TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Pfizer Suffers from A Challenging Week!

Weekly Options Members

Are Up 229% Potential Profit

Using A Weekly PUT Option!

Pfizer shares are having a bad week due to the latest analyst coverage, with analysts making across-the-board cuts to their statutory estimates.

Pfizer, last Friday, cut its full-year revenue forecast by $9 billion due to lower-than-expected sales of its COVID-19 vaccine and treatment.

This set the scene for Weekly Options USA Members to Make Potential Profit Of 229%, using a PFE Weekly Options trade!

Join Us And Get The Trades – become a member today!

Thursday, October 19, 2023

by Ian Harvey

Pfizer Inc. (NYSE:PFE) shares are having a bad week due to the latest analyst coverage, with analysts making across-the-board cuts to their statutory estimates. Revenue and earnings per share (EPS) forecasts were both revised downwards, with analysts seeing grey clouds on the horizon.

Following the latest downgrade, the current consensus, from the 20 analysts covering Pfizer, is for revenues of US$59b in 2023, which would reflect a stressful 25% reduction in Pfizer's sales over the past 12 months. Statutory earnings per share are supposed to tumble 69% to US$1.17 in the same period.

Previously, the analysts had been modelling revenues of US$66b and earnings per share (EPS) of US$2.88 in 2023. It looks like analyst sentiment has declined substantially, with a substantial drop in revenue estimates and a large cut to earnings per share numbers as well.

Why the PFE Weekly Options Trade was Originally Executed!

Pfizer Inc. (NYSE:PFE)’s stock will suffer a challenging week ahead, with a potential drop to new 52-week lows on the horizon, as investors react to fresh negative developments plaguing one of the world’s largest pharmaceutical companies.

Pfizer on Friday cut its full-year revenue forecast by $9 billion due to lower-than-expected sales of its COVID-19 vaccine and treatment. The company foresees a $7 billion reduction in expected revenue for its Paxlovid antiviral Covid treatment pill, and a $2 billion decline in revenue for its Comirnaty Covid vaccine it makes with BioNTech (NASDAQ:BNTX).

As a result, Pfizer’s management now expects 2023 revenue to be in the range of $58 billion to $61 billion, down sharply from its prior forecast of $67 billion to $70 billion.

The pharmaceutical giant also warned that it will take a one-time cash charge of $3 billion, related to severance, among other things, as it implements fresh cost-cutting measures.

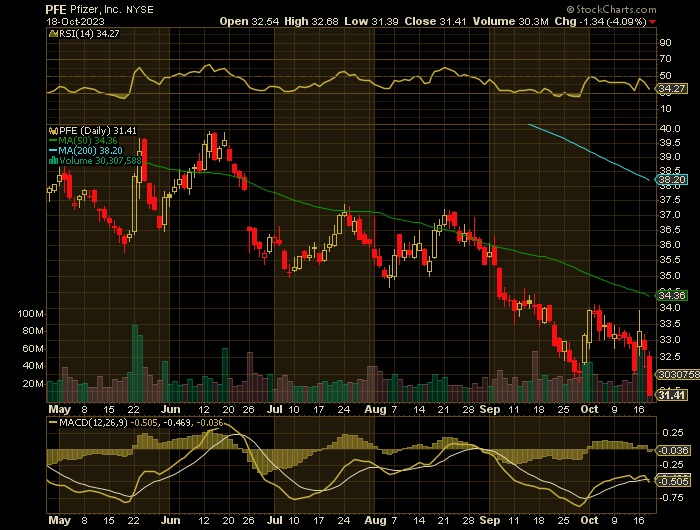

PFE stock - which fell to a more than two-year low of $31.77 on September 28 - ended at $32.12 on Friday. At current levels, the New York-based drugmaker has a market cap of $181.3 billion.

Shares have underperformed the broader market by a wide margin in 2023, tumbling 37.3% year-to-date, amid a significant slowdown in sales of its Covid-related product portfolio.

The PFE Weekly Options Trade Explained.....

