TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Raytheon

Technologies

A Defense Stock For Traumatic Times!

Members of “Weekly

Options USA” Are Using A Weekly Option To Profit!

Join

Us and Get the Trade!

Sunday, March 07, 2022

Raytheon Technologies can soften the stock market downturn due to geopolitical events like the current conflict between Russia and Ukraine can cause some big moves in financial markets.

And, javelin anti-tank missiles, built by RTX are part of a $350 million weapons package approved by the Biden Administration for Ukraine.

Join Us And Get The Trade – become a member today!

Geopolitical

events like the current conflict between Russia and Ukraine can cause some big

moves in financial markets, which is evident in the price action investors have

witnessed over the last few days. Commodity prices have been soaring, equity

markets have been quite volatile, and one area of the market is seeing heavy

buying since the onset of the invasion – defense stocks.

These are

companies that provide products or services to a military or intelligence

department of a government and could be poised to receive lots of new orders if

the current conflict continues to escalate.

U.S. defense stocks rose sharply Monday as Europe and the U.S. sent weapons to Ukraine. They pulled back slightly Thursday but in pre-market are moving back up.

While no U.S. troops will be deployed to Ukraine, U.S. defense hardware is on the front lines.

Javelin anti-tank missiles, built by Lockheed and Raytheon Technologies Corp (NYSE: RTX), are part of a $350 million weapons package approved by the Biden Administration for Ukraine.

"For the first time ever, the European Union will finance the purchase and delivery of weapons and other equipment to a country that is under attack," said European Commission President Ursula von der Leyen Sunday.

Russia's invasion has even prompted historically neutral and non-NATO countries to announce economic and military support for Ukraine.

Swiss President Ignazio Cassis said it was "very probable" that Switzerland would join the European Union in sanctioning Russia.

Sweden, a non-NATO member and traditionally a staunchly neutral country, announced it would send anti-tank weapons, helmets and body armor to Ukraine.

A senior U.S. defense official told reporters Monday that security assistance from the U.S. and NATO "continues to arrive." The official said that U.S. military equipment has arrived as recently as in the last few days.

About Raytheon Technologies.....

Raytheon Technologies Corp. is an aerospace and defense company, which engages in the provision of aerospace and defense systems and services for commercial, military, and government customers.

It operates

through the following segments: Collins Aerospace Systems, Pratt and Whitney,

Raytheon Intelligence and Space, and Raytheon Missiles and Defense. The Collins

Aerospace Systems segment manufactures and sells aero structures, avionics,

interiors, mechanical systems, mission systems, and power controls. The Pratt

and Whitney segment includes the design and manufacture of aircraft engines and

auxiliary power systems for commercial, military, and business aircraft. The

Raytheon Intelligence and Space segment is involved in the development of

sensors, training, and cyber and software solutions. The Raytheon Missiles and

Defense segment offers end-to-end solutions to detect, track, and engage

threats.

The company was founded in 1922 and is headquartered in Waltham, MA.

Major Catalysts for the Raytheon Weekly Options Trade…..

Exposure .....

Raytheon Technologies, a company that has more exposure to the commercial aerospace industry than many other defense stocks. This quality could be positive or negative depending on how quickly you think commercial air travel will bounce back after the pandemic. With that said, it’s nice to know that Raytheon has a balanced business that includes both commercial aerospace and defense segments, which means it can effectively deal with declines in either component of its business. Given the backdrop of current events, investors should be more interested in Raytheon’s defense business, which includes Raytheon Intelligence & Space and Raytheon Missiles & Defense.

Revenue .....

U.S. Defense spending should help to drive revenue growth for Raytheon in the coming years, particularly thanks to the rising geopolitical tensions and bipartisan support for defense spending.

Sales .....

Raytheon delivered Q4 sales of $17 billion, up 4% year-over-year, and saw its adjusted EPS rise by 46% year-over-year to reach $1.08, which could be a sign of good things to come for the company this year. Finally, with a 1.99% dividend yield, this is a defense stock that investors can confidently hold for the long term.

Russia.....

