TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Paramount Global Stock Falls On Double Downgrade!

Weekly Options Members

Are Up 129% Potential Profit, in 2 days,

Using A Weekly PUT Option!

BofA Securities analyst downgraded Paramount Global because the entertainment company wasn’t preparing to sell some of its assets. This sell-off is likely to continue.

Additionally, BofA sees a challenging macro environment and secular headwinds weighing on the business into 2024.

This set the scene for Weekly Options USA Members to profit by 129%, using a PARA Options trade!

Join Us And Get The Trades – become a member today!

Thursday, November 09, 2023

by Ian Harvey

Why the Paramount Global Weekly Options Trade was Originally Executed!

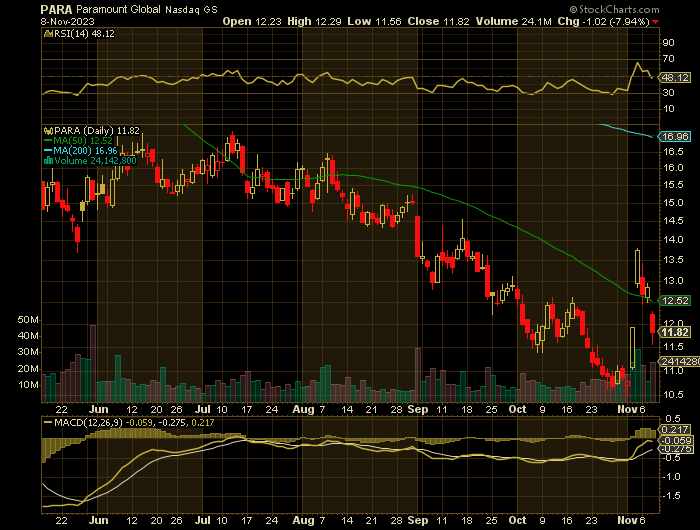

Paramount Global (NASDAQ: PARA) fell Monday after a BofA Securities analyst downgraded the stock because the entertainment company wasn’t preparing to sell some of its assets. This sell-off is likely to continue.

BofA Securities analyst Jessica Reif Ehrlich double-downgraded shares of Paramount to Underperform from Buy and slashed her price target to $9 from $32.

Reif Ehrlich wrote in a research note Monday that her previous bullish view on the stock came with the assumption that Paramount would sell some of its assets. However, despite receiving bids for assets like Showtime and BET Media Group, it doesn’t look like sales are coming anytime soon.

“Our concern is the longer it takes to execute potential asset sales, the less value they could ultimately garner,” the analyst said. She added that this, coupled with the challenging macro backdrop, creates an unfavorable medium-term outlook for the stock.

Additionally, BofA sees a challenging macro environment and secular headwinds weighing on the business into 2024.

The PARA Weekly Options Trade Explained.....

