TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Salesforce Shares Are Moving Higher!

And Members Are Up 359% Potential Profit, Using

A Weekly Call Option!

Members of “Weekly Options USA,”

Using A Weekly Call Option, Make Potential Profit Of 359%,

After The Leader In Enterprise Cloud Software, Salesforce,

Closed Out The Month By Exceeding Wall Street's

Forecasts

For First-Quarter Sales And Earnings.

Where To Now?

It appears that Wall Street fears were slightly overblown, and combined with several other factors, has pushed Salesforce stock higher ahead of its own earnings report on the last day of May.

The leader in customer relationship management (CRM) beat analyst forecasts for revenue and earnings, reaffirmed its full-year sales forecast, and increased its profit margin guidance.

This set the scene for Weekly Options USA Members to profit by 359%, using a CRM Weekly Options trade!

Join Us And Get The Trades – become a member today!

Sunday, June 11, 2023

by Ian Harvey

Why Salesforce Shares Jumped Friday!…..

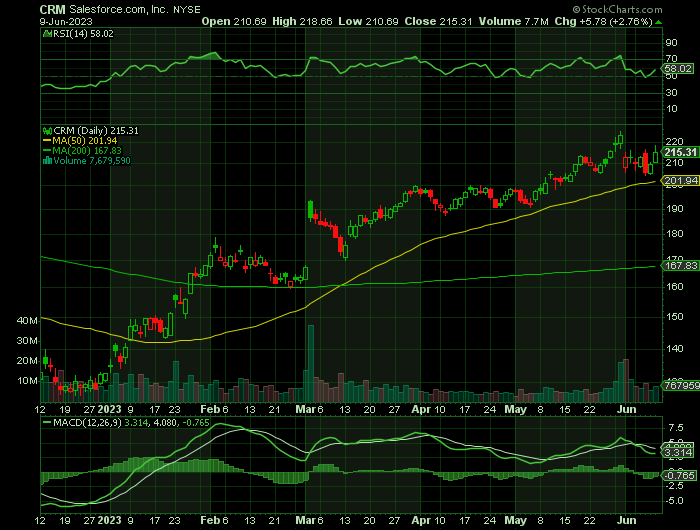

After a horrendous showing in 2022 (shares fell 48%), Salesforce stock has rallied nearly 60% so far in 2023. And that includes a post-earnings dip due to some mild investor disappointment with a lack of a more meaningful upgrade in financial outlook.

Salesforce kicked off its first quarter fiscal 2024 (ended April 30, 2023) in strong fashion. Revenue was up 11% year over year to $8.25 billion, about $70 million above guidance provided three months ago.

During the last earnings call, Benioff talked at length about the transformative force that generative AI will be. More importantly to shareholders, though, he added making Salesforce "the most profitable enterprise software company in the world" to the list of lofty aspirations.

Why the Salesforce Weekly Options Trade was Originally Executed?

Salesforce.com, inc. (NYSE:CRM) reported better-than-expected financial results for the first quarter of fiscal 2024. The enterprise cloud computing solution provider’s first-quarter fiscal 2024 non-GAAP earnings increased 71.4% to $1.69 per share from 98 cents reported in the year-ago quarter. The figure surpassed the Consensus Estimate of $1.61.

Also, the company’s ongoing restructuring initiative, which includes trimming the workforce, benefited first-quarter non-GAAP earnings by 72 cents per share.

This was a decent quarter with a profit rise of 68% year-to-date by the market close. With AI claimed to be the company’s biggest assets, Salesforce promises to be a worthy rival to Microsoft and Google in this arena.

Salesforce stock has gained 60% in 2023. CRM stock has outperformed the Nasdaq composite and the iShares Expanded Tech-Software ETF (IGV). The Nasdaq has gained 27% in 2023.

The CRM Weekly Options Trade Explained.....

