TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Occidental

Petroleum Shares Continues Upward Momentum!

AND, Members Make

Potential Profit of 210%,

Using A Weekly CALL Option!

There is an expectation that energy commodity prices would climb.

And,Buffett has been buying hand over fist in recent months, it's Occidental Petroleum Corp (NYSE: OXY). He already owned warrants and preferred stock in Occidental before disclosing a position in its common stock in March last year. He has consistently bought Occidental shares since.

On June 29, after the purchase of 2.1 million Occidental Petroleum Corporation’s shares, Berkshire Hathaway now owns 25% of the company.

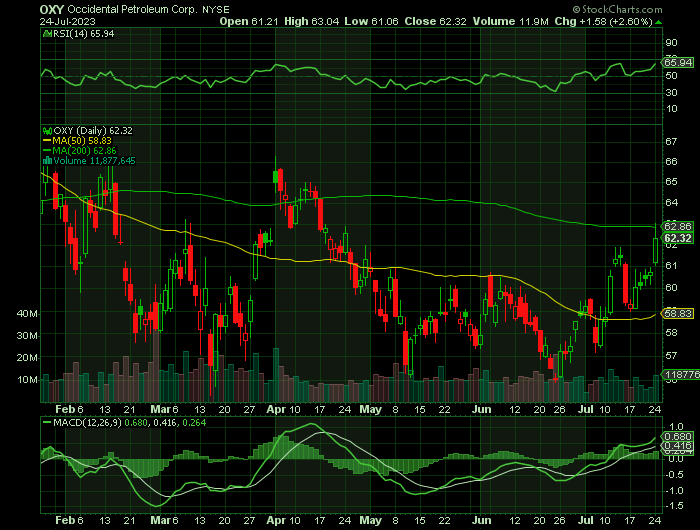

Since taking the weekly call trade on OXY there has been a steady jump in share price.

This set the scene for Weekly Options USA Members to Make Potential Profit Of 210%, using an OXY Weekly Options trade!

Join Us And Get The Trades – become a member today!

Tuesday, July 25, 2023

by Ian Harvey

There is an expectation that energy commodity prices would climb.

And, Buffett has been buying hand over fist in recent months, it's Occidental Petroleum Corp (NYSE: OXY) . He already owned warrants and preferred stock in Occidental before disclosing a position in its common stock in March last year. He has consistently bought Occidental shares since.

On June 29, after the purchase of 2.1 million Occidental Petroleum Corporation’s shares, Berkshire Hathaway now owns 25% of the company.

It is a growing belief that oil prices will rally, given the correlation between crude prices and oil company stock prices, and buying the dip in Occidental Petroleum is a reasonable assumption. That's a fairly widely held view among oil market forecasters these days.

Since taking the weekly call trade on OXY there has been a steady jump in share price.

For further insight read “Occidental Petroleum Shares Are Starting To Climb!”

Why the OXY Weekly Options Trade was Originally Executed!

Warren Buffett's Berkshire Hathaway disclosed in a filing late Wednesday that it purchased an additional 2,138,250 shares of Occidental Petroleum Corp (NYSE: OXY). Buffett's Berkshire acquired the additional shares between June 26 and June 28 for about $122.1 million. Berkshire's total ownership now stands at 224.1 million shares. The most recent purchase boosts Berkshire's stake in Occidental to more than 25% of outstanding shares.

Buffett's involvement with OXY began almost three years ago when Berkshire funded Occidental's takeover of Anadarko with $10 billion in equity. Buffett's company then began acquiring a stake in the oil company last year around the time when Russia invaded Ukraine, and the price of oil was rising.

At Berkshire's annual meeting on May 6, Buffett was full of praise for the oil company and its management. Notably, Buffett said that Berkshire had no plans to take control of the company. He said, "We're not going to buy control," and added, "We've got the right management running it."

After boosting its ownership stake from 23.7% to 25.1% in OXY, Buffett's Berkshire further cements its spot as the largest shareholder of OXY.

Since Buffett first began buying Occidental shares in early March 2022, the stock has risen over 53%. During that same period, the SPDR S&P 500 ETF Trust NYSE: SPY has risen close to 1.25%.

The OXY Weekly Options Trade Explained.....

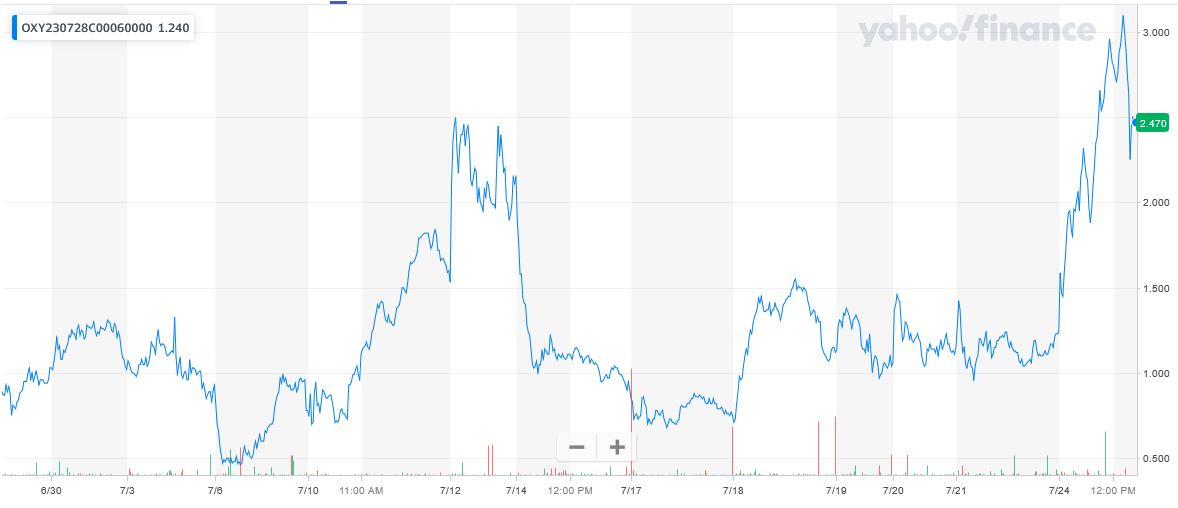

** OPTION TRADE: Buy OXY JUL 28 2023 60.000 CALLS - price at last close was $1.02 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the OXY Weekly Options (CALL) Trade on Monday, July 03, 2023, for $1.00.

Sold half the OXY weekly options contracts on Tuesday, July 11, 2023, for $1.84; a potential profit of 84%.

Sold the remaining OXY weekly options contracts on Monday, July 24, 2023, for $3.10; a potential profit of 210%.

Don’t miss out on further trades – become a member today!

Further Insight.....

Although OXY is one of the largest oil and gas producers in the U.S., it also operates a midstream and marketing segment that includes a low-carbon-ventures business focused on the carbon capture and sequestration (CCS) market. ExxonMobil estimates the CCS market to be worth $4 trillion by 2050.

Occidental also has a chemical subsidiary called OxyChem, an important cash generator that produces chemicals like chlorine and caustic soda that are used in several industries.

That makes Occidental one of the most diversified energy companies, and it's faring well: It earned record net income and a return on capital employed of 28% in 2022. Earlier this year, the company increased its dividend by 38%.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from OXY

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!