TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Target Shares Continue To Fall Due To Numerous Headwinds!

Weekly Options Members

Are Up 48% Potential Profit

Using A Weekly PUT Option!

Target watched its profits slide in 2022 due to a combination of inflation, deep price cuts and excessive inventory, and though its performance is better this year, it still faces numerous headwinds.

Now Target is closing stores in a several major U.S. markets due to what it calls “organized retail crime.”

This set the scene for Weekly Options USA Members to Make Potential Profit Of 48%, using a TGT Weekly Options trade!

Join Us And Get The Trades – become a member today!

Tuesday, October 03, 2023

by Ian Harvey

It has not been a happy couple of years for Target Corporation (NYSE:TGT). The discount retailer watched its profits slide in 2022 due to a combination of inflation, deep price cuts and excessive inventory, and though its performance is better this year, it still faces numerous headwinds. Now Target is closing stores in a several major U.S. markets due to what it calls “organized retail crime.”

“In this case, we cannot continue operating these stores because theft and organized retail crime are threatening the safety of our team and guests, and contributing to unsustainable business performance,” Target said in the press release. “We know that our stores serve an important role in their communities, but we can only be successful if the working and shopping environment is safe for all.”

The retailer said it “invested heavily” in strategies to prevent theft and organized retail crime in its stores, such as beefing up security, using third-party guard services and implementing theft-deterrent tools across its business.

“Despite our efforts, unfortunately, we continue to face fundamental challenges to operating these stores safely and successfully,” Target said.

Why the TGT Weekly Options Trade was Originally Executed!

Target Corporation (NYSE:TGT) said on Tuesday it would close nine stores across four U.S. states, including California, citing that theft and organized retail crime was threatening the security of the retailer's employees and customers.

The move, effective Oct. 21, will see the closing of one store in New York City, two in Seattle, three locations across the San Francisco and Oakland markets and three in Portland.

Despite heavy investments in security, the company continued to face "fundamental challenges" to running the stores safely, the retailer said. It operates nearly 2,000 stores across the United States.

"We cannot continue operating these stores because theft and organized retail crime are threatening the safety of our team and guests, and contributing to unsustainable business performance," Target said in a statement.

Theft and retail crime has become an increasingly pressing issue for U.S. retailers, with organized crime rings targeting retail inventories and causing more financial loss to companies.

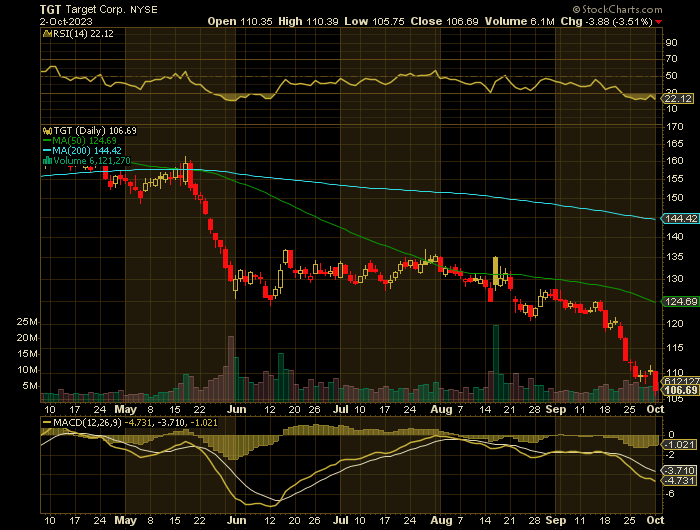

Target shares finished Tuesday trading off 2.5% at $109.48, compared with the nearly 1.5% drop in the S&P 500 index. The finish left the retailer's shares down almost 27% for 2023 to date.

The TGTWeekly Options Trade Explained.....

** OPTION TRADE: Buy TGT OCT 27 2023 109.000 PUTS - price at last close was $3.45 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the TGT Weekly Options (PUT) Trade on Wednesday, September 27, 2023, for $3.25.

Sold HALF the TGT weekly options contracts on Monday, October 02, 2023 for $4.80; a potential profit of 48%.

Holding the remaining TGT weekly options contracts for further profit as the market keeps fluctuating!

