TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Tesla Drawback Provides 184% Profit!

Updated Weekly Put Option!

Become a Member for future Trades.

UPDATE: Tesla Inc (NASDAQ: TSLA)’s business is struggling right now. The macroeconomic environment, with its high interest rates, inflationary pressures, and uncertainty about the near term, is negatively impacting the company.

Also, Tesla has to deal with stiff competition these days, with well-funded Chinese EV makers making things difficult.

This set the scene for Weekly Options USA Members to profit by 184% using a Tesla Weekly Options trade!

Become a Member Today and get FUTURE trades!

Sunday, May 12, 2024

by Ian Harvey

UPDATE.....

Read the previous article “Tesla Weekly Put Option Provides 44% Profit In 21/2 Hours!”

Tesla Inc (NASDAQ: TSLA)’s business is struggling right now. The macroeconomic environment, with its high interest rates, inflationary pressures, and uncertainty about the near term, is negatively impacting the company.

After reporting 3% sales growth in Q4 last year Tesla earnings plunged 47% to 45 cents a share in the first quarter, the third straight big EPS decline. Revenue fell 9% to $21.3 billion, the first decline since early in the pandemic. Both missed lowered views.

Tesla burned $2.5 billion in cash during the quarter, even with the company delaying payments.

Tesla stock originally surged despite grim first-quarter earnings as Musk touted robotaxis and cheaper EVs in the future, followed by Tesla clearing key hurdles for launching Full Self-Driving in China. Shares have since pulled back below a key level. It's one of the worst performers on the S&P 500 in 2024.

Also, Tesla has to deal with stiff competition these days, with well-funded Chinese EV makers making things difficult.

Tesla has slashed prices since late 2022, but demand is flagging as its line-up ages. The EV giant announced major layoffs starting in mid-April, with further cuts to key programs and jobs since then. Several top executives have left.

Profits are also down as margins have compressed due to a slowdown in revenue growth and ongoing vehicle price cuts.

Tesla has slashed prices worldwide starting in late 2022. Initially, these price cuts were viewed at least somewhat as proactive moves to grab market share and undercut rivals. But the EV giant has had to keep cutting prices to prop sales, slashing once-mighty profit margins and earnings. In Q1 2024 deliveries and revenue fell vs. a year earlier, with that likely to continue in Q2.

U.S. Model 3 production was low as the Fremont plant struggled with the upgraded version. The company produced 433,371 vehicles worldwide, even with Berlin and Fremont woes and with Tesla slashing Shanghai output.

Production is set to fall much further in Q2. Tesla deliveries appear to be sluggish so far in Q2.

Tesla has its own Supercharger network in its markets. That's especially important in the U.S. and countries like Australia, where third-party charging facilities are limited.

But at the end of April, Musk fired the entire Supercharger team. That will significantly slow new Supercharger installations and other efforts.

Tesla also has a solar installation business, but it's been struggling.

Analysts, who have been slashing Tesla estimates since the end of 2022, now see 2024 EPS sliding 22% to $2.43 a share after skidding 23% to $3.12 in 2023.

Why the TESLA Weekly Options Trade was Originally Executed!

Tesla Inc (NASDAQ: TSLA) slipped 5.7% Tuesday following Monday's surge on news reports that Beijing has given preliminary approval for the electric-vehicle giant to launch its Full Self-Driving in China. This decline is expected to continue in the near future.

