TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Salesforce.com

Provides 221% Profit Using A Weekly Call Option!

Some stocks of particularly high quality have continued to gain over the first two weeks of the year. One of these is Salesforce.com, inc. (NYSE:CRM), the ever-popular customer management software platform.

Salesforce closed the latest trading day at $274.46, indicating a +1.11% change from the previous session's end. The stock outpaced the S&P 500's daily gain of 0.88%.

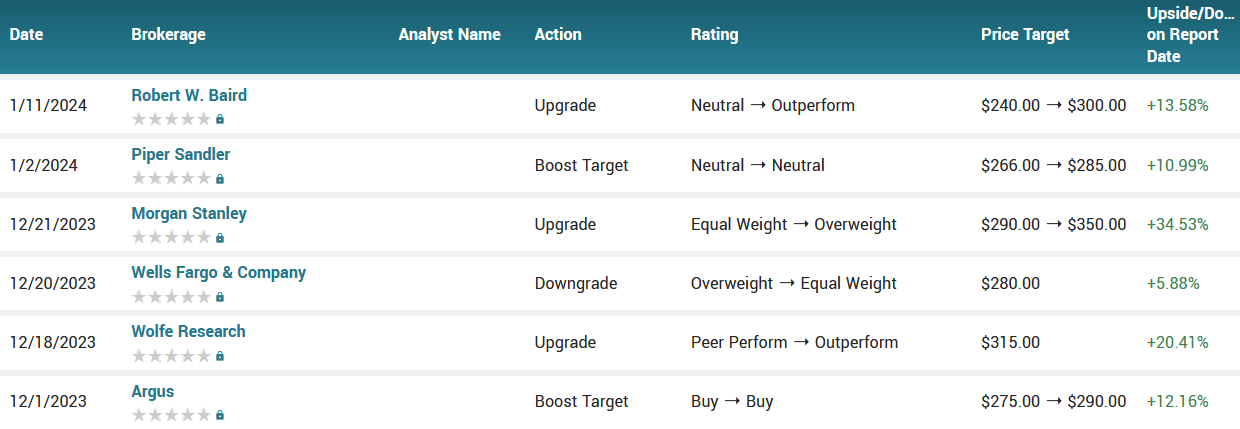

Last Thursday saw a fresh upgrade on Salesforce shares come from the team over at Baird. They upped their rating on the tech stock from Neutral to Outperform and, in the same breath, gave Salesforce shares a fresh price target of $300.

This set the scene for Weekly Options USA Members to profit by 221% using a CRM Options trade!

Join Us And Get The Trades – become a member today!

Saturday, January 20, 2024

by Ian Harvey

Why the Salesforce Weekly Options Trade was Originally Executed!

Some stocks of particularly high quality have continued to gain over the first two weeks of the year. One of these is Salesforce.com, inc. (NYSE:CRM), the ever-popular customer management software platform.

Salesforce closed the latest trading day at $274.46, indicating a +1.11% change from the previous session's end. The stock outpaced the S&P 500's daily gain of 0.88%.

Prior to yesterday's trading, shares of the customer-management software developer had gained 4.3% over the past month. This has outpaced the Computer and Technology sector's gain of 0.72% and the S&P 500's gain of 0.64% in that time.

Last Thursday saw a fresh upgrade on Salesforce shares come from the team over at Baird. They upped their rating on the tech stock from Neutral to Outperform and, in the same breath, gave Salesforce shares a fresh price target of $300.

Bullish upgrades like this, especially after a stock has already undergone a significant rally, will always be noticed by investors and tend to fuel even further gains in the near term. The team at Baird is bullish on the software sector as a whole, but on Salesforce in particular, and is particularly excited by the company's willingness to improve margins.

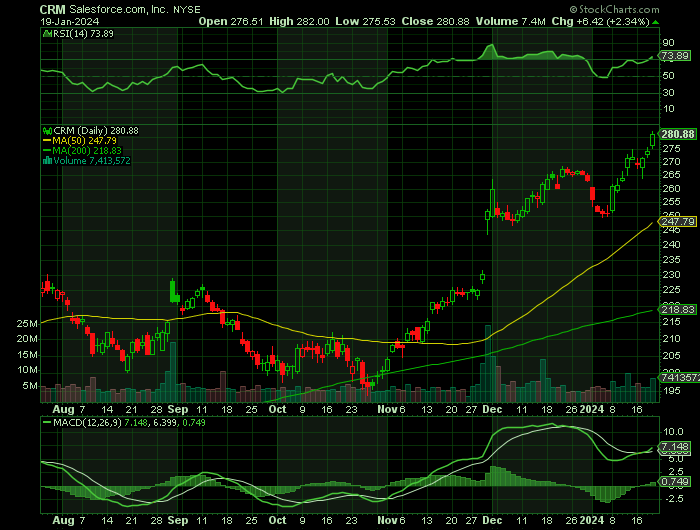

After hitting a high back in 2021, its shares started a slide that only bottomed out around this time last year. Since then, however, it's been all one-way traffic, with Salesforce shares currently up 115% in little more than twelve months. Indeed, almost a third of those gains have come since November, with the stock rallying nearly 10% alone over the past week. Heading into this week's trading, it's at its highest level in two years and looking good to continue gaining through the rest of the quarter.

The Salesforce Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy CRM FEB 09 2024 275.000 CALLS - price at last close was $4.89 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the CRM Weekly Options (CALL) Trade on Wednesday, January 17, 2024 for $3.28.

Sold the CRM weekly options contracts on Friday, January 19, 2024 for $10.52; a potential profit of221%.

Don’t miss out on further trades – become a member today!

About Salesforce.....

