TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

QUALCOMM Call Option

Up 278%!

The artificial intelligence (AI) boom shows no signs of cooling, creating significant opportunity for AI stocks.

Therefore, QUALCOMM, Inc. (NASDAQ:QCOM), one of the top AI stocks that is trading at a temporary discount, is seeing higher highs.

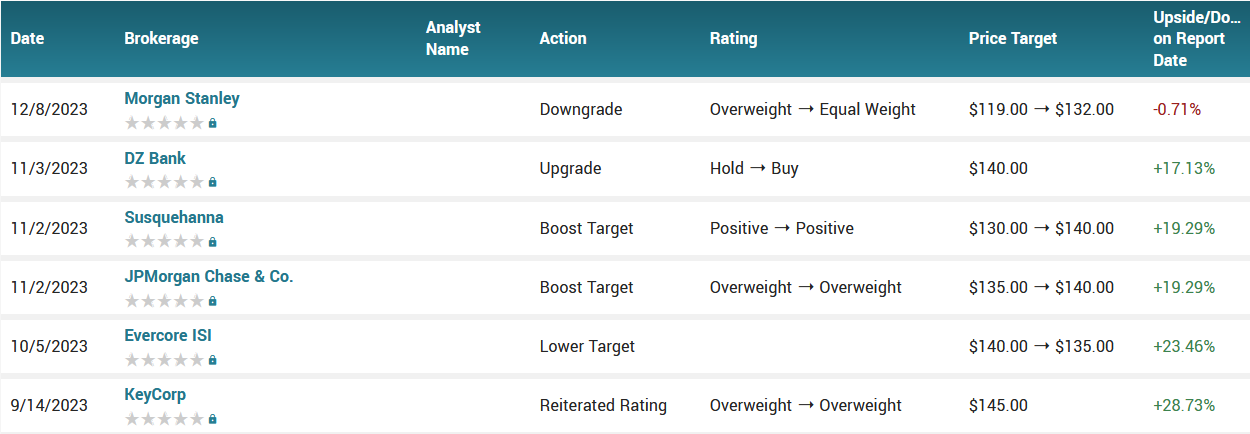

Mizuho just raised its price target to $155 from $140. Also, Bernstein analysts raised their price target to $160 from 145, with an outperform rating.

Also, Citi upgraded Qualcomm to Buy from Neutral and raised its price target to $160.00 from $110.00.

This set the scene for Weekly Options USA Members to profit by 278% using a QCOM Options trade!

Join Us And Get The Trades – become a member today!

Sunday, January 21, 2024

by Ian Harvey

Citi upgraded Qualcomm to Buy from Neutral and raised its price target to $160.00 from $110.00. Furthermore, the bank launched a positive catalyst watch on the stock, expecting an upside to Qualcomm's print and guidance when it reports earnings on Jan 31.

The analysts believe that the replenishment of inventory in the handset market will boost Qualcomm's revenue and margins. They anticipate this trend to continue at least through the first quarter of 2024 and expect Qualcomm to increase its market share at Samsung during this time.

We are raising our F24E revenue and EPS estimates from $37.5 billion and $7.61 to $38.5 billion and $8.16, and our F25E revenue and EPS estimates from $41.0 billion and $8.82 to $41.0 billion and $9.29, respectively.

Why the QUALCOMM Weekly Options Trade was Originally Executed!

The artificial intelligence (AI) boom shows no signs of cooling, creating significant opportunity for AI stocks. First, we have to consider tech heavyweights that are investing billions into it. Next, analysts at Next Move Strategy Consulting say the AI market, currently valued at about $100 billion, could grow twenty-fold by 2030 to more than $2 trillion.

Finally, according to analysts at UBS, “If the launch of the ChatGPT application is the iPhone moment for the AI industry, the recent rollouts of numerous applications like copilots and features like Turbo and vision from OpenAI in 4Q23 mean the App Store moment for the AI industry has arrived, in our view,” as noted by Business Insider.

Therefore, QUALCOMM, Inc. (NASDAQ:QCOM), one of the top AI stocks that is trading at a temporary discount is likely to see higher highs.

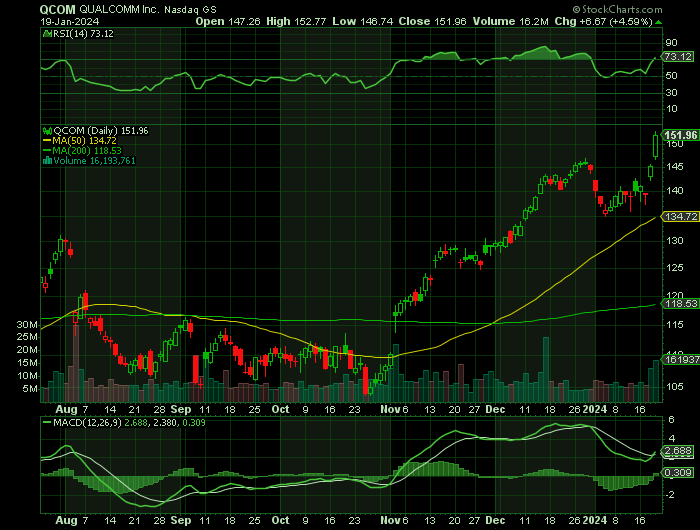

After running from about $105 to a high of $146.89, QCOM did pull back recently, finding support at $135. From here, QCOM will probably retest that prior high and potentially head back to $150.