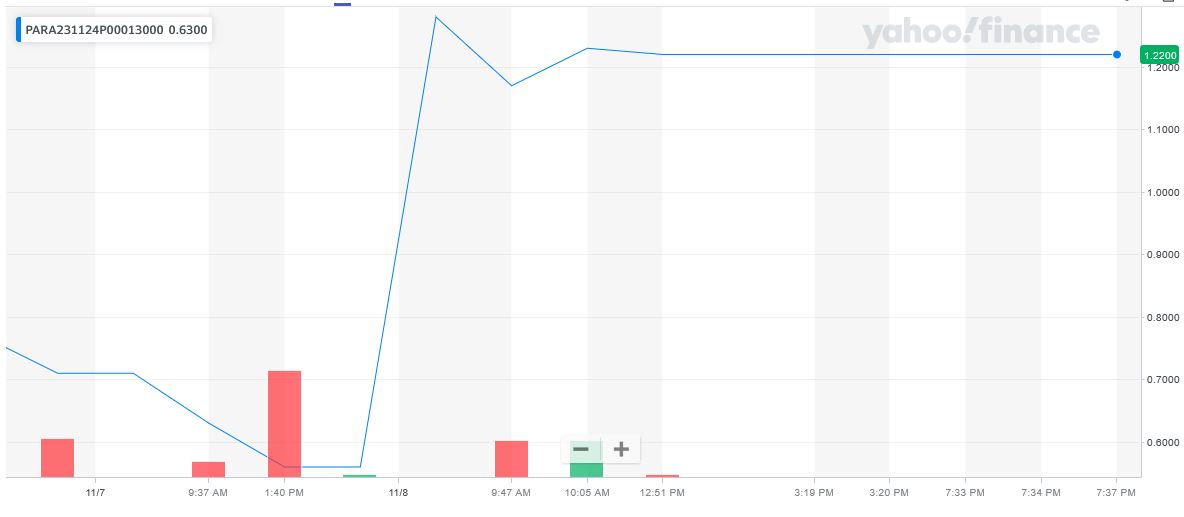

** OPTION TRADE: Buy PARA NOV 24 2023 13.000 PUTS - price at last close was $0.71 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the PARA Weekly Options (CALL) Trade on Tuesday, November 07, 2023 for $0.56.

Sold the PARA weekly options contracts on Wednesday, November 08, 2023 for $1.28; a potential profit of129%.

Don’t miss out on further trades – become a member today!

About Paramount Global.....

Paramount Global operates as a media and entertainment company worldwide. The company operates through TV Media, Direct-to-Consumer, and Filmed Entertainment segments.

The TV Media segment operates domestic and international broadcast networks, including CBS Television Network, Network 10, Channel 5, Telefe, and Chilevisión; and cable networks comprising Showtime, BET, Nickelodeon, MTV, Comedy Central, Paramount Network, Smithsonian Channel, and CBS Sports Network.

It is also involved in the television production operations; and ownership of broadcast television stations.

The Direct-to-Consumer segment provides a portfolio of direct-to-consumer streaming services, including Paramount+, Pluto TV, Showtime Networks' premium subscription streaming service, BET+, and Noggin.

The Filmed Entertainment segment operates produces franchise live-action and animated films, and genre films for audiences. It operates under the Paramount Pictures, Paramount Players, Paramount Animation, Nickelodeon Studio, and Miramax names.

The company was formerly known as ViacomCBS Inc. and changed its name to Paramount Global in February 2022. Paramount Global was incorporated in 1986 and is headquartered in New York, New York. Paramount Global operates as a subsidiary of National Amusements, Inc.

Further Catalysts for the PARA Weekly Options Trade…..

Last week, the company reported third-quarter earnings that gave a mixed picture of the business. Overall revenue was up 3% to $7.13 billion, which was slightly below estimates. Growth in its direct-to-consumer streaming segment was strong with revenue up 38% to $1.67 billion, but its linear TV division continues to experience declines.

On the bottom line, adjusted earnings per share fell 23% to $0.30, but that was better than the consensus of $0.09. Its base of Paramount+ subscribers continued to grow, with 2.7 million additions in the quarter to reach 63 million.

Ehrlich isn't alone in her assessment that Paramount's value lies in its assets, as some have speculated that Berkshire Hathaway owns the stock as an asset play as well.

The positive reaction from the market to Paramount's earnings last week could indicate that investors are sensing that the worst has passed, but an asset sale would also likely boost the stock and give the company money to pay down debt and invest in growth areas of the business.

Analysts.....

According to the issued ratings of 19 analysts in the last year, the consensus rating for Paramount Global stock is Reduce based on the current 9 sell ratings, 4 hold ratings and 6 buy ratings for PARA. The average twelve-month price prediction for Paramount Global is $15.72 with a high price target of $30.00 and a low price target of $9.00.

Summary.....

Given the uncertainty in the streaming sector and the challenge in transitioning to streaming, expect the volatility in the stock to continue.

Paramount Global shares traded down $1.07 during trading hours on Monday, hitting $12.69. The company had a trading volume of 22,291,648 shares, compared to its average volume of 12,679,054. Paramount Global has a 12 month low of $10.51 and a 12 month high of $25.93. The firm has a market cap of $8.26 billion, a price-to-earnings ratio of -7.13, and a PEG ratio of 42.41 and a beta of 1.76. The business has a fifty day moving average of $12.65 and a 200-day moving average of $15.10. The company has a quick ratio of 1.02, a current ratio of 1.17 and a debt-to-equity ratio of 0.70.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from PARAMOUNT GLOBAL

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!