TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

SoundHound Weekly Call Option Up 30% In 1 DAY!

More Profit Expected!

Become a Member and Get the Trade.

Shares in SoundHound AI Inc (NASDAQ: SOUN) are up over 80% so far this year, trouncing the major indexes.

Earlier this year, shares of SoundHound AI soared following news that Nvidia is an investor with the company.

Weekly Options traders made 606% potential profit on March 14, 2024, based on this catalyst.

This set the scene for Weekly Options USA Members to profit by 30% using a SOUN Weekly Options trade!

Become a Member Today and get the trade!

Tuesday, April 23, 2024

by Ian Harvey

Shares in SoundHound AI Inc (NASDAQ: SOUN) are up over 80% so far this year, trouncing the major indexes.

Artificial intelligence (AI) has many different applications. One budding area in the AI realm that big tech firms are exploring right now is voice-recognition software.

"Magnificent Seven" members Microsoft, Apple, Amazon, Alphabet, and Nvidia are all investing heavily in AI-powered speech.

Yet despite big tech's pursuit of this technology, a smaller player has made headlines this year. SoundHound AI specializes in voice-recognition software for the restaurant, automobile, and smart home industries.

Earlier this year, shares of SoundHound AI soared following news that Nvidia is an investor with the company.

Weekly Options traders made 606% potential profit on March 14, 2024, based on this catalyst.

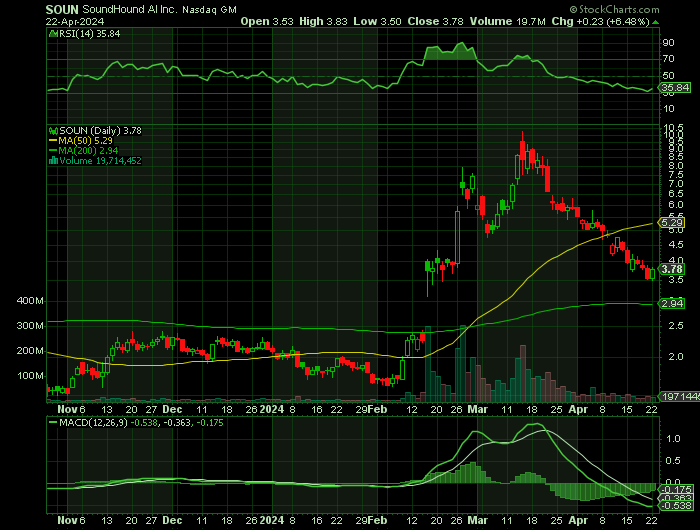

Although the stock has retreated from its peak levels, it's still up over 80% year to date. When you compare that to the 3% return of the Nasdaq Composite, you might be wondering if SoundHound AI can be a million-dollar opportunity.

BECOME A MEMBER AND GET THE TRADE!

About SoundHound AI.....

SoundHound AI Inc. is a cutting-edge technology company developing artificial intelligence (AI) solutions for voice-enabled devices and mobile applications. The company is headquartered in Santa Clara, California, with additional San Francisco and Tokyo offices. Founded in 2005 SoundHound AI has been at the forefront of voice recognition technology, with its flagship product being the SoundHound music and voice recognition app. The app has over 315 million downloads worldwide, and the company has also partnered with several prominent automobile manufacturers to integrate its technology into cars.

The leadership team at SoundHound AI comprises experienced executives with technology and business backgrounds. The CEO and co-founder, Keyvan Mohajer, has over 25 years of experience in technology and has led the company since its inception. In 2022, the company announced the appointment of a new Chief Financial Officer, Nitesh Sharan, who has 20+ years of experience in finance. Before joining SoundHound AI, he was the CFO at Nike and also served as the assistant treasurer at Hewlett Packard.

SoundHound AI has been experiencing revenue growth over the past few years while maintaining a healthy profit margin. The company has also held a healthy profit margin of around 10%. However, the company has struggled with debt in the past and in Q3 of 2022, the company made changes to bring that debt under control by slashing 10% of its workers. In 2021, the company raised $100 million in a funding round led by Tencent Holdings. In Q1 of 2023, the company issued new Series A Preferred Stock and Class A common stock to the shareholders' disappointment. Over the past year, SoundHound AI's stock price has been volatile, with several significant price movements. Trading volume has been relatively stable over the past year, with an average daily volume of around 1.5 million shares. SoundHound AI's valuation metrics are favorable when compared to industry peers.

SoundHound AI operates in the highly competitive AI technology industry, which is expected to grow rapidly over the next decade. The company faces competition from established players such as Google, Microsoft and Amazon and emerging startups. The industry is also subject to significant regulatory and political pressures as governments worldwide seek to regulate the use of AI technology.

SoundHound AI has several growth opportunities, including expanding its technology into new markets and developing new products. The company has already made inroads into the automobile industry, integrating its technology into several prominent car brands. In addition, the company has recently launched a new product, Houndify, which is a platform that allows developers to integrate voice recognition technology into their applications.

