TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Shopify Inc Shares Are Moving Higher!

And Members Are Up 60% Potential Profit, In Under 3 Hours,

Using

A Weekly Call Option!

Members of “Weekly Options USA,”

Using A Weekly Call Option, Make Potential Profit Of 60%,

In Under 3 Hours, As Shopify

Inc Currently Offers An Entry Point

As It Rallied Above Its 21-Day Moving

Average With The June 6 Price Action.

Where To Now?

The stock market is back in a confirmed uptrend. This means it is the best time to be buying fundamentally strong stocks breaking out of proper base patterns. These names will tend to have rising relative strength lines. Therefore, it’s a good time to add Shopify Inc (NYSE: SHOP) to our options trading week.

Shopify reported solid-sales volume growth in the most recent quarter, in part thanks to rising demand for international sales. Overall, revenue was up 27%, in part thanks to rising seller fees.

This set the scene for Weekly Options USA Members to profit by 60%, in under 3 hours, using a SHOP Weekly Options trade!

Join Us And Get The Trades – become a member today!

Tuesday, June 13, 2023

by Ian Harvey

Why the Shopify Inc Weekly Options Trade was Originally Executed?

A stock market rally that kicked off 2022 soon fell on its face. The market overall has been choppy since then, with bear market rallies often being undercut by painful drawdowns. Recent bullish action has seen the Nasdaq and the S&P 500 move back above their major moving averages, with the passage of the debt-ceiling deal helping to push indexes higher.

The stock market is back in a confirmed uptrend. This means it is the best time to be buying fundamentally strong stocks breaking out of proper base patterns. These names will tend to have rising relative strength lines. Therefore, it’s a good time to add Shopify Inc (NYSE: SHOP) to our options trading week.

E-commerce is reshaping the economy. Online shopping is a more convenient alternative to brick-and-mortar retail. This technology is not particularly new at this point, but still offers plenty of potential upside.

Shopify reported solid-sales volume growth in the most recent quarter, in part thanks to rising demand for international sales. Overall, revenue was up 27%, in part thanks to rising seller fees.

Merchants are also choosing to rely on Shopify for more services, which is a great sign for the company's long-term ambitions. And the stock is priced well below $100 per share even following its recent rally.

Expect to see significant price gains from a stock with forecasts of 715% earnings growth, which is happening with Shopify.

Analysts are forecasting earnings per share of $0.33 this year, a gain of 715% in a strong turnaround from 2022, admittedly against easy comparisons. Wall Street still expects a loss in the current quarter but sees revenue growing by 25% to $1.62 billion.

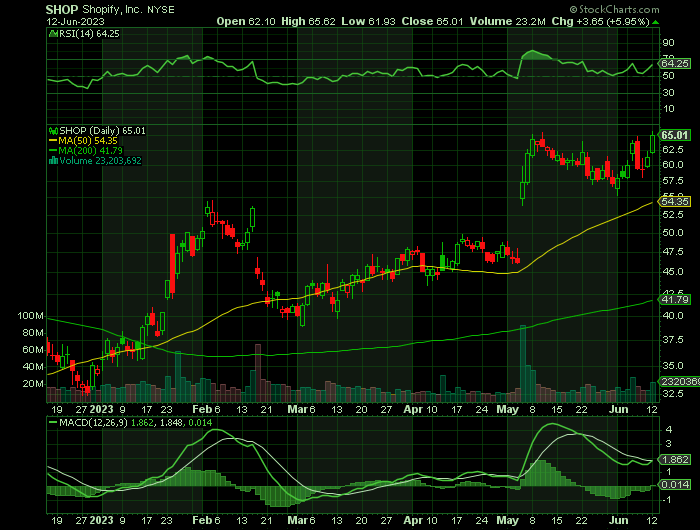

Shares of the cloud-based e-commerce platform rallied 6.24% on June 6, closing at $63.66 in trading volume, 86% higher than average.

The stock has been working on the right side of a consolidation that began in mid-May. Shopify stock currently offers an entry point as it rallied above its 21-day moving average with the June 6 price action.

Shopify’s technology allows small businesses to make online sales without the hassle and expense of setting up their own payment and fulfillment operations.

The SHOP Weekly Options Trade Explained.....

** OPTION TRADE: Buy SHOP JUL 07 2023 62.000 CALLS - price at last close was $3.10 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the SHOP Weekly Options (CALL) Trade on Monday, June 12, 2023, at 10:07, for $3.49.

Sold half the SHOP weekly options contracts on Monday, June 12, 2023, at 12:37, for $5.60; a potential profit of 60%.

Total Dollar Profit is $560 - $349 (cost of contract) = $211

Holding the remaining SHOP weekly options contracts for further profit before expiry.

Don’t miss out on further trades – become a member today!

About Shopify.....

