Friday, October 13, 2023

by Ian Harvey

NVIDIA Corporation (NASDAQ:NVDA's market cap recently crossed $1 trillion, joining an elite club of tech stocks.

Wall Street analysts expect the company's revenue to double to $54 billion this year.

The demand for Nvidia's AI hardware appears to be locked in through next year. Nvidia plans to triple the production of its H100 AI processor to at least 1.5 million units in 2024. Considering the limited supply of these high-powered chips, planned production is a good indicator of future sales.

These are incredibly expensive processors. The cost of these cards is why Nvidia is one of the best stocks to consider for the AI opportunity. Nvidia's net profit totaled $6.7 billion last quarter, up from $2.7 billion a year ago.

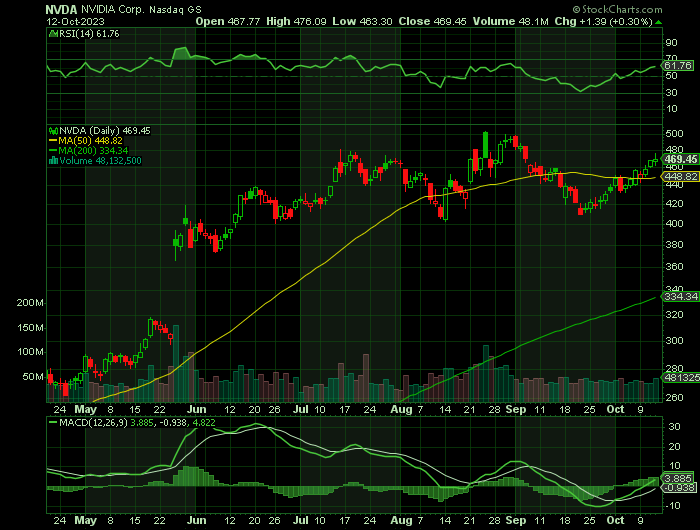

This is why the stock has surged 211% year to date.

Why the NVDA Weekly Options Trade was Originally Executed!

NVIDIA Corporation (NASDAQ:NVDA) is riding high as the king of the artificial intelligence (AI) mountain, posting hypergrowth top and bottom-line forecasts. It can largely be credited for lifting the technology sector higher and legitimizing the AI boom since its unexpected blowout in fiscal Q1 2024 earnings.

This is accompanied by the mouth-dropping 55% top-line guidance raise for Q2 2024. This opened the eyes of the world to the gargantuan opportunities that AI was creating across all industries, of which Nvidia was the key benefactor.

Nvidia stock rose Monday after investment bank Goldman Sachs added the artificial intelligence chipmaker to its "conviction list" of top stock picks.

In a note to clients, Goldman Sachs analyst Toshiya Hari reiterated his buy rating on Nvidia stock with a price target of $605.

On the stock market yesterday, Nvidia stock jumped 3% to close at $447.82.

Nvidia stock hit a record high $502.66 on Aug. 24 before pulling back in the recent stock market correction.

Santa Clara, Calif.-based Nvidia is "the principal 'shovel supplier' in the AI 'gold rush,' " Hari said. Further, the company's graphics processing units, or GPUs, are highly sought after for running AI applications in data centers, he added.

The NVDA Weekly Options Trade Explained.....