** OPTION TRADE: Buy PFE NOV 03 2023 32.000 PUTS - price at last close was $0.90 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

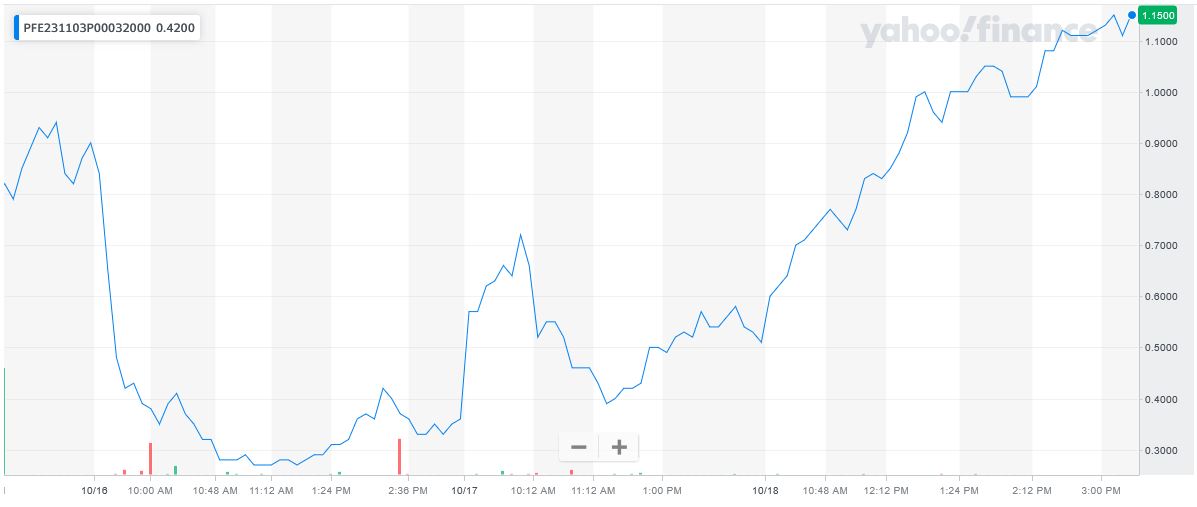

Entered the PFE Weekly Options (PUT) Trade on Monday, October 16, 2023, for $0.35.

Sold the PFE weekly options contracts on Thursday, October 19, 2023 for $1.15; a potential profit of229%.

Don’t miss out on further trades – become a member today!

About Pfizer.....

Pfizer Inc. is a US-based multinational biotech company. The company operates as a research-based pharmaceutical company focused on the discovery, production and marketing of medicines and vaccines. It is the 2nd largest drugmaker globally by revenue and is ranked 64th on the Fortune 500 list. The company’s avenues of research include Immunology, Oncology, Cardiology, Endocrinology and Neurology.

Regarding its product line, the company has at least ten blockbuster drugs producing more than $1 billion in avenue revenue each. The company brought in over $81 billion in total revenue in 2021. The US is its main market and represents roughly 50% of all revenue. China and Japan make up roughly 12% of the business, while the rest come from the “rest of the world”. It employs roughly 79,000 people and is headquartered in New York state.

Pfizer Inc. was founded in 1849 by Charles Pfizer Sr. and his cousin Charles Earhart. The two were German immigrants and chemists that set up shops outside New York City to make medicinal compounds. The first major success was an antiparasitic called santonin, and the commercialization of citric acid-making technologies quickly followed that up. Their success with citric acid led to the company’s expansion and other major discoveries.

World War I caused a shortage of materials for making citric acid and forced the company to seek alternatives. The one they latched on to was the fermentation of certain fungi known to produce citric acid naturally. This led to the advancement of fermentation technology that was later used in the commercial production of penicillin and then the advancement of antibiotics in general.

Pfizer Inc was incorporated on June 2nd, 1942 in Delaware, and another period of expansion began. The postwar drop in demand for penicillin led to the discovery of newer, more marketable antibiotics and cemented the company’s role in modern medicine. By the time he 80s rolled around, the company was trading on the New York Stock Exchange and on the path to developing today’s blockbuster lineup.

The company’s top seller in 2021 was Comirnaty, a COVID-19 vaccine. It generated nearly $37 billion in 2021 and was followed by Prevnar, Ibrance and Eliquis with just over $5 billion in sales each. Other blockbuster names on Pfizer’s list include Xeljanz and Enbrel, each bringing in $3.5 billion. Pfizer operates 39 research and production facilities worldwide and sells its products in 125 countries.