Also, the company recently unveiled its Snapdragon 7 Gen 3. QCOM notes that its components “deliver across-the-board advancements to ignite on-device AI,” as quoted by Engagdet.com.

Analysts like QCOM at current prices, too. For example, Mizuho just raised its price target to $155 from $140. Also, Bernstein analysts raised their price target to $160 from 145, with an outperform rating.

“Qualcomm is pioneering AI-enabled chip technology, a move set to revolutionize mobile computing,” as noted by Investorplace contributor Muslim Farooque. “Despite earlier challenges from sluggish phone sales and reduced 5G investment, the company’s rebound, backed by solid earnings, signifies market stabilization and resilience.”

The QUALCOMM Weekly Options Potential Profit Explained.....

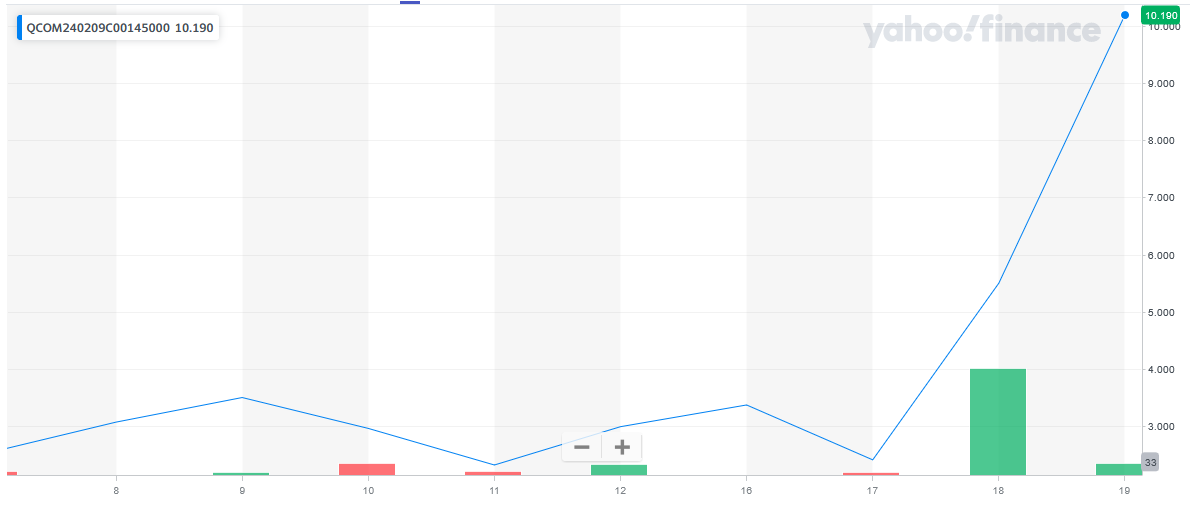

** OPTION TRADE: Buy QCOM FEB 09 2024 145.000 CALLS - price at last close was $3.50 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the QCOM Weekly Options (CALL) Trade on Wednesday, January 10, 2024 for $2.70.

Sold the QCOM weekly options contracts on Friday, January 19, 2024 for $10.20; a potential profit of 278%.

Don’t miss out on further trades – become a member today!

About Qualcomm…..

Headquartered in San Diego, CA, Qualcomm Incorporated designs, manufactures and markets digital wireless telecom products and services based on the Code Division Multiple Access (CDMA) technology.

It operates through the following segments: Qualcomm CDMA Technologies (QCT), Qualcomm Technology Licensing (QTL), and Qualcomm Strategic Initiatives (QSI). The QCT segment develops and supplies integrated circuits and system software based on technologies for the use in voice and data communications, networking, application processing, multimedia, and global positioning system products. The QTL segment grants licenses and provides rights to use portions of the firm's intellectual property portfolio. The QSI segment focuses on opening new or expanding opportunities for its technologies and supporting the design and introduction of new products and services for voice and data communications.

The company was founded by Franklin P. Antonio, Adelia A. Coffman, Andrew Cohen, Klein Gilhousen, Irwin Mark Jacobs, Andrew J. Viterbi, and Harvey P. White in July 1985 and is headquartered in San Diego, CA.

Further Catalysts for the QCOM Weekly Options Trade…..

Qualcomm, a prominent player in the telecommunications industry, is playing a crucial role in the development of smart cities. Its biggest contribution is via 5G, which supports wireless infrastructure, public safety and the efficient use of energy. Thanks to its high speeds, low latency and, 5G enables the most value-driven features of smart cities to take shape. Qualcomm’s devices like the Snapdragon X35 5G Modem-RF System and its partnerships with major telecommunication providers have allowed it to integrate its 5G offering into smart cities, making it a perfect example of one of best smart cities stocks right now.

There are some good reasons why investors should consider QCOM stock if trying to enter the smart cities sector. Its trailing price-to-earnings (P/E) ratio is significantly higher than its forward P/E, which suggests that analysts think the company is currently undervalued and has room for growth. Furthermore, Wall Street rates QCOM as a buy, and some analysts predict that its share price could rise to $155 within the next 12 months.

Other Catalysts.....

QUALCOMM unveiled the Snapdragon XR2+ Gen2 chip platform engineered to support next-generation use cases in mixed reality (MR) and virtual reality (VR) applications. Key players in the Android ecosystem, Google and Samsung, are planning to integrate the advanced chipset into their products for best-in-class XR experience. This cutting-edge Qualcomm chip is poised to rival Apple’s forthcoming Vision Pro in the augmented reality space.

The platform incorporates high-end MR and VR technology into a single-chip architecture. Its ultra-fast 12ms video see-through latency, combined with an upgraded image signal processor, facilitates seamless transformation between the physical and digital worlds, ensuring more comfort to end users. The chip efficiently supports 12 or more concurrent cameras, on-device AI along with XR acceleration blocks. The combination of these advanced features enables smooth interactions, including facial expression capture, controller usage, depth estimation, 3D reconstruction and more.

Qualcomm is reportedly the only chipset vendor with 5G system-level solutions spanning sub-6 and millimeter wave bands and one of the most extensive RF (radio frequency) front-end suppliers with design wins across all premium-tier smartphone customers. With the rollout of the 5G technology, it is benefiting from investment toward building a licensing program in mobile. The company is well-positioned to meet its long-term revenue targets, driven by solid 5G traction, greater visibility and a diversified revenue stream.

Snapdragon Digital Chassis.....

Qualcomm is attempting to bring artificial intelligence everywhere, including the car, while continuing to diversify the company's revenue streams.

The San Diego-based chipmaker said on Tuesday it is using its Snapdragon Digital Chassis to bring generative AI to vehicles, helping enable digital cockpits and enhanced connected car technologies, including advanced driver assistance and automated driving systems.

The company said its new Snapdragon Cockpit Experience Toolkit and its existing work with auto manufacturers will allow transportation companies get an idea of how to build better connected cars.

Qualcomm is showing off its Concept Car display at its booth at the Consumer Electronics Show in Las Vegas for demos.

The Snapdragon Digital Chassis, which is now is more than 350M vehicles, has helped Qualcomm diversify away from just smart devices. The company said it is tracking towards $4B in automotive-related revenue by 2026 and $9B by the end of the decade.

Qualcomm said in November that automotive revenue came in at $1.87B in fiscal 2023, up 24% year-over-year. Automotive revenue during the fourth-quarter was $535M, up 15% from a year ago.

In addition, Qualcomm teamed up with tech firm Bosch to show off a new central vehicle computer for Digital Cockpit and Driver Assistance functions.

Analysts.....

According to the issued ratings of 19 analysts in the last year, the consensus rating for QUALCOMM stock is Moderate Buy based on the current 1 sell rating, 6 hold ratings and 12 buy ratings for QCOM. The average twelve-month price prediction for QUALCOMM is $138.50 with a high price target of $165.00 and a low price target of $100.00.

Summary.....

Qualcomm is also in this AI race, with its Snapdragon X-series of chips coming in the middle of 2024, announced last October. These processors are based on the Arm architecture, rather than x86, and include a much more powerful NPU for AI processing than either Intel or AMD options. This is all upside for Qualcomm, part of its strategy of moving from a communications company to a compute company, so expect to see some significant wins with key system partners announced in the next few months. Qualcomm is also the only chip company in the client space that appears to be heavily investing in brand marketing, hoping it can capitalize on the stagnation of its chip competitors, tying Qualcomm and Snapdragon to the biggest advancements in AI computing for consumers.

QUALCOMM traded up $0.60 on Tuesday, hitting $139.63. 3,002,865 shares of the company’s stock were exchanged, compared to its average volume of 6,783,733. The stock has a 50-day moving average of $132.09 and a 200-day moving average of $120.82. The company has a current ratio of 2.33, a quick ratio of 1.67 and a debt-to-equity ratio of 0.67. QUALCOMM Incorporated has a 52 week low of $101.47 and a 52 week high of $146.89. The stock has a market cap of $155.41 billion, a price-to-earnings ratio of 21.66, and a P/E/G ratio of 1.52 and a beta of 1.32.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from QUALCOMM

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!