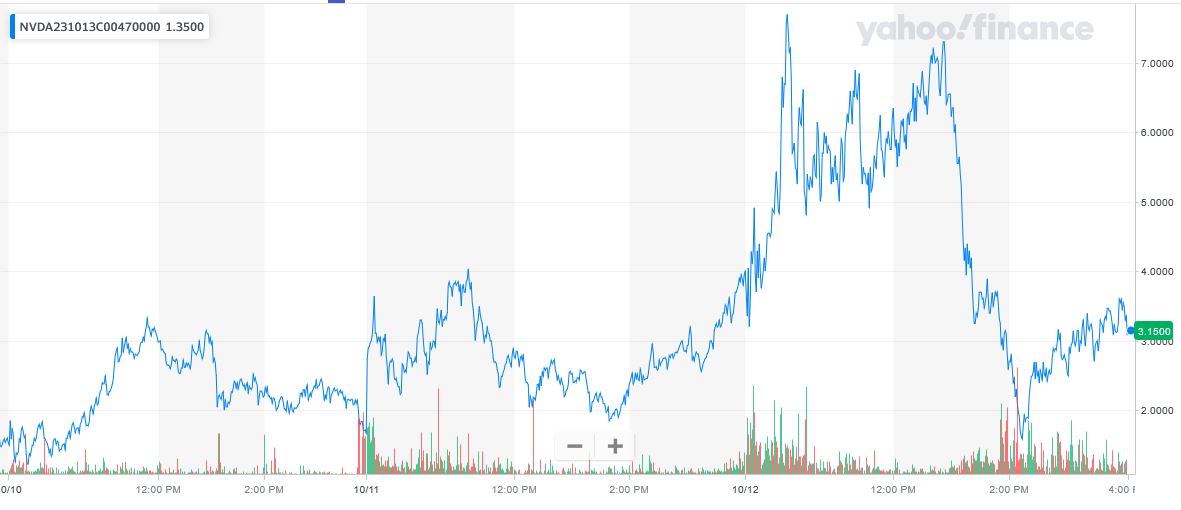

** OPTION TRADE: Buy NVDA OCT 13 2023 470.000 CALLS - price at last close was $4.10 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the NVDA Weekly Options (CALL) Trade on Tuesday, October 03, 2023, for $2.30.

Sold the NVDA weekly options contracts on Thursday, October 12, 2023 for $8.05; a potential profit of250%.

Don’t miss out on further trades – become a member today!

Further Catalysts for the NVDA Weekly Options Trade…..

Nvidia is likely "to maintain its status as the accelerated computing industry standard for the foreseeable future," Hari said. He also said that opinion is based on its "competitive moat and the urgency with which customers are developing and deploying increasingly complex AI models."

Demand for its GPUs in data centers should remain high for some time, Hari said. Also, Nvidia's supply of chips from its contract manufacturers is improving, he said.

"A strong and broadening demand profile in the data center, plus an improving supply backdrop should support sustained revenue growth through calendar year 2024," Hari said.

He added Wall Street is underestimating the potential gross profit margin uplift stemming from an improving product mix.

Other Catalysts.....

On Aug. 23, 2023, NVIDIA released its fiscal second-quarter 2024 results for the quarter ending July 2023. The Company reported an earnings-per-share (EPS) profit of $2.70, excluding non-recurring items, versus consensus analyst estimates for a profit of $2.08, a 62-cent beat. Revenues surged 101.5% year-over-year (YoY) to $13.51 billion, crushing analyst estimates for $11.19 billion.

Data center revenues were the superstar, growing 171% YoY to $10.32 billion, driven by cloud service providers and large consumer internet companies. Demand for the NVIDIA HGX platform was driven by the development of generative AI and large language models (LLMs). Gaming revenues rose 22% to $2.49 billion, driven by demand for GeForce RTX 40 Series GPUs.

Automotive sales rose 15% YoY to $253 million. Professional Visualization revenues fell 24% to $379 million due to the normalization of channel inventory levels. Professional Visualization products and services are used by engineering, design and entertainment professionals to create high-end visual content. Some of its products include the Quadro and RTX GPUs and the Omniverse software platform, which is used to create real-time 3D scenes.

Summary.....

NVIDIA raised its fiscal Q3 2024 revenue guidance from $15.68 to $16.32 billion, crushing $12.59 billion consensus analyst estimates. Non-GAAP gross margins are expected between 72% to 73%. Nvidia also raised its stock buyback program by an additional $25 billion without expiration in addition to the $3.95 billion remaining of the current buyback program.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from NVIDIA

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!