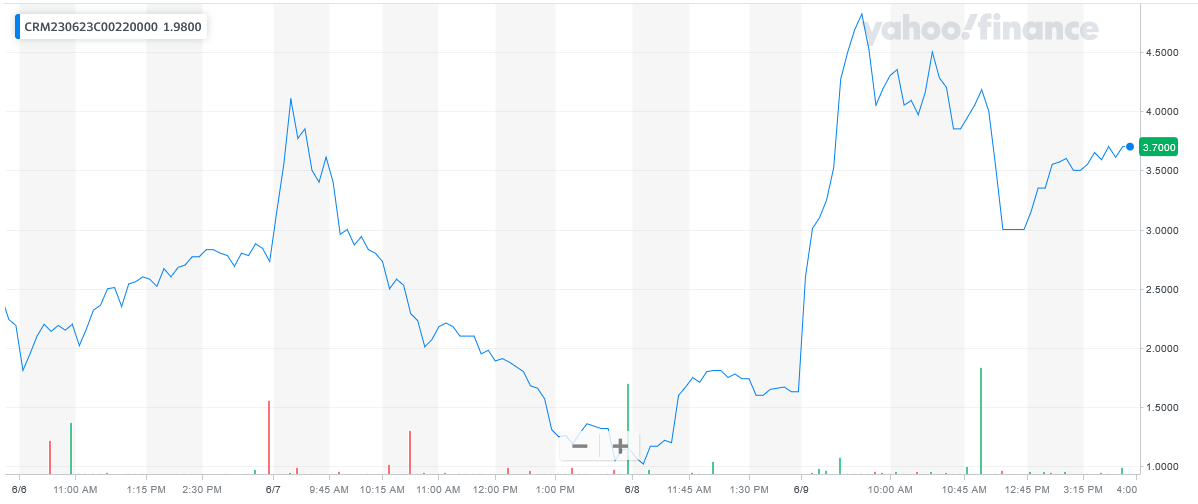

** OPTION TRADE: Buy CRM JUN 23 2023 220.000 CALLS - price at last close was $2.73 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the CRM Weekly Options (CALL) Trade on Wednesday, June 07, 2023 for $1.05.

Sold half the CRM weekly options contracts on Friday, June 09, 2023 for $4.82; a potential profit of359%.

Total Dollar Profit is $482 - $105 (cost of contract) = $377

Holding the remaining CRM weekly options contracts for further profit before expiry.

Don’t miss out on further trades – become a member today!

About Salesforce.....

Salesforce, Inc. provides customer relationship management technology that brings companies and customers together worldwide.

Its Customer 360 platform empowers its customers to work together to deliver connected experiences for their customers. The company's service offerings include Sales to store data, monitor leads and progress, forecast opportunities, gain insights through analytics and relationship intelligence, and deliver quotes, contracts, and invoices; and Service that enables companies to deliver trusted and highly personalized customer service and support at scale. Its service offerings also comprise flexible platform that enables companies of various sizes, locations, and industries to build business apps to bring them closer to their customers with drag-and-drop tools; online learning platform that allows anyone to learn in-demand Salesforce skills; and Slack, a system of engagement. In addition, the company's service offerings include Marketing offering that enables companies to plan, personalize, and optimize one-to-one customer marketing journeys; and Commerce offering, which empowers brands to unify the customer experience across mobile, web, social, and store commerce points.

Further, its service offerings comprise Tableau, an end-to-end analytics solution serving various enterprise use cases; and MuleSoft, an integration offering that allows its customers to unlock data across their enterprise.

The company provides its service offering for customers in financial services, healthcare and life sciences, manufacturing, and other industries. It also offers professional services; and in-person and online courses to certify its customers and partners on architecting, administering, deploying, and developing its service offerings. The company provides its services through direct sales; and consulting firms, systems integrators, and other partners.

Salesforce, Inc. was incorporated in 1999 and is headquartered in San Francisco, California.

Further Catalysts for the CRM Weekly Options Trade…..

