TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Taiwan Semiconductor Shares

Pop!

Weekly Options USA

Members Make 71% Potential Profit

In Less than An Hour!

Members of “Weekly Options USA,” Using A Weekly CALL Option, Make Potential Profit Of 71%,

In Less than An Hour,

After Nvidia's Success And A Push For AI In General

Boosted The Fortunes Of

Some Other Chip Makers!

Where To Now?

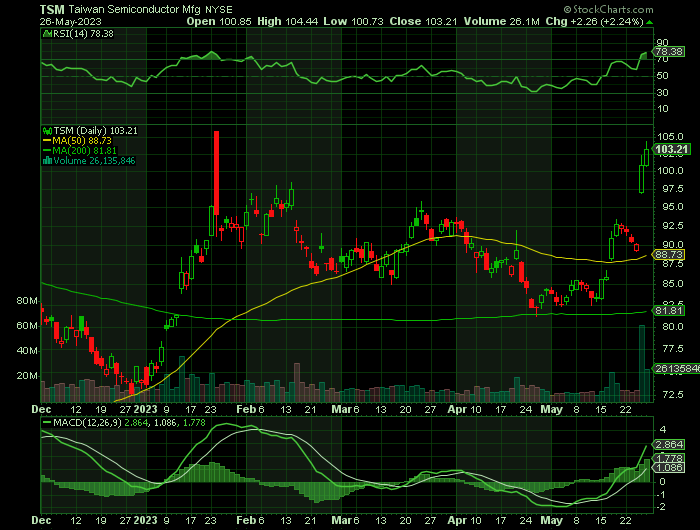

Taiwan Semiconductor shares jumped on Thursday by 12%, and again on Friday by 2.24%, after Nvidia set a new record for revenue from its data center unit with the help from TSMC; which is a key contract manufacturer for Nvidia and many other semiconductor companies. Taiwan Semiconductor will clearly benefit from any increase in demand for AI semiconductor chips.

This set the scene for Weekly Options USA Members to profit by 71%,in less than an hour, using a TSM Weekly Options trade!

Join Us And Get The Trades – become a member today!

Saturday, May 27, 2023

by Ian Harvey

Prelude…..

Nvidia's success and a push for AI in general boosted the fortunes of some other chip makers such as Nvidia's success and a push for AI in general will also boost the fortunes of some other chip makers such as Taiwan Semiconductor Mfg. Co. Ltd. (ADR)(NYSE: TSM). TSM supplies Nvidia with GPU technologies.

The market interpreted this as good news because Taiwan Semiconductor has obtained a lead in advanced semiconductor manufacturing over the past few years, and that lead only seems to be getting bigger.

Nvidia is selling a lot of AI chips, but Nvidia doesn't actually make its own chips. Rather, it farms out the manufacturing to Taiwan Semiconductor, which in turn relies upon machines built by ASML to make those chips. Hence, what's good news for Nvidia is logically good news for TSMC and ASML, as well.

Advanced chip manufacturing is hard, but TSM's years of experience making a wide variety of semiconductors has given it a knowledge and process lead that other manufacturers are struggling to match. In fact, rival GlobalFoundries threw in the towel on competing with Taiwan Semi on the leading edge back in 2018. Intel itself even hinted that it may outsource some manufacturing going forward, likely to TSM. The U.S. government also recently subsidized TSM to build a new fabrication plant in Arizona on national security grounds.

It seems TSM has built itself a formidable moat in chip manufacturing.

Why the Original Taiwan Semiconductor Shares Weekly Options Trade was Executed?

Nvidia's success and a push for AI in general will boost the fortunes of some other chip makers such as Taiwan Semiconductor which supplies it with GPU technologies.

Nvidia’s forward guidance and Huang's statement that it was seeing “surging demand” has boosted the outlook for TSMC, whose shares rose 12% as of 11:30 a.m. ET Thursday.

Analysts at Wedbush Securities expect cloud vendors to be "primary beneficiaries" of Nvidia's increased data center supply. And some of that benefit is already starting to spill over.

The TSM Weekly Options Trade Explained.....

** OPTION TRADE: Buy TSM JUN 09 2023 102.000 CALLS - price at last close was $2.68 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the TSM Weekly Options (CALL) Trade on Friday, May 26, 2023, at 9:58, for $2.43.

Sold half the TSM weekly options contracts on Friday, May 26, 2023, at 10:49, for $4.15; a potential profit of 71%.

Total Dollar Profit is $415 - $268 (cost of contract) = $147

Holding the remaining TSM weekly options contracts for further profit as the new week progresses.

Don’t miss out on further trades – become a member today!

Further Catalysts for the TSM Weekly Options Trade…..

