TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

T-Mobile Shares Are Rising And Moving Towards The $150

Mark!

Weekly Options Members

Are Up 181% Potential Profit

Using A Weekly Call Option!

T-Mobile CEO Mike Sievert sees shares as undervalued, expecting the price to climb above $150 eventually.

TMUS is buying back shares hand over fist. It recently announced a new share buyback program for about $15.25 billion.

T-Mobile has consistently produced strong operating results. It leads the industry in net subscriber additions, and it doesn't rely as heavily on promotions to get those sign-ups.

This set the scene for Weekly Options USA Members to Make Potential Profit Of 181%, using an TMUS Weekly Options trade!

Join Us And Get The Trades – become a member today!

Wednesday, September 13, 2023

by Ian Harvey

T-Mobile US Inc (NASDAQ:TMUS) CEO Mike Sievert sees shares as undervalued, expecting the price to climb above $150 eventually.

With expectations for $16 billion to $18 billion in free cash flow in 2024, T-Mobile's currently valued at just a 10x multiple. While that might be higher than its competition, there are a few reasons it deserves a higher multiple. Namely, it's growing faster and taking market share and it's not as debt-laden as its competition.

TMUS is buying back shares hand over fist. It recently announced a new share buyback program for about $15.25 billion over the next five quarters on top of its initial $14 billion buyback announced in September of 2022.

Sievert discussed the potential for dilution from the Softbank agreement at a recent investor conference. "It's of course overwhelmed by our purchases in the markets," he said. "In fact, we've purchased more in the last ... few months than the whole potential dilution event in the first place."

T-Mobile has consistently produced strong operating results. It leads the industry in net subscriber additions, and it doesn't rely as heavily on promotions to get those sign-ups. That's allowed it to keep its pricing flat while its competitors raise prices, which should only accelerate its share-taking.

Management raised its guidance for core adjusted EBITDA to $28.9 billion to $29.2 billion alongside its second-quarter earnings report. EBITDA margin is expanding as well, up 3 percentage points through the first six months of the year.

Why the TMUS Weekly Options Trade was Originally Executed!

T-Mobile US Inc (NASDAQ:TMUS) stock climbed 4% on Thursday afternoon following a dividend announcement.

T-Mobile announced it will issue its first-ever dividend to shareholders.

Yesterday at the Goldman Sachs Communacopia & Technology Conference, T-Mobile CEO Mike Sievert appeared, and announced the change in capital allocation policy.

"We’re outperforming this whole sector on growth, and our capital priorities have not changed," Sievert said at the Goldman Sachs Communacopia and Tech Conference in San Francisco. "It is to fund this historically great business plan, both organic and inorganic, core business as well as adjacencies."

T-Mobile is just winding up its prior $14 billion share-repurchase program announced last September. So Sievert announced the company's new $19 billion capital return program that will go through 2024. However, this time, of that $19 billion, $3.75 billion is earmarked for a new dividend in addition to the share repurchases. That upcoming dividend payment would amount to about to about a $0.63 quarterly dividend, or $2.52 annualized, which would equate to a 1.82% dividend yield at today's stock price. In addition, Sievert said the company plans to raise that payout by about 10% annually.

"In 2021, we laid out an aspiration that was big and bold that we saw up to $60 billion in shareholder returns during our planning horizon," Sievert added. "This is the second installment: $19 billion over the next five quarters and, as part of that, our first-ever dividend — a $3 billion annual dividend. That’s $3.75 billion over the next five quarters that we see increasing at about 10% a year."

The TMUS Weekly Options Trade Explained.....