Salesforce’s quarterly revenues of $8.25 billion climbed 11% year over year, surpassing the Consensus Estimate of $8.17 billion. The top line also improved 13% in constant currency. Despite this, the company's revenue growth for the quarter came in at its slowest pace since 2010. This slowdown was partly due to a shortfall in under-contract sales expected in the next 12 months (that is, cRPO, or current revenue performance obligation).

However, for the upcoming quarter Salesforce expects sales of $8.51B to $8.53B, higher than the $8.49B estimates.

The company has been benefiting from the robust demand environment as customers are undergoing a major digital transformation. Thus, the rapid adoption of its cloud-based solutions resulted in the better-than-anticipated performance in the fiscal first quarter.

Other Positive Catalysts.....

The company's stock led the NYSE gainers with a relatively large price hike in the past couple of weeks, but Salesforce is still trading at a fairly cheap price.

With profit expected to more than double over the next couple of years, the future seems bright for Salesforce. It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation.

CRM is currently undervalued, and with a positive outlook on the horizon, it seems like growth has not yet been fully factored into the share price.

Re-shuffling Top Positions.....

Salesforce Inc CEO Marc Benioff has shuffled the top management, a move that follows after the software company reported its slowest quarterly revenue growth since 2010.

Miguel Milano has been appointed as the chief revenue officer, adding that Ariel Kelman will take over as Salesforce's chief marketing officer.

After a previous tenure of nearly a decade at Salesforce, Milano will make a return from his recent position at software company Celonis. Kelman has previously served as CMO at Amazon Web Services and Oracle.

Kendall Collins, who will step into the role of chief of staff for Benioff, had worked as CMO at Okta and Cisco's AppDynamics.

Salesforce President and Chief Operating Officer Brian Millham would be assuming new duties such as marketing, employee success and business technology.

The appointments at Salesforce come amid mounting pressure from activist investors, including ValueAct, Inclusive Capital, and Starboard Value, who have been advocating for operational improvements, cost-control initiatives, and enhanced efficiencies over the past several months.

Earlier this year, Salesforce announced plans to close some offices and cut jobs by 10% after the pandemic-induced hiring left the company with a bloated workforce.

Other Moves.....

Salesforce in early 2023 disbanded a panel that explores mergers and acquisitions, implying it will make no more big acquisitions.

Further, rising corporate spending on digital transformation projects remains a plus for Salesforce stock.

Salesforce sells software under a subscription model. Its software helps businesses organize and handle sales operations and customer relationships. The company has expanded into marketing, e-commerce and data analytics.

Digital Transformation.....

During the coronavirus pandemic, demand for next-generation collaboration and productivity tools increased. In addition, many companies aim to automate operations and track key business metrics in order to support employees working from home.

Digital transformation projects turn paperwork into electronic records and automate business workflows. More companies are investing in business analytics and artificial intelligence tools that scrub customer data.

In addition, CRM stock could get a lift from U.S. federal information technology spending. The company provides "no-code" programming tools for the public sector.

Development.....

The customers of software-as-a-service, or SaaS, companies like Salesforce purchase renewable subscriptions, rather than one-time software licenses. Customers receive automatic software updates via the web.

Also, the company spends about 14% of revenue on research and development, relatively high for a software company. Increased hiring and wage inflation for software engineers also have been a headwind to margin growth.

AI.....

One technology that Salesforce hopes will drive more revenue is artificial intelligence. The enterprise software maker introduced its "Einstein" AI software cloud platform in September 2016. The first Einstein AI software tools helped salespeople predict which deals are most likely to close based on a company's historical lead and account data.

In addition, Salesforce has integrated AI tools into other enterprise software offerings over the past three years, targeting industries such as financial services in digital transformation. Einstein AI primarily works via chat bots.

Salesforce in 2019 agreed to buy data analytics firm Tableau for $15.7 billion in an all-stock deal. Tableau provides data visualization software. In addition, it enables customers to build databases, graphs and maps using time series analytics, a technique that analyzes a series of data points ordered in time.

Also, Salesforce expects synergy between its Einstein artificial intelligence tools and Tableau's business intelligence software. In 2021, Salesforce announced that it would rebrand Einstein Analytics as Tableau CRM.

