TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Southwest Airlines Shares Fall On Downgrade

and Softer Bookings!

Weekly Options Members

Are Up 112% Potential Profit

Using A Weekly PUT Option!

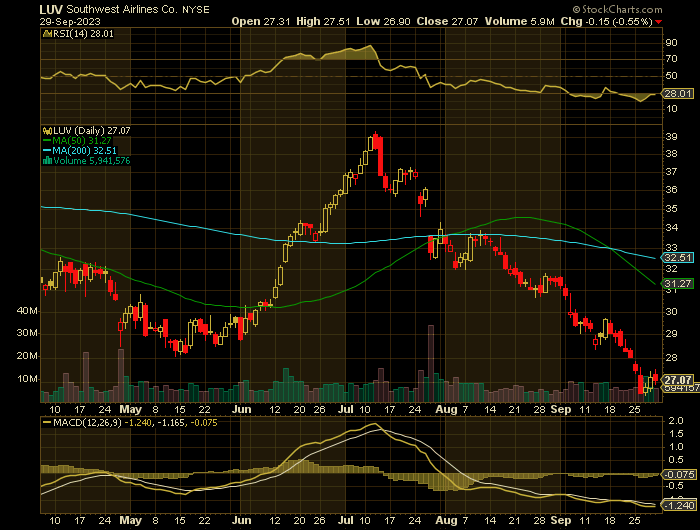

Southwest Airlines Co (NYSE: LUV) stock stalled following a downgrade and softer reported bookings in August.

Southwest Airlines lowered its third-quarter outlook for revenue per available seat mile and noted last-minute leisure bookings softened in August.

This set the scene for Weekly Options USA Members to Make Potential Profit Of 112%, using an LUV Weekly Options trade!

Join Us And Get The Trades – become a member today!

Sunday, October 02, 2023

by Ian Harvey

Why the LUV Weekly Options Trade was Originally Executed!

Airlines warned that rising fuel prices could bite into performance on Wednesday following a busy summer travel season. Southwest Airlines Co (NYSE: LUV) stock stalled following a downgrade and softer reported bookings in August.

Southwest Airlines lowered its third-quarter outlook for revenue per available seat mile and noted last-minute leisure bookings softened in August.

"While August 2023 close-in leisure bookings were on the lower-end of the company's expectations, modestly impacted by seasonal trends, overall leisure demand and yields continue to remain healthy," Southwest wrote in a securities filing. "Travel demand during Labor Day weekend was strong and produced record revenue performance for the holiday weekend."

Southwest expects Q3 revenue per available seat mile to fall between 5% and 7%, compared to its previous guidance for a 3% to 7% drop. The company raised its fuel cost guidance to range from $2.70 to $2.80 a gallon, up from $2.55 to $2.65 a gallon.

Southwest noted extreme weather-related disruptions resulted in roughly 1,400 cancellations so far in Q3.

BNP Paribas Exane downgraded Southwest Airlines stock to neutral from outperform early Wednesday and maintained its $34 price target.

About Southwest Airlines.....

Southwest Airlines Co. operates as a passenger airline company that provide scheduled air transportation services in the United States and near-international markets.

As of December 31, 2021, the company operated a total fleet of 728 Boeing 737 aircrafts; and served 121 destinations in 42 states, the District of Columbia, and the Commonwealth of Puerto Rico, as well as 10 near-international countries, including Mexico, Jamaica, the Bahamas, Aruba, the Dominican Republic, Costa Rica, Belize, Cuba, the Cayman Islands, and Turks and Caicos. It also provides inflight entertainment and connectivity services on Wi-Fi enabled aircrafts; and Rapid Rewards loyalty program that enables program members to earn points for dollars spent on Southwest base fares.

In addition, the company offers a suite of digital platforms to support customers' travel needs, including websites and apps; and SWABIZ, an online booking tool. Further, it provides ancillary services, such as Southwest's EarlyBird Check-In, upgraded boarding, and transportation of pets and unaccompanied minors.

The company was incorporated in 1967 and is headquartered in Dallas, Texas.

The LUV Weekly Options Trade Explained.....

** OPTION TRADE: Buy LUV SEP 29 2023 30.000 PUTS - price at last close was $0.88 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the LUV Weekly Options (CALL) Trade on Thursday, September 07, 2023, for $0.93.

Sold the LUV weekly options contracts on Friday, September 22, 2023 for $1.97; a potential profit of 112%.

Don’t miss out on further trades – become a member today!

NOTE: For those members that held onto LUV contracts, or sold half at this time, the price of the LUV shares continued to drop, therefore, our PUT Option increased in profit before expiration.

Further Catalysts for the LUV Weekly Options Trade…..

When Southwest Airlines had its holiday meltdown last December, it was caused by a perfect storm of weather problems and technology crashes happening at the same time. Basically, weather caused the initial problems and the airline's systems could not handle all the changes it needed to make to minimize the disruptions.

Southwest Airlines' situation was made worse by its technical problems and its poor choices in communicating with its customers.

Other Catalysts.....

The airline's pilots union is threatening to strike over a number of key issues with salary not being the only gripe.

Southwest Airlines and its pilots have been in federal mediation over a new contract and have been unable to come to terms.

The two sides have actually been negotiating for roughly 3 1/2 years with no end in sight.

This comes even as rivals United, American, and Delta have reached deals that give their pilots large raises.

Those deals should set the basic guidelines for an accord between Southwest Airlines and its pilots, but no agreement has been reached, and the Southwest Airlines Pilots Association has asked to be released from mediation.

The request was denied, which legally kept the airline's pilots from striking. That, however, does not mean that an agreement is near or that work actions will not take place.

Southwest's pilots can't strike but they can hold sickouts, which are a quasi-legal way to disrupt the airline. The union has not threatened to do that, but it has gone on the offensive to make clear that wages are not the key issue preventing a deal.

Further Catalysts…..

A new Securities and Exchange Commission filing shows that the airline is facing a number of headwinds. These could be a mixed blessing for passengers.....

- Revenue per seat mile is down: The company had expected that decline, but it raised the bottom of the range to down 5% to 7% from down 3% to 7%.

- Costs, both fuel and nonfuel, are higher: Southwest had expected to pay between $2.55 and $2.65 per gallon of fuel. It has revised that number to between $2.70 and $2.80. It had also estimated that nonfuel costs would be flat, and has revised that figure to an increase of 3.5% to 6.5%.

Analysts.....

According to the issued ratings of 17 analysts in the last year, the consensus rating for Southwest Airlines stock is Hold based on the current 2 sell ratings, 10 hold ratings and 5 buy ratings for LUV. The average twelve-month price prediction for Southwest Airlines is $37.17 with a high price target of $55.00 and a low price target of $25.00.

Summary.....

Southwest Airlines stock's 50-day moving average is $34.37 and its two-hundred day moving average is $32.50. The stock has a market cap of $18.34 billion, a PE ratio of 34.98, and a P/E/G ratio of 0.41 and a beta of 1.17. Southwest Airlines Co. has a 12 month low of $28.40 and a 12 month high of $40.38. The company has a debt-to-equity ratio of 0.74, a current ratio of 1.25 and a quick ratio of 1.19.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

Back to Weekly Options USA Home Page from Southwest Airlines

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!