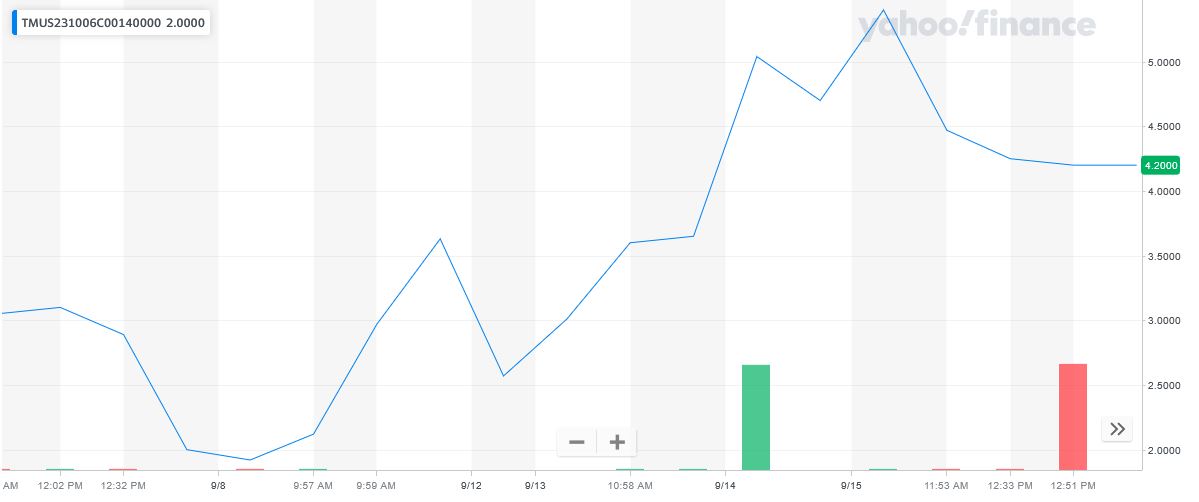

** OPTION TRADE: Buy TMUS OCT 06 2023 140.000 CALLS - price at last close was $2.92 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the TMUS Weekly Options (CALL) Trade on Friday, September 08, 2023, for $1.92.

Sold the TMUS weekly options contracts on Friday, September 15, 2023 for $5.40; a potential profit of 181%.

Don’t miss out on further trades – become a member today!

Further Catalysts for the TMUS Weekly Options Trade…..

In the second quarter, T-Mobile's postpaid net additions came in better than expected and fewer subscribers left the network, though overall sales dropped 2% year over year to $19.2 billion.

Sievert stated that investors can continue to expect industry-leading earnings growth and cash flow generation.

"What investors expect from us is ongoing, reliable growth, profitable growth that translates into industry-leading cash flow growth — and that's what we deliver," Sievert said. "We’ve been delivering it consistently over time, such that we believe it’s time to make the next installment of our longstanding aspirations around shareholder remuneration."

Other Catalysts.....

T-Mobile has demonstrated strong financial performance in recent years. The company recently reported annual revenue representing a slight decline compared to the previous year. Despite the decrease in revenue, T-Mobile reduced its operating expenses. The company's net income has experienced a slight decline recently as well.

T-Mobile operates in the highly competitive radiotelephone communication industry. The telecommunications sector is characterized by rapid technological advancements, evolving consumer preferences, and intense competition among major players. T-Mobile faces competition from other wireless carriers, such as Verizon and AT&T, as well as smaller regional and prepaid wireless providers.

T-Mobile has strategically positioned itself as a challenger brand, emphasizing its commitment to customer satisfaction, affordable pricing, and innovative services. The company's Un-carrier initiatives have disrupted traditional industry practices, attracting customers and differentiating itself from competitors. T-Mobile's nationwide network coverage and focus on expanding its 5G capabilities contribute to its competitive advantage in the market.

T-Mobile has several growth opportunities on the horizon. The company continues to invest in expanding its network infrastructure, particularly in rural areas, to enhance coverage and improve service quality. Additionally, T-Mobile is well-positioned to capitalize on the increasing demand for 5G connectivity, offering faster speeds and unlocking new possibilities for customers and businesses.

T-Mobile has also pursued strategic acquisitions to fuel its growth. For instance, the company completed its merger with Sprint Corporation, further strengthening its market position and enabling synergies in network expansion and cost savings. Moreover, T-Mobile has the potential to explore new business segments, such as Internet of Things (IoT) solutions and enterprise services, to diversify its revenue streams.

T-Mobile faces certain risks and challenges in the dynamic telecommunications industry. The evolving nature of consumer preferences and technological advancements pose risks in terms of maintaining a competitive edge and adapting to changing market dynamics. Regulatory changes and compliance requirements can also impact the company's operations and profitability.

Additionally, T-Mobile operates in a capital-intensive industry, requiring substantial investments in network infrastructure and spectrum licenses. This reliance on capital expenditures can strain the company's financial resources and cash flow generation. T-Mobile must carefully manage its debt levels and effectively allocate resources to sustain its growth trajectory.