Analysts.....

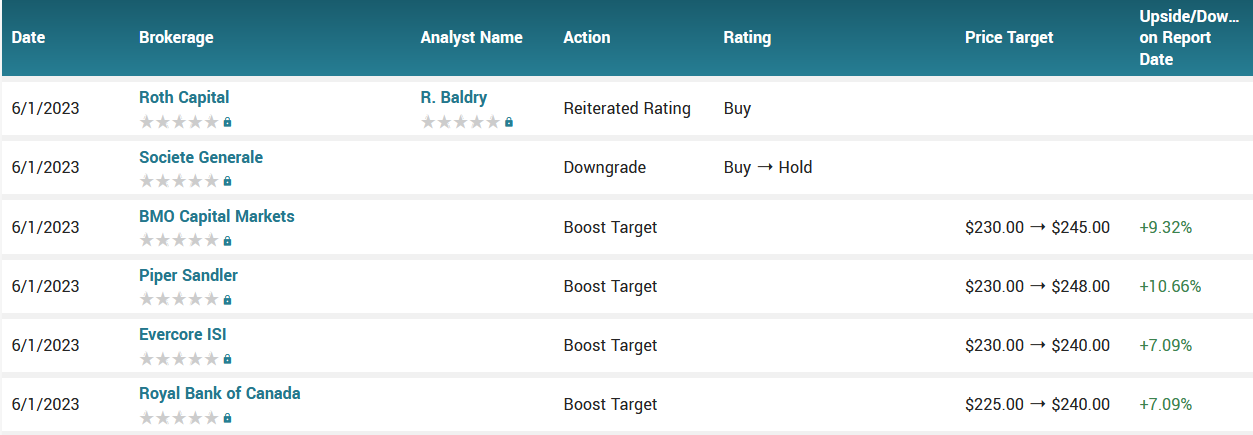

Goldman Sachs reiterated its Buy rating on CRM shares, citing the results as "strong in light of the challenging macro backdrop."

"The magnitude of revenue outperformance was below historical trends and guidance for Q2 CRPO (current remaining performance obligations), to grow +10% year-over-year was 1% below expectations," Goldman Sachs analyst Kash Rangan said in a note to clients.

Further, CRPO bookings are an aggregate of deferred revenue and order backlog.

Similarly, Bank of America reaffirmed a Top Pick status on CRM, noting it was "impressed" by the 1% guidance beat for cRPO growth "given the tough macro and disruption from restructuring actions.”

According to the issued ratings of 39 analysts in the last year, the consensus rating for Salesforce stock is Moderate Buy based on the current 1 sell rating, 13 hold ratings, 24 buy ratings and 1 strong buy rating for CRM. The average twelve-month price prediction for Salesforce is $220.97 with a high price target of $275.00 and a low price target of $150.00.

Summary.....

The upbeat view is that acquisitions have enabled Salesforce to expand from its roots in customer relationship management software into marketing, e-commerce and other markets.

Salesforce is one of many big-cap tech stocks to watch. Started in 1999, Salesforce went public in 2004. Benioff, who is also Salesforce's founder, worked at Oracle for 13 years before he left to start the software company.

CRM stock in 2020 was added to the Dow Jones Industrial Average. Further, it replaced Exxon Mobil (XOM) in the 30-stock benchmark.

Shares of CRM stock traded up $0.90 during mid-day trading on Tuesday, hitting $210.76. The company’s stock had a trading volume of 1,885,878 shares, compared to its average volume of 7,771,836. The stock has a market cap of $205.28 billion, a price-to-earnings ratio of 548.57, a PEG ratio of 2.24 and a beta of 1.24. The company has a debt-to-equity ratio of 0.16, a quick ratio of 1.02 and a current ratio of 1.02. Salesforce, Inc. has a 52-week low of $126.34 and a 52-week high of $225.00. The business has a 50-day moving average price of $201.02 and a 200 day moving average price of $172.28.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from SALESFORCE

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!