Russia's invasion and other geopolitical risks raise the possibility of more defense spending by the U.S. and its allies in the years to come as the focus shifts from Afghanistan toward Russia, China and North Korea.

Germany Spending.....

Germany announced it would increase its defense budget to above the 2% of GDP mark that the NATO alliance requires each member to contribute by a 2024 deadline.

"We have to ask ourselves — what capacities does Putin's Russia have and which capacities do we need to counter his threats?" Chancellor Olaf Scholz told parliament Sunday.

The 2% NATO deadline was agreed to in 2014, following Russia's attack on the eastern Ukrainian peninsula of Crimea. President Donald Trump had pressed Germany to boost defense spending ahead of the deadline, threatening to recall U.S. troops from Germany if Berlin didn't increase its defense budget.

Strong Backlogs.....

One of the main reasons that Raytheon is a great company for long-term investment is their business stability. Regardless of economic conditions, the U.S. government spends significant money on defense. Raytheon's defense segment is a beneficiary of this large (and increasing) defense budget. This provides a reliable source of revenue during both a strong and a poor economy.

In 2021, their defense backlog ended at $63 B, and book-to-bill ratio stayed above 1.0. Also, they had several large bookings during 4Q including $1.3 B classified bookings, $670 M of Electro-Optical infrared awards at RIS, and $730 B in Standard Missile-2 productions awards at RMD. Based on these numbers, it's pretty safe to say that Raytheon can cover their operating expenses, buy new machines for expansion, and pay solid dividends to shareholders.

Earnings.....

Raytheon just had an outstanding 4Q 2021 and overall 2021. Both top and bottom lines grew as expected, and they generated free cash flow of $5 B after spending $2.1 B in capital expenditure. Both commercial and defense sides performed strongly, and the result gave plenty of reasons for investors to celebrate.

The most

noticeable part was their margin expansion across the board. Mainly fueled by

cost synergies from the RTX merger ($760 M), the profit margins (Gross margins,

EBIT margins, and EBITDA margins) all increased by 4-5% from pandemic lows. The

margins have not quite returned to their pre-pandemic levels, but are certainly

headed in the right direction. This gives confidence that the company

fundamentals will recover with time.