Salesforce, Inc. provides customer relationship management technology that brings companies and customers together worldwide.

Its Customer 360 platform empowers its customers to work together to deliver connected experiences for their customers. The company's service offerings include Sales to store data, monitor leads and progress, forecast opportunities, gain insights through analytics and relationship intelligence, and deliver quotes, contracts, and invoices; and Service that enables companies to deliver trusted and highly personalized customer service and support at scale. Its service offerings also comprise flexible platform that enables companies of various sizes, locations, and industries to build business apps to bring them closer to their customers with drag-and-drop tools; online learning platform that allows anyone to learn in-demand Salesforce skills; and Slack, a system of engagement. In addition, the company's service offerings include Marketing offering that enables companies to plan, personalize, and optimize one-to-one customer marketing journeys; and Commerce offering, which empowers brands to unify the customer experience across mobile, web, social, and store commerce points.

Further, its service offerings comprise Tableau, an end-to-end analytics solution serving various enterprise use cases; and MuleSoft, an integration offering that allows its customers to unlock data across their enterprise.

The company provides its service offering for customers in financial services, healthcare and life sciences, manufacturing, and other industries. It also offers professional services; and in-person and online courses to certify its customers and partners on architecting, administering, deploying, and developing its service offerings. The company provides its services through direct sales; and consulting firms, systems integrators, and other partners.

Salesforce, Inc. was incorporated in 1999 and is headquartered in San Francisco, California.

Further Catalysts for the CRM Weekly Options Trade…..

Salesforce's fundamentals have been consistently getting better, leading to a stronger balance sheet, with expectations rising for its margins and free cash.

On the most recent third-quarter earnings call with investors, Salesforce's management announced for the first time that 17% of Fortune 100 companies were already using its EinsteinGPT AI CoPilot, a competitor to Microsoft's (NASDAQ:MSFT) OpenAI-based AI copilot. The launch of AI capabilities and automation in its software has been key for Salesforce to turn back into growth mode.

While the Platform segment saw a huge bump in year-over-year revenue with the early adoption of AI tools, the trend in adoption has sustained in AI and automation tools such as MulesSft and Tableau, leading to stronger year-over-year revenue growth.

Other Catalysts.....

In the last several years, Salesforce has made some strategic acquisitions, buying startups such as Slack, Tableau and MuleSoft, spending close to $50 billion. While Slack's services focus on organizational communication software, Tableau's services focus on intelligent data and analytics dashboards abd MuleSoft's software focused on automation and analytics. The most important point here is that all these acquisitions have been playing a critical role in providing growth to Salesforce.

Moving Forward.....

Per management's most recent forward-looking commentary, Salesforce is projected to grow 11% on a year-over-year basis. While those are still respectable gains, the real benefits for an investor will be seen in the company's margin expansion.

On the recent third-quarter call, management expressed immense confidence in moving ahead with achieving high-margin growth, with the chief financial officer saying, “We view this as a floor, not a ceiling on our success, and we intend to continue our focus on operating margin.”

Salesforce's management is confident they will be able to grow their earnings by approximately 56% to $8.19 per share, driven by higher cost efficiency in expenses. Consensus estimates project Salesforce's earnings per share to grow by around 18%. Given that Salesforce has a history of beating earnings expectations by at least 1.95% in the past five years, management's forward-looking guidance and consensus estimates are quite reasonable to assume this valuation.

GenAI-Powered Tools....

Salesforce, a leader in artificial intelligence (AI)-driven Customer Relationship Management (“CRM”), has unveiled a suite of innovative tools at NRF 2024 to reshape the retail landscape. These advancements, powered by the Einstein 1 Platform, bring generative AI to Commerce Cloud and Marketing Cloud, offering retailers real-time insights into customer behavior for enhanced interactions.

The Einstein 1 Platform seamlessly integrates with retail and shopper data, ensuring real-time context, data governance and security. With Salesforce data indicating that 83% of global retailers witness operational efficiency improvements with AI and 63% of marketers emphasizing the importance of trusted customer data for implementing generative AI, these tools address the critical aspects of the retail industry.

For shoppers, Salesforce introduces "Einstein Copilot for Shoppers," a consumer-facing version of the generative AI assistant. It facilitates natural language interactions, allowing customers to swiftly discover products and complete purchases. The AI assistant uses contextual data, such as location, preferences and past purchases, to provide personalized recommendations.

Analysts.....

Analysts at Baird consider the current valuation to be surprisingly attractive and believe Wall Street could be seriously underestimating the company's ability to deliver top-line growth through 2024. From where shares closed last week, they're looking for a further gain of some 10%, which would put the stock within touching distance of 2021's all-time high.

Also, Bank of America also joined the bull camp in recent weeks, calling Salesforce a large-cap top pick for 2024, based on improving front-office demand along with the same attractive valuation that Baird picked up on. This echoed the sentiment from Bank of America, who, in the first week of the year, called Salesforce a top software stock to own for 2024.

According to the issued ratings of 38 analysts in the last year, the consensus rating for Salesforce stock is Moderate Buy based on the current 10 hold ratings, 27 buy ratings and 1 strong buy rating for CRM. The average twelve-month price prediction for Salesforce is $262.36 with a high price target of $350.00 and a low price target of $153.00.

Summary.....

Salesforce has a market capitalization of $260.58 billion, a price-to-earnings ratio of 102.54, a PEG ratio of 2.10 and a beta of 1.28. The company has a current ratio of 1.04, a quick ratio of 1.04 and a debt-to-equity ratio of 0.15. The business has a fifty day simple moving average of $246.40 and a 200 day simple moving average of $224.52. Salesforce, Inc. has a twelve month low of $143.16 and a twelve month high of $275.24.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Salesforce

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!