TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

NVIDIA Weekly

Option Turns $820 Into $1,313!

Nvidia shares were marked 2.5% higher in mid-day Monday trading to change hands at $138.22 each, giving the stock a market value of $3.39 trillion.

The upward trajectory of AI chip stocks is a positive sign for AI hardware spending that assuages Wall Street’s concerns of a near-term slowdown on investment.

Recent strength came after CEO Jensen Huang said Nvidia’s Blackwell chip “is in full production,” and that demand for it “is insane.”

This set the scene for Weekly Options USA Members to profit by 60% using a NVDA Weekly Options trade!

Join Us And Get The Trades – become a member today!

Wednesday, October 16, 2024

by Ian Harvey

UPDATE

A week ago, NVIDIA Corporation (NASDAQ:NVDA) overtook Microsoft as the world's second largest company by market capitalization, behind only Apple (AAPL).

With Monday's gains, Nvidia's market cap is at $3.386 trillion, compared with Apple's $3.516 trillion. Apple, Nvidia and Microsoft are the only three companies with a market cap above $3 trillion.

The chipmaker's stock price has nearly tripled this year as demand for the company’s AI chips has surged.

Finance chief Colette Kress said Blackwell should generate "several billion" in revenue for Nvidia's fiscal fourth quarter, which ends in January. She added that legacy Hopper sales would accelerate over the second half of the year.

In a note to clients Sunday, Citi analysts said Nvidia is “still king” when it comes to its client base in the AI accelerator market. They said they expect chipmaker’s GPU sales to hyperscalers like Alphabet's (GOOGL) Google and Microsoft (MSFT) will double this year.

Citi and all but one of the other 22 analysts covering Nvidia tracked by Visible Alpha held a “buy” or equivalent rating on the stock as of Monday, with a consensus price target of $152.41, implying about 10% upside from Monday’s closing price.

Goldman Sachs analyst Toshiya Hari, meanwhile, cited Nvidia's likely benefit from the increasing complexity of AI workloads, which the group outlined in an updated investor deck last week. Hari lifted his price target by $15 to $150 a share in a note published Monday.

JPMorgan analyst Harlan Sur sees revenues for the semiconductor industry growing 6% to 8% in 2024. “We remain positive on semiconductor and semiconductor equipment stocks,” he said in a recent note to investors, “as we believe stocks should continue to move higher in anticipation of better supply/demand in 2H24/25 and stable/rising earnings power trends in CY24/25.”

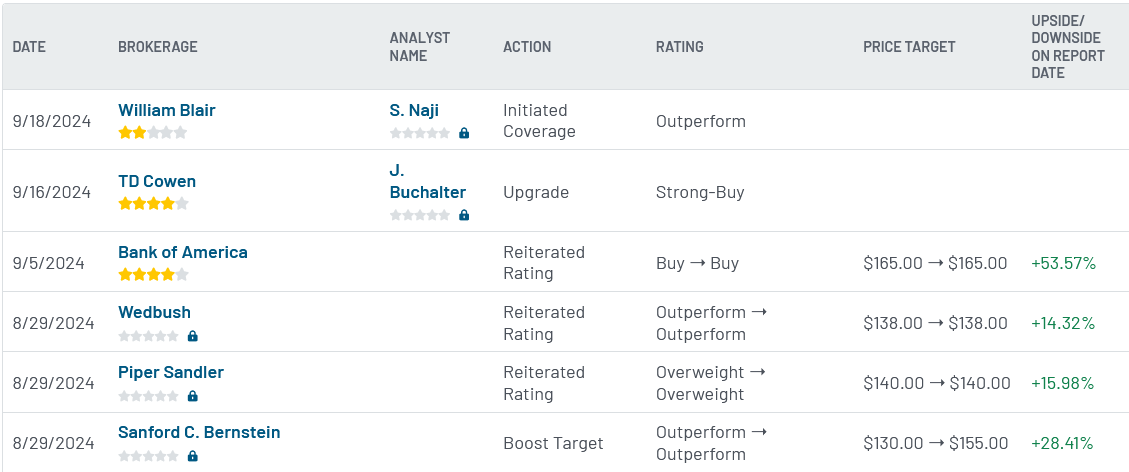

Elsewhere on Wall Street, TD Cowen analyst Joshua Buchalter reiterated his "top pick" buy rating on Nvidia stock with a price target of 165.

The NVIDIA Weekly Options Potential Profit Explained.....

** PROPOSED OPTION TRADE: Buy NVDA NOV 08 2024 130.000 CALLS - price at last close was $6.80 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the NVDA Weekly Options (CALL) Trade on Tuesday, October 08, 2024 for $8.20.

Sold the NVDA Weekly Options contracts on Monday, October 14, 2024, for $13.13; a potential profit of60%.

Holding remaining contracts for further profit.

Don’t miss out on further trades – become a member today!

Why the NVIDIA Weekly Options Trade was Originally Executed!

Trade Analysis

Current Situation

NVIDIA Corporation (NASDAQ: NVDA) is a premier global provider of graphics, compute, and networking solutions, renowned for its cutting-edge technologies that serve various markets, including gaming, professional visualization, data centers, and automotive applications. Within its Graphics segment, NVIDIA offers GeForce GPUs designed for gaming, the GeForce NOW streaming service, and Quadro/NVIDIA RTX GPUs tailored for enterprise graphics. Additionally, the company develops software solutions.

