TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Starbucks Is Capitalizing On Its Expansion

Initiatives!

Weekly Options Members

Are Up 79% Potential Profit

Using A Weekly CALL Option!

Starbucks Corporation is capitalizing on its expansion initiatives and strong North America comparable sales.

Starbucks strategically expands its market presence by opening stores, renovating existing ones, leveraging technology, cost management and fostering innovation.

This set the scene for Weekly Options USA Members to Make Potential Profit Of 79%, using a SBUX Weekly Options trade!

Join Us And Get The Trades – become a member today!

Sunday, October 08, 2023

by Ian Harvey

Starbucks Corporation (NASDAQ: SBUX) is capitalizing on its expansion initiatives and strong North America comparable sales.

Starbucks, a globally recognized coffee brand, strategically expands its market presence by opening stores, renovating existing ones, leveraging technology, cost management and fostering innovation.

In the first, second and third-quarter fiscal 2023, Starbucks opened 459, 464 and 588 net new stores worldwide, respectively. During fiscal 2023, it expects store count in the United States and China to grow approximately 3% and 13%, respectively, on a year-over-year basis. Management projects global store growth to be nearly 7%.

Starbucks’s North America comps have been impressive for tenth straight quarter. The segment benefited from growth in company-operated comparable store sales of 7%, net new company-operated store growth of 4% and strong licensed store sales. Segmental average ticket and transaction rose 6% and 1%, respectively, on a year-over-year basis.

Why the SBUX Weekly Options Trade was Originally Executed!

The Nasdaq Composite has come roaring back in 2023 and is crushing the performance of the S&P 500 and Dow Jones Industrial Average. But a lot of Nasdaq stocks have been selling off this year or are still down big off their highs.

Starbucks Corporation (NASDAQ: SBUX) is one of these growth stocks that is down big but looks as if has now bottomed out.

Pre-pandemic, the focus was on China, with a growing middle class and a booming economy offering a golden opportunity. The pandemic slowed that down. Today, China is picking back up.

Meanwhile, the Starbucks Rewards program supports same-store growth around the world. A silver lining of the pandemic is that it accelerated mobile ordering and rewards sign-ups.

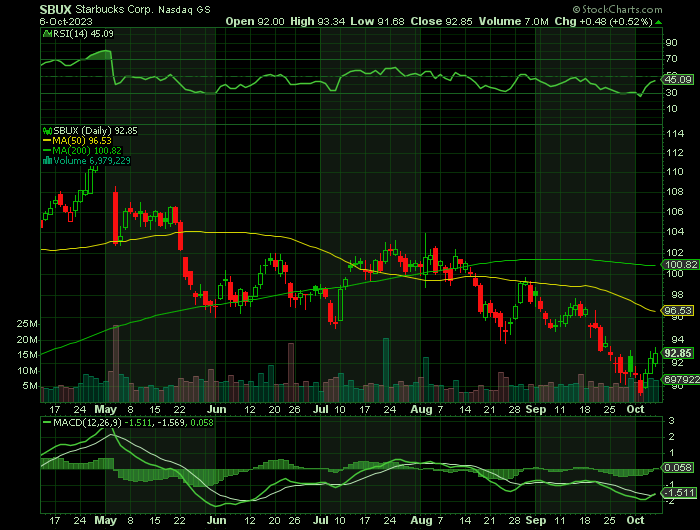

The stock recently pulled back and is down 8.6% year to date, but the company has reported exceptional growth during a difficult stretch for the economy.

The SBUX Weekly Options Trade Explained.....

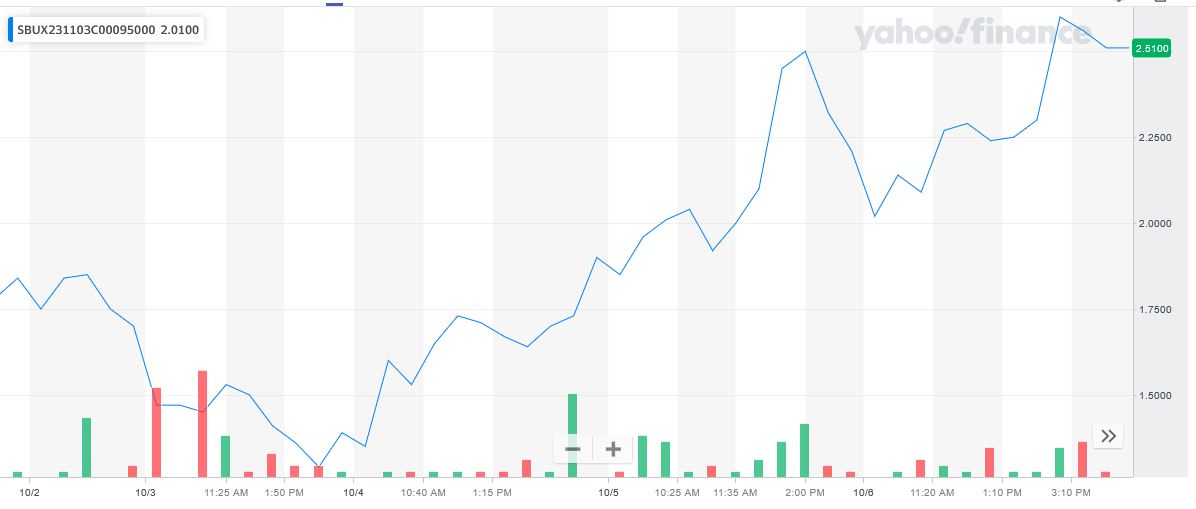

** OPTION TRADE: Buy SBUX NOV 03 2023 95.000 CALLS - price at last close was $1.84 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the SBUX Weekly Options (CALL) Trade on Monday, October 02, 2023, for $1.45.

Sold the SBUX weekly options contracts on Friday, October 06, 2023 for $2.60; a potential profit of79%.

Don’t miss out on further trades – become a member today!

Further Catalysts for the SBUX Weekly Options Trade…..

In the most recent quarter, 90-day active Starbucks Rewards customers reached 75 million globally, including 31.4 million in the U.S. and over 20 million in China. Rewards members also made up 57% of U.S. sales last quarter. The Rewards program is a key growth driver for the company and helps boost sales and satisfaction from loyal customers. It should continue to play a key role in growth for the foreseeable future.

Other Catalysts.....

Even with above-average inflation over the last year hurting consumer spending power, Starbucks reported a solid 12% year-over-year growth rate in sales last quarter, with adjusted earnings up 19%. That is impressive performance for a company that already has a global footprint of over 37,000 stores.

China Market.....

There doesn’t seem to be anything that indicates Starbucks is being hurt in China. Even the growth of local rival chains, such as Luckin Coffee, doesn’t seem to be a concern. There are so many more Starbucks that they can put up. It’s not like people aren’t going to Starbucks.

In Q3 2023, its China stores had 46% same-store sales growth as the time they reopened from the pandemic. It finished the quarter with 6,480 stores in China, about 40% of its U.S. total.

Analysts.....

According to the issued ratings of 20 analysts in the last year, the consensus rating for Starbucks stock is Moderate Buy based on the current 10 hold ratings and 10 buy ratings for SBUX. The average twelve-month price prediction for Starbucks is $114.38 with a high price target of $150.00 and a low price target of $97.00.

Summary.....

The Seattle-based company often faces significant challenges that it somehow overcomes with time. The pandemic indeed hurt its business in China. However, SBUX is having a rebound in its second-biggest market as it heads into 2024.

SBUX stock traded up $0.19 on Friday, reaching $91.27. The company had a trading volume of 7,376,557 shares, compared to its average volume of 6,202,491. Starbucks Co. has a 1 year low of $82.43 and a 1 year high of $115.48. The company’s fifty day moving average is $97.85 and its 200 day moving average is $100.88. The company has a market cap of $104.54 billion, a P/E ratio of 27.77, a PEG ratio of 1.60 and a beta of 0.93.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from STARBUCKS

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!