TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Shopify

Weekly Options Trade Up 115%!

Shopify Inc. (NYSE:SHOP) is an all-in-one e-commerce platform that empowers businesses of all sizes to build, manage, and grow their online stores. Founded in 2006, Shopify now holds a commanding >10% market share in US e-commerce.

Shopify is ideally positioned to benefit as e-commerce becomes more prevalent across both retail and wholesale channels.

Shopify’s consumer strength, even in the face of macroeconomic pressure, led to a double for the e-commerce platform provider.

This set the scene for Weekly Options USA Members to profit by 115% using a SHOPIFY Options trade!

Join Us And Get The Trades – become a member today!

Thursday, February 01, 2024

by Ian Harvey

Why the Shopify Weekly Options Trade was Originally Executed!

Shopify Inc (NYSE: SHOP) seems ready for a revolution. While the e-commerce world buzzes with investment options, Shopify brings together opportunity and innovation with its robust performance, innovative tools, and forward-looking vision.

Shopify is ideally positioned to benefit as e-commerce becomes more prevalent across both retail and wholesale channels. To quantify that, retail e-commerce sales are forecast to increase by 8% annually through 2030, while wholesale e-commerce sales are projected to increase by 19% annually through 2031. That points to mid-teens or even high-teens sales growth through the end of the decade.

Given that growth trajectory, Shopify's current valuation of 13.9 times sales seems reasonable, especially when the three-year average is 23.7 times sales.

Shopify’s consumer strength, even in the face of macroeconomic pressure, led to a double for the e-commerce platform provider.

Earnings for Shopify are expected to rise 1650% in 2023 and another 48% in 2024. Shares of Shopify are up 124.4% over the last year.

Shopify helps people start, run and grow a business. It was a big winner in the early years of the pandemic, but shares sold off in 2022. However, the analysts are getting bullish. 2 estimates have been revised higher for 2023 and 3 for 2024 in the last 60 days, with 1 estimate also being revised in the last month for both years as well.

The Shopify Weekly Options Potential Profit Explained.....

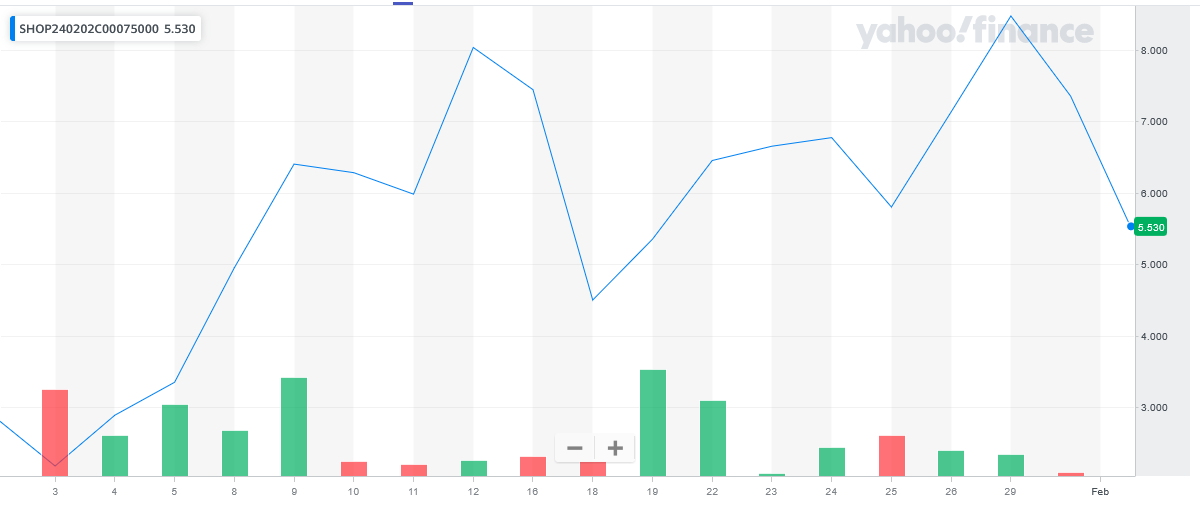

** OPTION TRADE: Buy SHOP FEB 02 2024 75.000 CALLS - price at last close was $3.35 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the SHOP Weekly Options (CALL) Trade on Monday, January 08, 2024 for $3.93.

Sold the SHOP weekly options contracts on Monday, January

29, 2024 for $8.47; a

potential profit of 115%.

Don’t miss out on further trades – become a member today!

About Shopify.....

Shopify Inc. is a commerce platform and eCommerce infrastructure provider connecting small businesses with a large and growing global marketplace. The company was formed in 2004 in Ottawa, Canada as Jaded Pixel Technologies but changed its name to Shopify Inc in 2011. The name change was part of a rebranding strategy that helped accelerate the business and drive it to $5.5 billion in sales in 2022.

As of October 2022, the company boasted “millions” of merchants in 175 countries with more than $543 billion in economic activity generated since launch. In terms of scale, Shopify employs more than 10,000 individuals and is among the top 20 publicly traded companies in Canada.