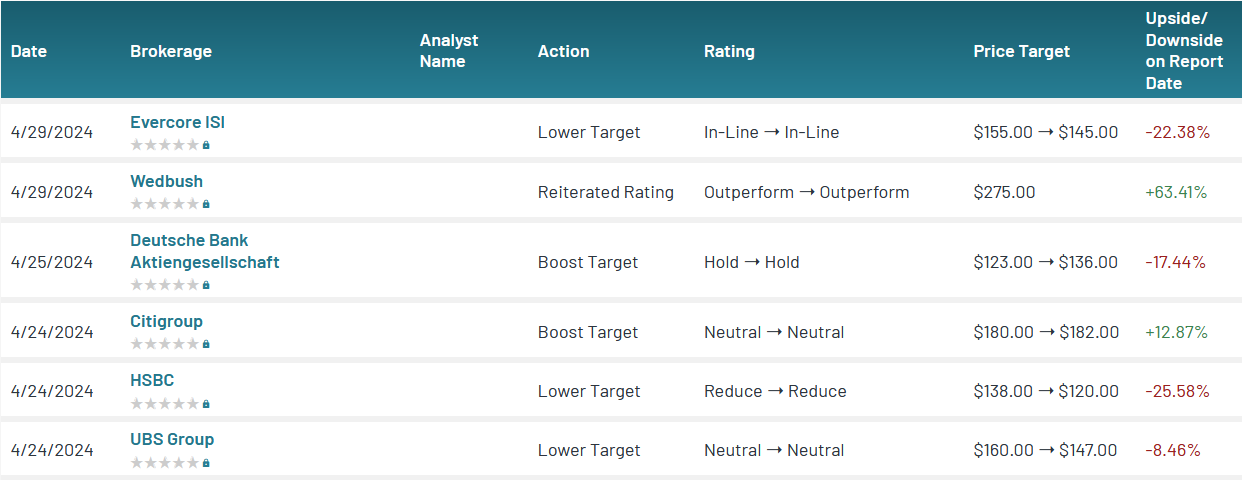

Also, to make matters worse, Evercore ISI lowered their price target on the stock from $155.00 to $145.00. Evercore ISI currently has an in-line rating on the stock. Tesla traded as low as $185.15 and last traded at $185.58. 48,332,160 shares changed hands during mid-day trading, a decline of 54% from the average session volume of 104,358,398 shares. The stock had previously closed at $194.05.

Last week, Tesla announced worse-than-expected earnings and revenue for the first quarter, with the electric-vehicle giant reporting its lowest quarterly per-share earnings since 2021. But Tesla stock soared as it signaled "more affordable" new models are still coming.

Tesla is grappling with falling sales and an intensifying price war, which led to its quarterly revenue falling for the first time since 2020, the company reported last week.

Musk made progress toward rolling out Tesla's advanced driver-assistance package in China, the epicenter of the EV price war, during a surprise visit to Beijing on Sunday.

That trip came just over a week after he scrapped a planned trip to India, where Tesla has long sought to start operations, due to "very heavy Tesla obligations."

The Tesla Weekly Options Potential Profit Explained.....

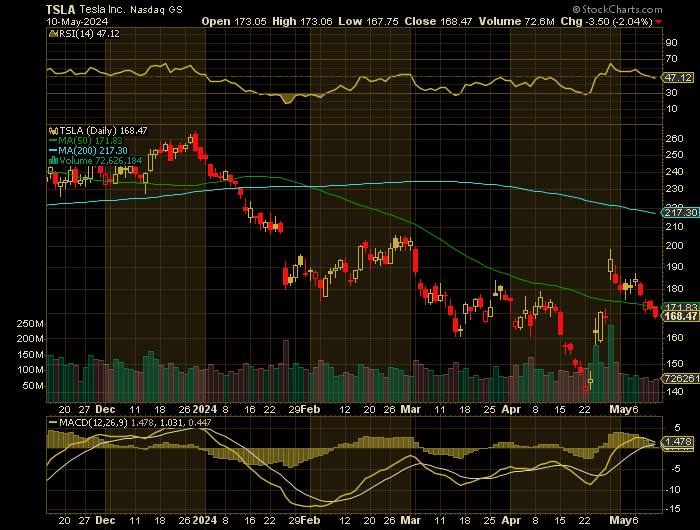

Entered the TSLA Weekly Options (CALL) Trade on Wednesday, May 01, 2024, at 9:57am, for $4.20.

Sold HALF the TSLA weekly options contracts on Wednesday, May 01, 2024, at 11:20am, for $6.05; a potential profit of 44%.

Sold the remaining TSLA weekly options contracts on Friday, May 10, 2024, for $11.93; a potential profit of 184%.

(This will vary for members depending on their entry and exit strategies).

Holding the remaining contracts for further profit!

BECOME A MEMBER AND GET FUTURE TRADES!

About Tesla.....

Tesla, Inc. is the world's leading manufacturer of electric vehicles. With more than 26% of the market share in 2022, the company's leadership position is all but assured for the coming decade if not longer. While specifically an EV manufacturer, however, the company is also engaged in many related and unrelated ventures that could produce significant results for shareholders.

Tesla, Inc. was first incorporated in 2003 in California as Tesla Motors, Inc but later changed its name. Founded by Martin Eberhard and Marc Terpening, Elon Musk became the company's largest shareholder in 2006 and then its CEO in 2008. Tesla went public via IPO in 2010 making it the first American automobile company to do so since Ford back in 1956. The company reached a half million in annual vehicle sales in 2020 and crossed over the 1 million mark in 2022.

