TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

PayPal Stock

Price Continues Downward!

BUt, “Weekly Options” Members are Up 164%

Using A Weekly put Option!

Can More Profit Be Expected?

Don’t

Miss Out On Further Profit!

Sunday, January 23, 2022

by Ian Harvey

Paypal Holdings Inc (NASDAQ:PYPL)

PayPal is caught in the web of downtrends that are multiplying across the land, and bears’ ranks are swelling. Despite the fact that the Nasdaq Composite still sitting a stone’s throw from its peak, some 40% of the index has been cut in half. There’s trouble beneath the surface, making for narrowing leadership and, ultimately, more vulnerability.

Markets tricked bottom fishers who bet that Paypal Holdings Inc (NASDAQ:PYPL) bottomed and would rally back to $200. Last week, PYPL stock lost almost approximately 8%, and for the week before another 5%, revisiting last months’ low.

Shares of digital payments behemoth Paypal ended 2021 down 19%, according to data provided by S&P Global Market Intelligence. This performance lagged behind the S&P 500, which produced a superb return of 27% for the year. Two straight quarters of decelerating revenue growth are causing investors to question the outlook for PayPal.

Markets signaled their disappointment in PayPal’s slowing growth when they speculated it would buy Pinterest (PINS). PayPal’s payment solution on e-commerce shopping sites faces increasing competition. Affirm and Square (SQ) are some of the firms pressuring PayPal. Incumbent credit card firms like Visa (V) and Mastercard (MA) will also invest to re-take lost market share.

PayPal might post strong operating profits in its next report. It had the flexibility to raise fees and widen spreads. Still, if the company posts weaker margins, it may increase customer fees in the next few quarters

Members Profits on the PayPal Trade.....

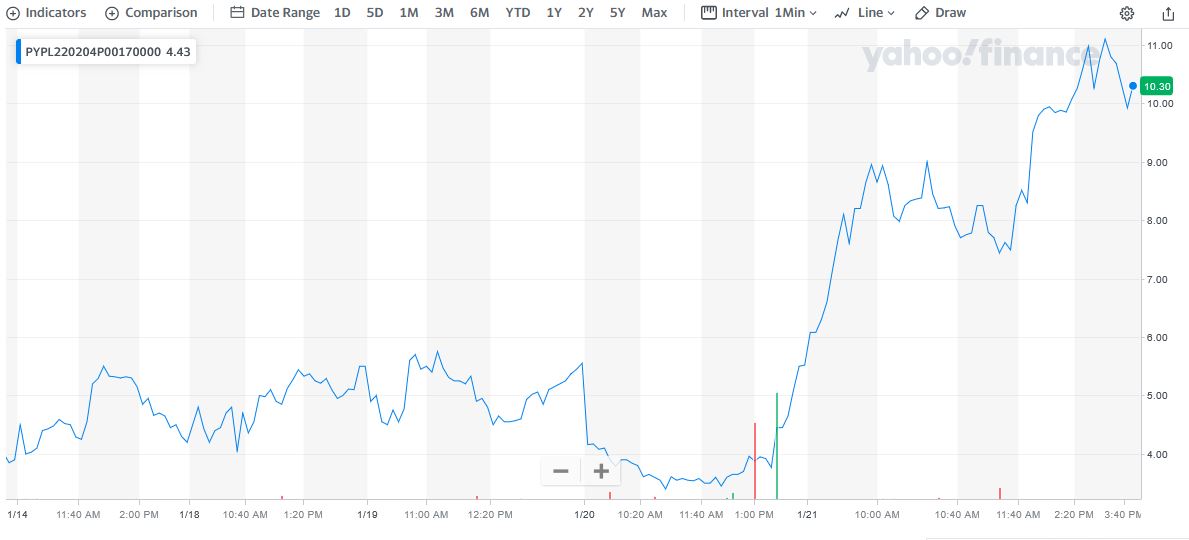

Weekly Options USA Members entered this trade on Tuesday, January 18, 2022 for approximately $4.20 – less than the $4.20 suggested – but due to the market volatility experienced in the recent period of time, the price of the option has moved up and down, but usually in a positive direction that we required.

