TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Salesforce

Stock Jumps On Earnings

Exceeding Wall Street Estimates!

Weekly Options Members

Are Up 832% Potential Profit

Using A Weekly CALL Option!

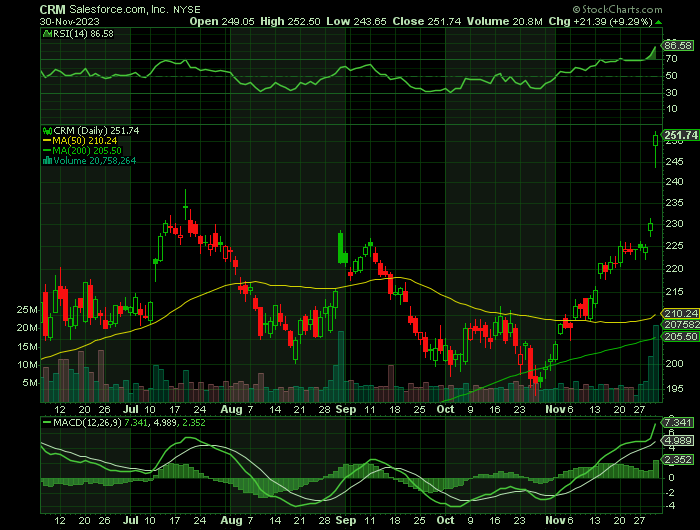

Salesforce.com, inc. shares surged as much as 9.6% early Thursday to a nearly two-year high, after the customer relationship management (CRM) platform provider announced better-than-expected quarterly results and strong forward guidance.

Multiple analysts, including from Morgan Stanley, Evercore, Wells Fargo, and Deutsche Bank, raised their price target for Salesforce's shares following the results.

This set the scene for Weekly Options USA Members to profit by 832%, using a CRM Options trade!

Join Us And Get The Trades – become a member today!

Thursday, November 30, 2023

by Ian Harvey

Salesforce.com, inc. (NYSE:CRM) shares surged as much as 9.6% early Thursday to a nearly two-year high, after the customer relationship management (CRM) platform provider announced better-than-expected quarterly results and strong forward guidance.

Salesforce's quarterly revenue grew 11% year over year to $8.72 billion, translating to net income of $1.22 billion, or $1.25 per share, under generally accepted accounting principles (GAAP). On an adjusted (non-GAAP) basis, which excludes one-time items like stock-based compensation and restructuring expenses -- Salesforce's earnings were $2.07 billion, or $2.11 per share. Most analysts were only modeling earnings of $2.06 per share on roughly the same revenue.

Multiple analysts, including from Morgan Stanley, Evercore, Wells Fargo, and Deutsche Bank, raised their price target for Salesforce's shares following the results.

The current median price target of the 48 analysts covering Salesforce is now $275, up from $257.50 a month ago, and their current recommendation is "buy."

"Salesforce represents a top AI (artificial intelligence) opportunity," said BofA Global Research analysts led by Brad Sills in an investor note, adding that they are more confident the company is on the "path back to sustained mid-teens subscription growth."

Salesforce is up 81.7% since the beginning of the year.

Why the Salesforce.com, inc.Weekly Options Trade was Originally Executed!

Boasting a booming share price, Salesforce attracted more investor cash during the third quarter according to regulatory filings.

Sachem Head Capital Management increased its stake in Salesforce by 33% during the third quarter while Farallon Capital Management upped its holding by 30% to own 2.5 million shares on September 30, the filings show.

Cost cuts, a boost in share buybacks and the dismantlement of its mergers and acquisition committee, plus stronger earnings increased investor backing. And news that one of the activists, Mason Morfit who runs ValueAct Capital, was invited onto the board helped silence some critics.

Salesforce's stock price has surged 64% since January.

While Salesforce's stock price lost some ground during the third quarter, it has continued to move higher and closed trading at $221.18 on Tuesday.

The Salesforce.com, inc. Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy CRM DEC 01 2023 230.000 CALLS - price at last close was $3.70 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

After the opening bell the stock dropped from the previous close which allowed for a cheaper entry for the trade.

Entered the CRM Weekly Options (CALL) Trade on Wednesday, November 15, 2023 for $2.39.

Sold the CRM weekly options contracts hit a high Thursday, November 30 at $22.29; a potential profit of832%.

Don’t miss out on further trades – become a member today!

About Salesforce.....

Salesforce, Inc. provides customer relationship management technology that brings companies and customers together worldwide.

Its Customer 360 platform empowers its customers to work together to deliver connected experiences for their customers. The company's service offerings include Sales to store data, monitor leads and progress, forecast opportunities, gain insights through analytics and relationship intelligence, and deliver quotes, contracts, and invoices; and Service that enables companies to deliver trusted and highly personalized customer service and support at scale. Its service offerings also comprise flexible platform that enables companies of various sizes, locations, and industries to build business apps to bring them closer to their customers with drag-and-drop tools; online learning platform that allows anyone to learn in-demand Salesforce skills; and Slack, a system of engagement. In addition, the company's service offerings include Marketing offering that enables companies to plan, personalize, and optimize one-to-one customer marketing journeys; and Commerce offering, which empowers brands to unify the customer experience across mobile, web, social, and store commerce points.

Further, its service offerings comprise Tableau, an end-to-end analytics solution serving various enterprise use cases; and MuleSoft, an integration offering that allows its customers to unlock data across their enterprise.

The company provides its service offering for customers in financial services, healthcare and life sciences, manufacturing, and other industries. It also offers professional services; and in-person and online courses to certify its customers and partners on architecting, administering, deploying, and developing its service offerings. The company provides its services through direct sales; and consulting firms, systems integrators, and other partners.