Under Musk's guidance, the company was reborn and moved away from the high-end sports-car segment and into a line of cars geared toward a larger audience. The first model, the Roadster, was soon eclipsed by the Model S which is the top-selling plug-in EV car to this day. Follow-on models include the Model X SUV in 2015, the Model 3 sedan in 2017, and the Model Y crossover in 2020.

Tesla, Inc.'s name change came in 2017 shortly after then and current CEO Elon Musk agreed to acquire SolarCity and expand the company's product line. Tesla is now headquartered in Austin, Texas, and operates global manufacturing capacity through a network of Gigafactories. The company has 5 Gigafactories in key locations around the world with a 6th planned. The Gigafactories are noteworthy for multiple reasons including their size, end-to-end production capability, and non-reliance on grid-supplied power.

Tesla's automobile segment designs, develops, manufactures, leases, and sells electric vehicles in the U.S., Europe, Asia, and internationally. This segment offers a line of luxury Ev s equipped with industry-leading features. The company also generates revenue by selling excess EV credits to the business at large. The Energy Generation and Storage segment designs, manufactures, sells, and installs, solar energy generation and energy storage products for residential, commercial, and industrial customers as well as electric utilities.

One of Tesla's related products is the Tesla Powerwall and Tesla Powerpack battery packs. The Powerwall and Powerpack are stationary lithium-ion battery packs for home or industrial use. The power packs can store solar or other green-generated powers for later use or backup power in emergency situations. This segment of the business was merged with Solarcity to form the Energy Generation and Storage segment. Among the many technologies worked on by the company are self-driving/autonomous vehicles, AI, and glass along with EV motors and batteries.

Further Catalysts for the TSLA Weekly Options Trade…..

Tesla is reportedly cutting additional jobs and two more top executives are gone after the electric vehicle giant slashed its workforce by 10% earlier this month.

The Information reported that Tesla CEO Elon Musk sent an email to executives on Monday evening informing them that senior director of EV charging, Rebecca Tinucci, would be leaving the company on Tuesday, along with nearly all of her 500-person-strong Supercharger team.

Tesla's director of vehicle programs and new product initiatives, Daniel Ho, is also out, along with his entire staff, the report said. It is unclear how many people worked in that division.

The company's public policy team, which was led by former executive Rohan Patel, will also be dissolved, the report said.

"Hopefully these actions are making it clear that we need to be absolutely hard core about headcount and cost reduction," Musk wrote in the leaked email, according to The Information. "While some on exec staff are taking this seriously, most are not yet doing so."

Other Catalysts.....

The report comes two weeks after the electric vehicle giant confirmed it would reduce its workforce by more than 10%, trimming its roughly 140,000 headcount by 15,000.

Last week, thousands of Tesla workers in California and Texas were informed they were out of jobs. The company disclosed alongside the layoffs that its senior vice president of powertrain and energy engineering, Andrew Baglino, had left after an 18-year stint at the EV maker.

In a separate report Tuesday, Electrek criticized Tesla's move to get rid of its Supercharger team and Tinucci, whom it credited with convincing rival manufacturers like Ford and General Motors to adopt Tesla's NACS plug for EVs.

BECOME A MEMBER AND GET FUTURE TRADES!

Analysts.....

According to the issued ratings of 32 analysts in the last year, the consensus rating for Tesla stock is Hold based on the current 7 sell ratings, 17 hold ratings and 8 buy ratings for TSLA. The average twelve-month price prediction for Tesla is $184.32 with a high price target of $310.00 and a low price target of $85.00.

Summary.....

Tesla stock traded down $10.77 on Tuesday, hitting $183.28. 126,403,453 shares of the company traded hands, compared to its average volume of 105,362,438. The company has a 50-day moving average price of $174.71 and a 200 day moving average price of $206.29. The company has a quick ratio of 1.17, a current ratio of 1.72 and a debt-to-equity ratio of 0.04. Tesla, Inc. has a 12-month low of $138.80 and a 12-month high of $299.29. The company has a market cap of $584.52 billion, a PE ratio of 46.76, a PEG ratio of 4.45 and a beta of 2.40.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from TESLA

Recent Articles

-

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem

191% Weekly Option Win on Super Micro Computer Amid Market Mayhem – What’s Next? -

Tariffs and the Stock Market: Positive and Negative Impacts in 2025

Tariffs and the Stock Market: Positive and Negative Impacts in 2025. This article explores both the positive and negative effects of tariffs on the stock market based on recent data, forecasts, and ma… -

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs