TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Palantir

Update - 86% Profit With A

Weekly Options Trade In 2 Days!

Shares of Palantir Technologies Inc (NYSE: PLTR) soared 31% after the company posted blowout financial results.

However, despite this climb in stock price, the company, known for its defense and intelligence work with the US and international governments, is set to ride the wave of AI hype.

This set the scene for Weekly Options USA Members to profit by 86% using a PLTR Options trade!

Join Us And Get The Trades – become a member today!

Saturday, February 10, 2024

by Ian Harvey

UPDATE

(see previous article on Palantir)

It may only be a matter of time before Palantir Technologies Inc (NYSE: PLTR) is added to the S&P 500 as Palantir is now a consistently profitable company, while also generating strong growth. And demand for AI is still in its early stages.

With Palantir launching an AI platform last year and deploying AI bootcamps, it could be on the cusp of much more growth in the future, potentially paving the way for an even higher stock price.

On Monday, the company reported its latest earnings numbers, where Palantir posted a profit for a fifth consecutive period. Revenue totaling $608 million was also up 20% year over year.

With its growth continuing to be strong, Palantir isn't a stock I'd expect to fall in value this year as it may only be a matter of time before analysts upgrade their price targets.

Why the Palantir Weekly Options Trade was Originally Executed!

Shares of Palantir Technologies Inc (NYSE: PLTR) soared 31% after the company posted blowout financial results.

However, despite this climb in stock price, the company, known for its defense and intelligence work with the US and international governments, is set to ride the wave of AI hype.

Palantir is solidifying itself as a top pick to gain exposure to the artificial intelligence revolution that's underway, according to Wedbush Securities.

Following the company's strong earnings beat for the last three months of 2023, Wedbush's Dan Ives raised the firm's 12-month price target for shares of the tech company to $30, representing nearly 80% upside from Monday's closing level of $16.72.

"Last night for Palantir was when this company went from an off Broadway play to a primetime Broadway theater right off of Times Square under the bright lights," Ives said in the note, assigning Palantir an "Outperform" rating.

Palantir's CEO Alex Karp said in a letter to shareholders that commercial demand for large language models continues to be "unrelenting."

"It's clear that as AI use cases explode, enterprise CIOs are looking towards Karp & Co. as the AI golden child for a platform to build out AI frameworks for the future," Ives said.

The Palantir Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy PLTR MAR 08 2024 24.000 CALLS - price at last close was $1.38 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the PLTR Weekly Options (CALL) Trade on Thursday, February 08, 2024 for $1.23.

Sold HALF the PLTR weekly options contracts on Thursday, February 08, 2024 for $2.14; a potential profit of74%.

The PLTR weekly options contracts on Friday, February 09, 2024, were up to $2.29; hitting a

potential profit of 86%.

(This result will vary for members depending on their entry and exit strategies).

Holding the remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About Palantir Technologies.....

Palantir Technologies Inc. is an SaaS company focused on AI and big data analytics. It was founded in 2003 in Denver, Co by well-known investors Peter Thiel and Stephen Cohen among others. The company’s goal is to augment human intelligence with data-gathering and analytic tools that can change the world for the better. As of 2022, Stephen Cohen, co-founder Alexander Karp, and Peter Thiel were president, CEO, and Chairman respectively.

Originally intended as a tool for the Federal Government, the company has since expanded to serve state and local governments as well as private corporations. The company’s name is based on J.R.R. Tolkien's Lord of the Rings trilogy. The palanteri are indestructible crystal globes used for seeing across great distances.

Today the company builds and deploys solutions for its clients based on three primary offerings. These are Palantir Gotham, Palantir Apollo, Palantir Foundry, and Palantir Metropolis. The goal is to generate alpha, or a competitive advantage, for its clients so they can succeed in a rapidly changing environment.

The company’s core offering is Palantir Gotham. Palantir Gotham was originally intended for the US intelligence community as a counter-terrorism tool but it has since been deployed by state and local governments as well as private enterprises as a global decision-making tool. Users are able to aggregate data from hundreds of inputs and funnel them into a single view for rapid decision-making and execution. The tool, which looks for and analyzes hidden patterns in deep data sets, has been used for “predictive policing” and has drawn some criticism because of it.