Members, as of Friday, January 21, were up 164%!

To view the actual trade sent to members CLICK HERE.

About PayPal.....

PayPal is the highest valued digital payments platform in the world. It enables global commerce across multiple platforms and devices, bringing new buying opportunities to consumers and businesses across the globe.

Established in 1998, PayPal's mission is to democratise financial services and empower people and businesses to join together and exchange value for better experiences.

The company allows individuals and merchants to get paid in more than 25 currencies in over 200 countries. It also has a wide range of services and products to make the process of payments easier, including online invoicing, credit card acceptance, and buy now pay later options, to name a few.

At the same time, PayPal is constantly looking to the future, developing new technologies to improve its services and stay ahead of the curve. Some of its latest innovations include cryptocurrency investing, bill splitting, and budgeting tools.

The company gave rise to four billionaires, including Elon Musk, Peter Thiel, Max Levchin, and Reid Hoffman. The role of this company as a catalyst for the entire fintech industry cannot be understated.

Furthermore, two of the world's most recognised brands, LinkedIn and Tesla Motors, founded by Reid Hoffman and Elon Musk, were born partially due to PayPal's success.

Having been around for longer than two decades, PayPal is now a well-established name in the global fintech industry, giving it a solid competitive edge. In fact, it is now worth more than $220bn.

Nevertheless, competition is heating up, and PayPal will need to continue innovating to stay ahead. It remains to be seen whether it will be able to retain its title as the world's most valuable fintech brand by this time next year.

The Major Catalysts for the PaYPaL Weekly Options Trade….

Analyst Thoughts.....

Jefferies downgraded PayPal last Wednesday, citing worsening e-commerce trends as shoppers return to bricks-and-mortar stores; warning that PayPal faces a "muted" setup for the year ahead.

Analyst Trevor Williams changed his rating to Hold, down from Buy, and lowered his price target to $200 from $255.

While RBC’s Daniel Perlin remains in the digital payments giant’s corner, the analyst thinks the company’s outlook necessitates a revision to his PayPal model. “We have better incorporated into our model management’s commentary around the difficult comps expected in FY22, given reserve releases in FY21, which should return to more normalized patterns in FY22,” the analyst explained.

As such, Perlin reduced his FY22 adj. EPS estimate from $5.42 to $5.07 and lowered the adj. EBITDA forecast from $8.42 billion to $7.95 billion.

PayPal’s share price decline is by no means unique in the payment space; most of its peers have seen “material multiple contraction,” while many growth stocks’ valuation have been hammered amidst the heightened fears of inflation and rising interest rates.

As such,

alongside the reduced FY22 estimates, there is also a price target cut for the

stock. The figure drops to $230 from $298.

According to the issued ratings of

42 analysts in the last year, the consensus rating for PayPal stock is Buy

based on the current 1 sell rating, 9 hold ratings and 32 buy ratings for PYPL.

The average twelve-month price target for PayPal is $269.92 with a high price

target of $350.00 and a low price target of $190.00.

Last Earnings Call.....

During the company's third-quarter 2021 earnings call, management provided sales guidance of $30 billion for 2022 that disappointed Wall Street. In October, the stock started trending down after rumors swirled that PayPal was in talks to acquire social media platform Pinterest in a possible $45-billion deal. PayPal came out and said that it was not pursuing a purchase of Pinterest.

Next Earnings.....

PayPal is estimated to report earnings on February 02, 2022. Analysts expect Paypal to post earnings of $1.12 per share. This would mark year-over-year growth of 3.7%. The reported EPS for the same quarter last year was $0.75.

After PayPal lowered expectations last quarter, Deutsche Bank’s Bryan Keane expects the digital payments giant to deliver “steady growth.”

Boosted by ~24% year-over-year TPV growth, the analyst anticipates PYPL will generate revenue growth of ~12.9% and EPS of $1.12.

