TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Taiwan

Semiconductor TSM Stock Strength Remains

During An Overall Market Pullback!

and, “Weekly Options USA” Members are Up 75%

Using A Weekly call Option!

More

Profit Is Expected Before Expiry?

Don’t

Miss Out!

Friday, February 11, 2022

by Ian HarveyTaiwan

Semiconductor TSM shares are trading higher this week, getting a boost

from Morgan Stanley analyst Charlie Chan, who sees a “a very positive

longer-term outlook.”

And,

“Weekly Options USA” Members, Were Up 75% Using

A Weekly Call Option!

More

Profit Is Expected Before Expiry?

Don’t Miss Out On Further Profit!

Taiwan Semiconductor TSM Mfg. Co. Ltd. (ADR)(NYSE: TSM)

Taiwan Semiconductor TSM Mfg. Co. Ltd. (ADR)(NYSE: TSM) shares are trading higher this week, getting a boost from Morgan Stanley analyst Charlie Chan, who lifted his rating on the contract-chip-manufacturing giant to Overweight from Equal Weight, seeing a “a very positive longer-term outlook.”

Chan cautions that in 2022, “a semi downcycle is emerging,” pointing to moderating consumer demand for personal computers, smartphones and televisions.

And, even after the pullback in the overall market Taiwan Semiconductor TSM stock bucked the downturn to remain positive and even advance higher.

At the time of writing the stock was defying the odds and was in the green.

Also, read the article “Taiwan Semiconductor TSM Records Net Profit Of 52.7%!”

The Trades Explained.....

Weekly Options USA Members entered this trade on Wednesday, February 09, 2022.

As of Thursday the trade was up 75%.

As some members may be still holding for higher profits the actual details of the trade cannot be forthcoming as yet.

Yesterday’s afternoon trading saw the Taiwan Semiconductor TSM stock price pull-back a bit.....which now leaves an opportunity for new members to enter the trade.

About Taiwan Semiconductor TSM …..

Taiwan Semiconductor Manufacturing's has obtained lead in advanced semiconductor manufacturing over the past few years, and that lead only seems to be getting bigger. Last month, rival Intel, one of the last chipmakers that manufactures its own chips, admitted that it had run into a design flaw for its 7 nm manufacturing process, and would be falling some 12 months behind schedule. Intel had already ceded the leading-edge node lead to TSM in 2018, and that lead only seems to be getting bigger.

Advanced chip manufacturing is hard, but TSM's years of experience making a wide variety of semiconductors has given it a knowledge and process lead that other manufacturers are struggling to match. In fact, rival GlobalFoundries threw in the towel on competing with Taiwan Semi on the leading edge back in 2018. Intel itself even hinted that it may outsource some manufacturing going forward, likely to TSM. The U.S. government also recently subsidized TSM to build a new fabrication plant in Arizona on national security grounds.

It seems TSM has built itself a formidable moat in chip manufacturing.

The Influencing Factors For A Successful Taiwan Semiconductor TSM Trade…..

Morgan Stanley Upgrade.....

Morgan Stanley analyst Charlie Chan upgraded Taiwan Semiconductor TSM to Overweight from Equal Weight with a NT$780 price target.

His initial rating was in anticipation of the semi-downcycle that is now unfolding.

While recognizing short-term challenges, several factors have prompted him to look beyond the current correction to what he sees as "a very positive longer-term outlook."

E.U. Open For Business.....

The European Union announced a blueprint on Tuesday to make one-fifth of the world's microchips, saying it was "open for business" to semiconductor giants from Taiwan and other industry leaders.

The European Chips Act provides at least €42 billion (US$48 billion) by 2030 in public and private sector capital behind an ambitious plan to effectively double the bloc's chip production, to 20 per cent of the global supply of semiconductors, the tiny processing units that will power the industries of the future.

Currently, the bloc produces 10 per cent of the world's supply, few of which are considered to be cutting-edge.

Margrethe Vestager, the EU's competition tsar, said that the bloc is already in talks with Taiwan Semiconductor TSM, a market leader.

"I know that some of the discussions taking place that include Taiwan Semiconductor TSM of Taiwan. And now let's see if those projects, they materialise as well. Europe is open for business, also for Taiwan Semiconductor TSM," Vestager said, adding that the companies in the United States, Japan, South Korea and Singapore were "like-minded partners" the EU would work with.

The Taiwan government is in talks with its Lithuanian counterparts about building a manufacturing facility there, a senior diplomat said - part of a blossoming relationship that has angered China.

"Well, at the government level, we are only helping Lithuania. I think this is the first case but we would like to provide assistance for other European countries," Eric Huang, head of the Taiwanese Representative Office in Vilnius, told the South China Morning Post.

Huang said that Taipei has formed an "expert group" to examine the "most feasible way" to help develop a tech ecosystem in Lithuania, and subsequently Europe.

"This is something that we would like to do intelligently because we want it to be a successful case. After the study of our expert groups we are going to understand which are the most feasible sectors for Lithuania to develop is semiconductor industry," Huang said.

Brussels, too, has been keen to draw on Taiwan's expertise in the sector, although it faces a challenge in managing the geopolitical fallout with China.

Late last year it shelved plans to upgrade its trade ties with Taiwan, for fear of further angering China.

Taiwan Semiconductor TSM Report.....

TSMC reported its fourth-quarter earnings before the U.S. markets opened on Thursday, December 13, 2022, before the market opened, and they were good: TSMC earned $1.15 per share on $15.74 billion in revenue, up 6.4% and 5.7%, respectively, from the third quarter -- and both above Wall Street's estimates.