Salesforce, Inc. was incorporated in 1999 and is headquartered in San Francisco, California.

Further Catalysts for the CRM Weekly Options Trade…..

Salesforce has refocused on improving operating margins amid cost-cutting spurred by activist investors. They included Elliott Management, Starboard Value, Third Point, ValueAct Capital and Inclusive Capital.

At its Dreamforce customer conference in San Francisco in September, Salesforce focused on generative artificial intelligence. Salesforce is one of many AI stocks to watch.

At Dreamforce, Salesforce announced the launch of the Einstein 1 platform and Einstein Copilot feature. Copilot is a conversational AI assistant that is integrated within the user interfaces of all Salesforce apps.

Other Catalysts.....

Salesforce in January said it will cut 10% of its workforce and reduce office space as part of a restructuring plan amid expectations that revenue growth will slow in fiscal 2024. More job cuts could be coming, some analysts speculate.

Salesforce in early 2023 disbanded a panel that explores mergers and acquisitions, implying it will make no more big acquisitions.

Further, rising corporate spending on digital transformation projects remains a plus for Salesforce stock.

Salesforce sells software under a subscription model. Its software helps businesses organize and handle sales operations and customer relationships. The company has expanded into marketing, e-commerce and data analytics.

Digital Transformation.....

During the coronavirus pandemic, demand for next-generation collaboration and productivity tools increased. In addition, many companies aim to automate operations and track key business metrics in order to support employees working from home.

Digital transformation projects turn paperwork into electronic records and automate business workflows. More companies are investing in business analytics and artificial intelligence tools that scrub customer data.

The bar keeps rising when investors look at Salesforce's "biggest acquisition ever."

Its purchase of Exact Target in 2013 was followed by e-commerce platform Demandware in 2016, and MuleSoft in 2018. Last year, Salesforce ponied up $15.7 billion in an all-stock deal to buy data analytics firm Tableau Software.

Then came the Slack deal, which closed in July. Amid growing competition with Microsoft (MSFT), Salesforce agreed to pay $27.7 billion for workplace collaboration software maker.

The upbeat view is that acquisitions have enabled Salesforce to expand from its roots in customer relationship management software into marketing, e-commerce and other markets.

Salesforce is one of many big-cap tech stocks to watch.

Fundamentals.....

For the quarter ended July 31, Salesforce earnings jumped 78% to $2.12 per share on an adjusted basis. Salesforce also said revenue climbed 11% to $8.6 billion.

Also, CRM stock analysts expected Salesforce to report earnings of $1.90 a share on sales of $8.53 billion.

Further, operating margins came in at 31.6% versus estimates of 28.3%.

A key financial metric, current remaining performance obligation, known as CRPO bookings, topped views. CRPO rose 12% to $24.1 billion versus estimates of $23.67 billion. CRPO bookings are an aggregate of deferred revenue and order backlog.

For the current quarter ending in October, Salesforce projected profit of $2.05 per share, well ahead of estimates of $1.84 per share. The company predicted revenue of $8.71 billion for CRM stock, topping estimates of $8.67 billion.

Artificial Intelligence.....

One technology that Salesforce hopes will drive more revenue is artificial intelligence. The enterprise software maker introduced its "Einstein" AI software cloud platform in September 2016. The first Einstein AI software tools helped salespeople predict which deals are most likely to close based on a company's historical lead and account data.

In addition, Salesforce has integrated AI tools into other enterprise software offerings over the past three years, targeting industries such as financial services in digital transformation. Einstein AI primarily works via chat bots.

But Salesforce has yet to disclose financial metrics on how much revenue the Einstein AI platform generates, directly or indirectly.

Meanwhile, Salesforce in 2019 agreed to buy data analytics firm Tableau for $15.7 billion in an all-stock deal. Tableau provides data visualization software. In addition, it enables customers to build databases, graphs and maps using time series analytics, a technique that analyzes a series of data points ordered in time.

Also, Salesforce expects synergy between its Einstein artificial intelligence tools and Tableau's business intelligence software. In 2021, Salesforce announced that it would rebrand Einstein Analytics as Tableau CRM.

Analysts.....

Bullish analysts say Salesforce AI's tools, plus Tableau and MuleSoft will make a powerful combination for digital transformation projects.

Also, Salesforce aims to partner with IT services firms such as Accenture (ACN) to add customers. Despite U.S.-China trade tensions, Salesforce has added Alibaba Group (BABA) as a sales channel partner in China.

In cloud computing, Salesforce has partnered with Google for data analytics. In addition, Salesforce has expanded its venture capital investing.

According to the issued ratings of 41 analysts in the last year, the consensus rating for Salesforce stock is Moderate Buy based on the current 1 sell rating, 14 hold ratings, 25 buy ratings and 1 strong buy rating for CRM. The average twelve-month price prediction for Salesforce is $241.28 with a high price target of $280.00 and a low price target of $153.00.

Summary.....

Shares of CRM traded up $5.09 during midday trading on Tuesday, hitting $220.37. 1,647,259 shares of the company’s stock traded hands, compared to its average volume of 6,464,129. Salesforce, Inc. has a 1 year low of $126.34 and a 1 year high of $238.22. The firm’s fifty day moving average is $208.61 and its 200-day moving average is $211.21. The company has a current ratio of 1.02, a quick ratio of 1.02 and a debt-to-equity ratio of 0.15. The stock has a market capitalization of $214.42 billion, a price-to-earnings ratio of 135.39, and a price-to-earnings-growth ratio of 1.62 and a beta of 1.18.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Salesforce.com, inc.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%! -

Palantir Future Looks Promising!

Palantir Future Looks Promising! Weekly Options Members Profit Up 102%! As of 2024, Palantir has seen a significant uptick in its stock performance, with a remarkable 114% increase year-to-date.