As of 2022, the company had a robust pipeline of potential treatments, with more than 220 in some stage of clinical trials. Among its leading candidates is a vaccine for RSV, a life-threatening respiratory disease affecting children. 2021 highlights include 8 FDA approvals, four new regulatory submissions and 13 new trial startups. Pfizer is also a well-known dividend payer and has returned more than $8.7 billion to shareholders since going public.

Further Catalysts for the PFE Weekly Options Trade…..

The drugmaker said it now expects 2023 revenue of between $58 billion and $61 billion, down from its prior forecast of $67 billion to $70 billion. It said the reduction was solely due to lowered expectations for its COVID-19 products.

Pfizer said it will take a non-cash charge of $5.5 billion in the third quarter to write off $4.6 billion of Paxlovid and $900 million of inventory write-offs and other charges for the vaccine.

The cost-cutting program, which will target savings of at least $3.5 billion annually by the end of 2024, will include layoffs, the company said, without providing details on how many jobs will be cut or from what areas. One-time costs to achieve the savings are expected to be around $3 billion.

Shares of the New York-based company were down about 7% in extended trading.

Pfizer slashed its forecast for sales of its antiviral COVID treatment Paxlovid by about $7 billion, including a non-cash $4.2 billion revenue reversal, as it agreed to allow the return of 7.9 million courses purchased by the U.S. government. It had previously expected Paxlovid revenue of about $8 billion for the year.

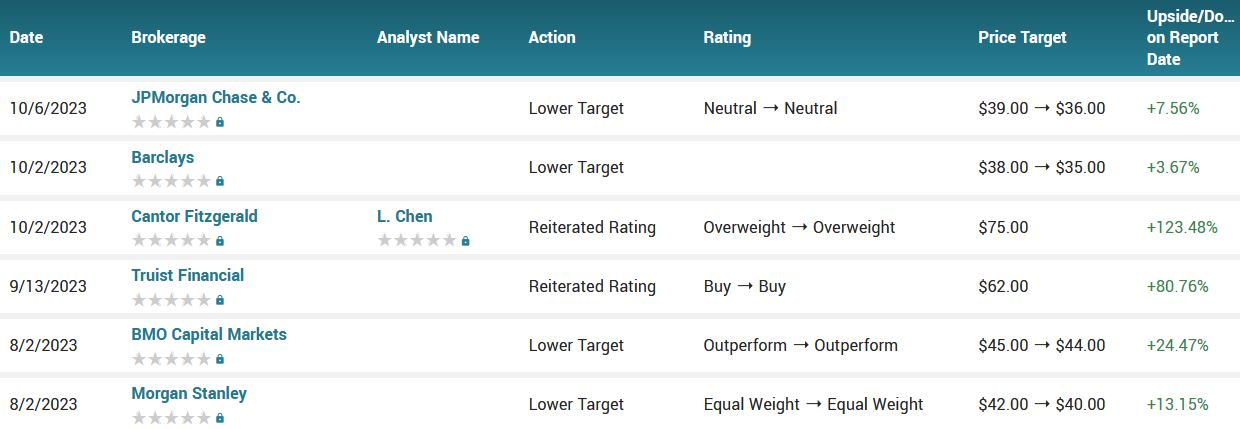

Analysts.....

According to the issued ratings of 16 analysts in the last year, the consensus rating for Pfizer stock is Hold based on the current 11 hold ratings and 5 buy ratings for PFE. The average twelve-month price prediction for Pfizer is $45.88 with a high price target of $75.00 and a low price target of $35.00.

Summary.....

Pfizer has a 12-month low of $31.77 and a 12-month high of $54.93. The firm has a fifty day moving average price of $34.55 and a 200-day moving average price of $36.99. The firm has a market capitalization of $181.35 billion, a P/E ratio of 8.54, and a P/E/G ratio of 1.11 and a beta of 0.61. The company has a current ratio of 2.12, a quick ratio of 1.82 and a debt-to-equity ratio of 0.62.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from PFIZER

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!