TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Palantir Stock Keeps

Climbing!

Weekly Options Up 220%!

Palantir's inclusion in the S&P 500 has contributed to a surge in its stock price, reflecting the market's positive reception to its robust AI capabilities and its potential for further growth.

Palantir's AIP platform has received high praise for its superior data analytics capabilities, making it a preferred choice for businesses seeking comprehensive AI solutions.

Ongoing collaborations with major tech firms enhance Palantir's service offerings and market reach, presenting more opportunities for growth.

This set the scene for Weekly Options USA Members to profit by 220% using a PLTR Weekly Options trade!

Join Us And Get The Trades – become a member today!

Sunday, October 06, 2024

by Ian Harvey

UPDATE

Palantir Technologies (NYSE: PLTR)'s inclusion in the S&P 500 has contributed to a surge in its stock price, reflecting the market's positive reception to its robust AI capabilities and its potential for further growth.

Palantir focuses on software -- combining the LLMs behind platforms like ChatGPT with proprietary data analytics and machine learning.

The company has a relatively strong moat because of its focus on sensitive government contracts. And a relatively fast-growing private-sector business could offer much-needed growth and diversification.

While contracting is Palantir's bread and butter, it also attracts commercial clients interested in its data analytics services.

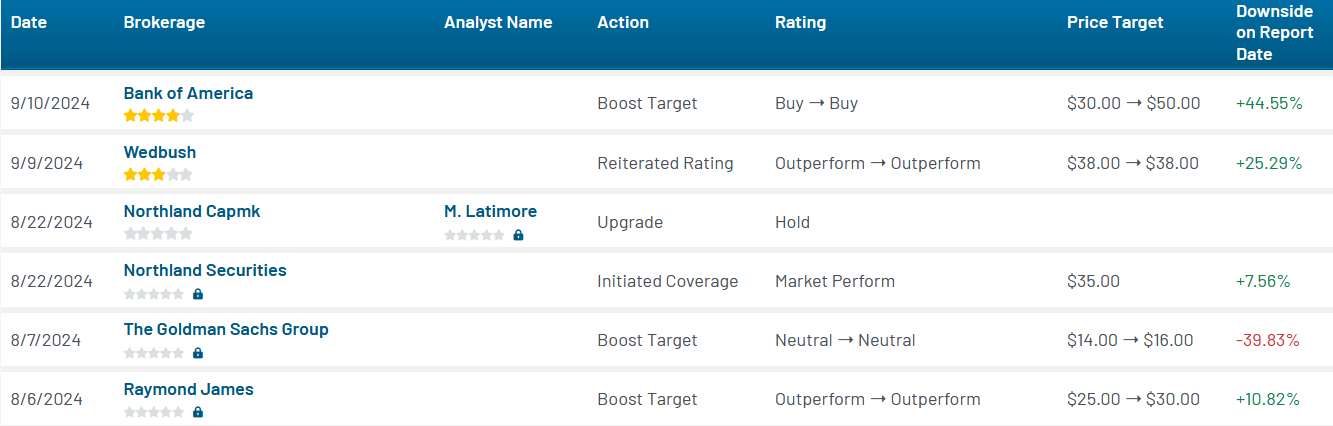

Bank of America recently raised the price target on the stock to $50 from $30 and kept a Buy rating on the shares.

Ryan Taylor, the chief revenue officer of Palantir, highlighted during the second quarter earnings call that the revenue expectations from AI infrastructure build-out have grown from $200 billion to $600 billion per year in just nine months, noting that his firm was uniquely positioned to take advantage of this as it delivered enterprise AI solutions on a scale unlike any other firm.

The PALANTIR TECHNOLOGIES Weekly Options Potential Profit Explained.....

** PROPOSED OPTION TRADE: Buy PLTR OCT 11 2024 35.000 CALLS - price at last close was $1.75 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the PLTR Weekly Options (CALL) Trade on Thursday, September 12, 2024, for $8.50.

