TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Target Shares Continue

To Fall Due To The “Woke War”

But Members Make 142% Potential Profit

Using A Weekly Put Option!

Members of “Weekly Options USA,” Using A Weekly Put

Option, Make Potential Profit Of 142%, In 26 Hours,

As Target Worries

About The Recent Rally

Against The Company’s Selection Of LGBTQ+ Merchandise.

Where To Now?

Target shares continue to take a hit leaving shareholders in the lurch as controversy continues to swirl over its Pride merchandising plans.

This set the scene for Weekly Options USA Members to profit by 142%, Within 26 Hours, using a Target Weekly Options trade!

Join Us And Get The Trades – become a member today!

Friday, May 26, 2023

by Ian Harvey

Prelude…..

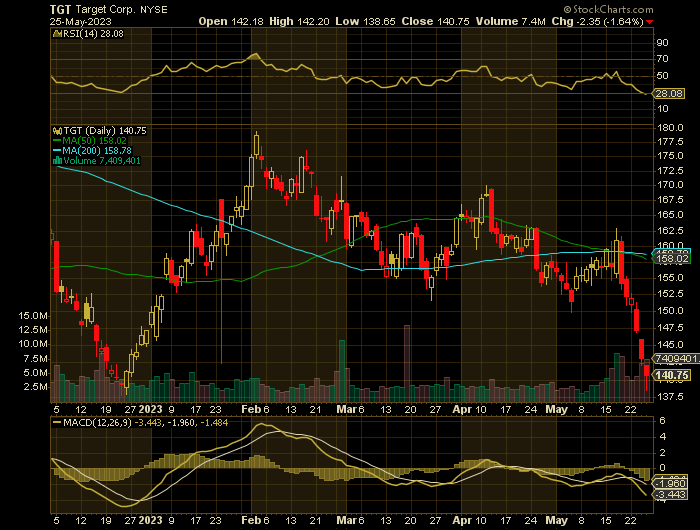

Target Corporation (NYSE:TGT) shares slipped another 1.6% on Thursday and have dropped more than 12.6% since the furor erupted a week ago Wednesday. That amounts to $9.3 billion in market value.

Shares have fallen for six consecutive days over that period, their longest losing streak since December 2022 and the worst six-day stretch since the six days ending May 25, 2022, when shares fell 27.34%.

Why the Target Shares Weekly Options Trade was Executed?

Target Corporation (NYSE:TGT) is the most recent company to be dragged into the supposed "woke war," currently rampaging across social media. Against the backdrop of a trans-friendly Bud Light promotion and Disney's ongoing battle with right-wing Florida Gov. Ron DeSantis, the recent rally against Target's selection of LGBTQ+ merchandise could have the company worried.

Recent posts on social media have criticized Target's exceptionally-inclusive line of LGBTQ+ clothing. The uproar mainly focuses on kids' clothes or swimsuits and undergarments designed for transgender customers.

The Target Weekly Options Trade Explained.....