Shopify was founded by Tobi Lütke. Mr. Lütke had been working on a website for a snowboard store but quickly realized the software was more valuable than just selling snowboards so his team switched gears. The platform was launched in 2006 and it quickly gained momentum. Mr. Lütke is a member of the board of directors and the company’s CEO, a position he has held since 2008.

Shopify is a commerce company but, more importantly, it is an eCommerce commerce company that can assist small businesses with all aspects of their operations. The company is in business to provide an eCommerce platform for small businesses globally. Its platform enables merchants to market, manage, and sell their products through a variety of sales channels that include but are not limited to eCommerce. Channels include the company’s core Shopify.com website as well as brick & mortar locations, pop-ups, social media, and buy-now buttons.

Because branding is such an important part of a business's success the company goes to great lengths to assist its merchants in that regard. The Shopify.com website includes several tools to help with branding that include a business name generator and a logo maker as well as a website builder and a full range of marketing products. Marketing products help merchants with email marketing and Facebook ads as well as automation of the same.

Among the many benefits of using Shopify is acceleration. Businesses that use the website to its fullest are able to accelerate their growth and reach milestones years ahead of their competitors. Brands that use Shopify.com include Heinz, Tupperware, and Netflix. According to data from BuiltWith, the Shopify platform was host to more than 1.58 million websites in 2021 and the figure is growing. Data from W3Techs suggest that more than 4.0% of the top 10 million websites are using Shopify.

Further Catalysts for the SHOP Weekly Options Trade…..

Shopify is a leader in commerce software.

Shopify reported stellar financial results in the third quarter. Revenue increased 25% to $1.7 billion due to the onboarding of larger merchants, strong momentum across Europe, and price increases. The company also reported generally accepted accounting principles (GAAP) net income of $708 million, up from a net loss of $188 million in the prior year. The driving forces behind improved profitability were the sale of its capital-intensive logistics business and workforce reductions.

The investment thesis for Shopify centers on its ability to simplify commerce and support the entire merchant lifecycle, from start-up to enterprise. Its software unifies physical and digital sales channels behind a common dashboard. That means merchants can manage their businesses across online marketplaces, social media networks, branded websites, and brick-and-mortar shops from a single platform.

Additionally, Shopify provides supplemental services that help merchants grow their businesses. That includes financial services like payment processing, working capital loans, and business bank accounts, as well as services for cross-border commerce and wholesale. Shopify also simplifies logistics by linking merchants with freight and fulfillment providers like Flexport and Amazon. Indeed, merchants can now offer "Buy with Prime" at checkout, a service that extends the shipping benefits of Prime membership beyond the Amazon marketplace.

No other commerce platform offers the same breadth of functionality, and Shopify has earned a leadership position in e-commerce and omnichannel commerce software. In turn, that success has attracted a partner ecosystem that is four times larger than its closest competitor, creating a network effect that further solidifies its market leadership.

To elaborate, Shopify has more developers and technology partners building products for its app store, which continuously extends the functionality of its platform. It also has more systems integrators and consulting partners selling its software. Both advantages ultimately bring more merchants to Shopify, which further incentivizes participation in its partner ecosystem, creating a virtuous cycle.

Other Catalysts.....

Shopify stock more than doubled last year after it continued to report double-digit sales growth while demonstrating a real effort to rein in costs and return to net profitability. It also split its stock in June 2022, but it stayed flat before rising in 2023.

Shopify is benefiting from the same e-commerce trends driving Amazon's core business. In fact, its gross merchandise volume of $56 million in the 2023 third quarter was nearly the same as Amazon's $57 million in online store sales. Shopify is a platform, so it doesn't count GMV as revenue; it only gets a portion of that as fees. Shopify reported $1.7 billion in revenue, which was 25% more than last year. Monthly recurring revenue, which is the sticky kind, increased 33% over last year.

Expansion.....

Shopify is expanding its target market from the small businesses it's known for to medium and large-sized businesses, which typically bring in higher revenue.

It launched several important new services last year, such as Shopify Components, which let enterprise businesses choose single services instead of signing up for full packages. That's a great way to bring new clients into the Shopify ecosystem. It also developed its own line of AI and generative AI solutions to keep it on the cutting edge of technology.

The company overshot in expanding to meet skyrocketing pandemic demand, but it efficiently wrapped up some costly new ventures that were draining earnings last year and cut its workforce. Management is guiding for revenue to increase in the high teens year over year in the fourth quarter, and for improved profitability. It has not yet released any 2024 guidance, but if it sustains its momentum with new features, double-digit growth, and higher profits, it should soar in 2024.

Innovation....

Shopify's new Retail Plan and POS Go checkout scanner are more than just tools; they're the backend of a seamless retail experience, merging the vibrancy of in-store shopping with the convenience of online commerce. For instance, with the Retail Plan, merchants get what they need for enhanced inventory management and customer relationships, leading to improved sales and customer retention. This isn't just an operational upgrade; it's a strategic vision coming to life, promising a future of sustained growth and innovation.