One of the primary risks facing SoundHound AI is the intense competition in the AI technology industry. The company must continue to innovate and differentiate itself from its competitors to remain successful. In addition, the industry is subject to significant regulatory and political pressures, which could impact the company's growth prospects. Finally, the company's success depends on adopting voice recognition technology, which could be affected by changes in consumer preferences or advances in alternative technologies.

Another challenge facing SoundHound AI is the potential for intellectual property disputes. The company's technology relies heavily on proprietary algorithms and software, which could be subject to infringement claims by competitors. The company may also face challenges in protecting its intellectual property rights in countries where intellectual property laws need to be stronger or better enforced.

Finally, SoundHound AI's growth is dependent on the ability to attract and retain talented employees. The company operates in a highly competitive industry and faces stiff competition for top talent from other technology companies. In addition, the company must compete with other startups for access to funding, which could impact its ability to invest in research and development and other growth initiatives.

BECOME A MEMBER AND GET THE TRADE!

Further Catalysts for the SoundHound Weekly Options Trade…..

The market for voice-recognition technology could reach $50 billion by 2029, according to Statista. Considering this tech can be integrated into vehicles, smart-home appliances, and various business settings, it's easy to see why so many of the world's largest enterprises are pursuing the technology.

Moreover, venture capital investor Chamath Palihapitiya recently posted on X that voice represents the "front door" to the next phase of the AI revolution.

Palihapitiya could be onto something here. Over the last year or so, the world has become captivated by the rise of ChatGPT. Its creator, OpenAI, recently announced the company is exploring applications in AI-powered speech.

Given the potential size of the market and the number of high-profile companies competing, it's intriguing that such a small-scale player like SoundHound is receiving so much attention.

BECOME A MEMBER AND GET THE TRADE!

Analysts.....

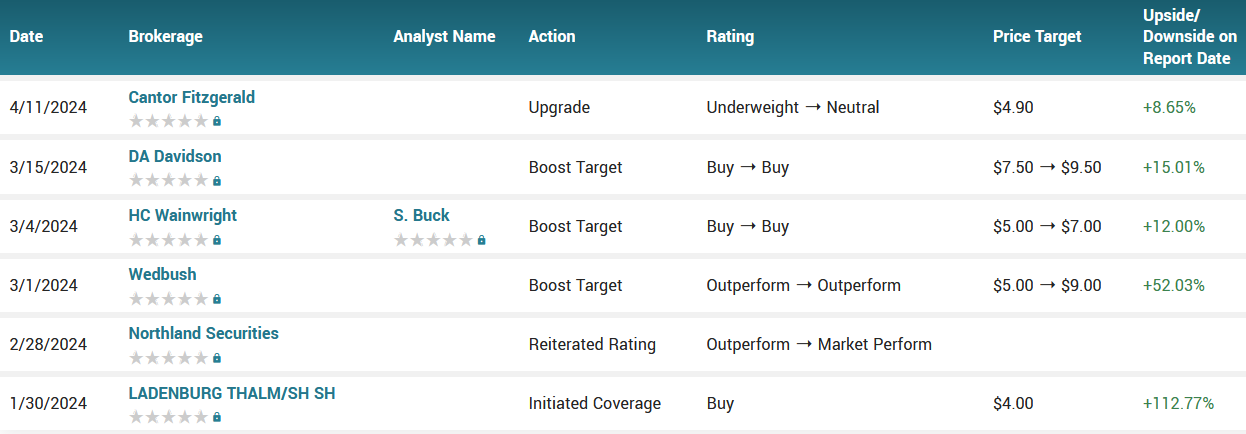

According to the issued ratings of 6 analysts in the last year, the consensus rating for SoundHound AI stock is Moderate Buy based on the current 2 hold ratings and 4 buy ratings for SOUN. The average twelve-month price prediction for SoundHound AI is $6.88 with a high price target of $9.50 and a low price target of $4.00.

Summary.....

In 2023, SoundHound AI grew revenue 47% to $45.9 million. Moreover, the company reduced its operating losses by 51% -- reporting negative adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $35 million.

The company calls itself a leader in AI, and it has been in the spotlight ever since Nvidia unveiled its stake in the company earlier this year.

SoundHound stock had already doubled earlier this year, but it has since fallen over 50% from its high. However, even from its current level, SoundHound looks like a good candidate to double again as management expects revenue to surge another 50% this year, while adjusted EBITDA turns positive in 2025.

SoundHound AI stock has a market cap of $1.10 billion, a P/E ratio of -9.10 and a beta of 2.75. The firm has a 50 day moving average of $5.37 and a 200-day moving average of $3.15. The company has a quick ratio of 4.69, a current ratio of 4.69 and a debt-to-equity ratio of 6.03.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from SOUNDHOUND

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!