Palantir Apollo is an operating system designed to give continuous delivery and deployment of safe, secure Internet access across all operating environments. The system is 1 of 5 recognized by the Department of Defense as a Mission Critical National Security System and used by businesses and organizations for autonomous software deployment. Among its advantages, the system can speed up the development of new software by as much as 50% simply by securing access to sensitive information and networks.

Further Catalysts for the PLTR Weekly Options Trade…..

The tech firm anticipates US commercial revenue to surpass $640 million in 2024, reflecting growth of at least 40%. Palantir reported on Monday that fourth-quarter revenue increased by 20% to $608.4 million, exceeding Wall Street's estimates of $602.4 million in revenue.

Palantir's U.S. commercial revenues skyrocketed by 70% YoY last quarter. Overall commercial revenues increased by 32% YoY. This dynamic suggests that U.S. companies are ahead of the curve in utilizing Palantir's solutions relative to their European and foreign counterparts. We should continue seeing robust commercial growth, with international commercial growth likely increasing in future quarters.

In Q4, Palantir closed 103 $1M+ deals, about a 100% increase over last year's Q4. U.S. commercial customer count expanded by 55% YoY and 22% QoQ. U.S. commercial count has now grown 13x in the previous three years. Palantir also reported its fifth consecutive quarter of adjusted operating margins and its fifth consecutive quarter of GAAP profitability.

Wall Street's hype for AI is still high even after the nascent technology fueled huge gains across the tech sector in 2023. Chip maker Nvidia has notched new highs in the last week after earnings from giants including Microsoft and Meta Platforms pointed to big plans for AI and demand for the GPUs that power the tech.

While a handful of mega-cap names continue to produce the biggest returns for investors, markets are looking for the next opportunity in AI as valuations among the Magnificent Seven look extreme and as many experts warn of a potential bubble reminiscent of the dot-com era.

Palantir, Ives says, is one such opportunity in AI.

"In a nutshell, PLTR remains an undiscovered gem and a core part of our thesis in the AI Revolution just now taking shape across the tech world," Ives added.

Other Catalysts.....

Despite being in business for over twenty years, Palantir Technologies Inc. (NYSE:PLTR) is just getting started in many ways. Palantir was widely regarded as a secretive government contractor for many years. It was so mysterious that many market participants had no idea what Palantir did. However, now that Palantir is hitting the mainstream, its commercial business is booming.

Moreover, with its dominant market-leading position in AI software and services, Palantir could experience exponential growth and increased profitability for years. While Palantir's stock is up by over 100% over the last year, its "Nvidia moment" hasn't arrived yet. Nonetheless, its coming and the stock should go considerably higher in the near future.

Moving Forward.....

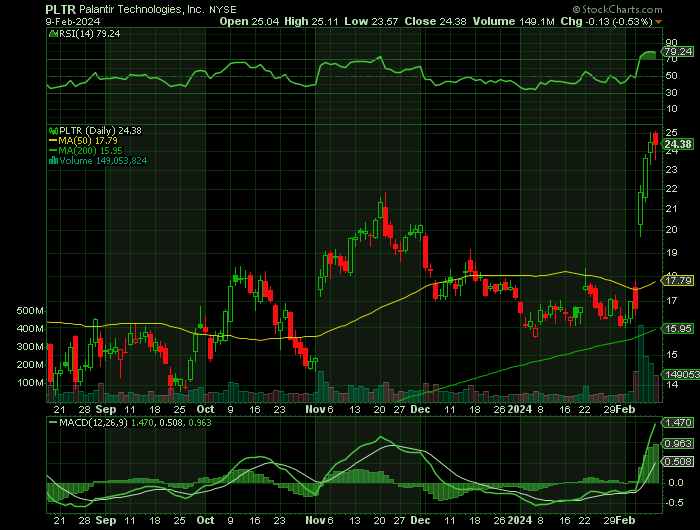

Palantir had an excellent earnings report last quarter (Q3 2023), and we're seeing more of the same in Q4. Palantir's stock surged in early November after it reported Q3 earnings but failed to break out above the $20-$22 resistance range. As a result, Palantir came back down to the $15-$16 range, filling the gap and creating an excellent long-term buying opportunity.