Sold the PLTR Weekly Options contracts on Friday, October 04, 2024, for $5.35; a potential profit of 220%.

Holding remaining contracts for further profit.

Don’t miss out on further trades – become a member today!

Why the PALANTIR TECHNOLOGIES Weekly Options Trade was Originally Executed!

Trade Analysis

Current Situation

Palantir Technologies (NYSE: PLTR) is a prominent SaaS company that specializes in AI and big data analytics. Founded in 2003, Palantir has expanded its offerings to include Palantir Gotham, Palantir Apollo, Palantir Foundry, and Palantir Metropolis, each designed to enhance decision-making capabilities across various sectors.

The company's recent launch of the AIP platform has significantly boosted its market position, with sales growing at an accelerated pace. This growth is supported by a recent Forrester Research report, which ranked AIP as the top AI and machine learning platform, outperforming competitors like Alphabet and Microsoft.

Palantir's inclusion in the S&P 500 has also contributed to a surge in its stock price, reflecting the market's positive reception to its robust AI capabilities and its potential for further growth.

Key Insights from Earnings Call

During the latest earnings call, Palantir's management highlighted the successful deployment of its AIP platform, which has been instrumental in driving revenue growth. The platform's ability to integrate with various data sources and provide actionable insights has led to increased adoption among new and existing customers.

The company's strategic focus on expanding its AI capabilities is expected to continue driving its growth, with management optimistic about the future prospects of its innovative solutions.

Catalysts for the Trade

- Robust AI Platform: Palantir's AIP platform has received high praise for its superior data analytics capabilities, making it a preferred choice for businesses seeking comprehensive AI solutions.

- Market Position and Growth: The company's recent inclusion in the S&P 500 and its consistent financial performance bolster its reputation and attract further investment.

- Strategic Partnerships: Ongoing collaborations with major tech firms enhance Palantir's service offerings and market reach, presenting more opportunities for growth.

Further Catalysts

Palantir's continuous innovation in AI and data analytics positions it well for future expansions and adaptations in a rapidly evolving tech landscape. The company's proactive approach to exploring new applications for its technology will likely open new avenues for revenue and market share expansion.

Analysts are optimistic about the company's trajectory, projecting continued revenue growth and market penetration, especially in sectors where data analytics and AI are becoming increasingly critical.

Analyst Reactions

Recent analyses by Wall Street experts have been favorable, with several analysts upgrading their price targets for Palantir following its strong quarterly performance and strategic market moves. The consensus view is that Palantir is well-positioned to maintain its growth momentum, supported by its advanced technology and strategic market initiatives.

Company Overview

Palantir Technologies, headquartered in Denver, Colorado, continues to lead in the AI and big data analytics sector. With a focus on enhancing human intelligence with advanced data solutions, Palantir stands out for its innovative approaches to complex data challenges.

The company's diverse offerings, including the high-performing AIP platform, demonstrate its commitment to leading the AI revolution, making it a compelling choice for investors looking for growth in the technology sector.

Technical Analysis

- Market Capitalization: $77.38 billion

- PE Ratio: 289.58 (reflecting high growth expectations)

- Beta: 2.72 (indicating higher market volatility)

- 52-Week Low: $13.68

- 52-Week High: $35.20

- Fifty-Day SMA: $29.34

- Two-Hundred-Day SMA: $25.34

Summary

Palantir Technologies presents a strong investment opportunity, particularly in the burgeoning field of artificial intelligence. The company's innovative platforms, strategic market positioning, and recent inclusion in the S&P 500 highlight its potential for sustained growth. Investors are advised to consider the current market dynamics and Palantir's growth trajectory when making investment decisions.

Trade Execution

Consider placing a buy order for PLTR OCT 11 2024 35.000 CALLS, with a premium of $1.75. Adjust your sell point and stop loss according to your risk tolerance.

Disclaimer

This trade suggestion is based on the current market analysis and is not a guaranteed success. Always consider your risk tolerance and consult with a financial advisor if necessary.