Don’t miss out on further trades – become a member today!

Further Catalysts for the TGT Weekly Options Trade…..

A report by the National Retail Federation (NRF), a trade association, earlier on Tuesday showed inventory "shrink" as a percentage of total retail sales accounted for $112.1 billion in losses in 2022, up from $93.9 billion in 2021.

Senate lawmakers, in fact, earlier this year introduced a bill to target so-called flash mobs that carry out large-scale theft. Lawmakers' move aims to "improve our federal response to organized retail crime and establishes new tools to recover goods and illicit proceeds, and deter future attacks on American retailers," according to co-sponsor Chuck Grassley (R-Iowa).

Analysts fear estimates and price targets are still much too high. As a weak holiday shopping season arrives, don’t be at all surprised when TGT stock drops below the $100 mark.

Other Catalysts.....

The United States just reached a new record high in total outstanding consumer credit card debt, topping the $1 trillion mark. The government’s pandemic-era relief has long since run out and many American households are finding themselves trapped deeper than ever in bills.

Things will get worse before they get better.

Soaring interest rates make it more expensive to buy houses, cars, and pay for consumer credit. Meanwhile, long-paused student loan payments are starting back up momentarily, adding yet more strain. Inflation inexorably keeps driving up prices of essential goods.

All this to say, it’s a rough time for retailers of things that are “nice to have” rather than essentials. This puts Target in particular in a rough spot.

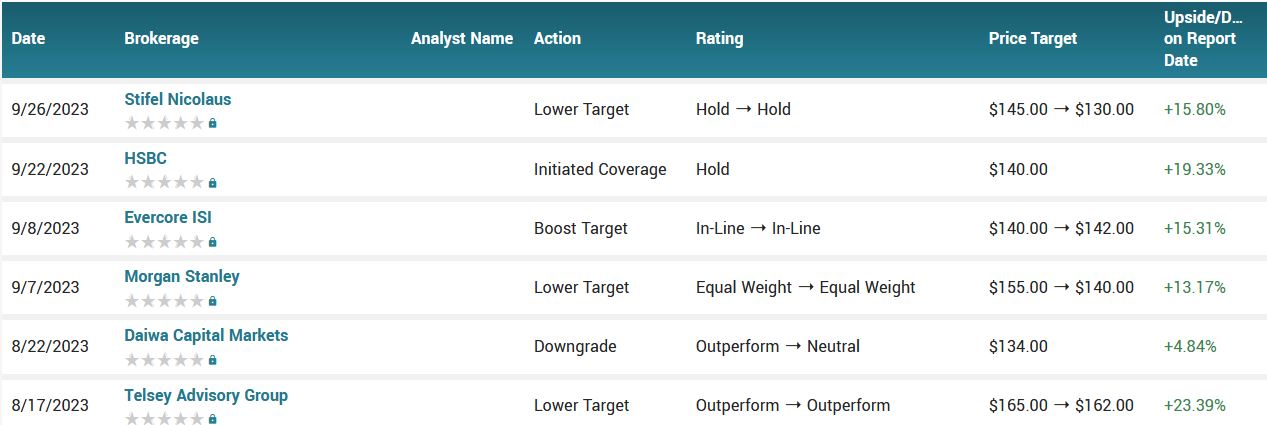

Analysts.....

Target had its price target reduced by Stifel Nicolaus from $145.00 to $130.00 in a research report sent to investors on Tuesday morning. Stifel Nicolaus currently has a hold rating on the retailer’s stock.

According to the issued ratings of 31 analysts in the last year, the consensus rating for Target stock is Hold based on the current 18 hold ratings and 13 buy ratings for TGT. The average twelve-month price prediction for Target is $157.57 with a high price target of $200.00 and a low price target of $120.00.

Summary.....

Target has a 50 day simple moving average of $127.29 and a 200-day simple moving average of $140.94. Target has a 12 month low of $109.12 and a 12 month high of $181.70. The company has a debt-to-equity ratio of 1.24, a current ratio of 0.83 and a quick ratio of 0.18. The stock has a market capitalization of $50.55 billion, a PE ratio of 15.04, and a price-to-earnings-growth ratio of 1.05 and a beta of 1.01.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from TARGET

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!