TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Salesforce (CRM)

Is Going Strong!

Members Make

Potential Profit of

114%, In 2 Days, Using A Weekly Call Option!

In an announcement Tuesday morning, Salesforce said it would be increasing the list price by an average of 9% across key product lines like its sales cloud, service cloud, marketing cloud, and Tableau.

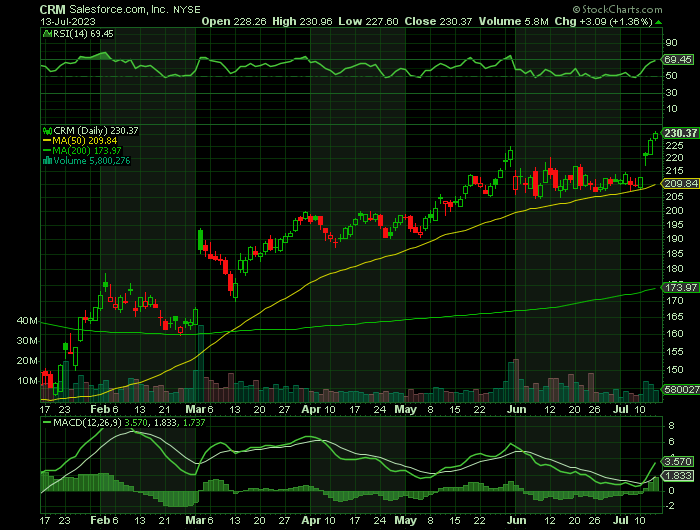

Salesforce.com (CRM) closed at $230.37 yesterday, marking a +1.36% move from the previous day. The stock outpaced the S&P 500's daily gain of 0.85%.

Shares of the customer-management software developer had gained 8.54% in the past month, and 17% in the past 3 months.

This set the scene for Weekly Options USA Members to Make Potential Profit Of 114%, using a CRM Weekly Options trade!

Join Us And Get The Trades – become a member today!

Friday, July 14, 2023

by Ian Harvey

Why the CRM Weekly Options Trade was Originally Executed?…..

Shares of Salesforce.com, inc. (NYSE:CRM), the cloud software giant, were moving higher today after the company announced a price increase across its core products.

In an announcement Tuesday morning, Salesforce said it would be increasing the list price by an average of 9% across key product lines like its sales cloud, service cloud, marketing cloud, and Tableau.

The company explained the move by saying it was its first list-price increase in seven years and that it had delivered 22 new releases since then, representing more than $20 billion in research and development. It also touted its new artificial intelligence (AI) products, including AI Cloud, Einstein GPT, and others.

Salesforce sells software under a subscription model. Its software helps businesses organize and handle sales operations and customer relationships. Also, the company has expanded into marketing, e-commerce and data analytics.

"It is worth noting the changes represent Salesforce's first list price increases in seven years, in which time the company has delivered 22 product releases and thousands of new features and enhancements, including generative AI-related developments," Truist analyst Terry Tillman said in a note to clients.

Salesforce stock climbed 3.9% to close at $221.17 on the stock market yesterday. With the gain, CRM stock has jumped 66% in 2023. Also, Salesforce holds an entry point of $225.10.

The CRM Weekly Options Trade Explained.....

** OPTION TRADE: Buy CRM JUL 28 2023 225.000 CALLS - price at last close was $3.75 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

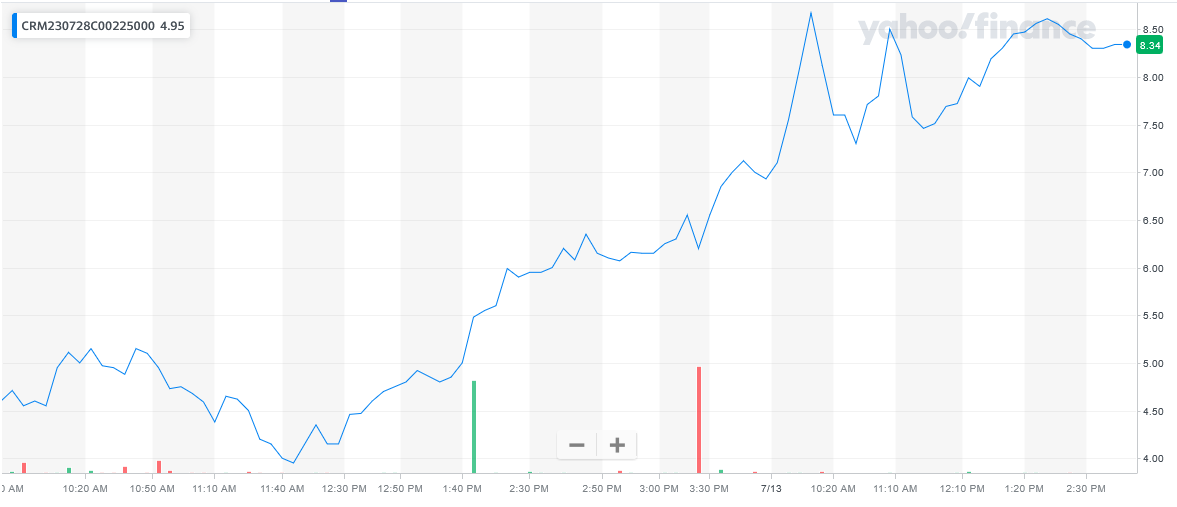

Entered the CRM Weekly Options (CALL) Trade on Wednesday, July 12, 2023 for $4.06.

Sold half the CRM Weekly Options contracts on Thursday, July 13, 2023, for $8.67; a potential profit of 114%.

Holding the remaining CRM weekly options contracts for further profit before expiry.

Don’t miss out on further trades – become a member today!

Further Catalysts for the CRM Weekly Options Trade…..

The enterprise software maker has taken steps to improve profit margins amid pressure from activist investors. They include Elliott Management, Starboard Value, Third Point, ValueAct Capital and Inclusive Capital.

In addition, Salesforce in January said it would cut 10% of its workforce and reduce office space as part of a restructuring plan.

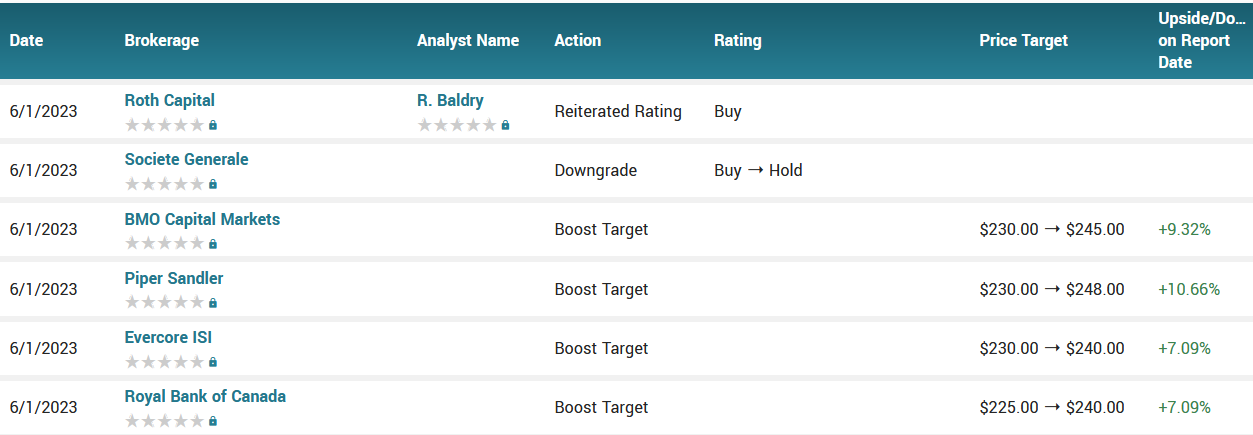

Analysts.....

The news, which shows the company's confidence at a time when much of the software industry is struggling with a slowdown in demand, earned it a round of applause from analysts. Raymond James maintained a strong buy rating on the stock, saying the price hikes aren't surprising and should be well received by the market.

Evercore ISI also called the price increase "pretty reasonable" as most of its peers push through annual increases of 4% to 5%, and said the move should be a tailwind going into 2024. The firm kept an outperform rating on the stock and a $240 price target, implying a 9% upside after today's gains.

According to the issued ratings of 39 analysts in the last year, the consensus rating for Salesforce stock is Moderate Buy based on the current 1 sell rating, 13 hold ratings, 24 buy ratings and 1 strong buy rating for CRM. The average twelve-month price prediction for Salesforce is $220.97 with a high price target of $275.00 and a low price target of $150.00.

Summary.....

Investor confidence has returned as the company cut costs through layoffs, real estate rationalization, and other moves, and sharpened its focus on profitability after developing a reputation for wasting money on acquisitions and other poor strategic decisions.

The price hikes should give income a significant lift since the additional revenue should flow through directly to the bottom line, and the company is unlikely to see much attrition given the sticky nature of cloud software products.

Salesforce has a debt-to-equity ratio of 0.16, a quick ratio of 1.02 and a current ratio of 1.02. Salesforce, Inc. has a 12-month low of $126.34 and a 12-month high of $225.00. The business’s 50-day moving average price is $208.76 and its 200 day moving average price is $184.27. The stock has a market cap of $206.44 billion, a P/E ratio of 550.04, and a price-to-earnings-growth ratio of 2.07 and a beta of 1.20.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from SALESFORCE

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!