The company first gained recognition with the launch of the GeForce 256 in 1999, which was hailed as the world’s first graphics processing unit (GPU). It revolutionized gaming by delivering smoother graphics and higher frame rates, ultimately shaping the future of computer graphics and gaming experiences.

Over the years, the company expanded its focus beyond gaming and has made a name for itself, especially in AI. Recently, CEO Jensen Huang highlighted the overwhelming demand for NVIDIA’s next-generation AI chip, Blackwell, calling it “insane.”

Huang expressed that the rapid pace of technological advancement presents an opportunity for the company to intensify its innovation efforts. He emphasized the goal of advancing capabilities, increasing throughput, and reducing both costs and energy consumption.

Blackwell is set to be priced between $30,000 and $40,000 per unit, and demand is high from major corporations such as Microsoft and Meta, which are establishing AI data centers to support applications like ChatGPT and Copilot.

Key Insights from Earnings Call

During the latest earnings call, NVIDIA's management highlighted the expanding demand for its AI-powered solutions. CEO Jensen Huang emphasized the platform's capability to provide autonomous, real-time threat prevention and response, which is critical as cyber threats become more sophisticated. The company also noted increased demand for its solutions, driven by the rising frequency and complexity of cyber threats.

The Singularity platform's one-click rollback feature, which allows networks to revert to a pre-breach state, was particularly highlighted. This capability is not widely available among competitors and underscores NVIDIA's innovative approach to cybersecurity.

Catalysts for the Trade

- Increasing Cybersecurity Spending: The corporate sector's growing awareness of cybersecurity risks is driving increased spending on advanced solutions. According to McKinsey, the shortfall in cybersecurity investment represents a significant market opportunity for companies like NVIDIA.

- Competitive Advantages: Unlike many competitors, NVIDIA offers both cloud-based and on-premises solutions, providing flexibility to clients. The local installation option ensures continuous protection, even without internet connectivity, a feature particularly valuable in sectors like defense and critical infrastructure.

- Strategic Partnerships: NVIDIA's partnerships with leading tech firms and integration of advanced technologies like AI and machine learning enhance its product offerings. These partnerships also provide a channel for expanding its customer base and market reach.

Further Catalysts

NVIDIA's competitor, AMD, recently faced a significant system outage, affecting critical infrastructure sectors. This incident has tarnished AMD's reputation, potentially leading clients to seek alternatives. NVIDIA, offering similar services, stands to gain new business as companies re-evaluate their cybersecurity vendors.

Analysts project NVIDIA to post a quarterly loss of $0.01 per share, a significant year-over-year improvement of 87.5%. Revenues are expected to grow by 31.8% to $197 million, further solidifying the company's strong growth trajectory.

Analyst Reactions

According to recent research from 27 Wall Street analysts, NVIDIA's stock has an average twelve-month price target of $24.87, with a high estimate of $37.00 and a low of $17.00. Analysts have highlighted NVIDIA's robust technology stack and its potential to capitalize on the increasing demand for advanced cybersecurity solutions.

The technology sector has recently experienced volatility, partly influenced by geopolitical tensions and comments from former President Donald Trump regarding Taiwan and trade policies. Despite these fluctuations, experts like Dan Ives from Wedbush view the current tech sell-off as a buying opportunity, particularly for stocks with strong fundamentals like NVIDIA.

Company Overview

NVIDIA Corporation, originally known as NVIDIA Labs, Inc., was founded in 1993 and is headquartered in Santa Clara, California. The company provides autonomous cybersecurity solutions, leveraging AI to offer comprehensive threat detection and response capabilities across various digital environments. Its offerings include endpoint protection, cloud security, identity security, and more. The company rebranded to NVIDIA in March 1993, reflecting its expanded focus on a broader range of cybersecurity solutions.

The Singularity Platform is the cornerstone of NVIDIA's product suite. It integrates AI to autonomously detect, prevent, and respond to cyber threats, providing a critical layer of defense for enterprises. The platform's unique capabilities, such as autonomous threat remediation and real-time analytics, distinguish it in the competitive cybersecurity landscape.

Technical Analysis

- Market Capitalization: $3.22 billion

- PE Ratio: -11.33 (indicative of current unprofitability but potential for future growth)

- Beta: 1.74 (reflecting higher volatility relative to the market)

- 52-Week Low: $13.87

- 52-Week High: $30.76

- Fifty-Day SMA: $19.89

- Two-Hundred-Day SMA: $23.00

Summary

NVIDIA presents a compelling investment opportunity in the rapidly growing cybersecurity sector. The company's innovative AI-driven solutions, robust revenue growth, and the current market dynamics—particularly the fallout from AMD's issues—create a favorable environment for stock appreciation. The current P/S ratio, significantly lower than previous highs, offers a more attractive entry point for investors.

Trade Execution

Consider placing a buy order for NVDA NOV 08 2024 130.000 CALLS, with a premium of $6.80. Adjust your sell point and stop loss according to your risk tolerance.

Disclaimer

This trade suggestion is based on the current market analysis and is not a guaranteed success. Always consider your risk tolerance and consult with a financial advisor if necessary.