Innovation is often met with skepticism, and Shopify's Retail Plan and POS Go provide no exceptions. Questions arise about adoption rates, integration with existing systems, and customer acceptance. Yet Shopify's history of turning challenges into opportunities suggests these tools will evolve and adapt, further entrenching the platform in the retail landscape. Investors should closely watch all numbers coming out of the pressure cooker that is Black Friday through Cyber Monday, but early results look very promising for Shopify's resilience.

Performance.....

Shopify's financial performance sings a compelling tune of strategic success. A 22% increase in gross merchandise volume (GMV) to $56.2 billion and a 25% rise in revenue to $1.7 billion in the third quarter illustrate not just growth, but also a deepening market penetration. These numbers, underscored by a 36% growth in gross profit, demonstrate Shopify's ability to adapt in the evolving retail landscape. These reassuring figures indicate Shopify's potential as a market leader.

Analysts.....

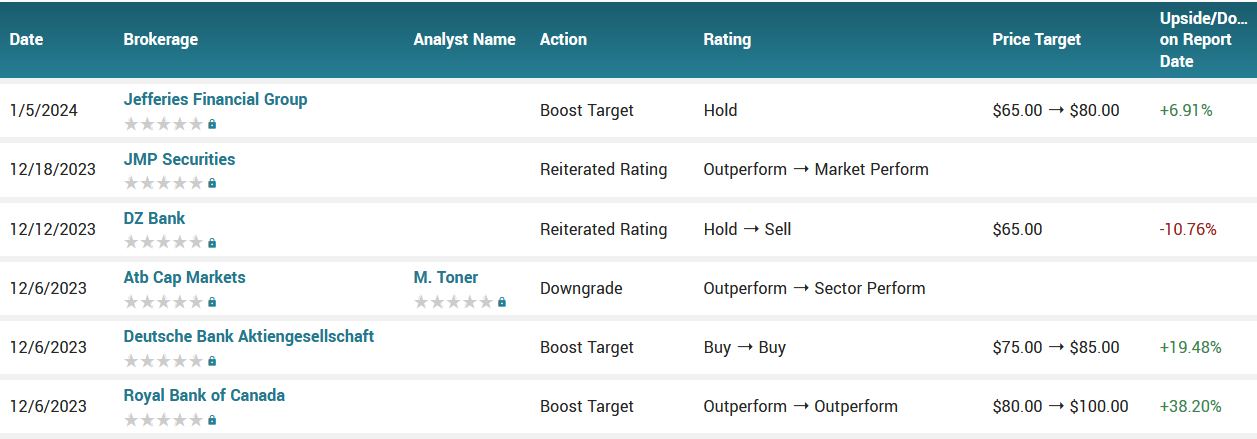

Shopify had its price objective lifted by Jefferies Financial Group from $65.00 to $80.00 in a report released on Friday. They currently have a hold rating on the software maker’s stock.

According to the issued ratings of 40 analysts in the last year, the consensus rating for Shopify stock is Hold based on the current 2 sell ratings, 21 hold ratings and 17 buy ratings for SHOP. The average twelve-month price prediction for Shopify is $69.51 with a high price target of $100.00 and a low price target of $41.00.

Summary.....

The company's aim appears to stretch far beyond mere expansion; it seems it's orchestrating a retail renaissance. Imagine a digital landscape bustling with activity, where Shopify's robust infrastructure effortlessly manages a staggering 967,000 requests per second during peak shopping moments like it did from Black Friday through Cyber Monday. Such results stand as a testament to a platform built for resilience and scale.

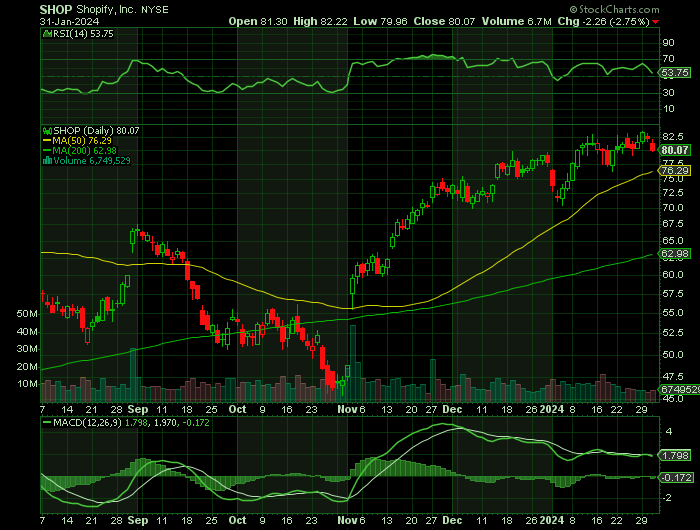

Shopify Stock has a market capitalization of $95.56 billion, a price-to-earnings ratio of -81.88 and a beta of 2.28. The company has a current ratio of 7.23, a quick ratio of 7.23 and a debt-to-equity ratio of 0.13. The business’s 50-day moving average price is $70.07 and its 200-day moving average price is $62.96. Shopify has a 12 month low of $34.97 and a 12 month high of $79.99.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from SHOPIFY

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!