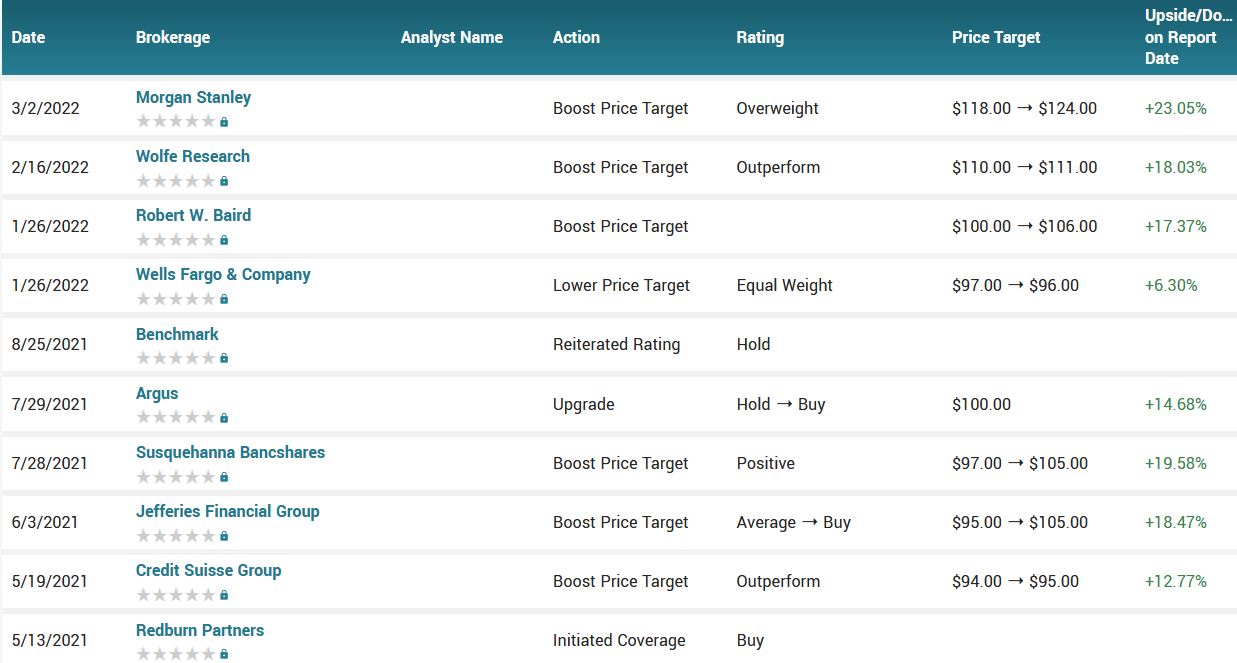

Analysts Thoughts.....

Morgan Stanley has a price target of $118. Analyst Kristine Liwag believes that the fourth-quarter guidance Raytheon gave is too conservative. The company guided for full-year earnings per share (EPS) of between $4.60 and $4.80 while consensus estimates were at $4.95. In addition, the analyst lauds the company’s strong free cash flow, stable business model and low use of leverage.

Jefferies has a price target of $105. Analyst Sheila Kahyaoglu was impressed with Collins Aerospace’s performance and expects the defense business to grow at a 3% compound annual growth rate (CAGR) until 2023. Additionally, Kahyaoglu sees momentum in profitability and believes that Raytheon should capitalize on international opportunities.

Finally, Argus has a price target of $100. Analyst John Eade believes that technical trends have turned positive, driven by a competent management team and earnings results. Furthermore, the analyst believes that RTX stock is trading “in line with or below” its peer group in terms of price-earnings (P/E) and price-sales (P/S) ratios.

According

to the issued ratings of 12 analysts in the last year, the consensus rating for

Raytheon Technologies stock is Buy based on the current 2 hold ratings and 10

buy ratings for RTX. The average twelve-month price target for Raytheon

Technologies is $105.00 with a high price target of $124.00 and a low price

target of $95.00.

Summary.....

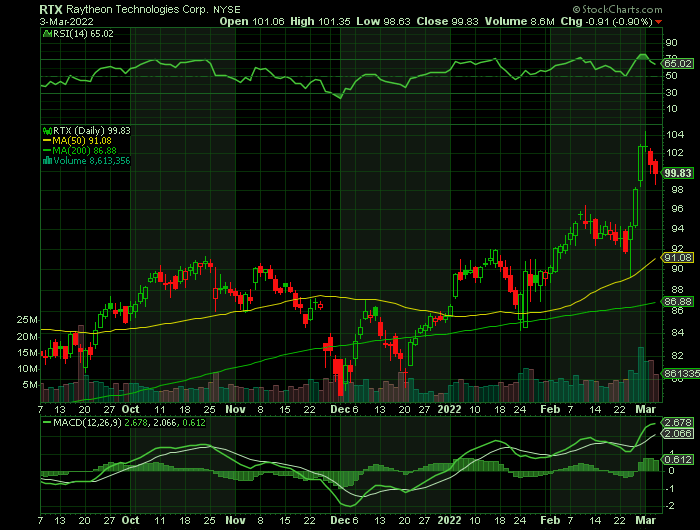

Raytheon Technologies Co. has a 1-year low of $72.74 and a 1-year high of $104.34. The firm has a market capitalization of $150.34 billion, a P/E ratio of 39.20, and a price-to-earnings-growth ratio of 1.93 and a beta of 1.32. The company’s 50-day moving average is $91.58 and its 200 day moving average is $88.19.

Therefore…..

What Weekly Options Trade Have Members Entered!

Still Time To Take Advantage Of The Profit!

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Stock options Made Easy, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Raytheon

Recent Articles

-

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem – What’s Next? -

Tariffs and the Stock Market: Positive and Negative Impacts in 2025

Tariffs and the Stock Market: Positive and Negative Impacts in 2025. This article explores both the positive and negative effects of tariffs on the stock market based on recent data, forecasts, and ma… -

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs