TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Salesforce Earnings Report

Sends

Stock Surging!

Stock Climbs 7% Friday

And “Weekly Options Members”

Make 526% & 240%

Potential Profit For The Week!

Friday, May 28, 2021

by Ian Harvey

Friday saw the catalyst - Salesforce Earnings Report - send our Options trade surging. Salesforce reported stronger-than-expected Q1 results, topping both earnings and revenue estimates driven by strong business momentum.

Meantime, there are 2 recommendations running for “Weekly Options Members,” which have produced potential profits of 526% and 240%, respectively.

Excellent results again!

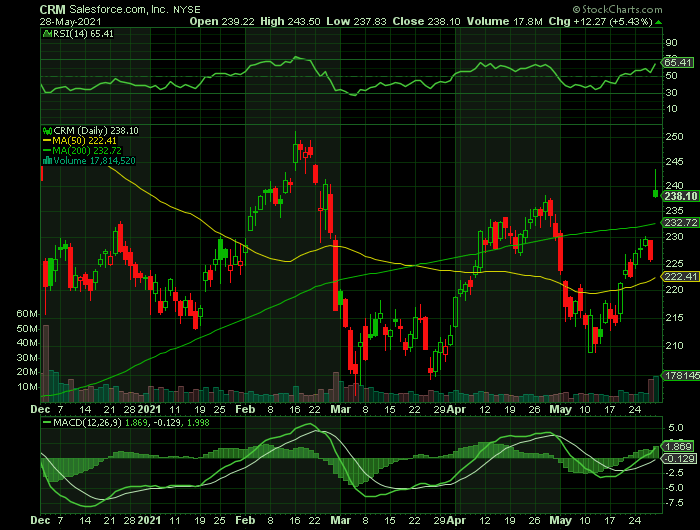

Salesforce.com, inc. (NYSE:CRM)

The major catalyst has been the expected Salesforce earnings report which was presented after the market closed Thursday, May 27, 2021.

Last week, due to the market fluctuation, members had been able to run concurrently two Salesforce weekly options trades, both of which have been very profitable.

Now after the Salesforce earnings report members of “Weekly Options USA” have scored big-time!

Shares of CRM have jumped 24.7% over the past year.

Salesforce Earnings Report…..

The company reported adjusted earnings of $1.21 per share, beating analysts’ estimates of $0.88 per share. Revenues of $5.96 billion exceeded the consensus estimate of $5.89 billion. Furthermore, earnings jumped 72.9% while revenues increased 22.6% on a year-over-year basis.

Even more encouraging, Salesforce reported big boosts to its total remaining performance obligations under current contracts. That number amounts to $35 billion, which works out to almost 1.5 years’ worth of revenue at current run rates. Salesforce has also strengthened its balance sheet, as cash and marketable securities balances have soared over the past couple of years.

Other Developments Helping Push-Up The Salesforce Earnings Report.....

Also, during Salesforce earnings report an announcement was made that the launch of the world’s largest software event, Dreamforce, was happening. The event will take place both in-person and digitally from September 21 – 23, 2021 across a global campus, including San Francisco, New York City, London, and Paris, among other cities.

Salesforce CEO Marc Benioff commented, “We believe our Customer 360 platform is proving to be the most relevant technology for companies accelerating out of the pandemic. With incredible momentum throughout our core business, we’re raising our revenue guidance for this fiscal year by $250 million to approximately $26 billion and non-GAAP operating margin to 18 percent. We’re on our path to reach $50 billion in revenue in FY26.”

Salesforce is in the process of buying Slack Technologies Inc. for $27.7 billion, an acquisition designed to fuel sales growth of more than 25% a year. The deal is part of Chief Executive Officer Marc Benioff’s effort to expand his company’s importance to a wide swath of corporate employees beyond the marketers and account representatives who use Salesforce apps to manage customers.

Moving Forward After A Great Salesforce Earnings Report.....

These solid results prompted Salesforce to boost its revenue and cash flow forecast. Based on Salesforce earnings report results, the company initiated guidance for the second quarter. Management expects Q2 2022 EPS in the range of $0.91 – $0.92, versus the consensus estimate of $0.85. Second-quarter revenues are expected to range between $6.22 billion and $6.23 billion, versus the consensus estimate of $6.15 billion.

For the Fiscal Year 2022, Salesforce projects adjusted EPS in the range of $3.79 – $3.81 and revenues to range between $25.9 billion and $26.0 billion.

Management now expects sales to rise roughly 22%, while operating cash flow grows as much as 13%.

"With incredible momentum throughout our core business, we're raising our revenue guidance for this fiscal year by $250 million to approximately $26 billion and non-GAAP [adjusted] operating margin to 18%," CEO Marc Benioff said. "We're on our path to reach $50 billion in revenue in FY26."

Analyst’s Optimistic After The Salesforce Earnings Report.....

Following the quarterly results announcement, Oppenheimer analyst Brian Schwartz maintained a Buy rating and a price target of $265 (11% upside potential) on the stock.

Schwartz said, “CRPO, which we view as the best leading indicator, accelerated to 32% growth in F1Q, and combined with the higher outlook implies results across the four clouds well-ahead of expectations too.”

The analyst further added, “Salesforce is generating a record number of big deals and magnitude of upside for the backlog and billings this quarter, which can support long-term growth. We believe the recovery and strength in the customer software market this year is driving a material benefit to the company’s bookings. On balance, the F2Q CRPO guidance implies a decel from this quarter, but could prove conservative given the strength in the end-market demand and execution.”

Cowen Inc. wrote in a note to clients before the results were announced, citing its surveys of Salesforce partners. With many companies expecting at least some of their workers to remain remote and tasks like sales calls to continue over teleconference, Salesforce clients are speeding up a move to modernize software, Chief Operating Officer Bret Taylor said in an interview. Meanwhile acquired products from the 2019 purchase of Tableau and 2018 takeover of MuleSoft were key parts of Salesforce’s biggest deals in the quarter.

“We’re seeing very, very healthy demand,” Taylor said. “You see it in our numbers, unambiguously.” Tableau figured into eight of the 10 biggest deals and MuleSoft was part of half of them, he said.

Overall, the stock has a Strong Buy consensus rating based on 18 Buys and 3 Holds. The average analyst price target of $279.25 implies 16.5% upside potential from current levels.

The Actual Recommended Salesforce Weekly Options Call Trades…..