That said, Keane does not foresee any unexpected fireworks. “Given the latest quarterly trends in eComm, continued supply-chain issues, delta/omicron, and eBay headwinds, we see relatively limited upside again this quarter,” said the analyst.

Looking at PayPal’s monthly users trends, Keane’s expected results appear in the same ballpark as the quarter’s action. Unique Visitors (UVs) rose by 14% sequentially from 676.8 million to 769 million and came in 11% above the figure reported during the same period last year.

Looking ahead to 1Q22, similar to 4Q21, given the “more difficult comps” yet offset by “moderating eBay headwinds,” Keane thinks PayPal will “potentially” guide to cc revenue growth of ~12-14%.

Effect of Pandemic.....

Digital payments certainly received a boost in 2020, but with the return of in-person shopping, PayPal is having problems getting back on track and produce the market-beating returns that investors expect of it.

If we take a step back and focus on the bigger picture, there's a lot to like about this business. As of Sept. 30, PayPal counted 416 million active accounts, up 15% year over year. The company processed $310 billion in TPV during the three-month period, which is an astronomical amount. The secular shift toward electronic payments is a real and sustainable trend, and PayPal is at the forefront.

CEO Dan Schulman one day hopes the company will have 1 billion active users, a feat that would entail people viewing PayPal as a one-stop financial shop. New upgrades to the flagship app, like bill pay, early direct deposit, shopping deals and rewards, and a savings account, make it more appealing.

It's hard not to believe that PayPal's stock, now trading at a nearly two-year-low price-to-earnings ratio of 46, will bounce back nicely in 2022. The business has a massive (and growing) customer base and is introducing new features to drive engagement, all of which should support healthy revenue and profit increases for the current year and beyond.

But, not quite yet!!

Lawsuit.....

Three PayPal users who've allegedly had their accounts frozen and funds taken by the company without explanation have filed a federal lawsuit against the online payment service. The plaintiffs — two users from California and one from Chicago — are accusing the company of unlawfully seizing their personal property and violating racketeering laws. They're now proposing a class-action lawsuit on behalf of all other users who've had their accounts frozen before and are seeking restitution, as well as punitive and exemplary damages.

PayPal has long angered many a user for limiting accounts and freezing their funds for six months or more. One high-profile case was American poker player Chris Moneymaker's who had $12,000 taken from his account after six months of being limited. Moneymaker was already in the process of asking people to join him in a class action lawsuit before his funds were "mysteriously returned."

Big Banks.....

Traditional finance and digital upstarts alike claim the other side has an unfair advantage.

Deep in Jamie Dimon’s 66-page letter to JPMorgan Chase & Co. shareholders last year lies a chart: 11 ways being a bank is costlier than being a fintech, from deposit insurance to higher capital and liquidity requirements. The longtime chief executive officer tallied tens of billions of dollars that he says such rules cost the bank over the past decade.

Dimon has for years griped about what he calls an unfair playing field. He isn’t alone: Big banks and the powerful lobbying groups representing them are readying a fight on multiple fronts, in what’s already shaping up as a definitive year for the rivalry between traditional banks and their tech competition.

Banks are bracing for tougher regulation from the Biden administration, but they hope stricter rules will apply to fintech as well.

Summary.....

PayPal could still fall a great distance despite getting cut nearly in half. Going into the 2020 pandemic, PYPL was sitting at $125, another $50 lower from here. Over the past six weeks, the daily downtrend has slowed and formed a sideways trading range. But instead of powering to the top side and building a compelling bullish breakout, it’s knocking heavily on the lower-end. The $177 support shelf has held long enough to where its failure would prove a significant breakdown.

If previous support breaks are any indication, we could see a swift move down to $160 if sellers press their bets.

Therefore…..

We Have Had A Successful PayPal Trade!

What Further PayPal Weekly Trades Will We Recommend?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Join us today and find out!

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!

Back to Weekly Options USA Home Page from PayPal