TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Paypal Holdings Stock Jumps On

Raised Forecast!

Weekly Options Members

Are Up 182% Potential Profit

Using A Weekly CALL Option!

Paypal Holdings Inc (NASDAQ:PYPL) raised its forecast for full-year adjusted profit above Wall Street estimates on Wednesday, when reporting September-quarter earnings.

Consumer spending has also held up remarkably well this year, keeping the outlook for PayPal bright going into the holidays.

This set the scene for Weekly Options USA Members to profit by 182%, using a PYPL Options trade!

Join Us And Get The Trades – become a member today!

Sunday, November 05, 2023

by Ian Harvey

Why the PYPL Weekly Options Trade was Originally Executed!

Paypal Holdings Inc (NASDAQ:PYPL) raised its forecast for full-year adjusted profit above Wall Street estimates on Wednesday, when reporting September-quarter earnings, with executives striking an optimistic tone for the payments giant's long-term growth strategy.

Newly appointed CEO Alex Chriss commented that he expects to grow revenue outside of purely transaction-related volume.

"We have opportunities to accelerate our revenue growth while reducing our expenses, helping further drive operating leverage," Chriss said on a call with analysts, adding the company is working on a comprehensive plan for 2024.

Consumer spending has also held up remarkably well this year, keeping the outlook for PayPal bright going into the holidays, as retailers dangle steep discounts on everything from electronics to clothing to entice inflation-weary shoppers.

PayPal said it expects adjusted profit for the full year to be about $4.98 per share from $4.95 earlier. Analysts on average had expected $4.92, according to LSEG data.

The PYPL Weekly Options Trade Explained.....

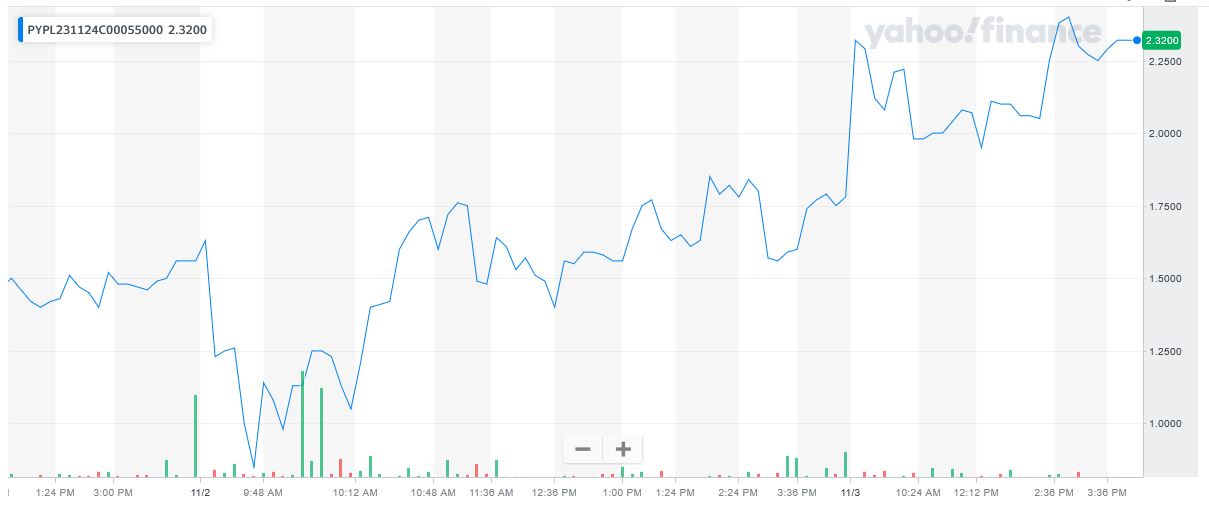

** OPTION TRADE: Buy PYPL NOV 24 2023 55.000 CALLS - price at last close was $1.56 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the PYPL Weekly Options (CALL) Trade on Thursday, November 02, 2023, at 9:44, for $0.85.

Sold the PYPL weekly options contracts on Friday, November 03, 2023 for $2.40; a potential profit of182%.

Don’t miss out on further trades – become a member today!

About PayPal.....

PayPal Holdings, Inc. is one of the world’s largest and oldest fintech companies having gotten its start in 1998. Originally a payment processing application named Confinity, the company will join forces with eBay in 2000 and then merge with the company in 2002. In 2008 Bill Me Later joined the company and eventually became Paypal Credit, the company also launched mobile apps that year that made it even easier and more accessible to millions of consumers.

Together, eBay and Paypal will change the course of eCommerce forever but the match did not last forever. Paypal quickly outgrew its original specifications to become the financial behemoth it is today. Brands in the portfolio include the original Paypal which was spun off from eBay in July 2015 as well as Venmo, Xoom, and Paypal Credit.

Dan Shulman was tapped as CEO-designee in 2014 and worked with the company extensively during the build-up to the IPO. Since then, Mr. Shulman has worked diligently as CEO to democratize and transform digital payments for the benefit of individuals, families, and businesses worldwide.

Now, PayPal provides digital financial infrastructure, services, and support across a wide range of applications globally including but not limited to payments, wallet services, and credit. The company is headquartered in San Jose, California, and is built on the belief that everyone has the right to participate in the global digital economy. The company operates a portfolio of web-based applications that provide a host of other services as well.

Paypal provides payment solutions under the PayPal, PayPal Credit, Braintree, Venmo, Xoom, Zettle, Hyperwallet, Honey, and Paidy names. The company began working with cryptocurrency late in 2020 and now supports four currencies. Paypal users can access the cryptocurrency wallet through their accounts and buy, sell, and trade the top four currencies including Bitcoin and Ethereum.

The company's platforms allow consumers to send and receive payments in over 200 countries and in approximately 50 currencies, not including cryptocurrencies which the platform supports as well. Members can connect their accounts to a bank and withdraw to it or use a PayPal-branded debit card to access funds. Balances can also be carried on a short or long-term basis but the company does not pay interest.

In terms of scale, the company boasts more than 430,000 active accounts including merchants and consumers. In Q2 of 2022, that equated to 5.5 billion individual transactions and more than $340 billion in total payment volume. In regards to depth, the average account made more than 48 transactions or just over 4 transactions per week. In terms of market share, Paypal began the COVID-19 pandemic with more than 50% of the market share in global digital payments and that figure increased in its wake.

Further Catalysts for the PYPL Weekly Options Trade…..

The company's low-margin business products have grown strongly, while growth in its branded products has slowed due to increased pressure from competitors such as Apple.

PayPal cut its annual forecast of adjusted operating margin expansion to 75 basis points from 100 basis points expected earlier. Adjusted operating margin was 22.2% in the third quarter.

The company said it expects operating margin on an adjusted basis to contract in the fourth quarter compared with a year earlier.

"New quarter, same story as gross profit headwinds persist on continued take rate pressure, offsetting better TPV growth," said analysts at Jefferies.

PayPal's revenue jumped 9% to $7.4 billion on FX-neutral basis in the third quarter ended Sept. 30, while total payments volume increased 13%.

It earned $1.30 per share on an adjusted basis in the quarter, beating expectations of $1.23 per share.

Other Catalysts.....

Total payment volume processed from merchant customers in the quarter climbed 15% to $387.7 billion. Analysts had projected total payment volume of $379.3 billion.

For the current quarter ending in December, PayPal predicted earnings of $1.36 a share at the midpoint of its outlook. Analysts had called for earnings of $1.40 a share.

"Q4 outlook is below street on revenue and EPS, though we believe the more salient number will be what's implied for the pace of improvement in transaction gross profit," said Jefferies analyst Trevor Williams in a note.

Analysts.....

Wells Fargo & Company started coverage on shares of PayPal in a report released on Tuesday. The firm set an “equal weight” rating and a $55.00 price target on the credit services provider’s stock. Wells Fargo & Company‘s price objective points to a potential upside of 6.47% from the company’s previous close.

According to the issued ratings of 35 analysts in the last year, the consensus rating for PayPal stock is Moderate Buy based on the current 1 sell rating, 14 hold ratings and 20 buy ratings for PYPL. The average twelve-month price prediction for PayPal is $85.52 with a high price target of $126.00 and a low price target of $55.00.

Summary.....

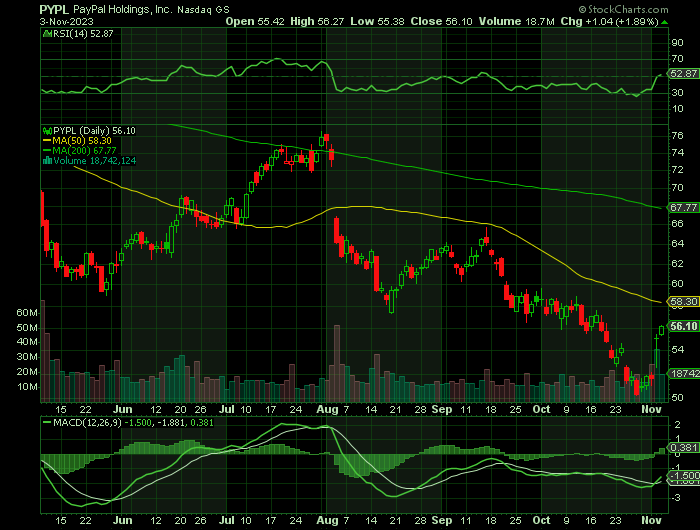

PayPal Stock traded down $0.14 during trading on Wednesday, reaching $51.66. 22,941,324 shares of the stock were exchanged, compared to its average volume of 15,117,914. PayPal has a twelve month low of $50.25 and a twelve month high of $92.62. The stock has a market cap of $56.72 billion, a P/E ratio of 14.42, and a price-to-earnings-growth ratio of 0.77 and a beta of 1.34. The stock’s 50 day moving average price is $58.77 and its two-hundred day moving average price is $64.31. The company has a debt-to-equity ratio of 0.54, a quick ratio of 1.30 and a current ratio of 1.30.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from PAYPAL

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!