Nvidia is selling a lot of AI chips, but Nvidia doesn't actually make its own chips. Rather, it farms out the manufacturing to Taiwan Semiconductor, which in turn relies upon machines built by ASML to make those chips. Hence, what's good news for Nvidia is logically good news for TSMC and ASML, as well.

Some of the largest tech companies in the world have chosen not to make semiconductor chips in-house. Instead, they've turned to Taiwan Semi, which operates a cutting-edge foundry business that allows its customers to submit their chip designs and have Taiwan Semi produce the physical semiconductors that will go into their products. Last year, Taiwan Semi used nearly 300 different process technologies to produce almost 12,700 different semiconductor chips for its clients. Taiwan Semi has the largest production capacity of any semiconductor producer, with commanding market share of roughly 30% when you take out commodity memory-chip production.

As more businesses try to roll out chip designs to take advantage of AI, Taiwan Semi will stand ready to produce those semiconductors. Already, Taiwan Semi saw revenue jump 43% in 2022 and earnings per share rise 68% because of heightened demand for chips. Artificial intelligence is likely to promote further growth, even in the face of macroeconomic headwinds.

The Benefits Of Advances In AI.....

The roller coaster continued on Wall Street this week as the broader market remained focused on the ongoing drama in Washington, DC, and continued to pin its hopes on an agreement to raise the debt ceiling amid partisan gridlock.

The current state of artificial intelligence (AI) and recent advancements in generative AI has been attracting quite a bit of attention in recent weeks and months. Many investors have wondered how much of the current zeitgeist is fad and how much is based in reality.

Solid results and a stunning forecast from a company that is benefiting from the current trend of AI, helped lift other stocks in the sector -- at least initially.

Analyst Attention…..

TSMC currently has an average brokerage recommendation (ABR) of 1.43, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by seven brokerage firms. An ABR of 1.43 approximates between Strong Buy and Buy.

Of the seven recommendations that derive the current ABR, five are Strong Buy and one is Buy. Strong Buy and Buy respectively account for 71.4% and 14.3% of all recommendations.

Citigroup strategists raised their rating on U.S. stocks to neutral and went overweight on the tech sector, citing booming AI demand and the prospective end to the Federal Reserve’s rate-hiking cycle.

“AI may continue to remain a kicker, given that it is not far enough developed to disappoint expectations yet. Given that AI is mostly a U.S. mega large cap theme, this should also reduce the risk of any U.S underperformance,” Citi’s global strategy and macro team said Friday.

Their report came a day after Nvidia’s stock hit a new high following the chipmaker saying that the AI boom was fueling record sales. Other chipmakers such as Taiwan Semiconductor Manufacturing, also rose alongside the tech sector.

Competitive Edge…..

Many of the big names in the tech industry rely either directly or indirectly on chips made at TSMC's fabrication plants.

Apple, the world's largest company, relies on TSMC for the fabrication of its internally designed chips. Leading processor companies including Nvidia and Advanced Micro Devices depend on its services too. Even Intel, which stands as the third-largest chip manufacturer in the world, outsources some of its fabrication to TSMC.

Outside of its relatively rare contracts with vertically integrated chip companies like Intel, Taiwan Semiconductor doesn't compete with its customers.

Well-Positioned…..

With demand for new chip nodes still high, TSM has continued to record fantastic margins. Taiwan Semiconductor posted a 56.3% gross profit margin, a 45.5% operating margin, and a net income margin of 40.7% in the first quarter. Management expects margins to remain strong over the long term even with some cyclical swings.

While sales and margins will likely continue to be somewhat cyclical owing to the launch of new chip nodes and some demand variation, cyclicality now appears to be being reduced by the increasing integration of chips into hardware across virtually all product sectors. Outside of short periods of relatively limited demand downturn, the chip sector now appears to be moving toward secular growth mode.

Semiconductor equipment manufacturer ASML projects that worldwide semiconductor revenues will rise at a 9% compound annual rate from 2020 through 2030, and reach annual sales exceeding $1 trillion at the end of that period. With TSMC posting such strong margins and enjoying dominant competitive positioning, it seems poised to be one of the key beneficiaries of that growth.

Summary.....

AMD competes head-to-head with Nvidia in some of the same markets, so its move higher is the most direct correlation. Because AMD makes semiconductors for data centers, cloud computing, and AI, it has a long runway ahead.

The company has steadily gained market share on Intel in the PC market, but NVIDIA could prove to be a tougher competitor. Still, it should get at least some benefit from the AI boom.

Conclusion…..

Taiwan Semiconductor Manufacturing is the clear-cut leader in the semiconductor fabrication space. By some accounts, it currently accounts for about 58% of the global market for contract chip manufacturing, and it's responsible for making more than 90% of ultra-high-end semiconductors.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from TSM

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!