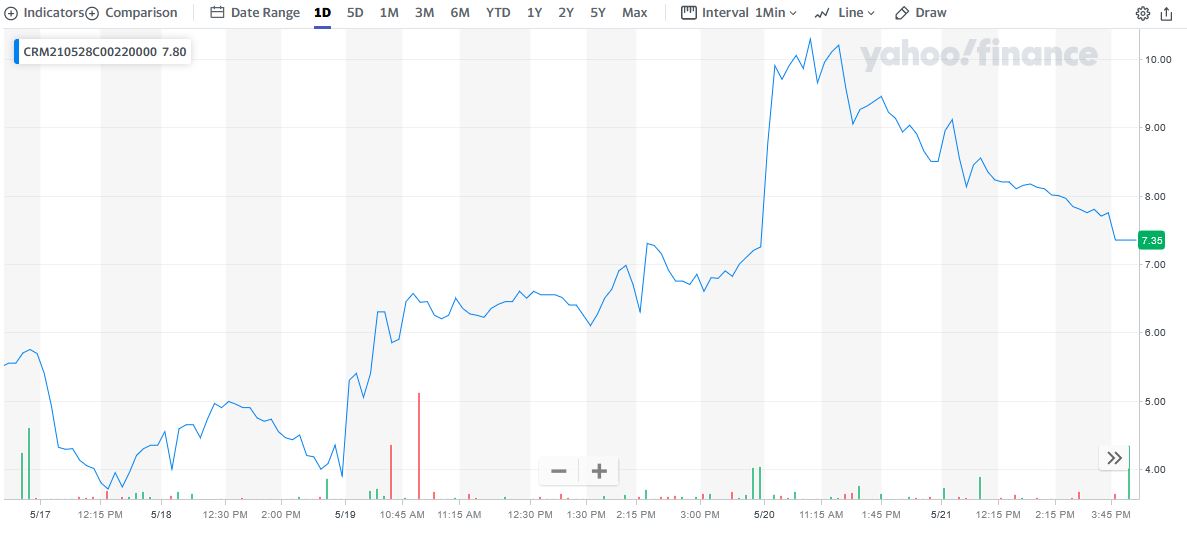

** Salesforce Weekly Options Call 1: Buy CRM MAY 28 2021 220.000 CALLS at approximately $5.70.

(actually bought for $3.60)

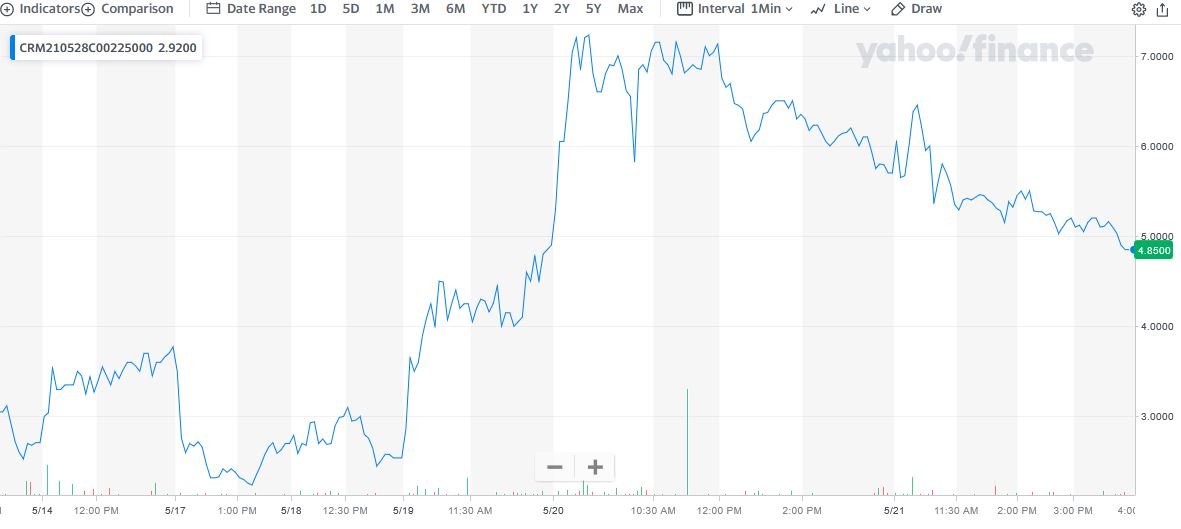

** Salesforce Weekly Options Call 2: Buy CRM MAY 28 2021 225.000 CALLS at approximately $5.00.

(actually bought for $5.30)

Salesforce Weekly Options Call Successes Explained.....

1. Weekly Options Members” entered a Salesforce weekly options trade on Monday, May 17, 2021 at 12:30pm – the low point for the day due to the pullback - for $3.60.

On Friday, May 28, 2021, our Salesforce weekly options trade climbed as high as $22.55 – a potential profit of 526%.

2. Weekly Options Members” entered a Salesforce weekly options trade on Thursday, May 20, 2021 at a cost of $5.30 at 9:30am.

On Friday, May 28, 2021, our Salesforce weekly options trade climbed as high as $18.00 – a potential profit of 240%.

Therefore…..

Members Have Exited The Trade After An Excellent Salesforce Earnings Report!

Will Teladoc Stock Price Continue Its Upward Momentum?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!

Back to Weekly Options USA Home Page from Zynga Earnings