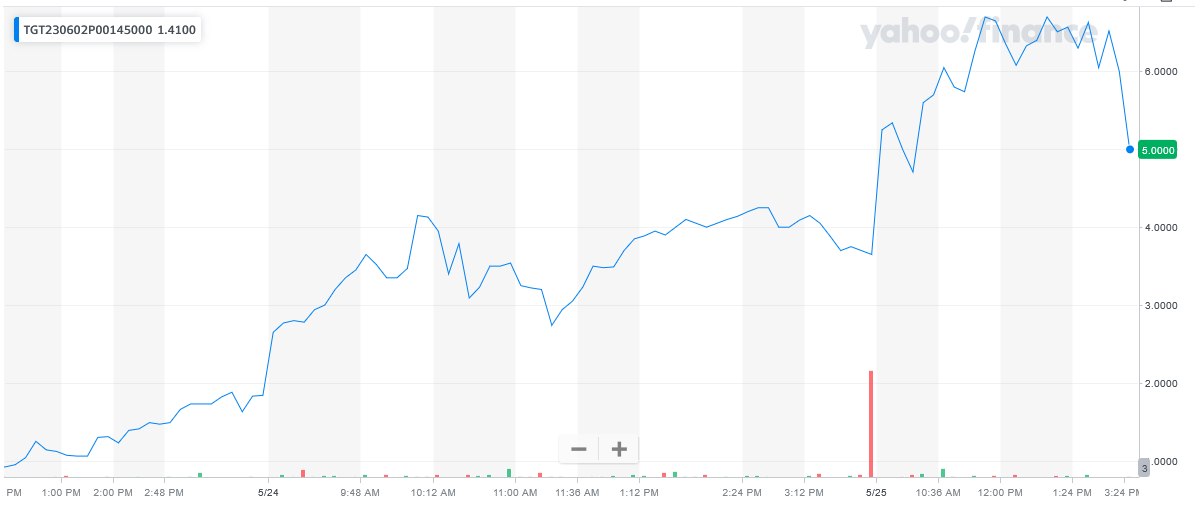

** OPTION TRADE: Buy TGT JUN 02 2023 145.000 PUTS - price at last close was $1.84 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the TGT Weekly Options (PUT) Trade on Wednesday, May 24, 2023, at 9:33, for $2.77.

Sold half the TGT weekly options contracts on Thursday, May 25, 2023, at 11:46, for $6.70; a potential profit of 142%.

Total Dollar Profit is $770 - $277 (cost of contract) = $493

Don’t miss out on further trades – become a member today!

Target Feels Threatened.....

"For more than a decade, Target has offered an assortment of products aimed at celebrating Pride Month," a company spokesperson said. "Since introducing this year’s collection, we've experienced threats impacting our team members’ sense of safety and well-being while at work. Given these volatile circumstances, we are making adjustments to our plans, including removing items that have been at the center of the most significant confrontational behaviour."

“Tuck friendly” women’s swimsuits, which allow trans women who have not had gender-affirming operations to conceal their private parts, were among Target's Pride items that garnered the most attention.

Adding fuel to the fire, the retailer's Gay Pride collection has been linked to a controversial designer: Abprallen's Erik Carnell, who is an outspoken Satanist whose brand features occult imagery and messages like "Satan respects pronouns" on brand apparel, Fox News Digital reported separately.

He is also known for aggressive messaging and phrases, including "Burn down the cis-tem," which have been featured on the website along with one that says "homophobe headrest" with an image of a guillotine.

The confrontations in Target stores are taking place as state legislatures introduce a record number of bills targeting LGBTQ+ individuals across the country. Some advocacy groups have criticized Target's response — calling on the retailer to not back down to hate-filled backlash and reaffirm its support with the LGBTQ+ community.

There are close to 500 anti-LGBTQ+ bills that have gone before state legislatures since the start of this year, an unprecedented number, according to the American Civil Liberties Union. Those efforts focus on health, particularly gender-affirming health care for transgender youth, and education. State legislatures are also pushing to prevent discussions in school regarding sexuality and gender identity.

Further Original Catalysts for the TGT Weekly Options Trade…..

Target has found itself in hot water again over its gay pride collection, this time because of its partnership with a controversial designer.

The major retailer partnered with U.K.-based brand Abprallen to sell merchandise with pro-LGBTQ messages to celebrate Pride month. A search on Target's website finds some of the items.

While the company was already under a microscope over its "tuck-friendly" swimsuits, some social media users were angered to discover that Abprallen's designer Eric Carnell is also an outspoken Satanist whose brand features occult imagery and messages like "Satan respects pronouns" on brand apparel.

Abprallen also sells merchandise with aggressive messages attacking critics. Pins with the phrases "heteronormativity is a plague," and "burn down the cis-tem" are featured on the website along with one that says "homophobe headrest" with an image of a guillotine.

Erik Carnell, the transgender designer behind the brand, explained in an Instagram post that Satan represents "passion, pride and liberty" and "loves all LGBT+ people."

The polarizing partnership caused an uproar from conservatives and parents rights advocates on social media.

Abprallen is currently selling two products on Target's website, a messenger bag that says "Too queer for here," and a sweatshirt that says "Cure transphobia."