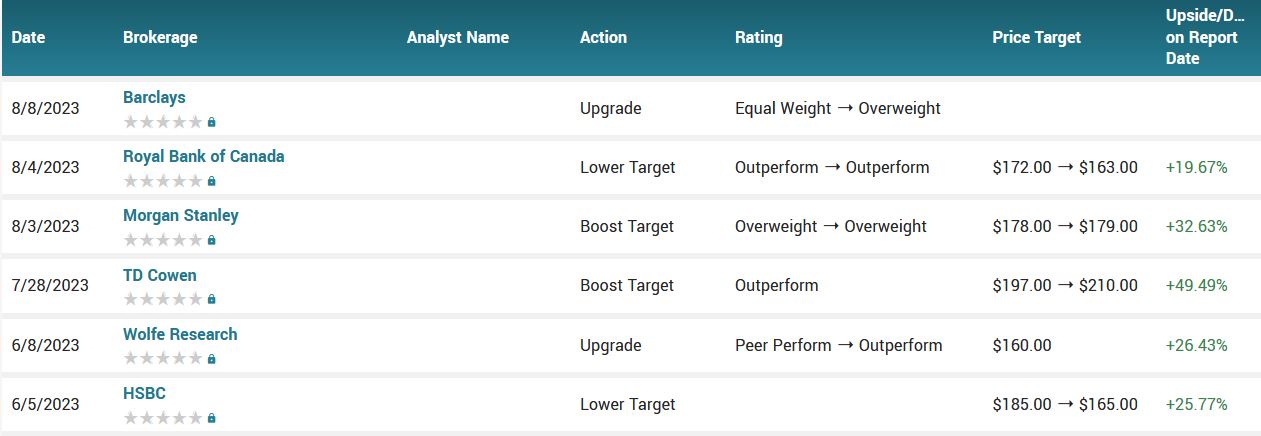

Analysts.....

"T-Mobile remains our favorite stock across our coverage as we see substantial synergy and operating efficiencies driving strong EBITDA and cash flow growth, as well as substantial capital return," JPMorgan's Philip Cusick wrote in July.

In a report released yesterday, John Hodulik from UBS maintained a Buy rating on T-Mobile US, with a price target of $180.00.

According to the issued ratings of 14 analysts in the last year, the consensus rating for T-Mobile US stock is Buy based on the current 1 hold rating, 12 buy ratings and 1 strong buy rating for TMUS. The average twelve-month price prediction for T-Mobile US is $182.55 with a high price target of $210.00 and a low price target of $160.00.

Summary.....

T-Mobile has greatly outperformed rivals Verizon Communications and AT&T over the long term, even when their higher dividends are factored in. So dividend-focused mutual and index funds are likely champing at the bit to be able to own T-Mobile as well, or as a substite for the others.

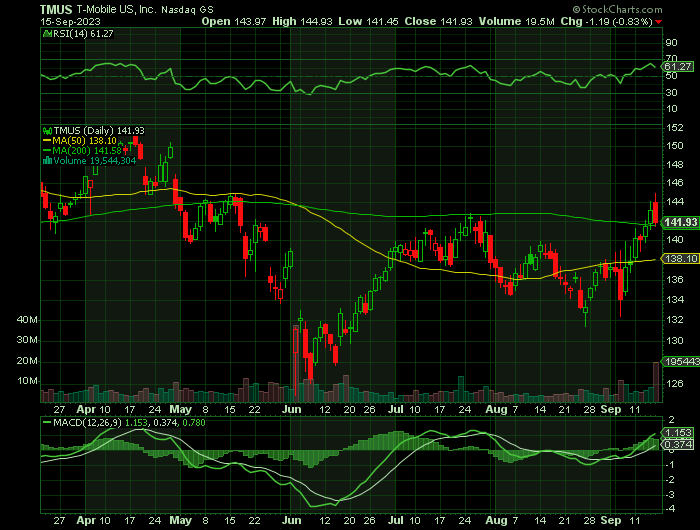

T-Mobile US Stock opened at $137.28 on Friday. The company has a fifty day moving average price of $137.88 and a 200-day moving average price of $140.11. The firm has a market capitalization of $161.50 billion, a P/E ratio of 27.35 and a beta of 0.55. The company has a debt-to-equity ratio of 1.14, a current ratio of 0.82 and a quick ratio of 0.77. T-Mobile US has a one year low of $124.92 and a one year high of $154.38.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from T-MOBILE

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!