Shopify Inc. is a commerce platform and eCommerce infrastructure provider connecting small businesses with a large and growing global marketplace. The company was formed in 2004 in Ottawa, Canada as Jaded Pixel Technologies but changed its name to Shopify Inc in 2011. The name change was part of a rebranding strategy that helped accelerate the business and drive it to $5.5 billion in sales in 2022.

As of October 2022, the company boasted “millions” of merchants in 175 countries with more than $543 billion in economic activity generated since launch. In terms of scale, Shopify employs more than 10,000 individuals and is among the top 20 publicly traded companies in Canada.

Shopify was founded by Tobi Lütke. Mr. Lütke had been working on a website for a snowboard store but quickly realized the software was more valuable than just selling snowboards so his team switched gears. The platform was launched in 2006 and it quickly gained momentum. Mr. Lütke is a member of the board of directors and the company’s CEO, a position he has held since 2008.

Shopify is a commerce company but, more importantly, it is an eCommerce commerce company that can assist small businesses with all aspects of their operations. The company is in business to provide an eCommerce platform for small businesses globally. Its platform enables merchants to market, manage, and sell their products through a variety of sales channels that include but are not limited to eCommerce. Channels include the company’s core Shopify.com website as well as brick & mortar locations, pop-ups, social media, and buy-now buttons.

Because branding is such an important part of a business's success the company goes to great lengths to assist its merchants in that regard. The Shopify.com website includes several tools to help with branding that include a business name generator and a logo maker as well as a website builder and a full range of marketing products. Marketing products help merchants with email marketing and Facebook ads as well as automation of the same.

Among the many benefits of using Shopify is acceleration. Businesses that use the website to its fullest are able to accelerate their growth and reach milestones years ahead of their competitors. Brands that use Shopify.com include Heinz, Tupperware, and Netflix. According to data from BuiltWith, the Shopify platform was host to more than 1.58 million websites in 2021 and the figure is growing. Data from W3Techs suggest that more than 4.0% of the top 10 million websites are using Shopify.

Further Catalysts for the SHOP Weekly Options Trade…..

Shopify is based in Canada, so it’s not eligible to be part of the S&P 500. However, with a market capitalization of $80.61 billion, it would qualify if it were U.S.-based. As such, the most appropriate performance benchmark is the Technology Select Sector SPDR Fund (NYSEARCA: XLK), which Shopify is outperforming on a three-month and year-to-date basis.

Shopify pulled back 3.40% in the past month as it formed its current consolidation. However, that appears to be essentially a round of profit-taking after the stock raced 62% higher after its recent quarterly report. The June 6 price action is a good signal that institutional buyers still have conviction about the stock, and it may potentially be lucrative for investors who opt to get in before the company’s fortunes turn higher.

Stock market performance is its strongest suit, with SHOP in the top 3% of stocks in terms of price performance over the past 12 months. It also is up around 72% since the start of the year.

Other Positive Catalysts.....

Growth is still robust, and the excellent first-quarter results demonstrate that Shopify's story is still ongoing. Despite the pressured retail environment, gross merchandise volume (GMV) increased 15% over last year to $49.6 billion, and revenue increased 25% to $1.5 billion. Management is guiding for similar growth metrics in the second quarter.

Logistics Business Sale Completed.....

One catalyst for the price move was Shopify’s completion of the sale of its logistics business to Flexport, a tech-driven global logistics platform. The transaction was announced in May.

According to the company, Shopify received stock representing a 13% equity interest in privately-held Flexport and its existing equity interest in Flexport. The two companies will continue to partner on logistics. Shopify also gets a seat on the Flexport board, according to supply chain and logistics trade publication FreightWaves.

The sale also includes Deliverr, a shipping services provider that Shopify acquired in July.

The sale also meant that the Shopify workforce was slashed by 20%, in addition to a 10% reduction announced in July.

Commerce Components.....

Shopify recently launched a new initiative called commerce components, which allows clients to choose stackable services that integrate into whatever systems they're already using. This is a further development of the packages it offers, which give clients the freedom to use Shopify's many capabilities to grow their businesses. For example, monthly recurring revenue increased 10% over last year, in part due to more Shopify Plus merchants converting its POS devices in physical stores.

Shopify is the leader in e-commerce software. In fact, its low-end subscription plans collectively rank as the most popular e-commerce software on the market, and Shopify Plus ranks as the second most popular e-commerce software on the market. That dominant competitive position translated into strong financial results in the first quarter despite a difficult macroeconomic backdrop.

Looking Ahead.....

Looking ahead, Shopify is set to accelerate growth as economic conditions improve. Retail e-commerce sales are expected to climb 14% annually through 2030, and wholesale e-commerce sales will increase 20% annually during the same period, according to industry experts. But as the market leader in e-commerce and omnichannel commerce software, Shopify should be able to outpace the industry average.