On Monday, Palantir provided another solid earnings announcement. Therefore, it's highly probable that Palantir will retest the all-important $20-$22 resistance range. However, this time, we may see a breakout to $25 or higher, as Palantir's stock has consolidated for around eight months and has many constructive technical and fundamental tailwinds.

The CCI, RSI, full stochastic, and other technical gauges are turning upward, implying that a shift to a more bullish momentum is approaching and could propel the stock considerably higher. Also, Palantir's stock has made a series of higher highs and higher lows, suggesting the stock is looking for a breakout to higher trading levels. Palantir's stock is also between the 50 and 200-day MAs, illustrating that it is no longer overbought technically, providing a solid setup to move higher.

Palantir's Artificial Intelligence Platform "AIP".....

Palantir's Artificial Intelligence Platform "AIP" is a full-spectrum AI platform that drives enterprise operations.

Palantir offers AIP boot camps to get customers from zero to use cases in days, enabling enterprises to solve real business problems immediately. AIP is powered by Ontology, a decision-centric system at the heart of AIP that integrates AI with enterprise data, logic, and action. From secure LLM access to end-user applications, AIP provides an integrated architecture that brings full spectrum AI to life, optimizing the everyday decision-making process.

Every organization, government, and commercial, domestic and foreign, can benefit from Palantir's comprehensive solutions and services. Palantir has an enormous market share to acquire in future years, making its stock one of the best buy-and-hold candidates for the next decade.

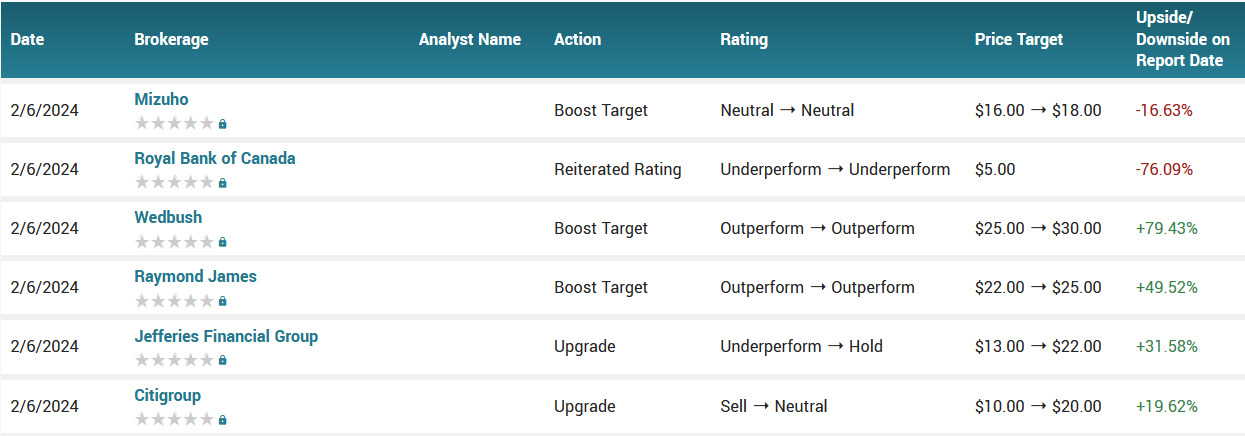

Analysts.....

According to the issued ratings of 14 analysts in the last year, the consensus rating for Palantir Technologies stock is Reduce based on the current 4 sell ratings, 7 hold ratings and 3 buy ratings for PLTR. The average twelve-month price prediction for Palantir Technologies is $15.25 with a high price target of $30.00 and a low price target of $5.00.

Summary.....

As of Feb. 7, PLTR stock had advanced 37% in 2024 following the Q4 earnings report. Also, Palantir stock jumped 167% in 2023. The Nasdaq composite climbed 43% while the S&P 500 rose 24%.

PLTR stock bulls point to artificial intelligence software as a growth driver. Palantir has already mined the AI opportunity with government customers for intelligence gathering, counterterrorism and military purposes.

Now Palantir aims to use generative AI to spur growth in the commercial market. The software maker has expanded into health care, energy and manufacturing.

Palantir Technologies has a 50 day simple moving average of $17.37 and a 200-day simple moving average of $16.91. The stock has a market cap of $51.35 billion, a price-to-earnings ratio of 260.92, and a PEG ratio of 1.97 and a beta of 2.66.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Palantir

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!