Target Pride swimsuits boast "tuck-friendly construction" and "extra crotch coverage," presumably to accommodate male genitalia, even if they are made in an otherwise female style.

Less than a week after the release of the podcast, Target women’s style swimsuits that advertise "tuck-friendly construction" to hide male genitalia went viral, angering some customers and igniting outrage online. In the days since, customers have laid into the brand for its pride displays in stores across the country, particularly the display of pride-themed children’s items and baby onesies which have irked many customers.

Recalls.....

Target Corp. has issued a recall on a massive amount of products.

A large recall was done over the popular baby swing the MamaRoo and RockaRoo. The safety recall created a concern of the strap from the swing that could cause entanglement and strangulation. 4moms, the maker of the MamaRoo and RockaRoo, issued the recall after there was one death involving a 10-month-old that died from asphyxiation from the strap, and another 10-month-old suffered injuries from the strap.

The retail giant issued another recall but from the home décor aisle this time. Target sold about 4.9 million of Threshold Glass Jar Candles that pose a risk to the consumer while the candle is lit. The glass jar has broken in some cases, which caused lacerations and burns on the victims. Target has received at least 137 reports of the candle jar breaking while in use. Only six injuries have been reported. Target reportedly sold these candles nationwide and through its website starting back in August 2019 until March 2023.

Earnings.....

Analysts at KeyCorp cut their Q2 2024 EPS estimates for Target in a research report issued on Wednesday, May 17th. KeyCorp analyst B. Thomas now anticipates that the retailer will post earnings of $1.55 per share for the quarter, down from their prior estimate of $2.22. The consensus estimate for Target’s current full-year earnings is $8.26 per share.

Target last posted its quarterly earnings data on Wednesday, May 17th. The retailer reported $2.05 earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of $1.76 by $0.29. Target had a net margin of 2.49% and a return on equity of 24.49%. The company had revenue of $24.95 billion for the quarter, compared to the consensus estimate of $25.28 billion. During the same period last year, the company earned $2.19 earnings per share. The firm’s revenue was up .5% compared to the same quarter last year.

Selling.....

CHURCHILL MANAGEMENT Corp cut its holdings in shares of Target Co. (NYSE:TGT – Get Rating) by 5.3% in the fourth quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 15,740 shares of the retailer’s stock after selling 875 shares during the quarter. CHURCHILL MANAGEMENT Corp’s holdings in Target were worth $2,346,000 at the end of the most recent quarter.

In other Target news, insider Brian C. Cornell sold 35,000 shares of the business’s stock in a transaction on Tuesday, March 14th. The stock was sold at an average price of $158.98, for a total value of $5,564,300.00.

Also, CAO Matthew A. Liegel sold 1,459 shares of the business’s stock in a transaction on Thursday, May 18th. The stock was sold at an average price of $160.75, for a total value of $234,534.25.

Insiders own 0.29% of the company’s stock.

Analysts.....

According to the issued ratings of 29 analysts in the last year, the consensus rating for Target stock is Moderate Buy based on the current 12 hold ratings, 16 buy ratings and 1 strong buy rating for TGT. The average twelve-month price prediction for Target is $181.69 with a high price target of $220.00 and a low price target of $132.00.

Summary.....

Critics compared Target to Bud Light, after the brand faced backlash for partnering with transgender influencer Dylan Mulvaney.

The campaign account for Rep. Nancy Mace, R-S.C., wrote, "Bud light: shocks and insults their customers. Target: hold my beer."

The reaction seemingly worried Target management, who took "emergency" action Friday directing some managers and district senior directors to tamp down the Pride sections in their stores over fears of re-creating a "Bud Light situation."

Target’s fifty day simple moving average is $159.96 and its 200 day simple moving average is $160.86. The company has a debt-to-equity ratio of 1.38, a current ratio of 0.88 and a quick ratio of 0.18. The firm has a market cap of $70.01 billion, a price-to-earnings ratio of 25.88, and a P/E/G ratio of 1.20 and a beta of 1.02. Target Co. has a one year low of $137.16 and a one year high of $183.89.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from TARGET

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!