The company's sales in that quarter rose across the board, with increased demand for chips for smartphones, high-performance computing, internet of things, e-vehicles and various consumer electronics.

In the fourth quarter, shipments of 5-nanometer chips accounted for 23% of total wafer revenue. Meanwhile, 7-nanometer chips accounted for 27% of wafer revenue. Manufacturers measure circuit widths on chips in nanometers, or one-billionth of a meter.

Smartphone chips accounted for 44% of Taiwan Semi's revenue in the December quarter. High-performance computing chips made up 37% of revenue in the period.

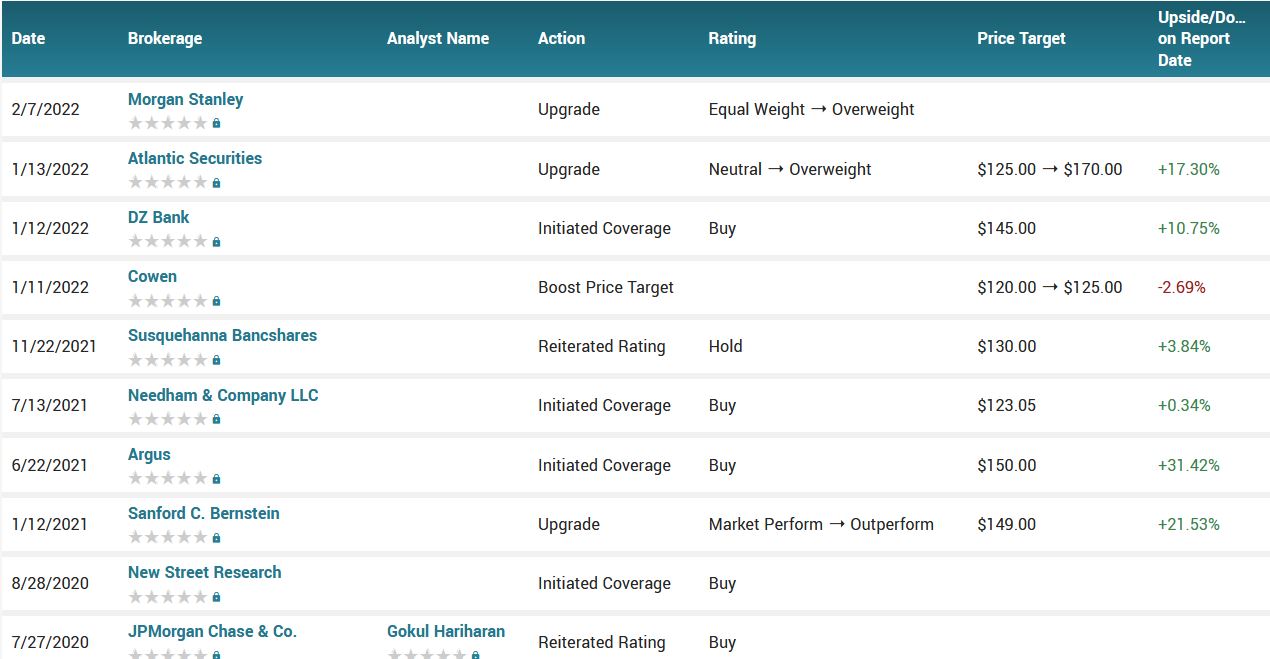

Analysts.....

According to the issued ratings of 8 analysts in the last year, the consensus rating for Taiwan Semiconductor Manufacturing stock is Buy based on the current 3 hold ratings and 5 buy ratings for TSM. The average twelve-month price target for Taiwan Semiconductor Manufacturing is $139.01 with a high price target of $170.00 and a low price target of $123.05.

Summary.....

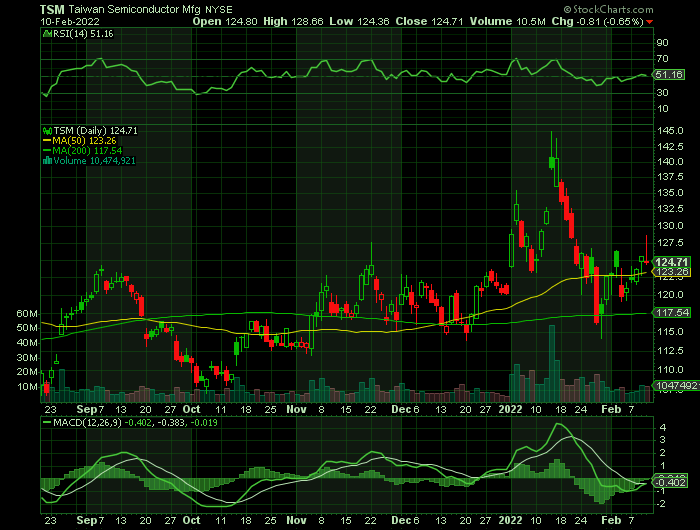

Taiwan Semiconductor TSM has a 50 day simple moving average of $123.59 and a 200-day simple moving average of $119.03. The company has a market capitalization of $641.57 billion, a P/E ratio of 30.03, and a P/E/G ratio of 1.11 and a beta of 0.90. The company has a debt-to-equity ratio of 0.23, a current ratio of 2.09 and a quick ratio of 1.81. Taiwan Semiconductor Manufacturing Company Limited has a 1 year low of $107.58 and a 1 year high of $145.00.

Therefore…..

Don’t Miss Out On The Continued Stock Movement Of Taiwan Semiconductor TSM!

What Further Taiwan Semiconductor TSM Weekly Trades Will We Recommend?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Join us today and find out!

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!

Back to Weekly Options USA Home Page from Taiwan Semiconductors TSM