Here's the case for fivefold returns: Shopify currently has a market cap of about $75 billion and shares trade at 12.5 time’s sales. If the company can grow revenue at 20% annually over the next decade -- a reasonable assumption given its market opportunity and its annualized revenue growth of 51% over the last five years -- its market cap could increase fivefold to $375 billion while its valuation falls to a more reasonable 10.2 times sales.

The company

is benefiting from strong growth in the merchant base. It has been focused on

winning merchants regularly, based on product offerings including Shop Pay and

Shop Pay Installments.

Solid adoption of new merchant-friendly applications holds promise.

Partnerships with YouTube, Twitter, Facebook, Instagram, and Google are

expected to expand its merchant base. The divestiture of the logistics business

to Flexport will boost profitability.

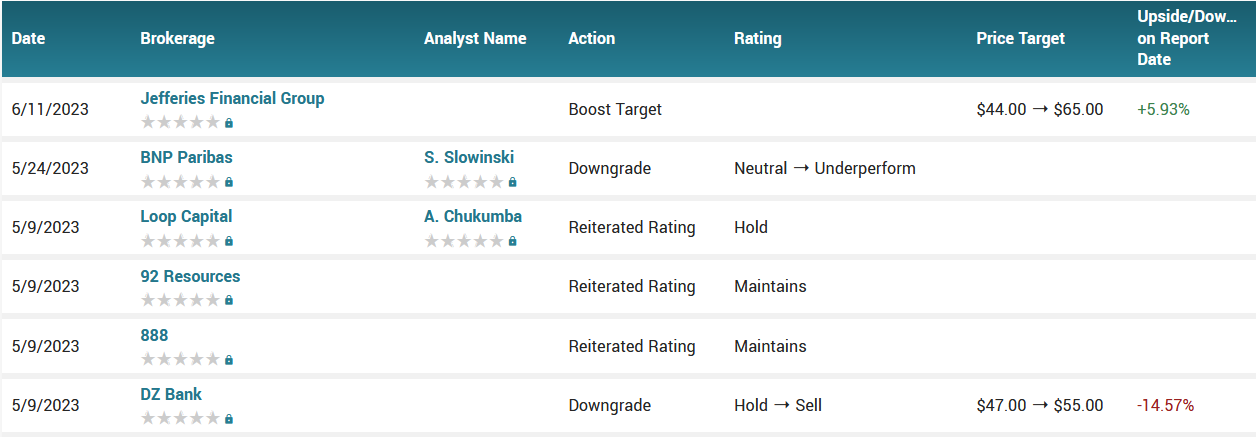

Analysts.....

CFRA analyst Angelo Zino is rating Shopify stock as a buy with a 68 target. He hailed the firm's move to sharply cut expenses and to divest its logistics business. Artificial intelligence initiatives are also seen as possible catalysts.

- Shopify was upgraded by analysts at StockNews.com from a “sell” rating to a “hold” rating in a report released last Thursday.

- Robert W. Baird boosted their price target on shares of Shopify from $55.00 to $65.00 in a research note on Friday, May 5th.

- TD Securities lifted their price objective on shares of Shopify from $47.00 to $60.00 and gave the company a “hold” rating in a report on Friday, May 5th.

- Credit Suisse Group boosted their price target on shares of Shopify from $40.00 to $53.00 in a report on Friday, May 5th. Finally, Deutsche Bank Aktiengesellschaft boosted their price target on shares of Shopify from $55.00 to $67.00 in a report on Friday, May 5th.

According to the issued ratings of 37 analysts in the last year, the consensus rating for Shopify stock is Hold based on the current 2 sell ratings, 22 hold ratings and 13 buy ratings for SHOP. The average twelve-month price prediction for Shopify is $55.63 with a high price target of $80.00 and a low price target of $30.00.

Summary.....

Shopify went public in May 2015. At the time, the stock was listed at $3.5. Now, it trades at $80.25. That’s a total return of 2,290% over the course of eight years or a compound annual growth rate of 48.75%.

Shopify’s performance, despite its recent downturn, is phenomenal. The company has outperformed all major indexes over the past eight years. The S&P 500 is up only 108% since mid-2015, while the S&P/ TSX Composite Index are up 31.5% over the same period.

Shopify even outperformed other tech stocks. The Invesco QQQ Nasdaq Index is up 235% since mid-2015.

The stock was driven by the rapid adoption of online shopping and Shopify’s stellar growth rate over the past decade. However, growth and adoption are likely to be slower in the years ahead.

Shopify has a fifty day simple moving average of $54.18 and a two-hundred day simple moving average of $46.05. The stock has a market cap of $78.33 billion, a P/E ratio of -40.64 and a beta of 2.03. Shopify has a 12-month low of $23.63 and a 12-month high of $65.54. The company has a current ratio of 6.71, a quick ratio of 6.71 and a debt-to-equity ratio of 0.11.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from SHOPIFY

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!